Options

Options Traded Value

Traded Value$SPDR S&P 500(SPY.US)

02/06/2026

Today's opening price is $681.460,

$SPY 260206 681 Call(SPY260206C681000.US) opened at $2.93,

$SPY 260206 682 Put(SPY260206P682000.US) opened at $3.03;

At market open, the Longbridge options calculator showed Put/Call IVs of 23.90%/24.80% respectively,

at 13:29, they were 17.80%/22.90%;

The amplitude ranged from 0.65% at 09:42 to 1.28% at 13:29;

$SPY 260206 681 Call(SPY260206C681000.US)

The opening IV exceeded expectations,

Plan to only trade the underlying stock today, not options,

$Walmart(WMT.US)

10:25 $128.450 => 11:20 $129.930, LONG,

Didn't notice, my preset mindset today was to short on rallies,

Thinking there should be profit-taking after several consecutive days of hitting new highs,

The market rebounded today, driving up individual stocks,

12:31:45 $129.9550 => 12:37:06 $129.710, SHORT,

Opened the position a bit late, wanted to wait for a break below the 12:02 support level for safety,

12:43 $129.530 => 12:50 $130.050, LONG,

Noticed the rebound at 12:41, but unfortunately didn't open a position in time,

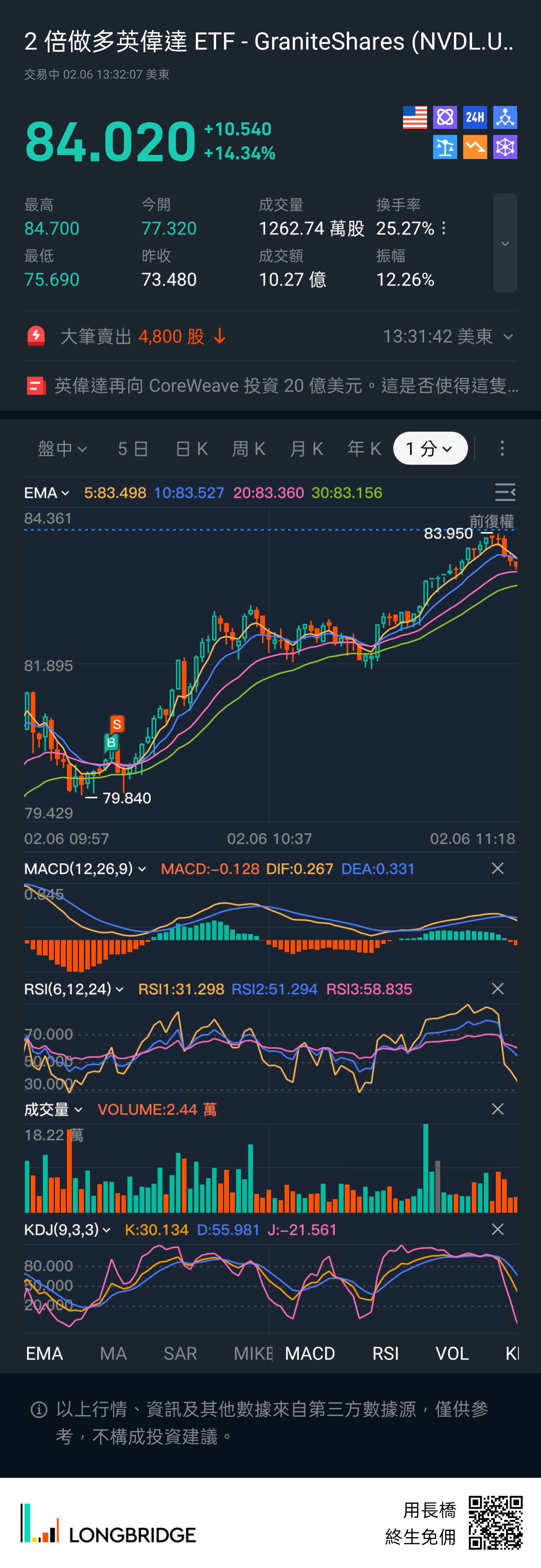

$GraniteShares 2x Long NVDA Daily ETF(NVDL.US)

10:10:37 $80.3583 => 10:11:47 $80.5820,

Stop-loss was correct, this level seems to lack upward momentum,

10:16 $80.320 => 10:30 $82.320,

Didn't break down, probably because I was watching too many tickers,

Switching back and forth on the phone, missed the best entry point,

Didn't dare to chase the high, just watched it go up,

Plan for next week:

1️⃣ On Monday, besides continuing to trade the weekly options of $SPDR S&P 500(SPY.US),

Focus on only one underlying stock, tentatively $Walmart(WMT.US),

This ticker has significant intraday volatility, with small bid/ask spreads,

The current market is unsettled, with safe-haven funds flowing into it,

2️⃣ Starting next week, adjust the open/close position settings: use limit orders to open with stop-loss, and market orders to close, ready to exit if things go wrong,

3️⃣ The two major challenges of day trading: trend judgment and entry point selection, need further thought next week.

The copyright of this article belongs to the original author/organization.

The views expressed herein are solely those of the author and do not reflect the stance of the platform. The content is intended for investment reference purposes only and shall not be considered as investment advice. Please contact us if you have any questions or suggestions regarding the content services provided by the platform.