Likes Received

Likes Received Trending Creators in 2025

Trending Creators in 2025I looked at the financial report data, and although the numbers are all good,

I went back and looked at NVIDIA's last quarter's financial report, and the numbers are even better, with higher growth rates and profit margins.

But NVIDIA's multiple is not as high as VRT's.

I never understood before, with NVIDIA and AMD, clearly NVIDIA crushes it in every aspect, but the multiple has never been as high as AMD's.

So, stock trading is quite mystical 😂

Since I can't figure it out, I'll just focus more on long-term stocks.

Consistently beating earnings is never wrong.

Take the multiple less seriously; the market isn't stupid either. In the long run, pricing is always reasonable.

$Vertiv(VRT.US)

$NVIDIA(NVDA.US)

$AMD(AMD.US)

$Vertiv(VRT.US)

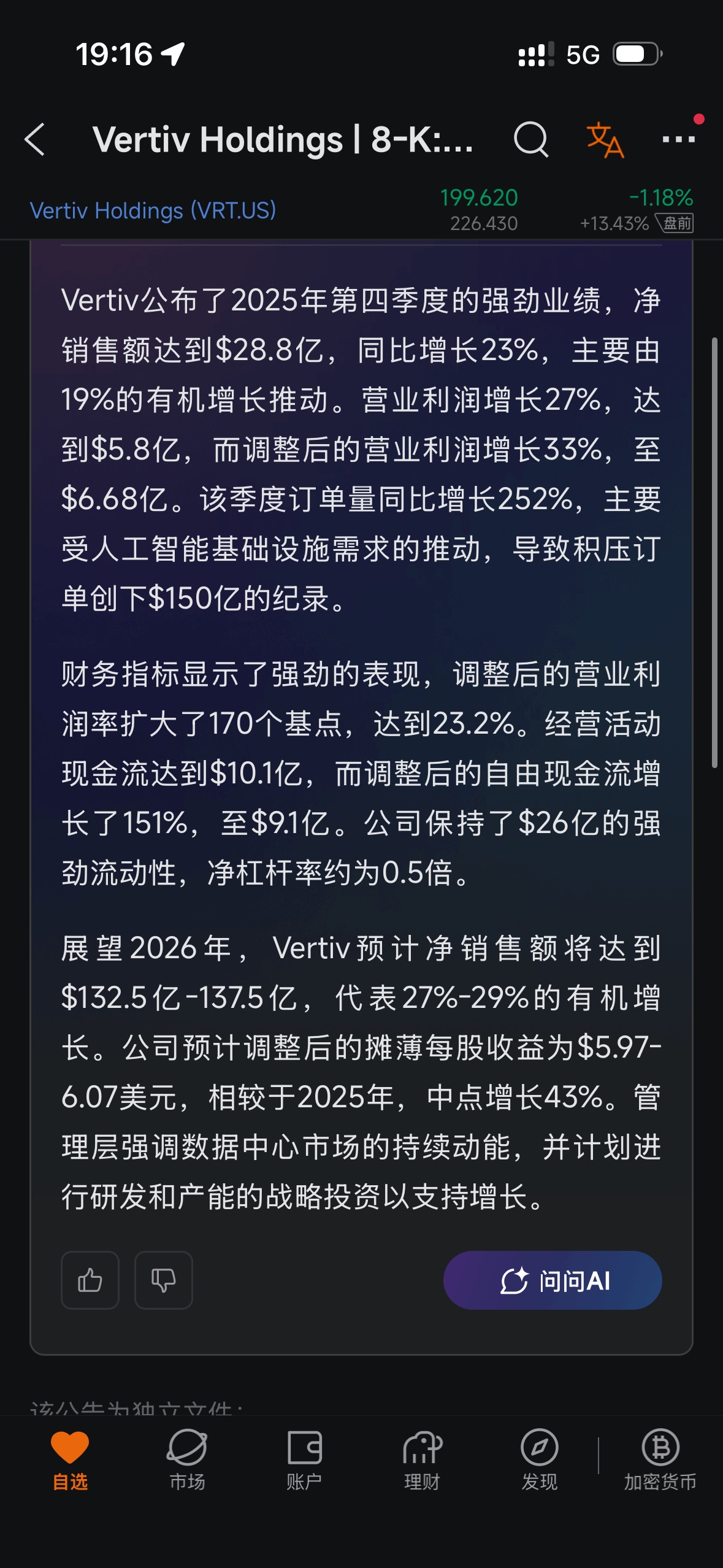

The earnings report is out, with several highlights in the data.

1 Operating profit margin is better than last quarter; with capacity expansion, marginal costs have come down. Guidance for next year continues to trend higher.

2 Backlog has reached a record high.

I'll check the details when I get home.

The copyright of this article belongs to the original author/organization.

The views expressed herein are solely those of the author and do not reflect the stance of the platform. The content is intended for investment reference purposes only and shall not be considered as investment advice. Please contact us if you have any questions or suggestions regarding the content services provided by the platform.