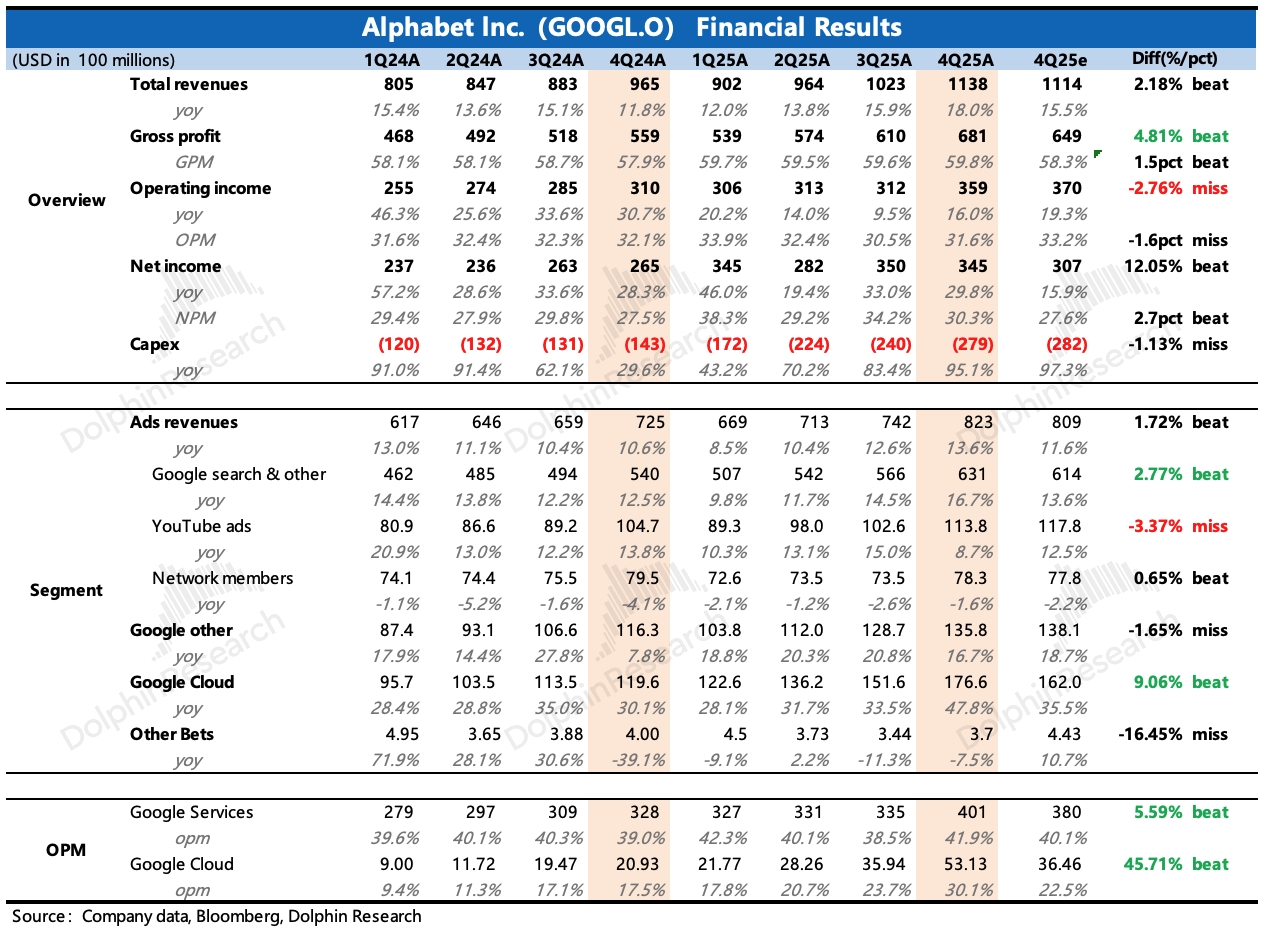

GOOGL 4Q25 First Take: The Q4 print wasn’t flawless, with a mix of positives and negatives. The bigger surprise isn’t just the quarter itself.

1) Stunning Capex: 2026 Capex guide at $175–185bn, roughly doubling YoY, vs. the Street at ~$130bn. Meta was seen as aggressive, but Alphabet just signaled who the real deep-pocketed player is. Cash flow isn’t a constraint, but the market will question whether such spend can drive sustained acceleration.

2) Cloud on fire: Q4 grew 48%, a major beat. RPO reached ~$240bn, with ~$85bn net add QoQ, even stronger than Q3, underpinning high growth in the near to mid term.

3) Search also strong: Q4 rose 16.7%, slightly ahead of estimates. The ad market was solid into year-end, with e-comm and travel particularly strong.

AI is lifting conversion and pushing advertisers toward performance channels. Still in an AI tailwind phase, but keep an eye on OpenAI’s ad push this year.

4) YouTube softer than expected: Q4 ads grew <9%, notably below the 12–13% consensus, failing to fully lap last year’s tough comp. Beyond external competition, likely internal cannibalization from still-under-monetized Shorts and pressure on YouTube TV’s brand ads.

5) Investment drag not yet visible: Q4 OPM was still near 32%, with only modest QoQ/YoY erosion. However, D&A has been climbing since Q3, up 40%+ YoY.

With the 2026 Capex surge, total costs will spike absent tighter control. Headcount actions should continue; net adds in Q4 fell sharply to 650 vs. prior quarters. $Alphabet(GOOGL.US) $Alphabet - C(GOOG.US)

The copyright of this article belongs to the original author/organization.

The views expressed herein are solely those of the author and do not reflect the stance of the platform. The content is intended for investment reference purposes only and shall not be considered as investment advice. Please contact us if you have any questions or suggestions regarding the content services provided by the platform.