JD.com (Minutes): The goal of food delivery is to 'sustain itself', and overseas investments will be made cautiously in the long term.

The following are the minutes organized by Dolphin Research$JD.com(JD.US) FY25 Q3 Earnings Call Minutes, for earnings interpretation please refer to "JD.com: Even without State Subsidies, Still "Attacking Everywhere""

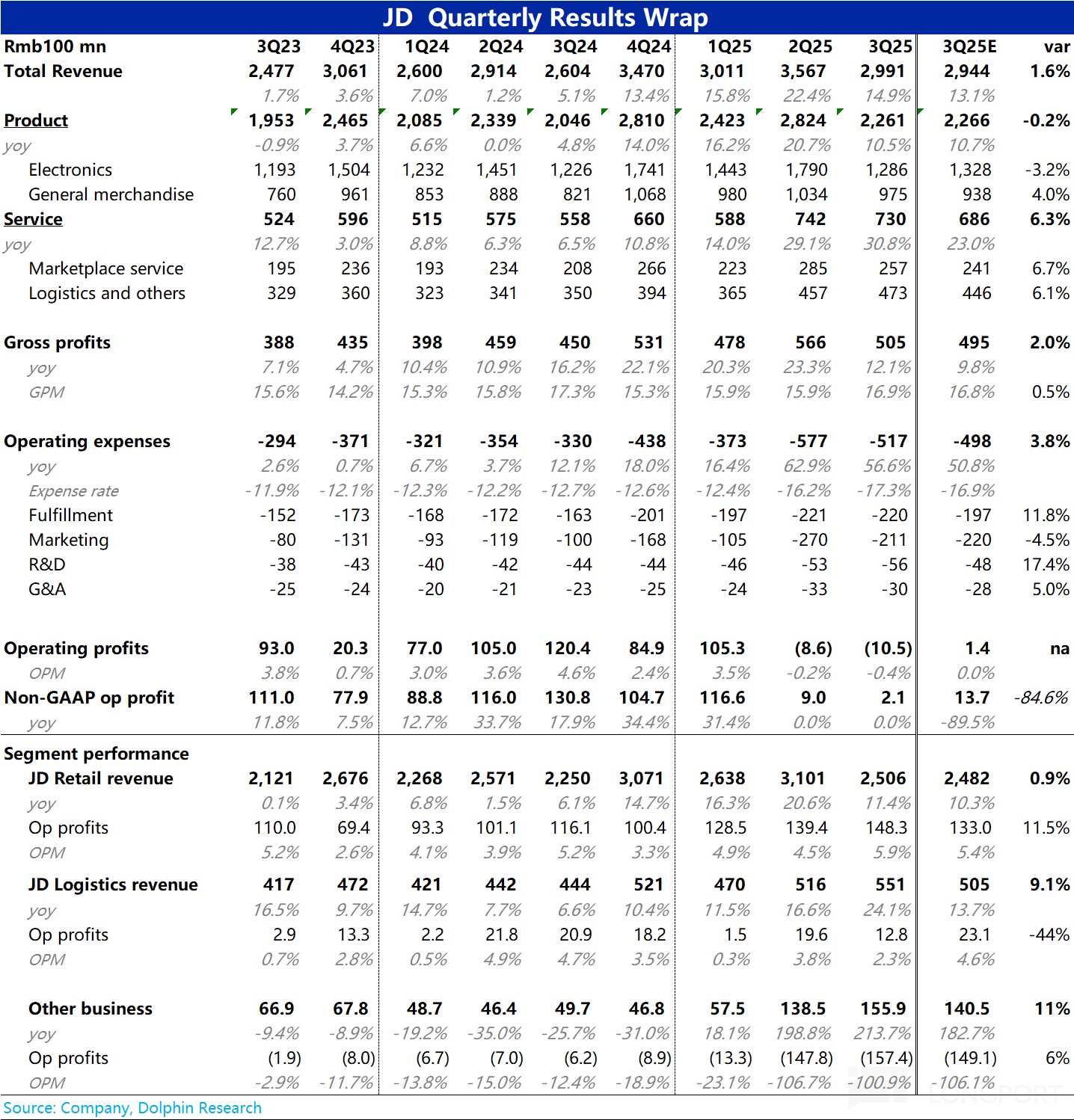

I. Review of Core Financial Data

Performance Overview:

Total Revenue: RMB 299 billion, a year-on-year increase of 15%.

Net Profit: Non-GAAP net profit of RMB 5.8 billion.

User Scale: Annual active customer count surpassed the 700 million mark; monthly active customer count increased by over 40% year-on-year.

Core Retail: Revenue of RMB 250.6 billion, up 11% year-on-year; operating profit margin increased to 5.9%.

Business Highlights: General merchandise revenue grew by 19% year-on-year; service revenue grew by 31% year-on-year; advertising revenue increased by over 20% year-on-year

Cash Situation: Cash and equivalents totaled RMB 211 billion; free cash flow over the past 12 months was RMB 13 billion.

II. Detailed Information from the Earnings Call

2.1 Key Information from Executive Statements

User Growth and Activity:

User base and activity showed strong growth momentum, with monthly active customer count increasing by over 40% year-on-year, and annual active customer count surpassing the 700 million milestone; shopping frequency for all user groups (including new users, old users, and JD Platinum members) achieved significant improvement.

Progress in Core Retail Business:

Retail revenue grew by 11% year-on-year, driven by accelerated growth in daily necessities, marketplace platform, and marketing service revenue; in terms of profit, JD Retail's gross margin and operating profit margin both maintained steady expansion, demonstrating the benefits of scale and improved operational efficiency.

The electronics and home appliance categories faced high base pressure, but the company responded through supply chain advantages, user insights, and customized product development; daily necessities category revenue grew by 19% year-on-year, with strong growth momentum expected to continue into the fourth quarter, benefiting from product mix optimization, enhanced price competitiveness, and improved service quality.

Platform and Marketing Services:

Platform transaction service fees and marketing service fee revenue at the group level grew by 24% year-on-year, maintaining double-digit growth for four consecutive quarters; advertising revenue achieved accelerated growth quarter-on-quarter, with a year-on-year increase of over 20% in the third quarter, mainly due to ecosystem optimization, AI intelligent advertising tools, and improved traffic allocation efficiency. Market and marketing revenue is expected to maintain healthy growth in the fourth quarter.

JD Takeaway:

GMV achieved double-digit growth quarter-on-quarter, operating losses further narrowed compared to the previous quarter, benefiting from increased order volume, healthy order structure, prudent investment strategy, and expanded revenue channels; strong synergy effects with retail business, with increased user cross-selling rate, benefiting supermarket, electronic accessories, and IT categories.

Jingxi and International Business:

Jingxi is deeply cultivating the mid-to-low tier market, with simultaneous growth in merchant and user scale; international business is expanding from Germany and the Benelux region to the UK, paving the way for global expansion; both are progressing steadily according to plan and are important pillars of long-term strategy.

AI Technology Development:

Released AI roadmap, including digital human assistant and AI intelligent agent "Joy Inside" and industry-customized AI solutions; upgraded retail technology infrastructure, such as "JD Broadcaster" serving over 40,000 brands, with lower costs than human broadcasters and better sales performance; AI customer service handled over 4.2 billion inquiries during promotional periods.

Guidance:

Expected steady growth in daily necessities category and market & marketing revenue in the fourth quarter, with takeaway business scale expansion, user experience optimization, and synergy effects release being future focuses.

2.2 Q&A Session

Q: Regarding government transaction subsidies, as the base increases in the fourth quarter, what is the growth outlook for JD Retail's electronics and home appliances? How does the slowdown in transaction subsidy growth affect profit margins?

A: Transaction subsidies have created a high base for the industry but have driven industry upgrades and innovative product development. JD has enhanced market share and supply chain capabilities through this. We will consolidate market position through product innovation (customized products in collaboration with brands), price optimization (leveraging scale advantages to reduce costs), and service experience (omnichannel layout, with over 20 JD Malls nationwide and more than 100 city flagship stores for home appliances as of Q3).

Regarding profit margins, we will continue to provide high-value products and strengthen supply chain collaboration. Growth drivers have diversified, with supermarket, health, fashion categories, and advertising revenue becoming new engines. During the 11.11 promotion, shopping customer count increased by 40% year-on-year, laying the foundation for growth next year.

Q: Regarding overseas development, please share the overseas strategy, investment scale, and pace.

A: International expansion is JD's long-term core strategy, aiming to establish a global retail network. We adopt a localized e-commerce model, leveraging supply chain advantages and collaborating with global brands. Currently, Europe's Joybuy business is in the testing phase in the UK, France, Germany, and the Netherlands, focusing on enhancing product supply, logistics capabilities, and user experience. Regarding CECONOMY's transaction pending regulatory approval. Investment will remain gradual and prudent, with the scale not being large, strictly managing investment pace to achieve healthy and sustainable growth.

Q: Regarding takeaway business, how long does JD plan to invest during the loss-making customer acquisition phase? What is the progress in economic benefits, commissions, and 7Fresh business model improvement?

A: Takeaway and instant retail are JD's long-term strategies. In the third quarter, takeaway GMV achieved double-digit growth quarter-on-quarter, with a healthier order structure, high-value orders as the mainstay, and average order value increasing quarter-on-quarter. Despite fierce competition, with improved unit economic benefits, quarterly losses narrowed quarter-on-quarter.

Currently, merchants are exempt from commission policy, with only limited advertising revenue starting to be generated. We continue to improve operational efficiency, enrich quality restaurant merchants, optimize subsidy strategies, and upgrade system capabilities. Ultimately, JD Takeaway will become a self-sustaining business.

7Fresh kitchen model launched in July, ensuring food safety through supply chain innovation, with rapid order growth also driving sales of surrounding restaurants. In the future, we will promote strategic progress with a long-term perspective, focusing on long-term investment returns, aiming to establish a self-sustaining business, and generating synergy effects with JD's ecosystem in terms of users, supply chain, and fulfillment, reducing long-term user acquisition costs.

Q: Regarding general merchandise categories, how to further strengthen competitive advantages in speed, selection, quality, and price in the three key categories of supermarket, health, and apparel?

A: General merchandise has achieved double-digit growth for four consecutive quarters. In the supermarket category, we enhance user awareness and penetration through promotional activities (such as Black Friday, Super 18) and drive conversion through rapid platform user growth. By optimizing supply chain capabilities to reduce costs and improve operational efficiency, we offer more competitive prices, validating the economic scale of the self-operated model.

Meanwhile, we refine operations with brand collaboration, creating categories with strong user awareness and growth potential, such as alcohol, maternal and infant, and home cleaning, which have established strong awareness, with other categories expected to break through. General merchandise is an important pillar of JD's growth, and we will continue to enhance operations and user awareness to support long-term sustainable growth.

Q: What synergy effects does takeaway traffic bring to general merchandise categories? What is the retention rate of new takeaway users? Can you quantify the proportion of takeaway users becoming active users in core retail?

A: The synergy effects between takeaway business and JD Retail are reflected in: 1) User Growth and Engagement: JD App's daily active user count maintained rapid growth in the third quarter. During JD's "Double Eleven" promotion, both user base and shopping frequency maintained strong growth momentum, with shopping user count increasing by 40% year-on-year. Takeaway user retention rate remains high, enhancing overall user engagement.

By October, annual active customer count surpassed 700 million in October, with the conversion rate of new takeaway users increasing month by month, with the earliest batch of takeaway users achieving a conversion rate of nearly 50% in the third quarter.

2) Cross-category Sales: Takeaway users' cross-category purchasing trend is becoming more apparent, especially in supermarket products and life services, which are comprehensive merchandise categories. Takeaway creates new growth momentum for comprehensive merchandise categories by attracting new users and increasing existing users' shopping frequency.

3) Instant Retail: Takeaway business accelerates the development of instant retail business, and we have formed a dedicated team focusing on this area. In the future, we will continue to accelerate synergy between takeaway and core retail in user momentum, cross-category purchasing, and marketing, and explore broader commercial ecosystem synergy effects.

Q: Can you update the latest AI strategy and investment? How does AI help core business, and what is its financial impact?

A: JD has established a comprehensive AI capability framework covering infrastructure, models, platforms, application scenarios, and products. Over the next three years, we will continue to invest, nurturing a trillion-scale cross-industry AI ecosystem. At the JD Exploration Conference in September, we released the AI strategic roadmap and flagship products, including the digital human assistant "TaTaTa" and intelligent agent "JoyInside".

In terms of application: 1) Providing merchants with over 50 AI tools (such as AI advertising placement agents), helping them improve efficiency and reduce costs in content generation, marketing, and customer service; achieving breakthroughs in shopping efficiency and personalized experience through intelligent search and recommendation functions based on natural language interaction.

2) Logistics robots have been deployed in over 20 provinces in China and more than 10 countries globally, covering the entire chain from warehousing, sorting to transportation and delivery. In the future, the expanded deployment of logistics robots, autonomous vehicles, and drones will further reduce social logistics costs, enhance partner efficiency, and optimize consumer experience.

Q: Regarding platform ecosystem development, including merchant number contribution and outlook for the next few quarters?

A: In the third quarter, the platform ecosystem made solid progress, with the number of active merchants increasing by over 200% year-on-year. We have introduced more top merchants and industrial belt merchants, with takeaway business also bringing a large number of quality restaurant merchants. In the third quarter, the number of users purchasing third-party products increased by over 50% year-on-year, reflected in accelerated growth in commission and advertising revenue, with a year-on-year increase of 24% in the third quarter, the highest growth rate since the second quarter of 2022.

In the future, we will further expand industrial belt merchants and takeaway merchants, enriching local supply; strengthen platform infrastructure, providing merchants with more technical tools to enhance operational efficiency; optimize merchant operation rules and traffic allocation efficiency, creating a clear growth path and fair ecosystem; while strengthening user mindshare for third-party products, especially in fashion and other third-party-driven categories. Platform ecosystem business will be a long-term driver of revenue and profit growth.

Q: Regarding profitability and profit margin outlook for the coming years?

A: In the third quarter, JD Retail's profit continued to grow steadily, validating confidence in the long-term profit margin trend of retail.

Driving factors include: 1) Healthy development of the platform ecosystem will drive growth in commission and advertising revenue, leading to profit margin expansion; 2) Supply chain advantages and core retail business scale effects will continue to reduce costs and improve efficiency, with JD Retail's gross margin expanding year-on-year for 14 consecutive quarters;

3) Category structure changes impact profit margins, with most categories and brands' operational efficiency and profit margin performance continuously improving, supermarket category has established strong procurement capabilities and differentiated product supply, with significant profit improvement potential in the future, electronic products and home appliances categories also have long-term profit improvement space through product mix optimization.

New business investment will focus on supply chain capabilities, with deeper synergy effects expected between new initiatives and existing businesses, improving overall business ecosystem operational efficiency and profitability. The long-term high single-digit profit margin target remains unchanged.

<End of Text>

Risk Disclosure and Statement of this Article:Dolphin Research Disclaimer and General Disclosure