Ctrip (Minutes): Marketing expenses will continue to rise in the peak season of 4Q

The following is a summary of the $Trip.com(TCOM.US) FY25Q3 earnings call minutes organized by Dolphin Research. For earnings interpretation, please refer to "Trip.com: Awaiting the Release of Overseas Profits"

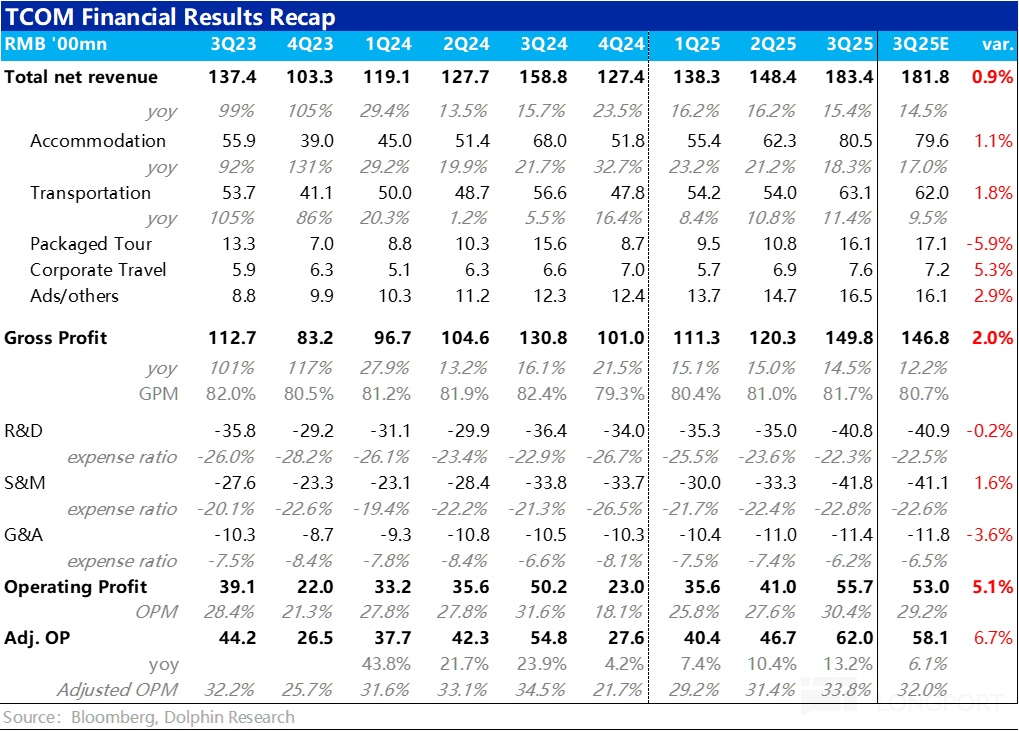

I. Review of Core Financial Information

II. Detailed Content of the Earnings Call

2.1 Key Information from Management Statements

1. Strong Market Demand: The global tourism industry is booming, with travel enthusiasm surging. Travel demand is rising across the board, primarily driven by the robust vitality of domestic tourism in China and the steady recovery of outbound travel. Travelers are actively exploring new destinations, seeking authentic and in-depth cultural experiences.

2. Company Business Highlights: The company's AI-driven tools have performed excellently, such as the "Trip Planners," which saw a 180% year-on-year increase in independent visits after upgrades. The company is actively responding to and leveraging the favorable policies of China's expanded visa-free and transit visa-free policies, aiming to increase inbound tourism revenue to account for 1%-2% of GDP. To promote cultural exchange and inbound travel experiences, the group has launched the "Taste of China" immersive culinary experience project.

a. Outbound Travel: Hotel and flight bookings increased by nearly 20% year-on-year, recovering to 140% of the same period in 2019. Japan, South Korea, and Southeast Asia remain popular. Long-haul travel demand is strong, especially during the Golden Week. Europe has become a key growth area, with bookings in countries like Iceland and Norway doubling, showing strong consumer power for high-quality in-depth travel.

b. Domestic Travel: Remains active, driven by user demand for novel, immersive experiences (such as cultural and outdoor activities). First-tier cities like Beijing and Shanghai remain top choices; meanwhile, bookings in remote western regions (such as Xinjiang and Tibet) have increased by nearly 30%. Small cities, with their unique charm and slow-paced life, are becoming new favorites for urban residents seeking relaxation.

c. Inbound Travel: Platform inbound travel bookings increased by over 100% year-on-year, reflecting strong international demand. The Asia-Pacific region is the main contributor, with strong growth in Europe and the United States as well. Building on the successful experiences in Beijing and Shanghai, a free transit tour service was launched at Hong Kong International Airport to simplify the booking and travel experience for international tourists.

d. International Platform Business (Trip.com Global): Total bookings on the international platform increased by about 60% year-on-year. The Asia-Pacific region contributed the most (growth over 50%); the mobile app became the core driver, contributing over 70% of total bookings.

3. User Segmentation and Product Innovation

a. "Silver Generation" Market:

- This group has a consumption capacity three times that of young people, driving the market from "price competition" to "value creation."

- Membership and total transaction volume (GMV) of the "Old Friends Club" both increased by over 70% year-on-year.

- By opening offline flagship stores, launching themed trips, and equipping dedicated service teams, the company deeply serves this customer group.

b. Young Customer Market:

- Thanks to the demand for "entertainment + travel" such as concerts and live performances, this segment's revenue achieved triple-digit growth.

- Collaborated with leading global live entertainment companies to provide a "ticket + flight and hotel" one-stop solution, turning entertainment hotspots into economic growth points for destinations.

4. Technology Empowerment and Ecosystem Support

a. AI Technology Application:

- Launched AI communication tools (to solve language barriers) and AI content generators (to enhance marketing capabilities).

- Updated hotel rating and ranking mechanisms to encourage hotels to return to the essence of service and improve guest satisfaction.

b. Service Diversification: Provides customized services for users from different cultural backgrounds (such as halal food options, smart toilet labels, foreign currency exchange, etc.).

2.2 Q&A Session

Q: How does management view the development trajectory of AI agents on your platform? Do you think it will become mainstream?

A: We firmly believe AI is a core pillar of the company's strategy. On the user side, we are shifting more services to AI-driven tools. The AI assistant "TripGenie" has covered over 200 countries and regions, with user numbers increasing by over 200% year-on-year in the first half of 2025. We are also continuously optimizing the balance between advanced AI search and traditional search to provide users with real-time recommendations that better match personal preferences. On the operational side, AI helps us detect issues and provide intelligent solutions, which not only enhances employee productivity and customer service efficiency but also increases satisfaction and conversion rates. Looking ahead, we will continue to invest in AI, aiming to make every step of travel more convenient, reliable, and enjoyable by combining cutting-edge technology with our 26 years of industry experience.

Q: Could you share recent observations on consumer behavior and travel trends during the National Day and Mid-Autumn Festival holidays?

A: We observed a very strong "3L" trend, namely Long stay, Long distance, and Long tail destinations. With longer holidays, users tend to travel long distances, which happens to be our advantage. Specifically, the domestic market achieved healthy single-digit growth, while outbound travel was even stronger. On our platform, outbound hotel and flight bookings increased by over 30% year-on-year, and inbound travel bookings surged by over 100% year-on-year, so we are very satisfied with the data for this holiday.

Q: Considering the current geopolitical tensions between China and Japan, how significant is the Japanese market's contribution to the company's revenue? What impact do you expect this to have on finances in the coming quarters?

A: Regarding the Japanese market, we believe that as long as consumers have purchasing power, they will choose to travel to different destinations. The main factors influencing travelers' choices are whether the destination is safe and friendly, whether visa policies are convenient, and whether there are sufficient direct flights. Based on our years of observation, even if a specific destination is affected, travelers with time and budget will turn to other options. Therefore, overall, our platform has not been significantly affected by this.

Q: What is the recent trend in average daily rates (ADR) for hotels? What is the outlook for next year?

A: In the third quarter, the year-on-year decline in hotel and flight prices narrowed to low single digits. During the Golden Week, due to strong demand, domestic hotel and flight prices rose, but fell back after the holiday. From the supply side, the supply of domestic hotels is growing at a mid-to-high single-digit rate year-on-year, which may put some pressure on future room prices. Internationally, flight capacity has recovered to about 88% of 2019 levels, so cross-border flight prices, although lower than last year, are still higher than pre-pandemic levels; international hotel prices have remained basically stable.

Q: How does management view recent consumer sentiment? What are your preliminary views on the outlook for next year?

A: We observe that the tourism industry remains very strong, with a continued increase in people's desire to explore the world. In terms of leisure travel, thanks to the extra holidays this year, the market has maintained steady growth. Long-haul travel on our platform is strong, with outbound hotel and flight bookings growing by over 30%, with Europe being a key driver. Domestic tourists tend to seek deeper, more immersive experiences, exploring niche destinations, and per capita consumption on our platform has remained flat compared to last year. Business travel has also remained stable, and as Chinese companies go global, we have attracted more corporate clients, with average business travel spending on the platform achieving year-on-year growth.

Looking ahead to 2026, we see challenges as opportunities and will continue to strengthen our foundation. In terms of international business, Trip.com's market share in overseas markets is growing rapidly, proving the effectiveness of our strategy, and we will continue to invest globally, especially in the Asia-Pacific region. In terms of domestic business, we focus on capturing more demand and providing excellent service, with a focus on exploring the three major growth opportunities of inbound tourism, the silver generation, and young travelers. By deepening cooperation with partners to bring inbound tourists to the domestic market, we can not only create a large number of jobs but also bring significant incremental opportunities to partners in hotels, airlines, and other sectors. Therefore, we are very optimistic about the growth prospects for 2026.

Q: What impact do you expect the new strategies of peers in the Chinese market (increased competition) to have on our business?

A: We believe that healthy competition is beneficial to the industry because it ultimately brings joy and a better experience to users. Our core advantages in competition are as follows:

First, we invest heavily in technology and AI to improve the efficiency of the entire industry. Second, we provide a one-stop solution that consumers love, where users can conveniently book hotels, airport transfers, and other services after booking flights, and we also offer trusted destination lists. Most importantly, our excellent customer service capability. For example, if unexpected events such as tsunamis, earthquakes, or wars occur during travel, our team can contact local customers within 2 minutes to ensure they are moved to a safe area and can prioritize travel arrangements for customers needing to return the next day. This comprehensive protection before, during, and after the trip allows users to feel at ease when choosing us.

We believe that as long as we continue to make the right investments in products, technology, and services, and earn the trust of our customers, our business can continue to grow.

Q: Trip.com's international business saw strong growth in the third quarter. Could management share more about the specific performance of the international business and operational highlights in different regional markets?

A: In the third quarter, our international business achieved significant growth. Total bookings on the Trip.com platform increased by about 60% year-on-year, with the Asia-Pacific region growing by over 50%, showing strong momentum amid macroeconomic uncertainty.

The Asia-Pacific region remains the focus of our international business operations and the largest contributor to growth. Through localized products and customized marketing strategies, our brand awareness and market position in several key markets have continued to improve, and we have become one of the leading online travel agencies (OTAs) in the region, winning the "2025 Asia's Best Online Travel Agency" award by Travel Weekly Asia. Meanwhile, emerging markets such as the Middle East and Europe also show encouraging growth momentum.

In addition, our inbound travel business performed particularly well, with bookings in the third quarter increasing by over 100% year-on-year. This is due to our continuous product innovation, such as "Half-Day Tours of the Bund," "Half-Day Tours of the Great Wall," and "Taste of China" immersive dining experiences, which have consolidated our leading position in the inbound travel market. We will continue to invest heavily and drive the sustained growth of our international business.

Q: Inbound travel is currently the fastest-growing business. Could management introduce the latest developments in this business and the main drivers of future growth?

A: The strong growth of the inbound travel business is due to multiple positive factors. According to our research, inbound tourists generally feedback that China is very safe (especially friendly to female tourists), people are hospitable, the food is rich, the history is long, and the infrastructure is modern and efficient. More attractively, they can enjoy "affordable luxury" experiences here, such as staying in a five-star hotel with excellent service for just a couple of hundred dollars.

Policy-wise, there are also great benefits, such as visa-free policies for over 60 countries and the extension of transit visa-free duration to 10 days, which greatly facilitate tourists and business people coming to China.

Based on these favorable conditions, we fully leverage our advantages to seize opportunities. We have the most comprehensive inventory of travel products in China and high-quality service capabilities, including 24-hour multilingual customer service, promising to answer calls within 30 seconds to solve practical problems for tourists. This comprehensive service guarantee enables us to effectively drive the growth of inbound tourist numbers.

This business not only brings a pleasant travel experience to inbound tourists but also brings multiple values to us: it creates a large number of jobs for young people and brings new revenue growth points to partners in hotels, airlines, ground operators, and major attractions. Therefore, we are very optimistic about the future development of the inbound travel business and will continue to invest.

Q: We noticed an increase in marketing expenses for international business this quarter. Could management introduce Trip.com's marketing progress and effectiveness this quarter? Also, what are the marketing plans for the next quarter and 2026?

A: Our marketing strategy in the third quarter achieved solid results. As the business scale expands, our marketing efficiency in major target markets has also significantly improved. For example, the "Mega Sale" events we held in major markets such as South Korea, Thailand, and Malaysia this quarter all set new sales records. Internally, we empower the execution team to set ROI indicators consistent with long-term growth goals, which not only motivates the team but also ensures strict control over marketing efficiency.

Looking ahead, for the upcoming global holidays, we will continue to use proven successful marketing models to execute our signature events while remaining keen and flexible to capture emerging market trends. By combining these short-term opportunities with our long-term strategy, our goal is to accelerate revenue growth, further consolidate market position, and expand our organic mobile user base.

Q: As our penetration in regional markets deepens, do you feel that competition with global online travel agencies (OTAs) like Agoda is intensifying? We observe that Google is increasingly promoting paid search over natural search (SEO). Does this trend affect the traffic acquisition cost or strategy for your meta-search platform (such as Skyscanner)?

A: We believe the Asia-Pacific market has great potential, mainly based on the following points: First, the region accounts for about 60% of the global population, the middle class is rapidly expanding, and economic growth is leading the world. Second, the Asia-Pacific region has extremely rich tourism resources, from magnificent nature to vibrant cities. Third, the current market structure is relatively fragmented, and online penetration is relatively low, providing excellent opportunities for industry consolidation and digital expansion.

It is precisely because of these favorable market dynamics that we are investing heavily in expanding the Asia-Pacific market. Our core strategy is to provide one-stop travel solutions for travelers in the Asia-Pacific region worldwide, combined with localized products and excellent customer service. Our globalization strategy emphasizes deep insights into the uniqueness of each market and adopts flexible and targeted market strategies. We believe that in this way, we can maintain continuous growth momentum in the region and continuously expand market share.

Q: Regarding destination services and the "experiential" tourism market (such as part of the packaged travel business you mentioned), could management share the company's long-term positioning and the market opportunities you see? Especially in the context of recent IPO news from companies in this field (such as Klook, KKday).

A: Destination services currently account for a small proportion of our group's total transaction volume (GMV), with an estimated GMV of about $5 billion, accounting for only 2% to 3% of the total. Although the base is not large, this business is growing very rapidly, with a year-on-year growth rate of over 130% on the Trip.com platform this year, especially driven by strong demand in the Asia-Pacific region. Currently, our platform covers about 300,000 destination service products worldwide and is still expanding.

Our core advantage lies in the "one-stop travel platform." After users book flights and hotels on our platform, we can better match their needs for activities, attractions, transportation, and other destination services, thereby enhancing the overall travel experience.

Our strategy for this business has several key points:

Traffic cost advantage: Most of our customers are users who have already booked flights or hotels, so the traffic cost of acquiring these destination service customers is basically zero. We do not need to spend additional marketing expenses to attract them.

Not pursuing short-term profitability: Since the business scale is still small, our current goal is not to profit from it. The main purpose is to improve the user experience, enhance user stickiness, and ensure that customers love our platform and products.

Leveraging the existing ecosystem: With our large Asia-Pacific user base, loyalty programs, and AI tools, we can deepen user interaction and promote repeat purchases.

Looking ahead to the next 3 to 5 years, our focus is on expanding product coverage and market share. We plan to actively expand in this field, with the fundamental goal of improving the loyalty and satisfaction of customers in our main businesses of flights and hotels by perfecting the one-stop service ecosystem. This strategy allows us to leverage traffic advantages without the pressure of profitability, thereby occupying a unique advantage in this field.

Q: This quarter's operating expenditure was slightly below market expectations. How does management view the trend of operating expenditure for the fourth quarter and the entire year of 2026?

A: We always strictly manage all investments. In terms of sales and marketing, we will flexibly adjust spending based on the maturity of each market and the characteristics of different channels, so the overall expense mix will remain consistent with business priorities. In terms of personnel costs, as more markets grow rapidly, we are expanding the global team, but at the same time maintaining high standards for new hires to ensure excellent marginal cost efficiency.

The quarter-on-quarter growth in operating expenses in the third quarter was mainly due to seasonal factors in the Chinese business. Looking ahead, with the arrival of the global holiday season, we plan to gradually increase marketing investment. Therefore, the marketing ratio may increase quarter-on-quarter, but its year-on-year change will depend on changes in the regional and channel mix.

From a longer-term perspective, we continue to focus on improving operational efficiency. Our focus will be on achieving this goal by increasing direct mobile traffic, strengthening cross-selling, and consolidating customer loyalty.

Q: Regarding Trip.com's (international business) profit margins. With the rapid growth of international business, how should we view its profit margin expansion prospects next year and in the longer term?

A: It is too early to provide specific guidance on profit margins for 2026. Overall, we view profit margins as a natural result of the dynamic business mix and the continuous improvement of operational efficiency in each business unit. In the long run, we believe there are no structural limitations on the company's profit margins. With our innovative strategy, global expansion, and forward-looking investments, we believe the company's long-term profit margin levels will be comparable to international peers.

<End Here>

Risk Disclosure and Statement of this Article:Dolphin Research Disclaimer and General Disclosure