Top 10 Influencers in 2025

Top 10 Influencers in 2025The market is a second-order chaotic system with countless complex small rules inside; and how to formulate your own rules is personal. How to formulate the criteria for judging a company requires even more detailed and separate research.

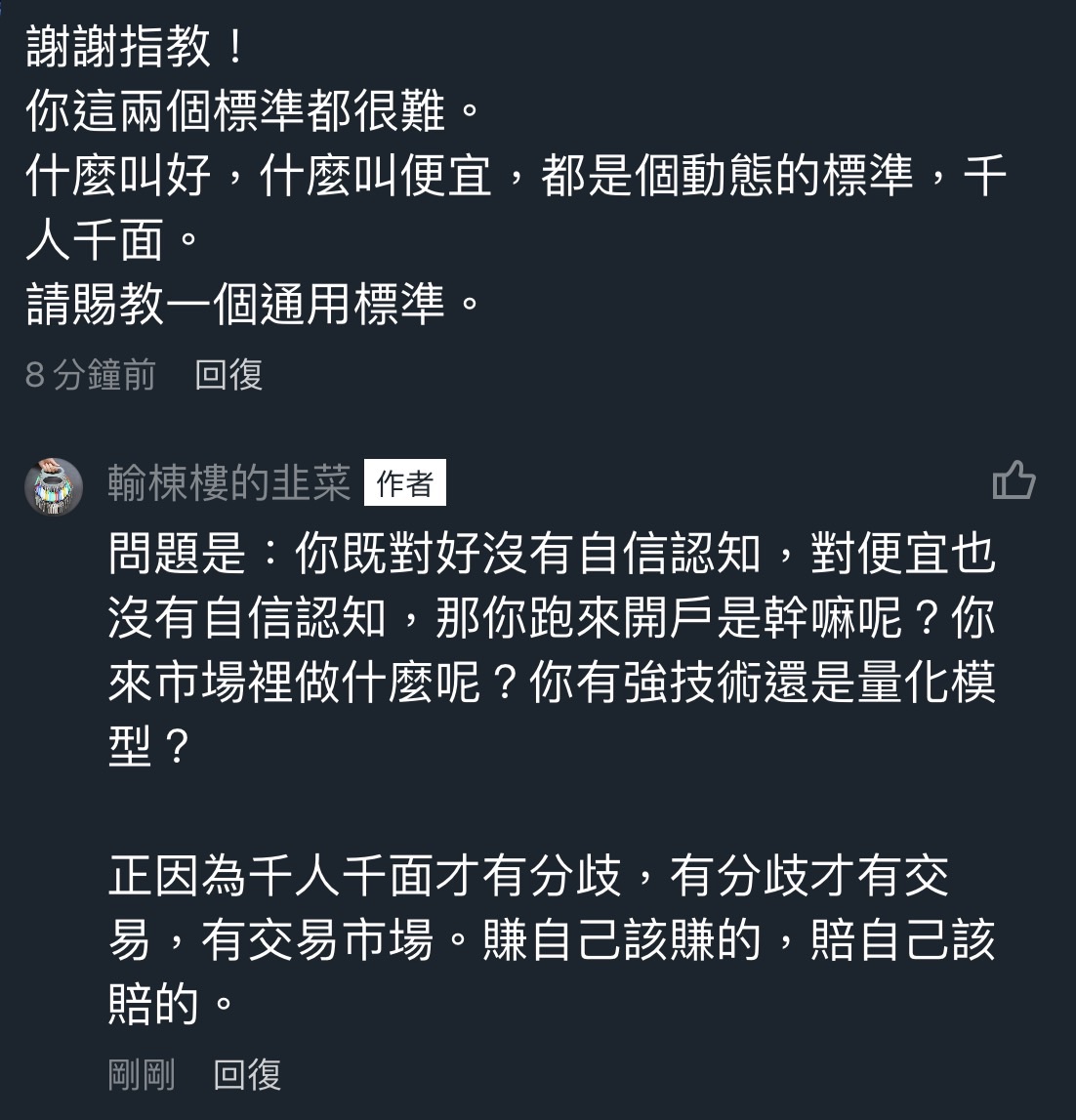

If anyone tells you that there is a universal rule that can judge all companies, and this rule can make you rich forever, then you can basically conclude that they are a scammer.

In terms of personal rules, copying homework—if the other party is a billionaire and you may only have a few hundred thousand in disposable funds—your rules are completely different and cannot be the same, because the same action will make them a fortune while you will suffer heavy losses.

For company rules, some may be seasoned industry insiders with unique judgments and higher risk tolerance, while others may not have enough understanding of the industry. To put it bluntly, they lack conviction, can't hold on, and easily flip-flop, eventually getting harvested. These rules are again different, as the criteria for judging a company depend on individual cognition.

Under the above circumstances, there is no universal wealth code. Trading, to put it plainly, is about divergence—more specifically, divergence in cognition.

The copyright of this article belongs to the original author/organization.

The views expressed herein are solely those of the author and do not reflect the stance of the platform. The content is intended for investment reference purposes only and shall not be considered as investment advice. Please contact us if you have any questions or suggestions regarding the content services provided by the platform.