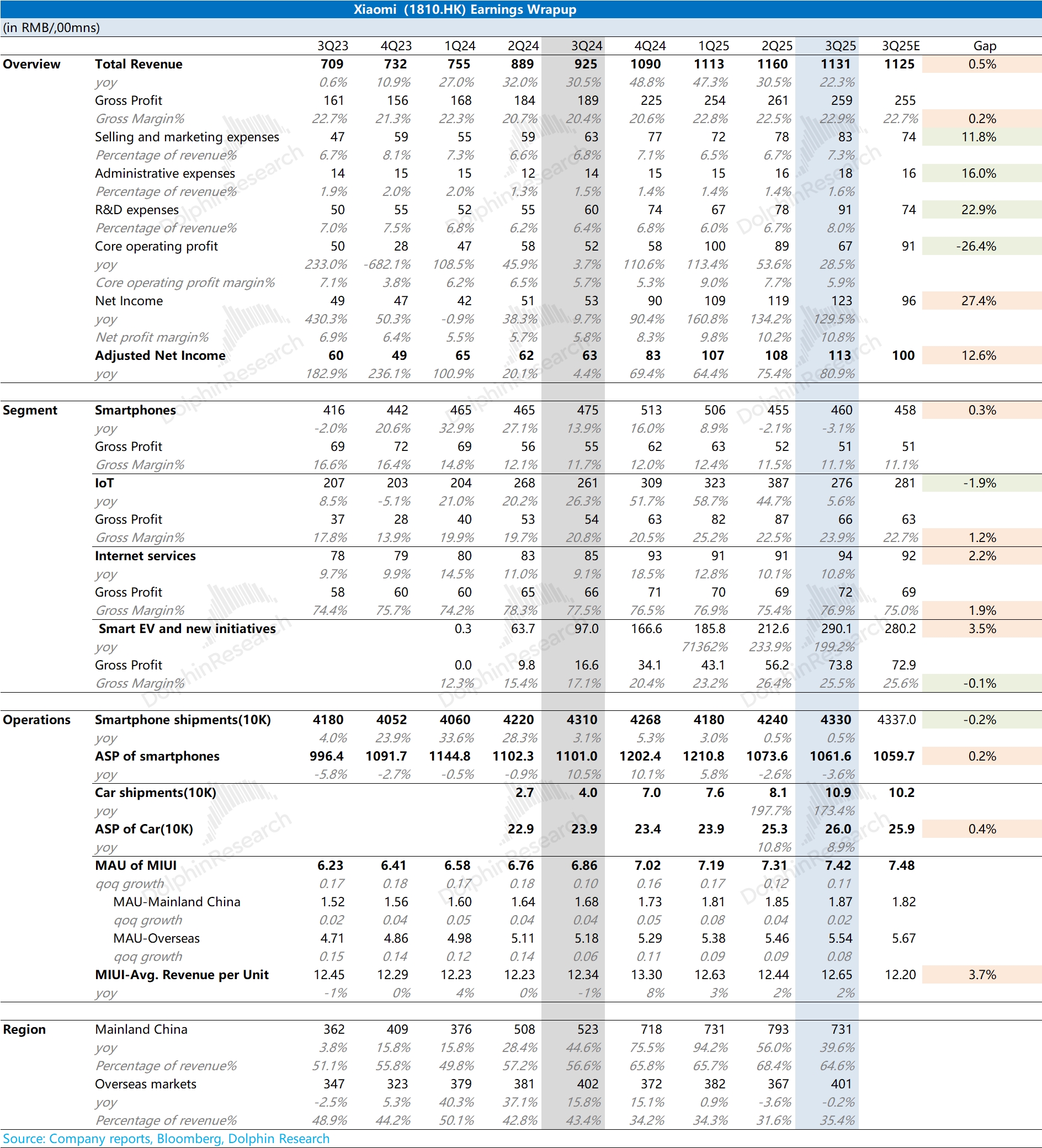

Xiaomi Quick Interpretation: Xiaomi's performance this quarter generally met market expectations, with improvements in revenue and gross margin mainly driven by the automotive business. Specifically, traditional businesses are under significant pressure, while the automotive business contributes the current main increment.

① Traditional Business: The company's mobile phone business declined again year-on-year this quarter, with a slight increase in mobile phone shipments, but the average price of mobile phones continued to decline, which is actually a sign of intensified competition.

On the other hand, the previously high growth of the IoT business, a major driver of the company's traditional business, has no longer been sustained this quarter, with growth slowing to single digits.

After the tightening of state subsidies (changed to coupon grabbing or lottery), it has significantly affected the demand in the terminal market, directly impacting the logic of the company's traditional business recovery.

Currently, coupled with the impact of rising storage prices, the company's mobile phone gross margin has fallen to around 11% this quarter. If storage prices continue to rise next year, it will directly pressure the company's performance next year;

② Automotive Business: The high growth performance of Xiaomi's automotive business in the financial report is mainly due to past backlog orders. From a dynamic perspective, the company's production capacity and orders should be considered together.

Xiaomi's automotive deliveries reached 48,000 units in October, indicating that the company currently has a monthly production capacity of nearly 50,000 units. However, the company's current weekly order situation has fallen to 4-5k units, corresponding to only about 20,000 new orders per month. In other words, this means that the company is consuming about 30,000 units of 'backlog orders' each month.

Considering the ramp-up situation of the company's second-phase factory, if the company continues to have 4-5k weekly orders, then by mid-next year, the company's 'backlog orders' will be exhausted. At that time, the logic of the company's automotive business will shift from 'supply shortage' to a demand-driven 'supply surplus'.

Overall, 'tightening of state subsidies', 'rising storage prices', and 'decline in weekly orders' are all recent negative factors for Xiaomi, directly affecting market expectations for the company next year. Currently, Xiaomi is also in a 'vacuum period' for new products, with new mobile phones already released and no new automotive products recently.

If there is no strong response to the above negative factors, it will be difficult for Xiaomi to gain market confidence at this stage. For more information, please follow Dolphin Research's subsequent detailed commentary and management minutes. $XIAOMI-W(01810.HK) $XIAOMI-WR(81810.HK) $Xiaomi Corporation(XIACY.US)

The copyright of this article belongs to the original author/organization.

The views expressed herein are solely those of the author and do not reflect the stance of the platform. The content is intended for investment reference purposes only and shall not be considered as investment advice. Please contact us if you have any questions or suggestions regarding the content services provided by the platform.