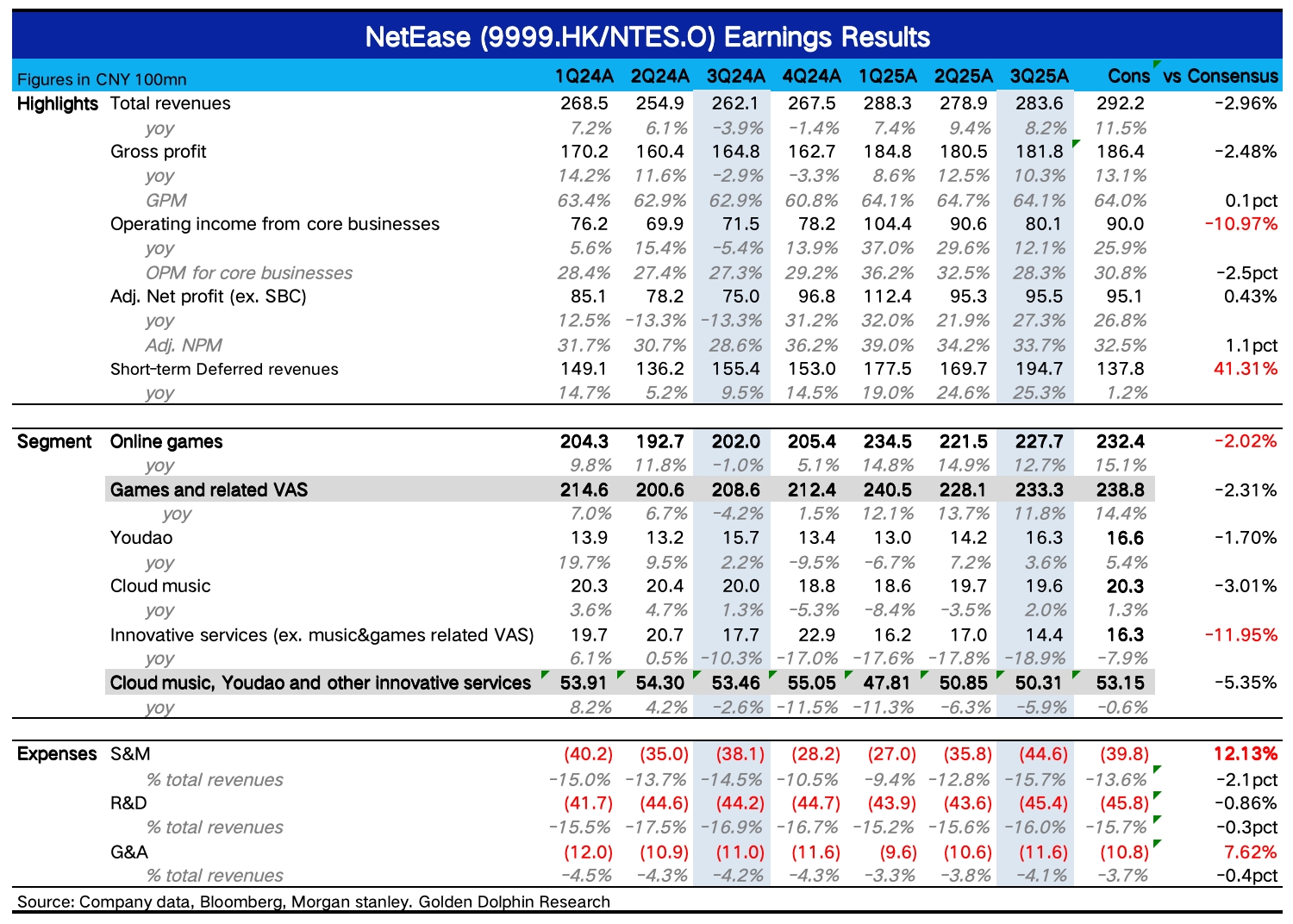

NetEase 3Q25 Quick Interpretation: Overall, the third-quarter performance fell short of Bloomberg consensus expectations, with the main expectation gaps in gaming revenue and sales expenses.

However, the market may have already been somewhat prepared, as some institutions mentioned earlier this month that current market expectations were too high and that results might miss.

Among the underperforming metrics, the only bright spot was deferred revenue, which provided some comfort: Despite a higher base, the year-on-year growth rate accelerated slightly compared to the previous quarter.

Given that PC games and overseas games were the main sources of growth this quarter, Dolphin Research believes that the revenue expectation gap is likely related to changes in the deferred recognition cycle for games. The market may not be satisfied with this quarter's results, but since the stock price has been adjusting recently and the long-term resilience of games remains strong, the punishment might be somewhat mitigated.

The most critical focus now is the launch plans and revenue targets for next year's two major games, "Forgotten Sea" and "Infinity," and it is advisable to pay attention to the upcoming earnings call.

1. Slowing Game Growth: Third-quarter game growth did not accelerate as expected by the market compared to Q2. The expectation gap may primarily lie in PC games, although, in terms of absolute growth rates, the pressure is on mobile games. However, during the summer season in Q3, "Eggy Party" and "Yan Yun: Sixteen Tones" released content updates, driving domestic mobile game revenue back to positive growth. Overseas mobile games also performed well due to the contribution from the new game "Destiny: Stars."

Therefore, Dolphin Research speculates that market expectations for PC game revenue were too high. There is no reliable third-party data source for tracking PC games, so it is understandable that institutions had significant expectation gaps. Although there was growth from the Blizzard series games in Q3, competition in PC games intensified, especially from Tencent's titles like "Delta Action," which may have had a 分流 effect.

2. Deferred Revenue Shows It Wasn’t That Bad: Notably, Q3 deferred revenue significantly exceeded market expectations, and its growth rate was better than seasonal changes in previous periods, similar to Q3 last year when Blizzard had just returned. Therefore, this quarter's revenue performance may also be related to the deferred recognition cycle. Generally, overseas games and PC games have slightly longer deferred cycles than domestic mobile games. The growth in Q3 mainly came from overseas mobile games and domestic PC game revenue.

3. Other Businesses Mostly Fell Short of Expectations: Among non-gaming businesses, Youdao Education and Cloud Music slightly missed Bloomberg expectations, but the larger drag was from Yanxuan.

4. Stable Gross Margin, High Expense Growth: On the profit side, gross margin remained relatively stable. Gaming and value-added services gross margin declined slightly quarter-on-quarter but increased by 1 percentage point year-on-year, mainly due to a higher proportion of self-developed games. Sales expenses surged 17% year-on-year in Q3 due to promotions for new games and summer version marketing for existing games, missing market expectations by nearly 500 million yuan.

Additionally, administrative expenses returned to positive growth this quarter, but given the team optimization and restructuring efforts by NetEase since Q3, we do not expect sustained significant expansion in this expense item.

Ultimately, Non-GAAP net profit was 9.5 billion yuan, which met expectations mainly due to adjustments for SBC expenses and items like investment income (up 800 million year-on-year). Core operating profit from the main business was 8 billion yuan, below market expectations. $NTES-S(09999.HK) $NetEase(NTES.US)

The copyright of this article belongs to the original author/organization.

The views expressed herein are solely those of the author and do not reflect the stance of the platform. The content is intended for investment reference purposes only and shall not be considered as investment advice. Please contact us if you have any questions or suggestions regarding the content services provided by the platform.