Pinduoduo 3Q25 Quick Interpretation: The performance of Pinduoduo, which was once unpredictable with its stock price often experiencing sharp rises and falls, has now become increasingly stable and "predictable." This quarter's performance is largely in line with expectations, with both positives and negatives.

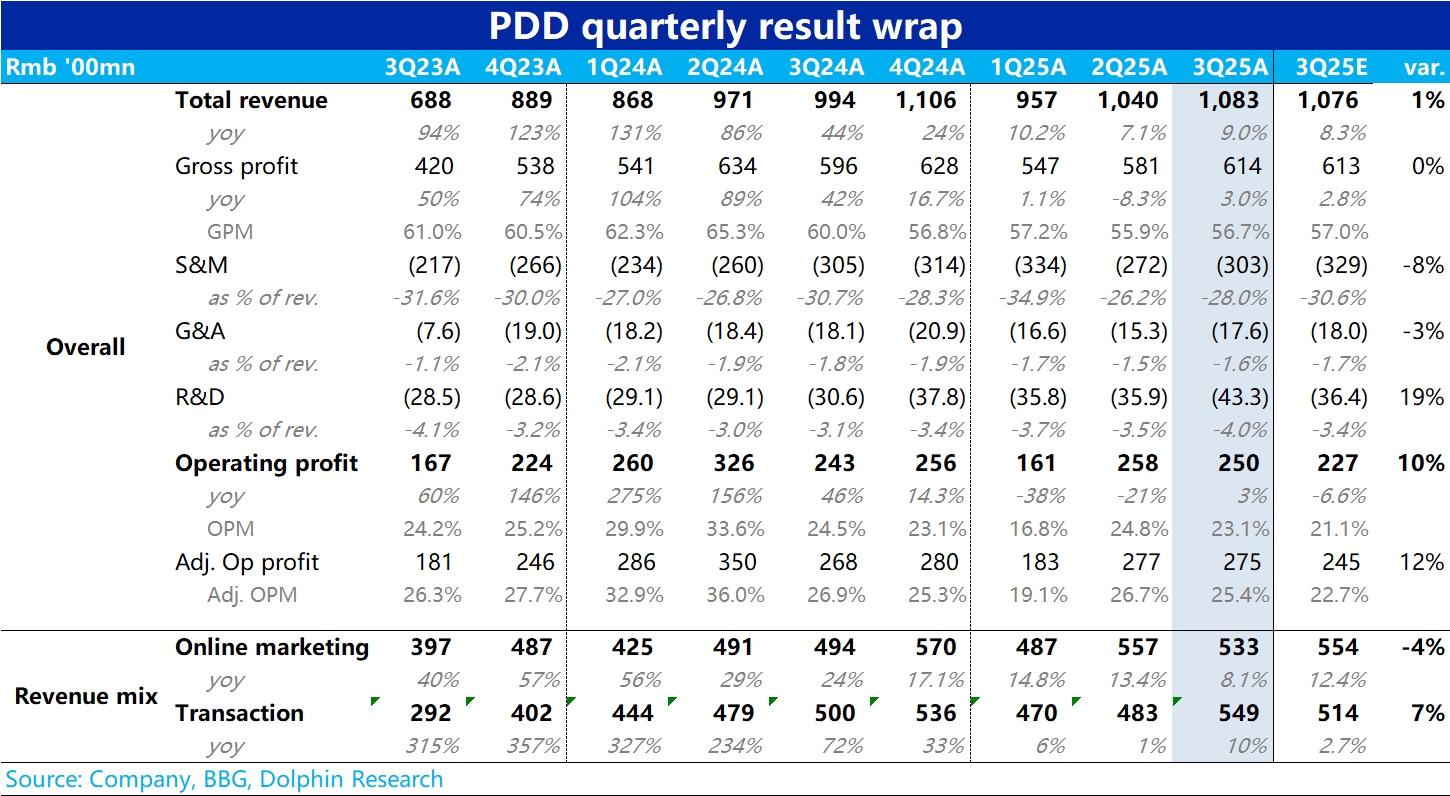

1. Firstly, this quarter's total revenue grew by 9% year-on-year, slightly outperforming the market expectation of 8.3%. Although the trend seems to have accelerated quarter-on-quarter, the more critical advertising revenue growth rate has further slowed significantly to a single-digit 8% year-on-year.

The implied signal here is that either the GMV growth rate of Pinduoduo's main site is slowing faster than expected, or the merchant support program has led to a further year-on-year decline in monetization rate.

Dolphin Research has always held the view that the growth of Pinduoduo's domestic main site will return to the industry average. However, since the benefits of state subsidies have started to decline this quarter, the market might expect Pinduoduo's relative disadvantage to be alleviated. It seems that JD.com, Alibaba, and others have attracted some of Pinduoduo's users with massive food delivery subsidies, leading to increased active users and frequency of use.

2. As the impact of tariffs on Temu has largely dissipated, the U.S. business has returned to normal operations, and other regional businesses are expanding rapidly. Driven by this, the growth rate of transactional revenue has rebounded to 10%, slightly exceeding Bloomberg's consensus expectations, and is also the reason for the rebound in total revenue growth. However, compared to more optimistic expectations from Goldman Sachs (around 59 billion), it seems that Temu's growth is not as strong.

3. This quarter's gross profit performance is basically in line with expectations, continuing to decline due to the impact of the revenue structure. The expectation gap comes from marketing expenses being about 2.6 billion less than expected, thereby leading to operating profit exceeding expectations by approximately the same scale.

Dolphin Research believes that the main reason is that as the impact of state subsidies declines, the need for self-subsidized spending has also decreased. Meanwhile, the increase in Temu's marketing expenses may not be as much as imagined.

$PDD(PDD.US) $KraneShares 2x Long PDD Daily ETF(KPDD.US)

The copyright of this article belongs to the original author/organization.

The views expressed herein are solely those of the author and do not reflect the stance of the platform. The content is intended for investment reference purposes only and shall not be considered as investment advice. Please contact us if you have any questions or suggestions regarding the content services provided by the platform.