SEA: An Unchanged Report Card Can't Compete with a 'Changed Heart' Market

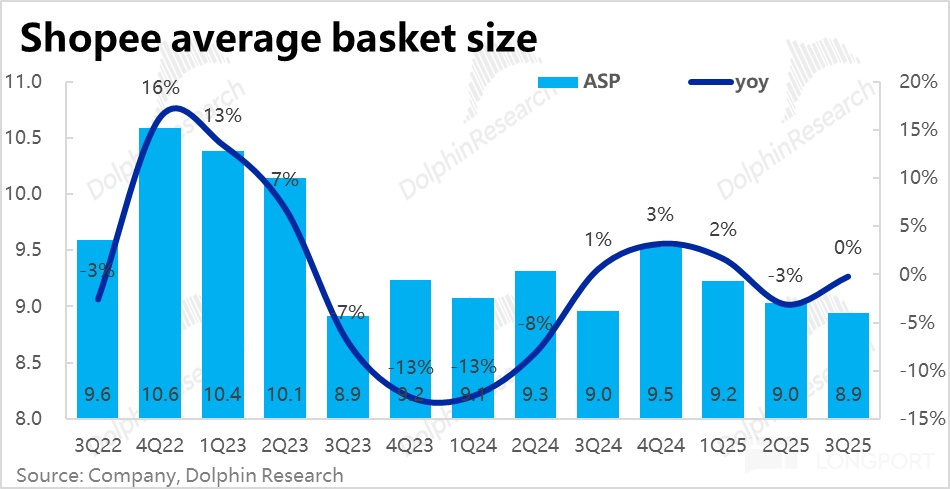

The Southeast Asian Little Tencent $Sea(SE.US) delivered its third-quarter performance report before the U.S. stock market opened on the evening of November 11. In summary, this quarter's performance is characterized by both highlights and shortcomings. Firstly, growth remains very strong, with revenue and business growth in the three major segments exceeding expectations.

However, as the company has started to focus more on growth rather than profit, with gross margin narrowing quarter-on-quarter and expenses maintaining high growth, the profit margins of each segment have deteriorated marginally this quarter. Specifically:

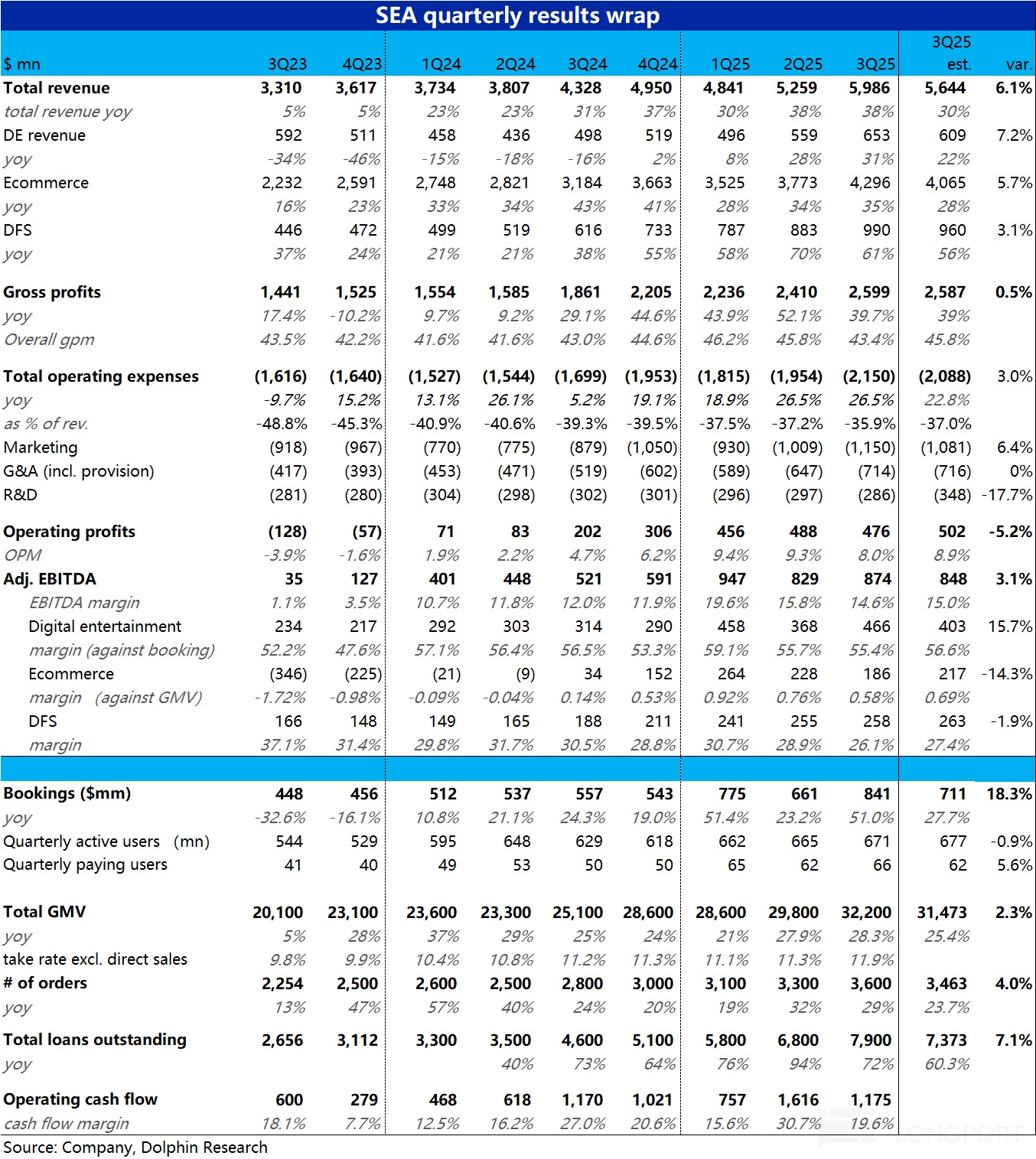

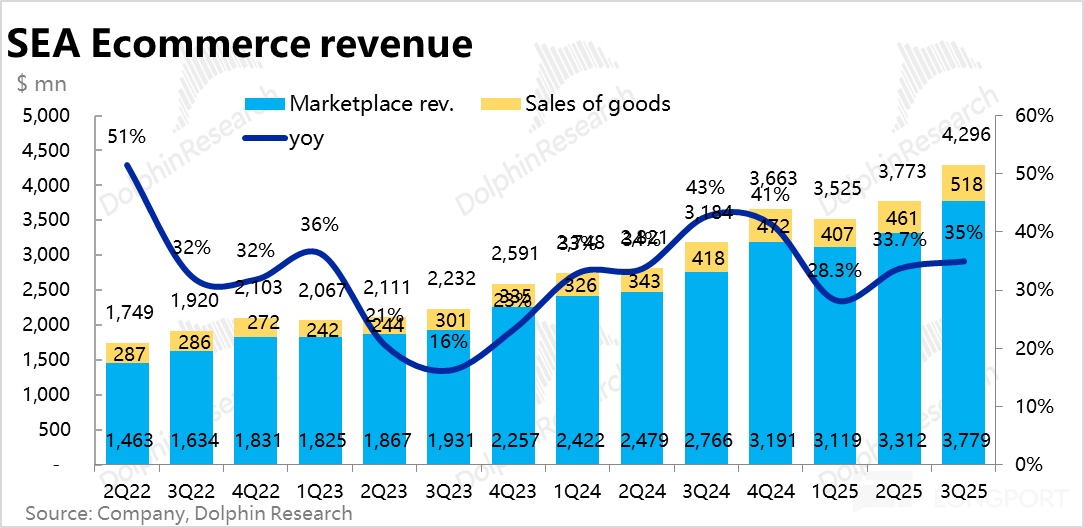

1. GMV remains strong, but not driven by volume: The most important Shopee e-commerce segment's GMV growth rate this quarter was still 28.3% year-on-year. It slightly accelerated compared to the previous quarter and exceeded the sell-side expectation of 25.4%, undoubtedly still quite strong.

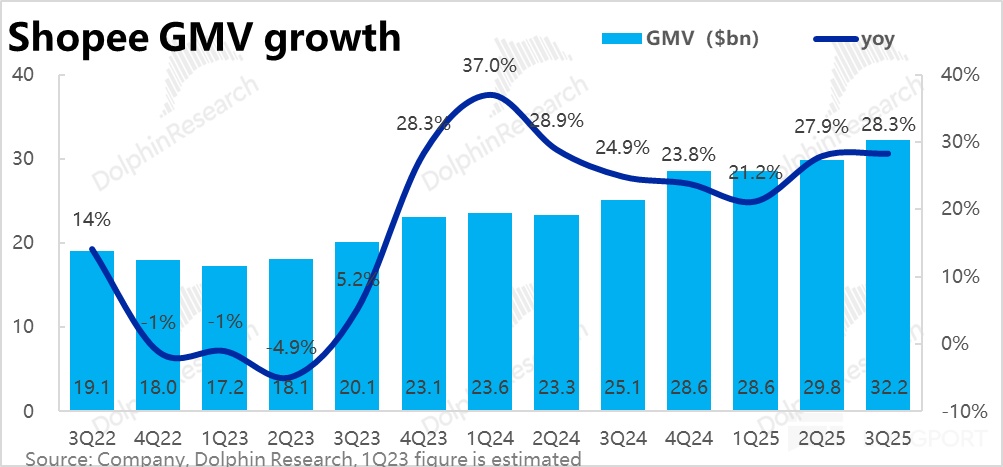

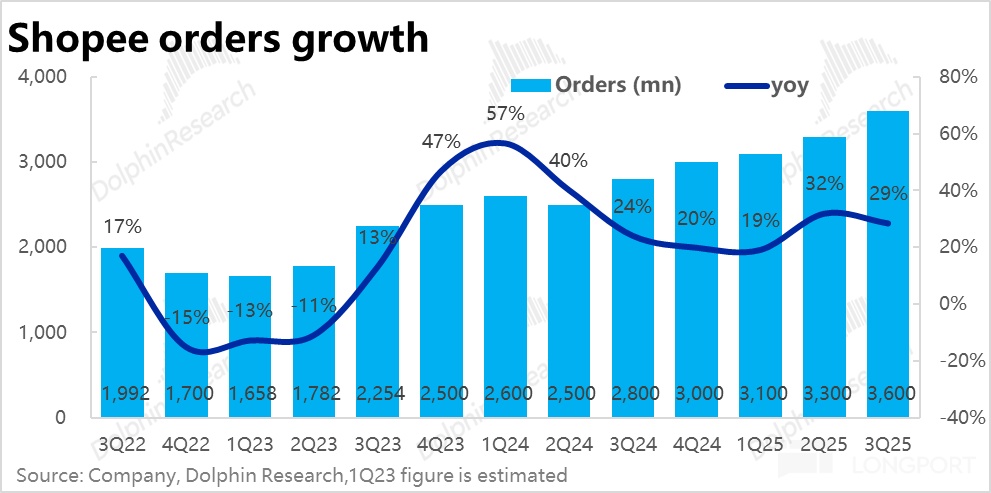

The slight flaw is that the outperformance this quarter was mainly driven by the recovery of average order value, while the growth rate of order volume declined quarter-on-quarter (32% last quarter vs. 29% this quarter). It failed to clearly verify the market's expected bullish signal that e-commerce order volume would continue to accelerate after increased investment and logistics subsidies.

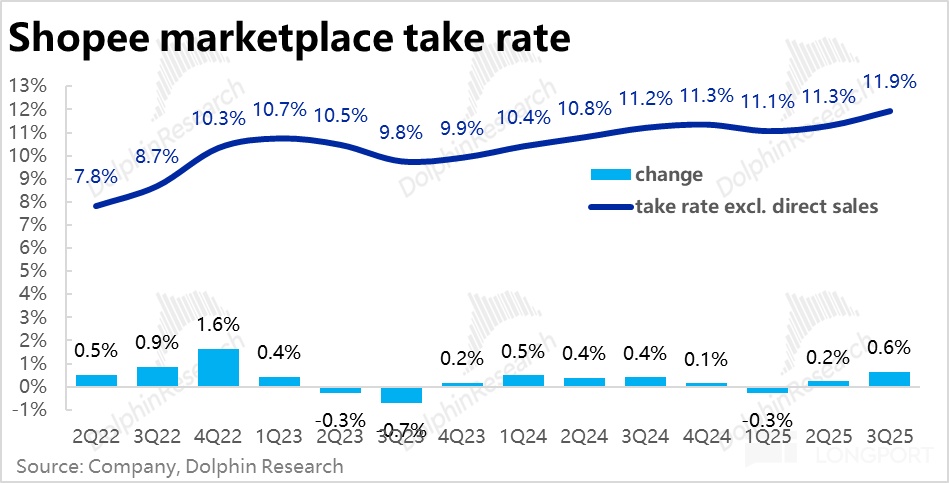

2. Commission monetization rises, but logistics monetization declines: As major platforms in Southeast Asia continue to jointly improve monetization, this quarter Shopee's overall platform monetization rate reached 11.9%, with the quarter-on-quarter increase being the highest since 2023. Driven by this, Shopee's platform revenue growth rate this quarter reached as high as 37%, accelerating by a full 3 percentage points quarter-on-quarter.

More specifically, this quarter saw a significant quarter-on-quarter increase of 0.9 percentage points in commission-based monetization rate, while logistics-based service monetization rate declined by 0.2 percentage points quarter-on-quarter. This indicates that the company is further increasing logistics fee reductions or subsidies.

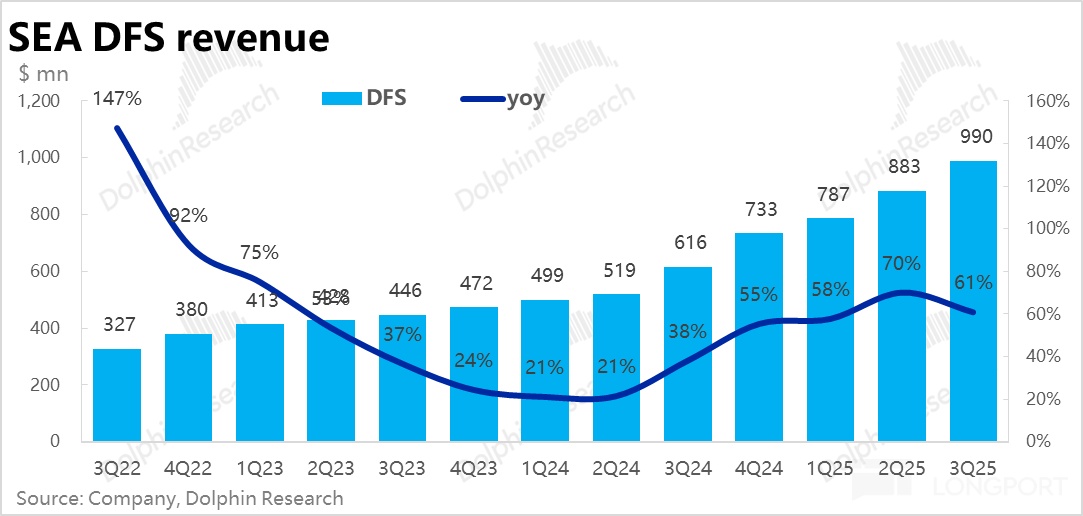

3. Monee continues to expand and grow rapidly: Firstly, the net increase in total loan balance, both on and off the balance sheet, reached $1.1 billion this quarter, slightly accelerating compared to last quarter and significantly stronger than the sell-side expectation of a net increase of $600 million. Driven by this, the segment's revenue also maintained a high year-on-year growth of 61%.

From the revenue growth being slightly lower than the loan balance, it can be inferred that with the expansion of new business, the loan structure should be gradually tilting towards products or customer groups with lower interest rates.

The company disclosed that the proportion of bad debts over 90 days this quarter was 1.1%, still generally stable. The bad debt rate calculated by bad debt loss provision/loan balance also remained generally stable quarter-on-quarter, indicating that credit quality and risk control are still quite stable.

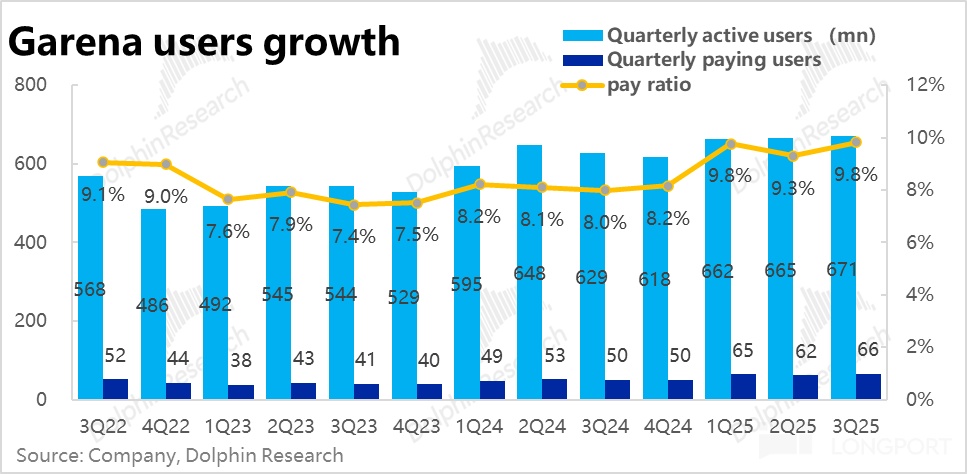

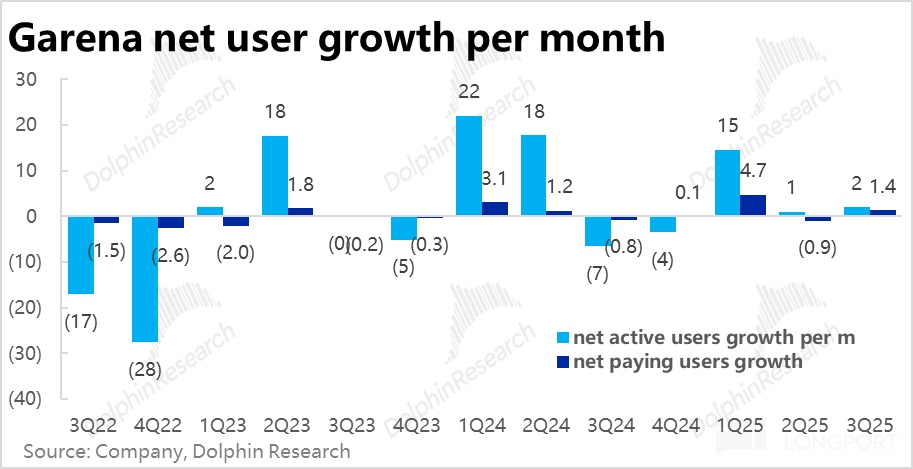

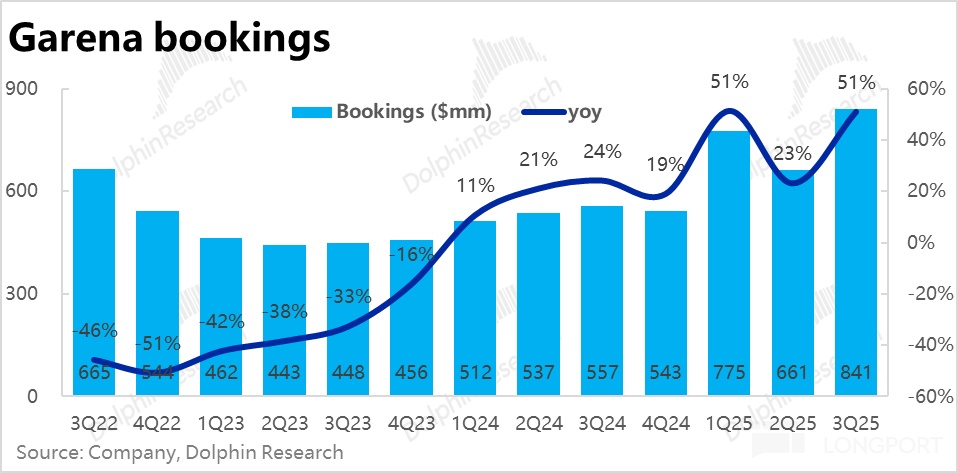

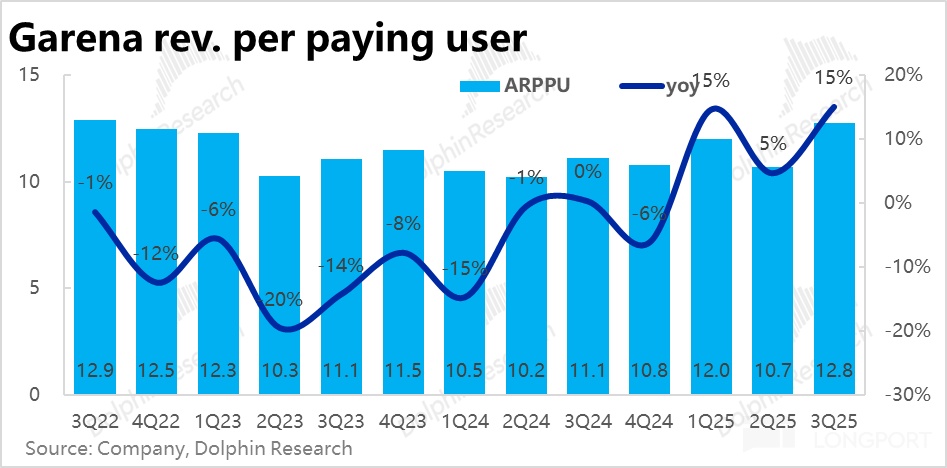

4. Garena's joint celebration: This quarter, thanks to collaborations with popular IPs like Naruto and Squid Game, Garena games delivered quite impressive growth again.

The game revenue growth rate this quarter surged again to 51% year-on-year, significantly exceeding the market expectation of 28%. It was consistent with the growth rate during the first quarter's collaboration with Naruto. Additionally, the joint activities also promoted user return and increased willingness to pay. This quarter, active users and paying users increased by approximately 2 million and 1.4 million quarter-on-quarter, respectively. The payment rate also returned to the first quarter's high of 9.8%.

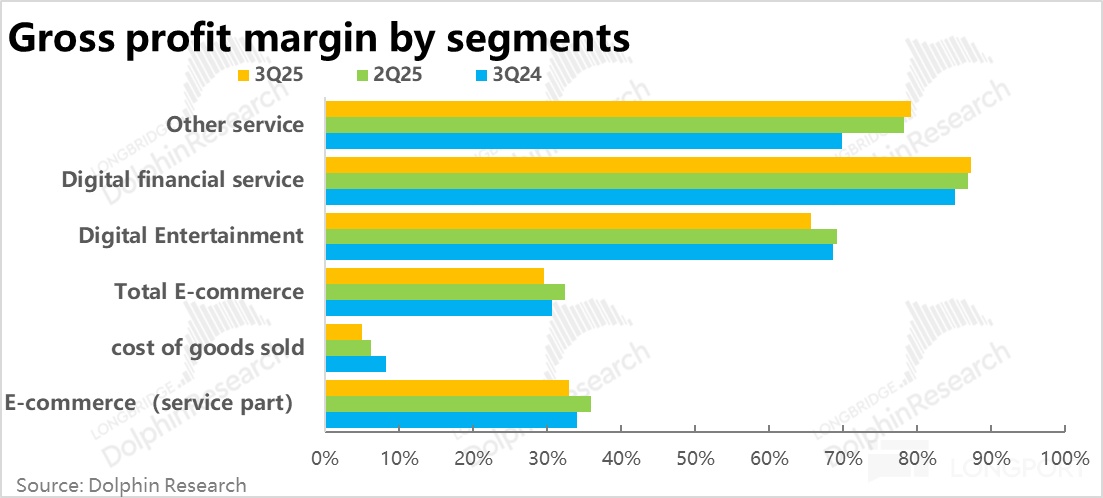

5. Decline in gross margin: Although the growth of the three major segments was quite good, due to logistics subsidies and changes in business structure, gross margin deteriorated this quarter.

The company's overall gross margin still improved year-on-year, but narrowed significantly by 2.4 percentage points quarter-on-quarter, falling below market expectations. As a result, despite revenue significantly exceeding sell-side expectations, gross profit was only in line with sell-side expectations.

Looking at the segments, the gross margins of the e-commerce and gaming segments declined both year-on-year and quarter-on-quarter. Although the financial segment's gross margin is still improving, the rate of improvement has started to narrow.

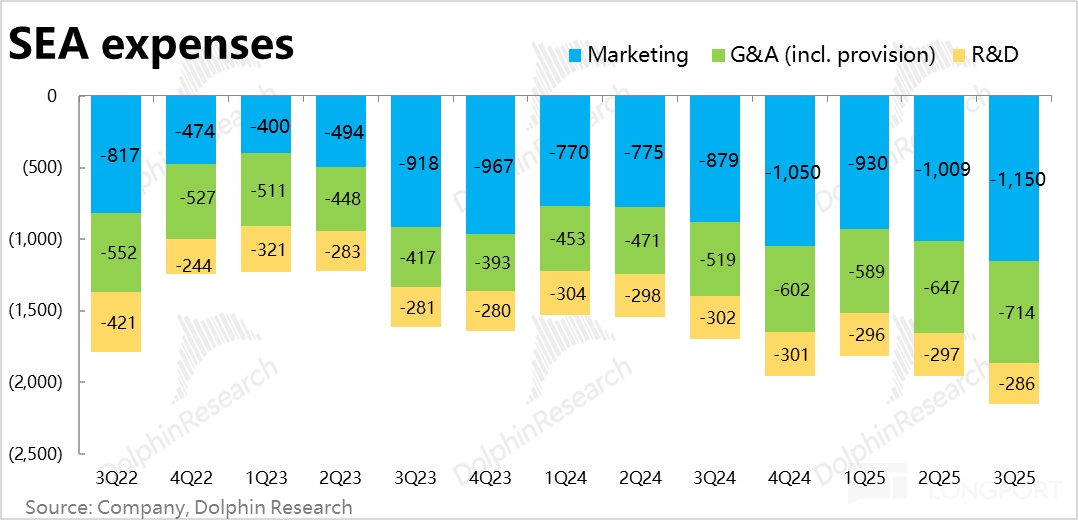

6. Expenses grow rapidly: The impact on the expense side is more significant, with total operating expenses this quarter amounting to nearly $2.15 billion, a year-on-year increase of 26.5%, consistent with last quarter's growth rate, and about 3% higher than sell-side expectations.

On one hand, bad debt loss provision matched the growth of loan balance (+76% yoy), which is understandable but still significantly drives total expense growth. Additionally, marketing expenses grew rapidly (+38% yoy), reflecting the company's willingness to invest for growth.

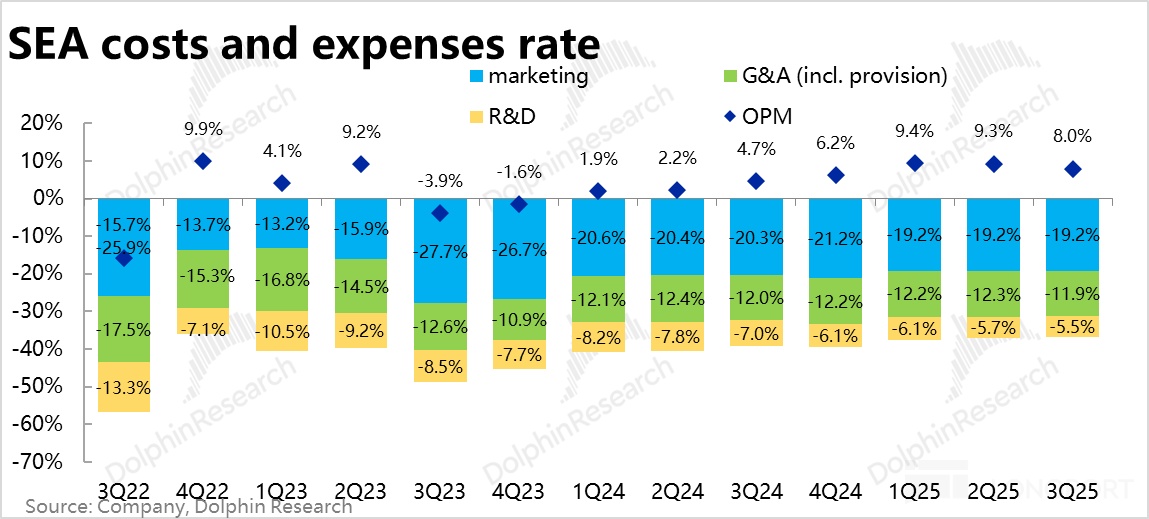

7. Profit margins of the three major segments deteriorated: In terms of final profit performance, this quarter the company's overall adj. EBITDA profit margin was 14.6%, narrowing by 1.2 percentage points quarter-on-quarter. However, due to total revenue significantly exceeding expectations, the final profit amount was approximately $870 million, slightly outperforming the sell-side expectation of $840 million.

However, structurally, the market is more concerned about the profit margins and profit amounts of the e-commerce and financial segments, which were below expectations, indicating that the quality of profit is not good.

Among them, the e-commerce segment's profit margin narrowed from 0.76% to 0.58% (calculated by dividing by GMV), although the market had expected logistics and other investments to lead to a narrowing of profit margin quarter-on-quarter, the actual situation was worse.

The financial segment's profit margin also unexpectedly declined, this quarter being 26.1% (calculated by dividing by revenue), declining by 2.8 percentage points quarter-on-quarter. As a result, the financial segment's adj. EBITDA only grew by 37% year-on-year, significantly lower than revenue and loan balance growth rates.

The gaming segment's profit margin (calculated by dividing by revenue) was also below market expectations by about 1.2 percentage points, and slightly declined quarter-on-quarter. However, due to the strong inflow, the profit amount was better than expected. From the trend, the profit margins of the three major segments have deteriorated.

Dolphin Research's View:

In fact, this quarter's performance is quite similar to last quarter's. Both quarters showed outperformance in growth, with the e-commerce and gaming segments accelerating in growth trends. However, corresponding to strong growth, the increase in costs and expenses led to pressure on profit margins, making Sea's performance this quarter not flawless.

Last quarter, Dolphin mentioned that the market's optimistic or pessimistic view on the significant increase in expenses, a "neutral" objective situation, often depends on the quality of business and revenue growth. If growth is strong, the market is likely to interpret the increase in expenses as the company seeing a very optimistic demand outlook, requiring increased investment to drive business growth. If business growth is poor, the increase in expenses will be seen as "wasteful spending" in the absence of growth.

Therefore, purely from a performance perspective, Dolphin believes there is no essential difference between this quarter and last quarter. However, after last quarter's performance, Sea's stock price surged, while this time the trend is quite tangled. Dolphin believes this is more due to changes in overall market sentiment, with a preference for immediate profit certainty rising over long-term uncertainty.

Regarding subsequent business views and judgments, firstly 1) in the e-commerce business, the Southeast Asian region currently remains in a relatively stable progress pattern, with major platforms like Shopee, TikTok Shop, and Lazada still tacitly cooperating to improve monetization rates, jointly increasing revenue and profit, without signs of intensified competition.

The main issue is that in the Brazilian market, which currently contributes about 15% of the group's overall GMV, competition is becoming more intense. Local leader Mercado is taking various countermeasures against challengers like Shopee, including significantly lowering the tax-free threshold and providing more commission and fee reductions for low-price products (Shopee's advantage area) to enhance its competitiveness in this price range.

Moreover, from Mercado's previously announced financial report, its e-commerce order volume and GMV growth rate in 3Q have indeed accelerated significantly (at the cost of narrowing profit margin improvement), reflecting the effectiveness of these measures.

Similarly, Shopee, on one hand, to respond to Mercado's counterattack, and on the other hand, for long-term growth in the Southeast Asian region, the market also tends to believe that Shopee's profit margin will be under pressure from expenses, and the speed of improvement will slow down. One of the core focus points of the market's valuation of Shopee is the expectation of its steady-state profit margin, which is why the company's stock price has fallen by about 20% from its previous high. This performance can be said to confirm this concern.

However, investment in fulfillment is a short-term potential profit suppressor, but in the long term, it is an important part of establishing e-commerce business competitive barriers. If it is only due to logistics investment, rather than competition leading to a decline in monetization rate, Dolphin tends to believe it will not be a big issue in the medium to long term.

Of course, the fact that e-commerce order volume growth did not rise this quarter is indeed not a very good signal.

2) As for the Monee financial business, from this quarter's perspective, the performance trend has not changed significantly. It still maintains strong growth beyond expectations and relatively stable bad debt levels. However, with the expansion into new markets & customer groups, on one hand, the early profit space in new markets is generally lower than in mature markets, and the investment in the early customer acquisition stage will be more, so the profit margin may also be temporarily under pressure. But Dolphin still tends to believe that Monee's profitability and market space have not been fully released and fully priced.

3) In the gaming business, although the fundamental issue of lacking new games has not been resolved, from this year's two joint activities, which drove the return of users and revenue, Dolphin believes it at least verifies the company's capabilities in activities and operations. It has the ability to keep its flagship games "evergreen" through continuous operations.

Regarding valuation, Dolphin generally maintains the previous estimates, dividing into baseline and optimistic scenarios:

1) In the baseline scenario, based on 2025 earnings, the gaming segment is given 13x adjusted net profit, the e-commerce segment 20x EV to EBITDA (based on a steady-state 2% EBITDA to GMV profit margin), and the financial business 18x adjusted net profit. After deducting unallocated headquarters costs (valued at 10x) and adding back net cash, the neutral stock price is estimated to be around $160.

2) In the optimistic scenario, the valuation benchmark is moved to 2026, and the e-commerce business's valuation is raised to 20x EV to EBITDA (steady-state margin compared to previous expectations adjusted to 2.2%), and the financial business's valuation multiple is also raised to 20x adjusted net profit. The gaming business valuation remains unchanged. Under this scenario, the estimated single stock price is about $206, with some room compared to the current price.

In short, Dolphin believes that compared to last quarter, the company has not changed much, but what has changed is the market's preference and different perspectives on the same issue. After a good "golden pit" is created by risk aversion sentiment or liquidity issues, it may instead be an opportunity.

Below is a detailed interpretation of the financial report:

I. Shopee E-commerce: GMV growth remains strong, commission monetization rises but logistics monetization declines

The most important Shopee e-commerce segment, this quarter's growth performance can still be considered quite strong. The key GMV increased by 28.3% year-on-year, slightly accelerating compared to last quarter, and again significantly exceeding the sell-side expectation of 25.4%.

The slight flaw is that the outperformance this quarter was mainly driven by average order value, while the growth rate of order volume declined quarter-on-quarter. Specifically, order volume grew by 29% year-on-year, slowing by 3 percentage points quarter-on-quarter. Meanwhile, average order value turned positive from last quarter's year-on-year -3% to year-on-year flat. It failed to clearly demonstrate the trend of accelerated growth in e-commerce business volume after increased subsidies.

In terms of revenue and monetization, according to research, Shopee, Lazada, and TikTok Shop are still jointly improving monetization rates. Reflected in the financial report, Shopee's overall platform monetization rate reached 11.9%, increasing by 0.6 percentage points quarter-on-quarter, the highest increase since 2023.

More specifically, this quarter saw a significant quarter-on-quarter increase of 0.9 percentage points in commission-based monetization rate, while logistics-based service monetization rate declined by 0.2 percentage points quarter-on-quarter, indeed reflecting the impact of increased logistics subsidies.

Strong GMV growth and continued rise in take rate, Shopee's total revenue grew by 35% year-on-year this quarter, accelerating again quarter-on-quarter. Among them, platform revenue growth was as high as 37%, accelerating by a full 3 percentage points quarter-on-quarter.

II. Monee Financial continues to exceed expectations with strong growth

This quarter, the financial segment Monee's growth was also very strong. The total loan balance, both on and off the balance sheet, reached $7.9 billion this quarter, significantly better than the sell-side expectation of $7.34 billion. In terms of growth trend, this quarter's net increase reached $1.1 billion, further accelerating compared to last quarter's $1 billion.

With strong loan balance growth, this quarter's financial segment revenue was $990 million, growing by 61% year-on-year. It can be seen that Monee's revenue growth is slightly lower than loan balance growth, reflecting that the company's credit business structure should be tilting towards users and products with lower interest rates.

This quarter's bad debt ratio over 90 days was 1.1%, slightly increasing by 0.1 percentage points quarter-on-quarter, generally stable. The bad debt cost calculated by bad debt loss provision/loan balance also remained generally stable quarter-on-quarter. Therefore, the company's credit quality and risk control are quite stable.

III. Garena Games: Another joint celebration

After a slight cooling last quarter, Garena's gaming segment experienced explosive growth again this quarter through collaborations with Naruto anime and Squid Game.

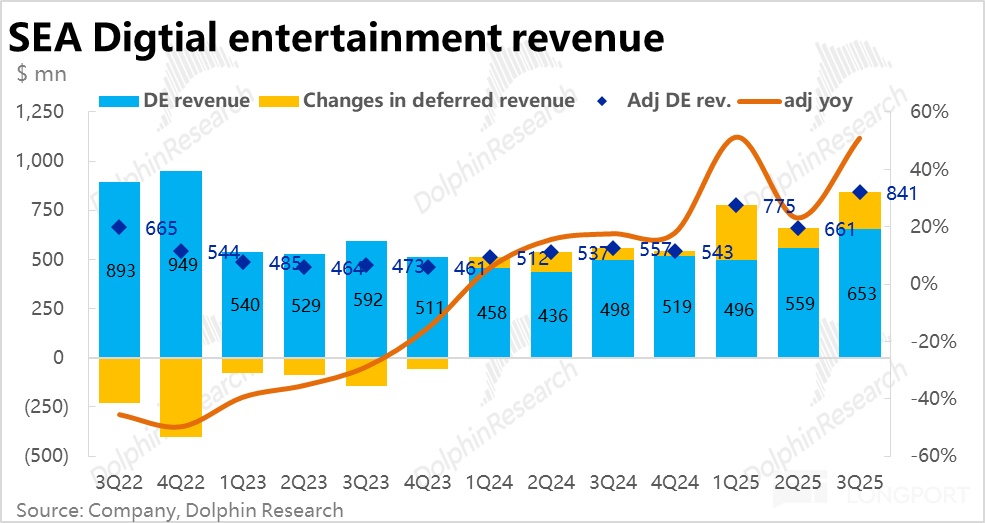

This quarter's game revenue growth rate surged again to 51% year-on-year, consistent with the growth rate during the first quarter's collaboration with Naruto. It was again significantly exceeding sell-side expectations.

Driven by joint activities, this quarter's active user numbers and user payment ratios also increased significantly quarter-on-quarter. Among them, monthly active users and paying users increased by approximately 2 million and 1.4 million quarter-on-quarter, respectively. The payment rate also returned to the first quarter's high of 9.8%.

Due to the significant impact of deferred revenue, GAAP revenue this quarter was approximately $650 million, growing by 31% year-on-year, which may not reflect actual operating conditions. It is better to focus on the operating indicators mentioned earlier.

IV. Total revenue significantly outperformed, but gross profit just met expectations

Due to the better-than-expected growth of the major segments mentioned above, Sea's overall revenue grew by 38% this quarter (maintaining last quarter's growth rate) reaching approximately $5.99 billion, significantly outperforming sell-side expectations by about 6 percentage points.

However, as mentioned earlier, although growth was strong, profit was not as impressive. Firstly, at the gross profit level, the company's overall gross margin still improved year-on-year, but narrowed significantly by 2.4 percentage points quarter-on-quarter to 43.4%, also significantly below market expectations of 45.8%. As a result, despite revenue significantly exceeding sell-side expectations, gross profit was only in line with sell-side expectations.

Moreover, looking at the segments, the gross margins of the e-commerce and gaming segments declined both year-on-year and quarter-on-quarter.

For the former, the decline in e-commerce segment gross profit was mainly due to increased logistics subsidies, and it can be seen that the gross profit of e-commerce self-operated business also narrowed significantly.

The decline in gaming segment gross margin may be due to the lower GAAP revenue recognition, with a mismatch in cost recognition.

V. All major segments require investment, expenses remain high

Facing competition from Mercado in the Brazilian market, and the company's recent shift in attitude to prioritize growth over profit, the company's expense investment intensity is also increasing. Overall, total operating expenses this quarter amounted to nearly $2.15 billion, a year-on-year increase of 26.5%, consistent with last quarter's growth rate, and about 3% higher than sell-side expectations.

Specifically, on one hand, bad debt loss provision matched the growth of loan balance (+76% yoy), which is understandable but still significantly drives total expense growth. Additionally, marketing expenses increased significantly by nearly 38% year-on-year. With strong growth in all three major segments, the company's spending on customer acquisition and promotion is also clearly increasing.

VI. Profit seems to exceed expectations, but actual profit margins of all segments are declining

In terms of final profit performance, focusing on the company's main adjusted EBITDA indicator, this quarter the company's overall adj. EBITDA profit margin was 14.6%, narrowing by 1.2 percentage points quarter-on-quarter, below sell-side expectations of 15%.

Although the profit margin narrowed, due to total revenue significantly exceeding expectations, the overall adj. EBITDA profit amount was approximately $870 million, slightly outperforming sell-side expectations of $840 million.

However, structurally, the main reason is that the least important gaming segment's profit significantly exceeded expectations (due to strong revenue growth), while the market is more concerned about the profit margins and profit amounts of the e-commerce and financial segments, which were below expectations. Therefore, it can be said that the quality of profit is not good.

Specifically, the most concerned e-commerce segment's profit margin narrowed from 0.76% to 0.58% (calculated by dividing by GMV), although the market had expected profit margin to decline, the actual extent was greater, resulting in profit amount being about $30 million less than expected.

The financial segment's profit margin also unexpectedly declined, this quarter being 26.1% (calculated by dividing by revenue), declining by 2.8 percentage points quarter-on-quarter. As a result, despite revenue growing by 61%, the financial segment's adj. EBITDA only grew by 37% year-on-year, slightly underperforming expectations.

And the gaming segment's profit margin (calculated by dividing by revenue) was also below market expectations by about 1.2 percentage points, and slightly declined quarter-on-quarter. But thanks to the strong revenue growth exceeding expectations, and the profit margin decline being relatively "mild," the final profit amount of the gaming segment was still good, exceeding expectations by about $60 million. Making the company's overall adj. EBITDA still appear better than expected.

But actually, from the trend, the profit margins of the three major segments are all deteriorating, just to varying degrees.

<End of text>

Past Dolphin Research analyses of [Sea]:

May 14, 2025, conference call "Sea (Minutes): Unable to guide full-year game revenue, e-commerce profit margin target GMV 2%~3%"

May 14, 2025, financial report commentary "Little Tencent Sea: Riding on the 'Naruto' big IP, can explosive performance last?"

March 5, 2025, financial report commentary"SEA: Didn't drop the ball, still 'Little Tencent'"

March 5, 2025, Minutes "Sea (Minutes): 25-year GMV expected to grow 20%"

November 13, 2024, financial report commentary"Sea: Southeast Asian Little Tencent becomes 'Little Sweetheart' again?"

November 13, 2024, conference call Minutes "Sea: How to view subsequent growth (3Q24 conference call)"

August 13, 2024, financial report commentary"Sea: Strongly dispelling ghost stories, Southeast Asian Little Tencent is still good"

August 13, 2024, conference call Minutes "Sea: Will the good growth trend of e-commerce and games continue?"

May 17, 2024, financial report commentary"Southeast Asian Little Tencent: 'Enemy' becomes 'Friend,' Sea rises again?"

May 17, 2024, conference call Minutes"Sea: Believing e-commerce competition will not be extreme again"

March 5, 2024, financial report commentary"Tiktok's absence sends a reversal, SEA's spring is coming?"

March 5, 2024, conference call Minutes"Sea: 24-year e-commerce GMV expected to achieve around 18% growth"

In-depth:

June 8, 2022 "Dual business flywheel stops, SEA deeply trapped in transformation pain period"

January 10, 2022 "Staying in one corner or crossing the sea? Southeast Asia is still SEA's 'Dragon Rising Land'"

Risk disclosure and statement of this article:Dolphin Research Disclaimer and General Disclosure

The copyright of this article belongs to the original author/organization.

The views expressed herein are solely those of the author and do not reflect the stance of the platform. The content is intended for investment reference purposes only and shall not be considered as investment advice. Please contact us if you have any questions or suggestions regarding the content services provided by the platform.