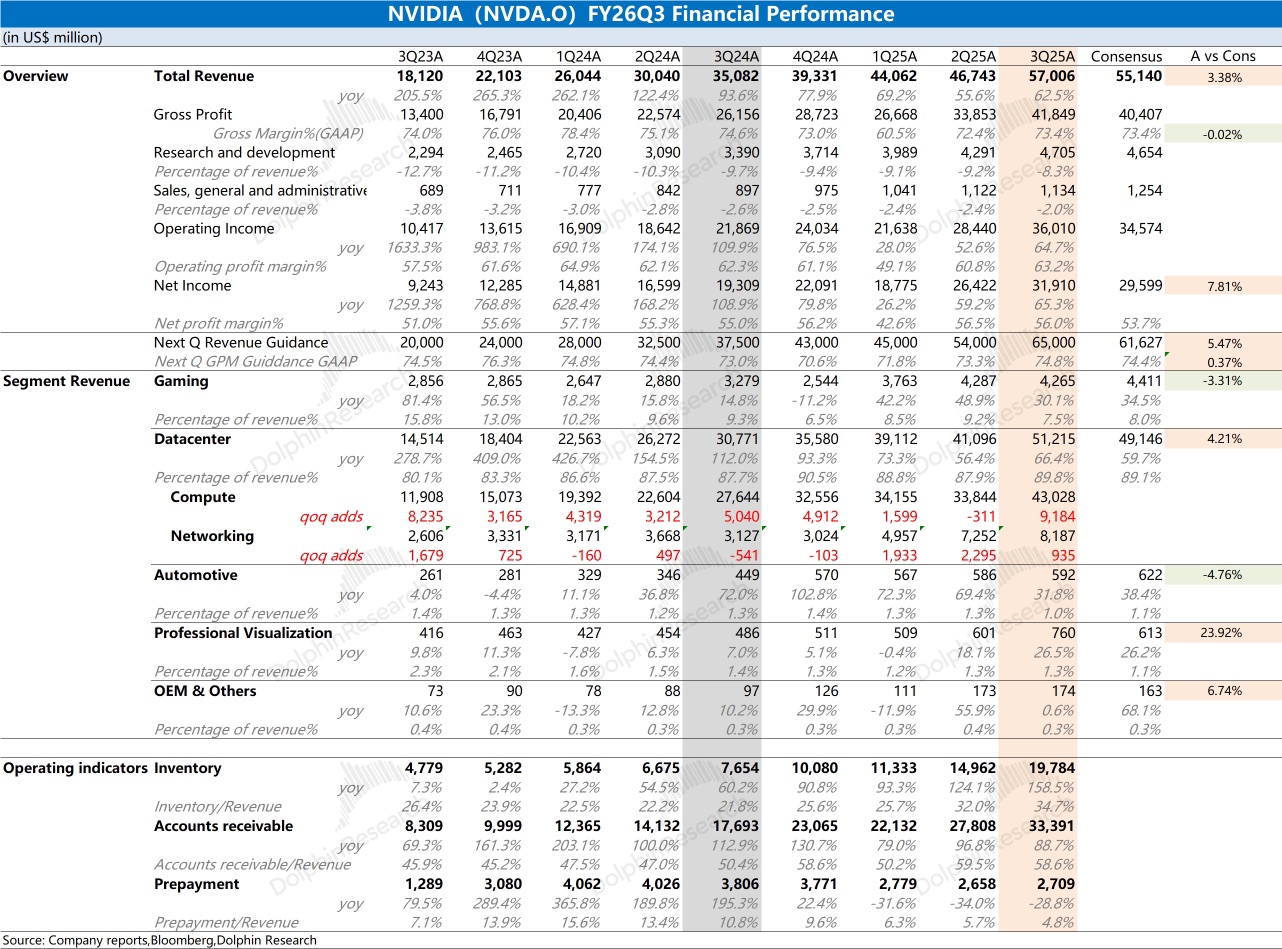

NVIDIA Quick Interpretation: The company once again delivered better-than-expected results this quarter, especially with a $10 billion quarter-over-quarter increase in revenue, which is quite impressive. The growth in revenue this quarter was primarily driven by the increased mass production of the Blackwell series.

Additionally, the company provided guidance for the next quarter, expecting revenue to reach $65 billion, an $8 billion quarter-over-quarter increase, still better than the market expectations (ranging from $63 billion to $64.5 billion) that had been revised upwards by buyers. The company's gross margin for the next quarter is expected to rise to 74.8%, still driven by the Blackwell product cycle.

Since the company had previously disclosed its AI business outlook at the GTC conference, projecting cumulative shipments of Blackwell+Rubin to reach 20 million units by the end of 2026 (roughly corresponding to $500 billion in revenue), the market is relatively certain about the company's high growth next year. The recent performance shown in the financial report and guidance mainly provides short-term support.

Recently, institutions like SoftBank and Bridgewater have been reported to be selling off or reducing their holdings of NVIDIA stock, reflecting market concerns about the company. Compared to the financial report data, there is actually more concern about how the company's management will reassure the market, including the impact of ASIC competition and customer self-development, whether the gross margin can be maintained above 75% by the end of 2026 and beyond, and the sustainability of downstream customers' AI Capex.

Therefore, in this financial report, the market is more looking forward to specific explanations from the company's management and more certain information beyond next year, which can truly boost market confidence. For more content, please follow Dolphin Research's subsequent comments and related content from the management minutes. $NVIDIA(NVDA.US)

The copyright of this article belongs to the original author/organization.

The views expressed herein are solely those of the author and do not reflect the stance of the platform. The content is intended for investment reference purposes only and shall not be considered as investment advice. Please contact us if you have any questions or suggestions regarding the content services provided by the platform.