GOOG Return Rate

GOOG Return Rate Total Assets

Total Assets$Alphabet - C(GOOG.US) was lowered to 306 last week. When $NVIDIA(NVDA.US) was at 170, I had no bullets to add to my position. This highlights the importance of having dry powder. If only I had 20% of my portfolio in cash. I'm usually fully invested, and I need to change that. $Invesco QQQ Trust(QQQ.US)

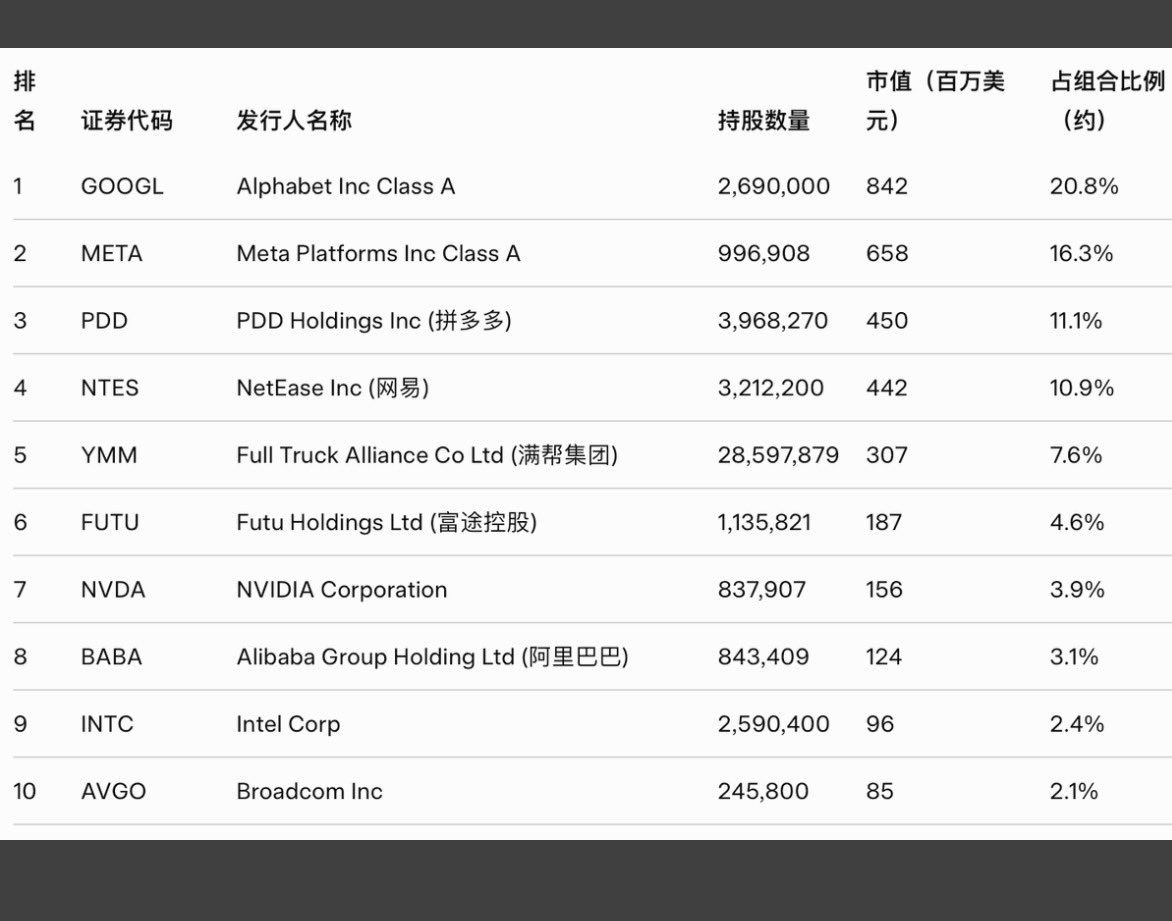

Greenwoods Asset Management's U.S. stock holdings.

1. $Alphabet(GOOGL.US):842,000,000 ÷ 2,690,000 ≈ $313.01

2. $Meta Platforms(META.US):658,000,000 ÷ 996,908 ≈ $660.04

3. $PDD(PDD.US):450,000,000 ÷ 3,968,270 ≈ $113.40

4. $NetEase(NTES.US):442,000,000 ÷ 3,212,200 ≈ $137.60

5. $Full Truck Alliance(YMM.US):307,000,000 ÷ 28,597,879 ≈ $10.74

6. $Futu(FUTU.US):187,000,000 ÷ 1,135,821 ≈ $164.64

7. $NVIDIA(NVDA.US):156,000,000 ÷ 837,907 ≈ $186.18

8. $Alibaba(BABA.US):124,000,000 ÷ 843,409 ≈ $147.02

9. $Intel(INTC.US):96,000,000 ÷ 2,590,400 ≈ $37.06

10. $Broadcom(AVGO.US):85,000,000 ÷ 245,800 ≈ $345.81

The copyright of this article belongs to the original author/organization.

The views expressed herein are solely those of the author and do not reflect the stance of the platform. The content is intended for investment reference purposes only and shall not be considered as investment advice. Please contact us if you have any questions or suggestions regarding the content services provided by the platform.