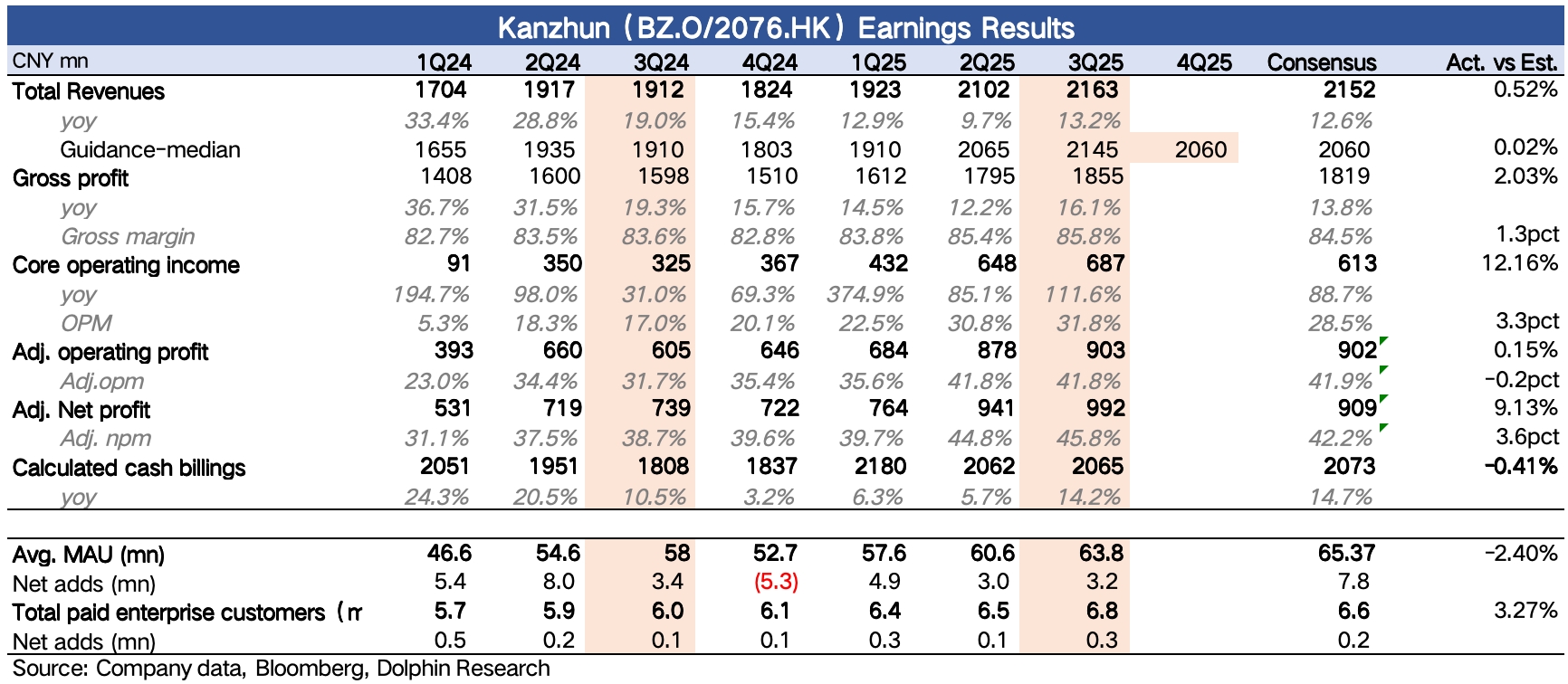

Kanzhun 3Q25 Quick Interpretation: The recruitment giant Kanzhun's third-quarter performance overall met expectations, although it may lack surprises compared to previous periods.

Despite significant external pressures, the company's number of corporate clients continues to grow, user mindshare remains leading, and internal efficiency improvements have led to a sustained trend of improving profitability.

1. Billings expected to rebound: Third-quarter billings increased by 14% year-on-year, showing a significant rebound compared to the previous quarter. Although this was within expectations, last year's base was also low. Given the relatively high-pressure environment, maintaining resilience is commendable.

2. Revenue guidance is moderate: The company's revenue guidance for the fourth quarter implies a growth rate in the range of 12.4% to 13.5%, with a slight sequential improvement, driven by a decrease in the base, which aligns with market expectations.

3. Net increase in B-end clients: The growth in billings mainly stems from a stable net increase in the number of clients. In the third quarter, paid corporate clients saw a net increase of 300,000, higher than the previous quarter.

However, the calculated average revenue per client declined year-on-year, and combined with Sensor Tower's tracking data on iOS (19% year-on-year growth), we speculate that the increase mainly comes from small and medium-sized enterprises.

4. C-end monthly active users continue to grow: Overall monthly active users reached 63.8 million, with a net increase of 3.2 million sequentially, slightly below expectations. However, within the industry, BOSS Zhipin's user scale share continues to rise.

5. Maintaining cost control and efficiency improvement: The final core operating profit was 690 million, exceeding the market expectation of 610 million, with a profit margin of 32%, up 1 percentage point sequentially.

As in the previous two quarters, this mainly resulted from a significant decline in sales and R&D expenses. This strict cost control trend is the main theme of BOSS Zhipin's internal operations this year. $Kanzhun(BZ.US) $BOSS ZHIPIN-W(02076.HK)

The copyright of this article belongs to the original author/organization.

The views expressed herein are solely those of the author and do not reflect the stance of the platform. The content is intended for investment reference purposes only and shall not be considered as investment advice. Please contact us if you have any questions or suggestions regarding the content services provided by the platform.