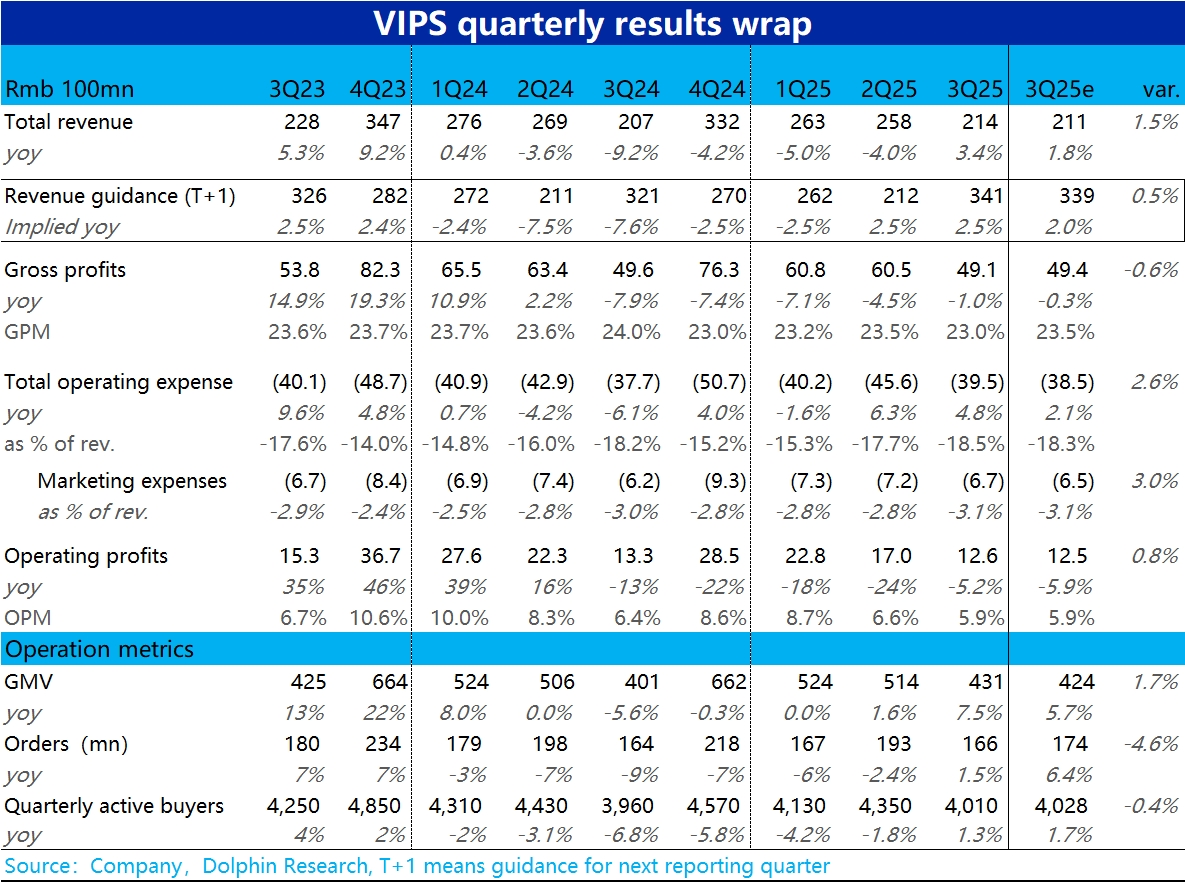

Vips 3Q25 Quick Interpretation: This quarter's performance of Vipshop generally met or slightly exceeded the consensus expectations of the sell-side. The operational trend improved as expected, and revenue finally stopped declining and started to rise. The company's stock price has reflected the improvement in performance with a gain of slightly over 12% since the last financial report.

1. In terms of core operating metrics, GMV growth rate further increased to 7.5% year-on-year this quarter, showing a significant acceleration. This was due to the order volume growth rate rebounding to 1.5% year-on-year (last year's base was also very low), and the rest was driven by a significant year-on-year increase in average order value. The reason behind the positive order volume growth is the return of active users, with a net increase of 500,000 people quarter-on-quarter, and a year-on-year rebound. The order frequency per user remained stable.

2. The gap between GMV and revenue growth rates narrowed to 4.1% quarter-on-quarter (but still slightly increased year-on-year), with the impact of high return rates still present. Overall revenue grew by 3.4% year-on-year, finally stopping the decline and starting to rise, slightly exceeding market expectations.

3. A less favorable signal is that the gross profit margin declined by 1 percentage point year-on-year to 23%, resulting in a 1% year-on-year decrease in gross profit, which was below expectations. Additionally, total expenses this quarter were 100 million more than expected, growing by 4.8% year-on-year, higher than the revenue growth rate. This was mainly due to faster growth in fulfillment and marketing expenses directly related to the business (growth rate of 7%~8%), while the growth of other expenses remained low.

4. Due to the greater-than-expected decline in gross profit margin and faster expense growth, operating profit should have performed poorly. However, this quarter confirmed other operating profits of only 300 million, nearly 100 million more than the previous two quarters this year, so total operating profit still roughly met expectations at 1.28 billion. (It is worth noting whether the company will explain the source of this other profit).

5. In terms of shareholder returns, approximately 250 million USD was repurchased this quarter, with a cumulative repurchase of 610 million USD this year. The company previously promised that the total shareholder return for this year would exceed 900 million USD, corresponding to about 10% of the company's current market value. It is very likely that dividends will be announced in the fourth quarter. $Vipshops(VIPS.US)

The copyright of this article belongs to the original author/organization.

The views expressed herein are solely those of the author and do not reflect the stance of the platform. The content is intended for investment reference purposes only and shall not be considered as investment advice. Please contact us if you have any questions or suggestions regarding the content services provided by the platform.