Long-term government bonds in both the US and Japan are struggling. The core reasons are simple: weak auctions, buyers holding back, and tough financial conditions.

Japan‘s bonds (JGBs) are seeing yields spike, demand is low from domestic investors, and auctions are poor. Monetary shifts by the Bank of Japan and looming fiscal promises also add pressure.

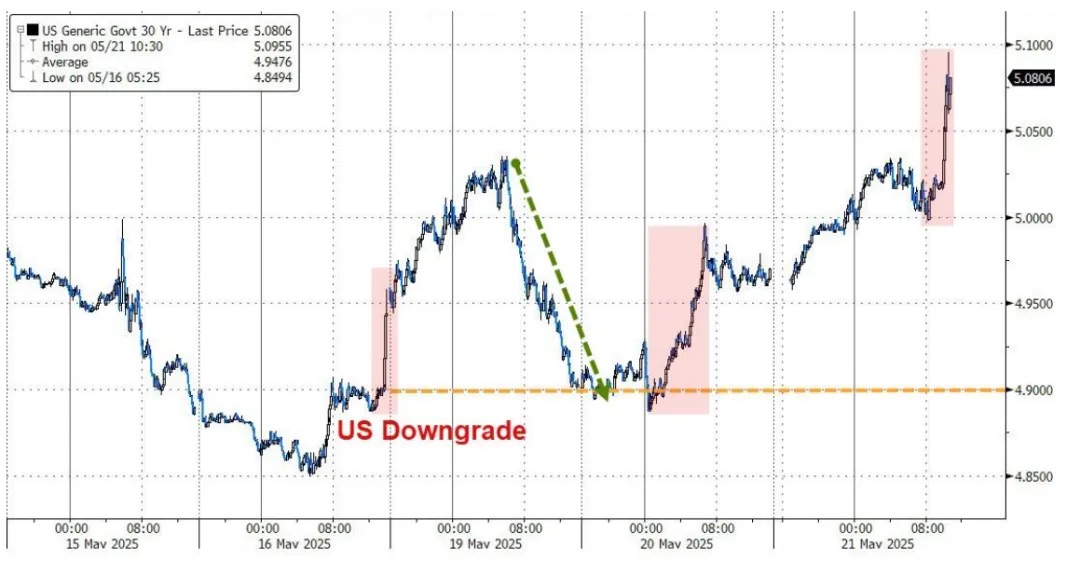

US Treasuries face similar issues, with recent auctions performing badly and 30-year yields pushing higher.

Overall, it’s the same story: huge government spending creates deficit worries, monetary policy has limited positive impact, and crucially, buyers are on strike.

Bottom line: It‘s still not a good time to buy.

$2x Long VIX Futures ETF(UVIX.US)$Tesla(TSLA.US)$Apple(AAPL.US)$NVIDIA(NVDA.US)$Alphabet - C(GOOG.US)$Alphabet(GOOGL.US)$Unitedhealth(UNH.US)$Coinbase(COIN.US)

The copyright of this article belongs to the original author/organization.

The views expressed herein are solely those of the author and do not reflect the stance of the platform. The content is intended for investment reference purposes only and shall not be considered as investment advice. Please contact us if you have any questions or suggestions regarding the content services provided by the platform.