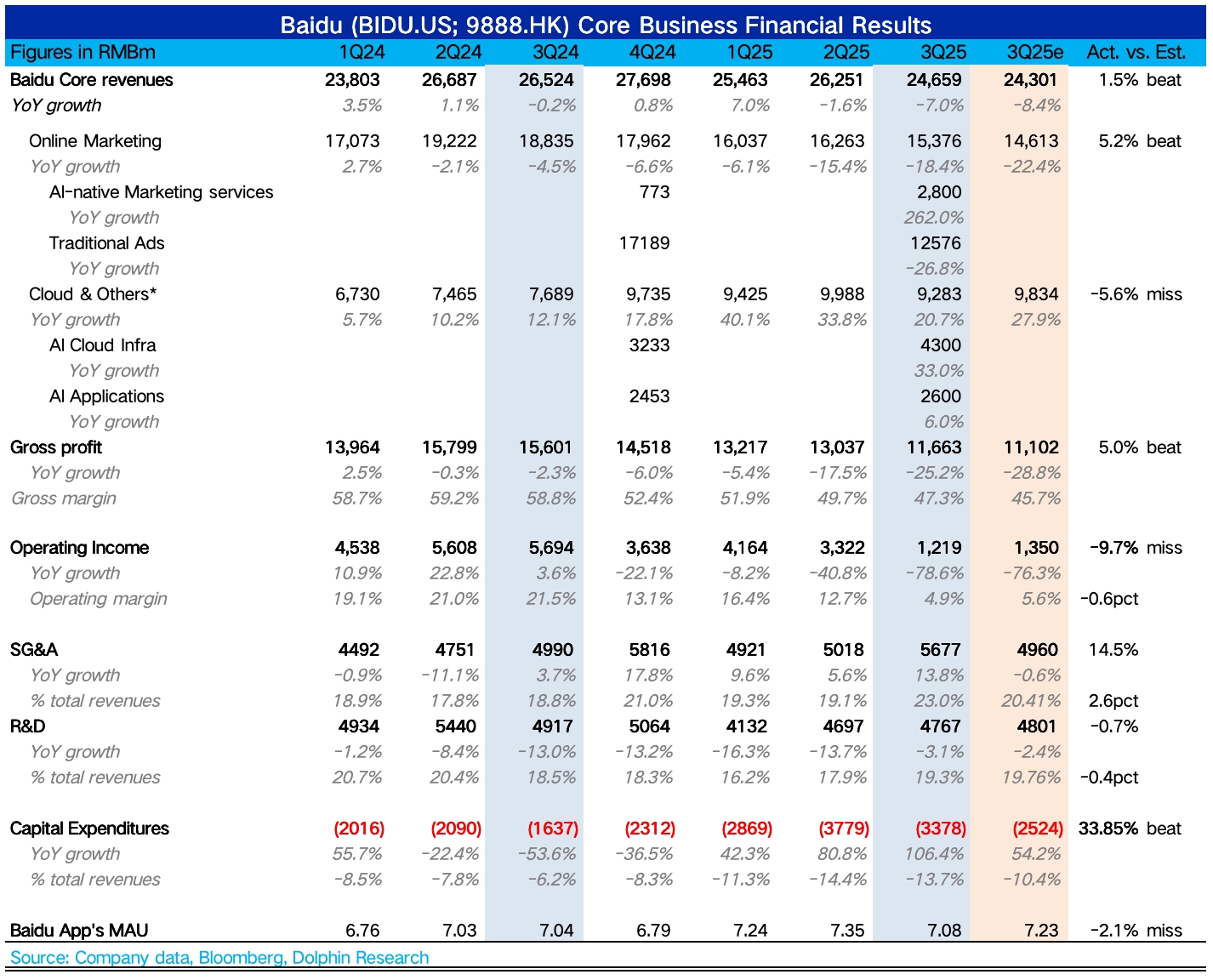

Baidu 3Q25 Quick Interpretation: Third-quarter results basically met guidance and market expectations. This earnings report provides detailed disclosure of AI revenue, aiming to shift market focus from weak advertising to new growth point AI.

In the previous preview, the company mentioned spin-off financing, increasing shareholder returns, and future dual listing and inclusion plans, which were not mentioned in the earnings report. The conference call can be watched for any incremental information.

1. AI revenue contribution accounts for 40%. Baidu's AI revenue is divided into three categories: AI cloud infrastructure, AI applications, and AI native marketing services. Specifically:

(1) AI cloud infrastructure 4.3 billion, year-on-year growth rate of 33%, mainly including API, large models, and GPU leasing, with GPU leasing subscription growth rate of 128%, compared to only 50% last quarter.

On one hand, it reflects the acceleration of AI empowerment in the industry. On the other hand, combined with Tencent's earnings report mentioning that some computing power comes from external leasing, it is not ruled out that the leading giants who previously supplied their own computing power also contributed to the demand this quarter.

The overall smart cloud revenue announced in the conference call, Dolphin Research estimates a growth rate of about 25% (approximately 6.1 billion), which means that the vast majority of revenue is related to AI demand.

(2) AI applications 2.6 billion, year-on-year growth rate of 6%, mainly including Baidu Library, Baidu Netdisk, digital employees, etc. Although it also belongs to AI+, the growth rate is relatively low. Dolphin Research estimates it is mainly due to Baidu Netdisk (promotional discounts this quarter) and other miscellaneous items dragging down. Meanwhile, competition also has an impact, with Quark and WeChat Netdisk recently enhancing functions or services.

(3) AI native marketing services 2.8 billion, year-on-year growth rate of 262%, mainly including Agent and digital humans, with digital humans already reaching 500 million in revenue last quarter. Agent is the intelligent entity for merchants, and this part of the revenue has been positioned by the company as the second growth curve of marketing services business.

2. User loss, advertising pressure remains high. Q3 overall marketing revenue declined by 18%, slightly better than guidance. However, excluding the AI part, the implied traditional advertising part declined by 27% year-on-year. The company mainly attributes it to the impact of AI-generated content, with 70% of mobile search results containing AI-generated content in the third quarter.

But this level of decline, Dolphin Research believes, still cannot exclude the factor of traffic migration to peer ecosystems, including other in-app searches and AI native applications. In the third quarter, Baidu's mobile app MAU decreased by 27 million users quarter-on-quarter, and the product experience improvement effect after AI integration search weakened, reflecting some signs of migration.

3. Other income highlights are mainly Roborun, with order volume accelerating this quarter as internationalization progresses. Overall non-marketing business growth rate of 21% meets market expectations (BBG expectations lagging behind in the chart below).

4. Profit margin significantly declined: Due to multiple factors, Baidu's core operating profit margin fell to 5% in the third quarter.

1) Changes in business structure: With AI revenue recognition, related costs bring significant increments. Currently, the profit margin level of AI business is obviously not comparable to mature advertising business. In the third quarter, Baidu made a one-time impairment of servers and other basic equipment to be eliminated (about 16 billion), and the cost pressure caused by server depreciation in the short term is expected to be partially alleviated in the future.

2) Increase in marketing expenses: The weakening of profit margin in the third quarter is also related to the increase in marketing promotion, which should mainly be related to AI business, including the expansion of cloud service sales teams and the promotion of AI native applications.

5. Capital expenditure slightly expanded: Baidu's capital expenditure in the third quarter was 3.4 billion, year-on-year growth rate of 106%, which can echo the aforementioned action of eliminating traditional servers. With the old ones eliminated, new server-related expenditures also need to increase. Additionally, considering Baidu also has Kunlun chip business, the expansion of capital expenditure may not be external GPU procurement, but possibly related to the procurement of supporting facilities for Kunlun chip. $Baidu(BIDU.US) $BIDU-SW(09888.HK)

The copyright of this article belongs to the original author/organization.

The views expressed herein are solely those of the author and do not reflect the stance of the platform. The content is intended for investment reference purposes only and shall not be considered as investment advice. Please contact us if you have any questions or suggestions regarding the content services provided by the platform.