Beike 3Q25 Quick Interpretation: Overall, Beike's performance this quarter can be summarized as "not good, but not as bad as feared."

Due to the recent general decline in U.S. stocks, the company's share price has also retreated by more than 15%, hitting bottom and recovering amid low expectations & stock prices.

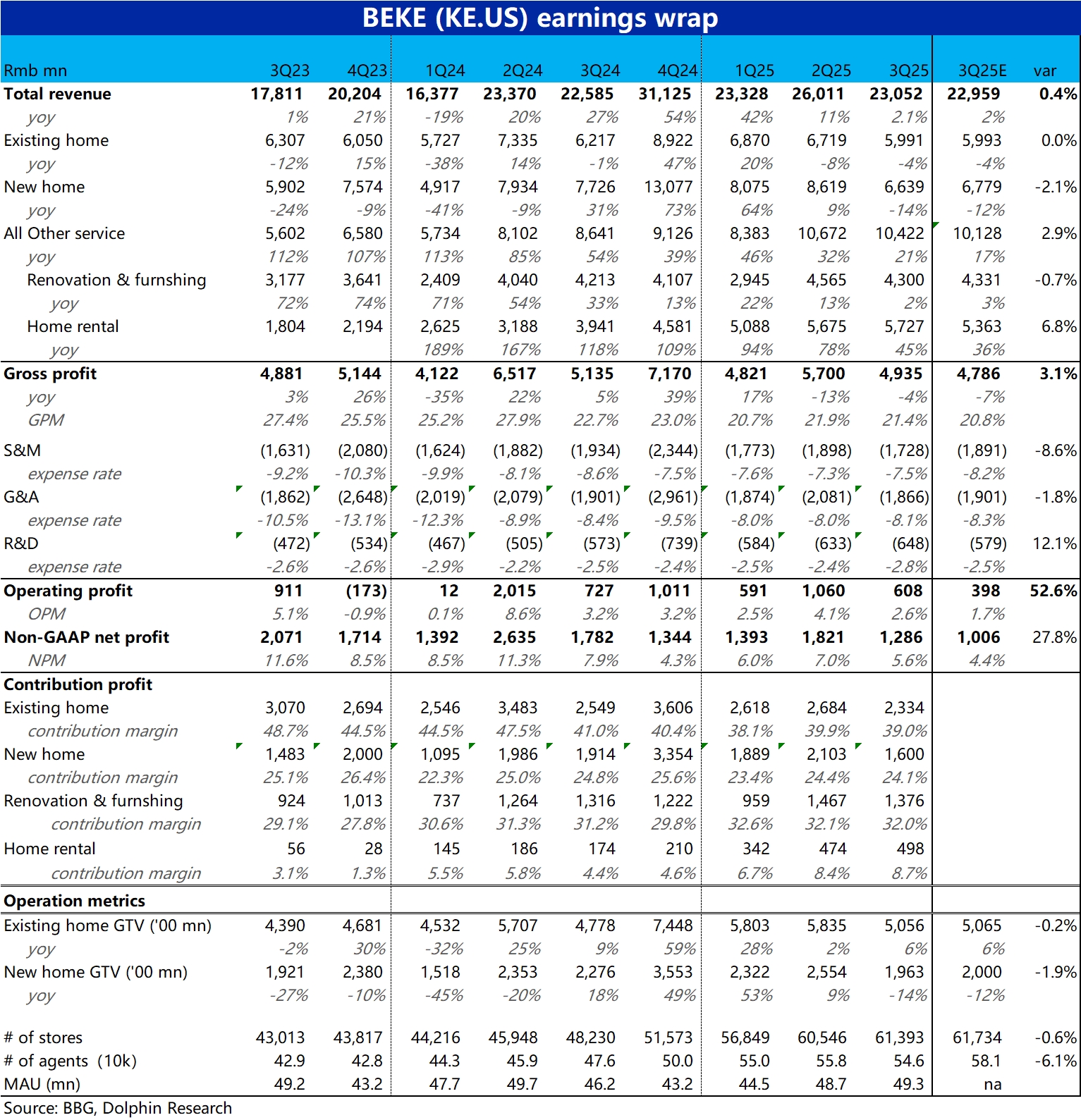

1) In terms of financial performance, total revenue for the quarter grew approximately 2% year-on-year, largely in line with expectations. Although the gross profit margin declined year-on-year, leading to a decrease in gross profit by 200 million (-4% yoy), the expectation was lower at -7%.

Facing industry headwinds, the company timely reduced its expenses, with total operating expenses down approximately 2% year-on-year (about 80 million). As a result, the final operating profit only declined by slightly over 100 million year-on-year, better than market expectations.

The market's main focus, adjusted net profit was 1.29 billion, down nearly 500 million from the same period last year (the decline was larger than operating profit, mainly due to lower SBC expenses this quarter). Although it is clearly not good in absolute terms, it is still much better than the market expectation of 1 billion adjusted profit.

2) In terms of operating indicators, this quarter the transaction volume of existing homes and new homes grew 6% and declined 14% year-on-year, respectively. The transaction situation of existing homes was consistent with market expectations, but new homes were worse. As policy benefits nearly fade and gradually enter last year's high base period, the real estate transaction situation is generally within the expected range of poor performance.

3) In terms of monetization, since the monetization rate of existing homes and new homes is still declining year-on-year, the revenue growth rate of both businesses is negative (in line with market expectations). However, from a quarter-on-quarter perspective, the monetization rate has actually stabilized and rebounded, which is not a bad news.

Similarly, although the contribution gross profit margin of new home and existing home businesses (calculated by contribution profit/GTV) also declined year-on-year, it was generally stable from a quarter-on-quarter perspective.

4) Among other businesses, the housing rental business performed well, partially offsetting the decline in performance of core traditional businesses. This quarter, rental income continued to grow significantly by 45% year-on-year, much better than expected.

Meanwhile, the contribution gross profit margin of the rental business also continued to rise slightly by 0.3 percentage points quarter-on-quarter, offsetting the year-on-year decline in core business profits. $KE(BEKE.US) $BEKE-W(02423.HK)

The copyright of this article belongs to the original author/organization.

The views expressed herein are solely those of the author and do not reflect the stance of the platform. The content is intended for investment reference purposes only and shall not be considered as investment advice. Please contact us if you have any questions or suggestions regarding the content services provided by the platform.