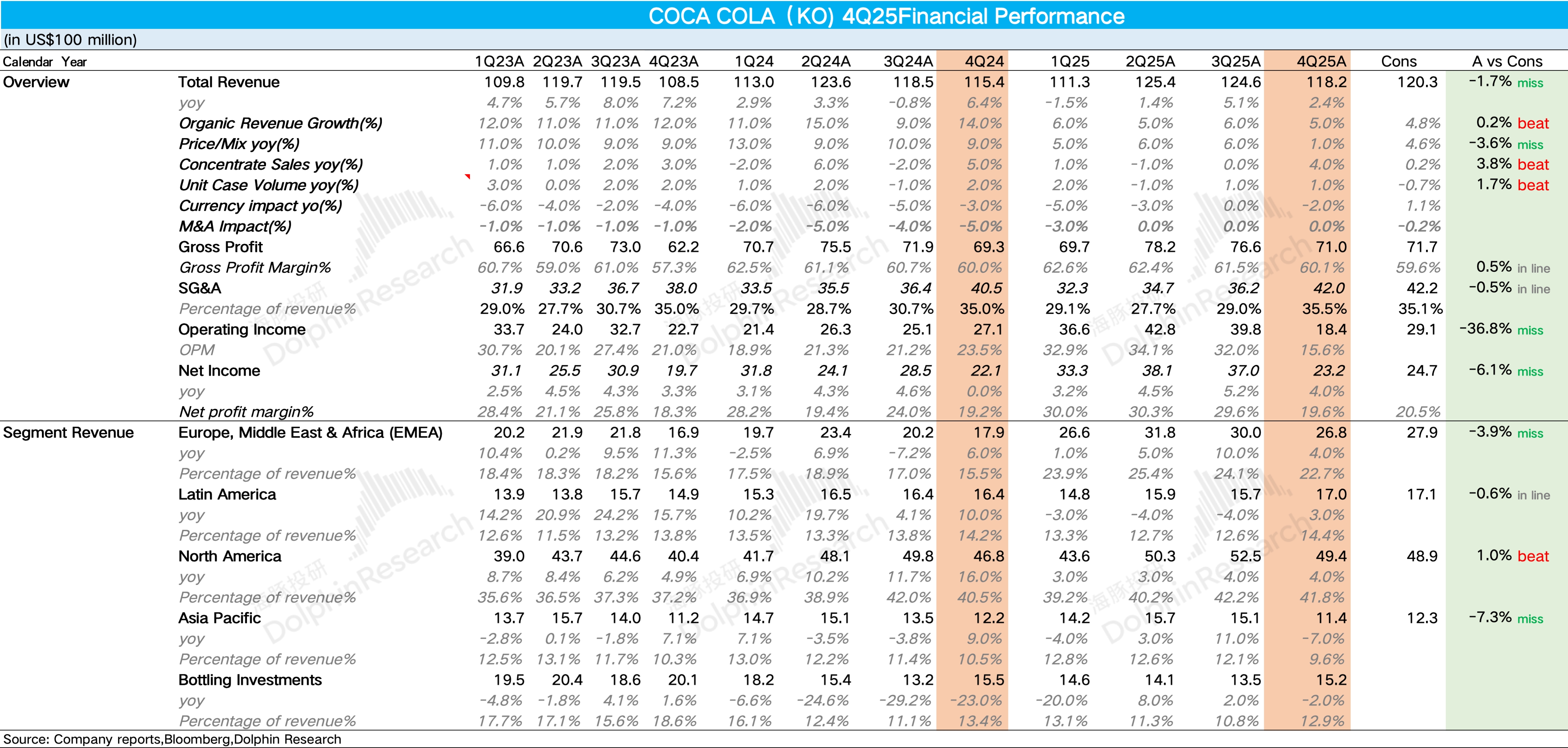

KO 4Q25 First Take: Results were mixed, with revenue missing consensus. Profit fell sharply due to a $960 mn impairment on BODYARMOR, the premium sports drink acquired in 2021.

1) Organic growth rose 5% in Q4, with concentrate sales up 4% YoY and ahead of expectations. However, with unit case volume up only 1%, Dolphin Research believes this largely reflects bottlers pulling forward inventory.

Pricing increased just 1% YoY, below estimates and dragged by APAC and EMEA. With consumers more price sensitive, KO’s premiumization-led mix actions struggled to pass through price in Q4.

2) GPM: While key inputs and packaging (HFCS, PET) trended lower, a higher mix of lower-margin SKUs likely offset the commodity tailwind. As a result, GPM was essentially flat.

On opex, excluding the one-off BODYARMOR impairment, the opex ratio edged down. This suggests better operating and marketing efficiency, aided by AI.

For 2026, the company guided to 4%-5% growth, a touch below the 5% Street consensus, reflecting a cautious stance amid policy pressure and macro headwinds. For more detail, follow Dolphin Research's takeaways and the earnings call.$Coca Cola(KO.US)

The copyright of this article belongs to the original author/organization.

The views expressed herein are solely those of the author and do not reflect the stance of the platform. The content is intended for investment reference purposes only and shall not be considered as investment advice. Please contact us if you have any questions or suggestions regarding the content services provided by the platform.