JD 3Q25 Quick Interpretation: As the first among the three major e-commerce groups to disclose its performance, JD.com's results this time are generally mixed.

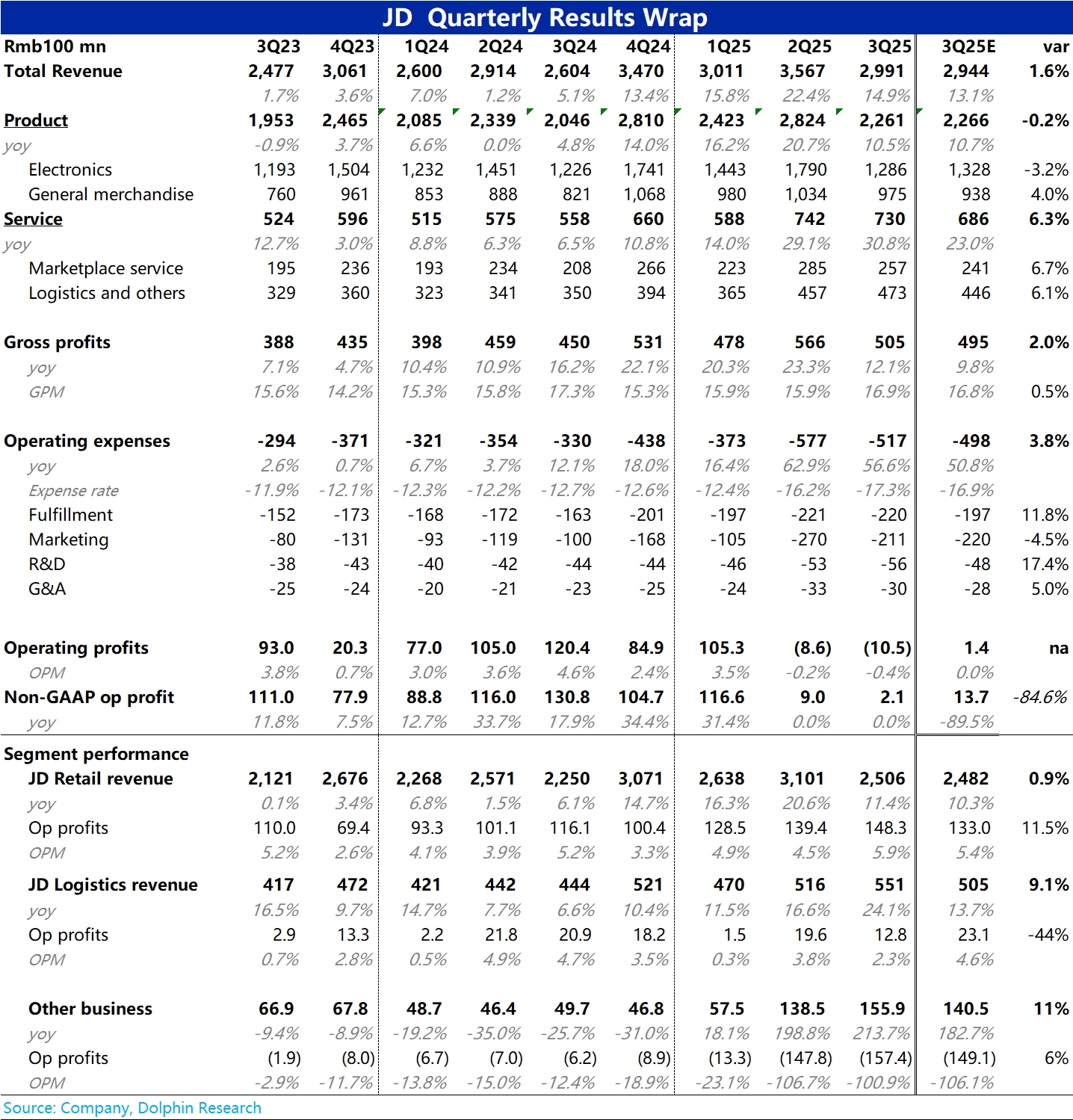

Firstly, in terms of revenue, the slowdown in the growth of electrical product sales was more severe than expected, but it was offset by the stronger-than-expected sales of general merchandise. Additionally, the company's 3P service business revenue grew more robustly than anticipated, resulting in the group's overall revenue slightly exceeding expectations.

Regarding profit, on one hand, the operating profit margin of the core mall group continued to improve significantly, better than expected. On the other hand, although the investment and losses in the food delivery business should have narrowed, the increased investment and losses in other areas such as Jingxi and overseas business led to further expansion of losses in the new business segment and the group overall compared to the previous quarter.

Specifically:

1. Weak electrical, strong general: The revenue growth of electrical products this quarter was only 5%. Although the market had anticipated a decline in growth due to the retreat of state subsidies and last year's high base, the actual situation was worse.

However, driven by the supermarket and apparel categories (JD opened several offline malls and launched "JD Fashion"), general merchandise grew nearly 19% year-on-year, stronger than expected. With both offsetting each other, JD's self-operated sales growth this quarter ultimately met expectations.

2. Retail stable, services stronger: While self-operated retail remained relatively stable, JD's 3P service business and logistics business growth this quarter were also quite impressive, with service revenue increasing nearly 24% and logistics revenue growing nearly 35%. Both business growth rates were significantly better than expected, indicating further enhancement of JD's 3P merchant ecosystem and monetization capabilities.

3. Dragged by structure, gross margin slightly declined: The company's overall gross margin this quarter was 16.9%, slightly down 0.4 percentage points year-on-year, dragging gross profit growth behind revenue growth. Specifically, the gross margin of the core mall business still increased significantly year-on-year (up 1.3 percentage points), but was dragged down by the decline in logistics and other business gross margins, while their revenue share increased.

4. Expenses continue to grow high, but the intensity has narrowed: This quarter's total operating expenses amounted to 51.7 billion, a year-on-year increase of 57%, but both the year-on-year growth rate and net increase have declined compared to the previous quarter. Similarly, the expense growth rate of the mall has narrowed, but logistics and new business segments are still in high growth.

5. Therefore, the operating profit margin of the mall segment improved by 0.7 percentage points year-on-year, with profit exceeding expectations by about 1.5 billion. However, the losses in logistics and new business exceeded expectations by 1 billion and 800 million respectively, leading to the group's total operating profit slightly missing expectations. $JD.com(JD.US) $JD-SW(09618.HK)

The copyright of this article belongs to the original author/organization.

The views expressed herein are solely those of the author and do not reflect the stance of the platform. The content is intended for investment reference purposes only and shall not be considered as investment advice. Please contact us if you have any questions or suggestions regarding the content services provided by the platform.