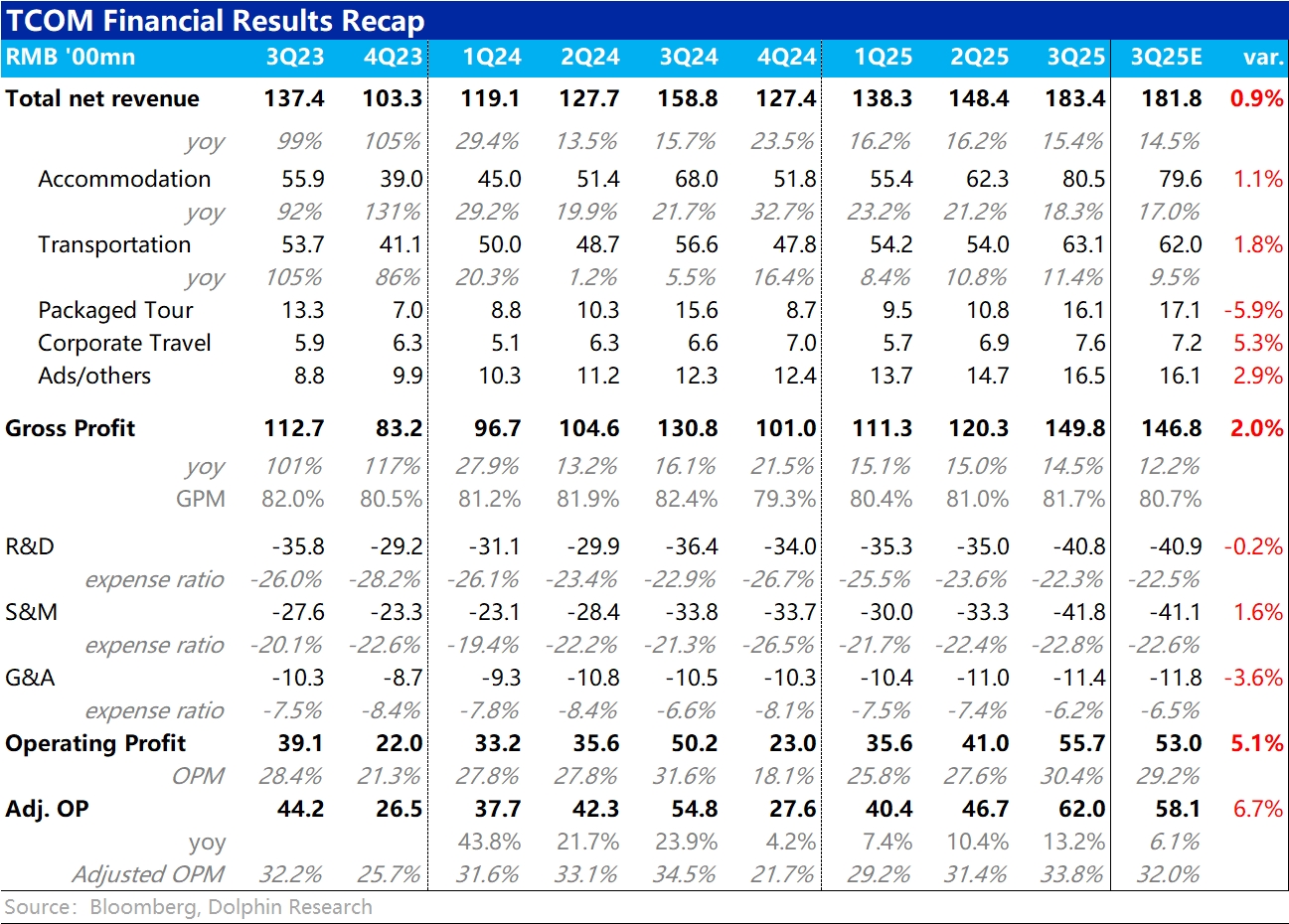

Trip.com 3Q25 Quick Interpretation: Overall, Trip.com's performance this quarter remains generally stable and better than market expectations. In terms of trends, growth remains steady, but due to relatively high expenses, profit growth still slightly lags behind revenue growth. Specifically:

1. Growth: Total revenue increased by 15.4% year-on-year to 18.34 billion, with a slight deceleration quarter-on-quarter, but still slightly better than expected. In detail, the hotel business, which accounts for the largest proportion, saw a quarter-on-quarter slowdown of about 3 percentage points, partially offset by a slight acceleration in the ticketing business. More meaningful sub-segment growth details need to be observed in the conference call discussions.

2. Gross Profit: Mainly due to the higher proportion of overseas business, which has a lower gross margin, the overall gross margin this quarter still contracted by about 0.7 percentage points year-on-year, resulting in a 14.5% year-on-year increase in gross profit, slightly lower than the revenue growth rate, but still better than Bloomberg's consensus expectations.

3. Expenses and Profit: Similarly, mainly due to the investment in overseas business, expenses this quarter also maintained relatively high growth (+16.7% yoy), exceeding the growth rates of revenue and gross profit.

The main driver was a nearly 24% increase in marketing expenses. As a result, with a slight narrowing of the gross margin and expansion of expenses, adjusted operating profit grew by 13% year-on-year this quarter, still in a period of profit margin contraction. However, the trend shows that the extent of profit margin contraction has narrowed compared to the previous two quarters and is better than the company's previous guidance. $Trip.com(TCOM.US) $TRIP.COM-S(09961.HK)

The copyright of this article belongs to the original author/organization.

The views expressed herein are solely those of the author and do not reflect the stance of the platform. The content is intended for investment reference purposes only and shall not be considered as investment advice. Please contact us if you have any questions or suggestions regarding the content services provided by the platform.