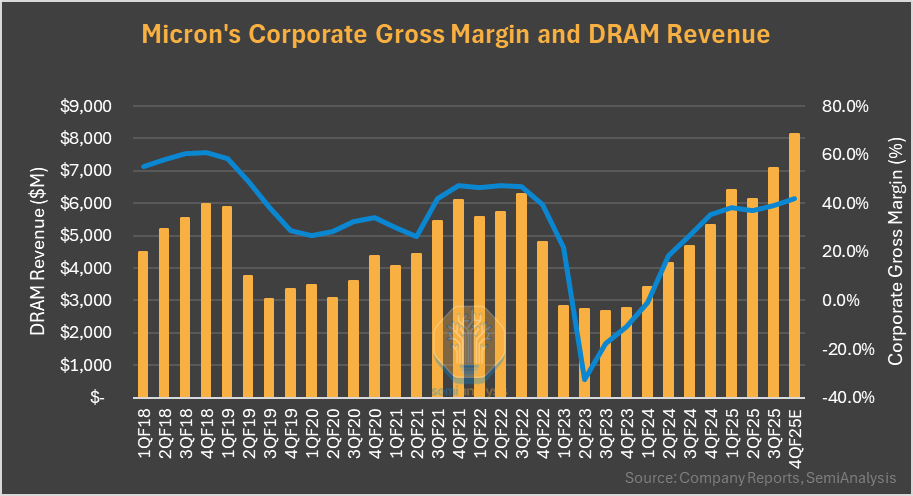

Micron's gross margin guidance suggests it will grow in QNov and beyond. Despite historic high DRAM revenue, GM is well below the prior peaks of 60%+. NAND, which is below corp avg, dragging down. Rapid node introduction weigh in too. Micron's new segmentation from 4QF25 could give insight into its HBM margin profile better as the company will report GM and OPM for each segment.

Source: Sravan Kundojjala

The copyright of this article belongs to the original author/organization.

The views expressed herein are solely those of the author and do not reflect the stance of the platform. The content is intended for investment reference purposes only and shall not be considered as investment advice. Please contact us if you have any questions or suggestions regarding the content services provided by the platform.