ARM (Minutes): All new computing power is based on Arm architecture

The following are the minutes of the ARM FY2026 Q2 earnings call organized by Dolphin Research. For an interpretation of the earnings report, please refer to ARM: SoftBank as a Backer, the 'Hot Cake' in the AI Chain?

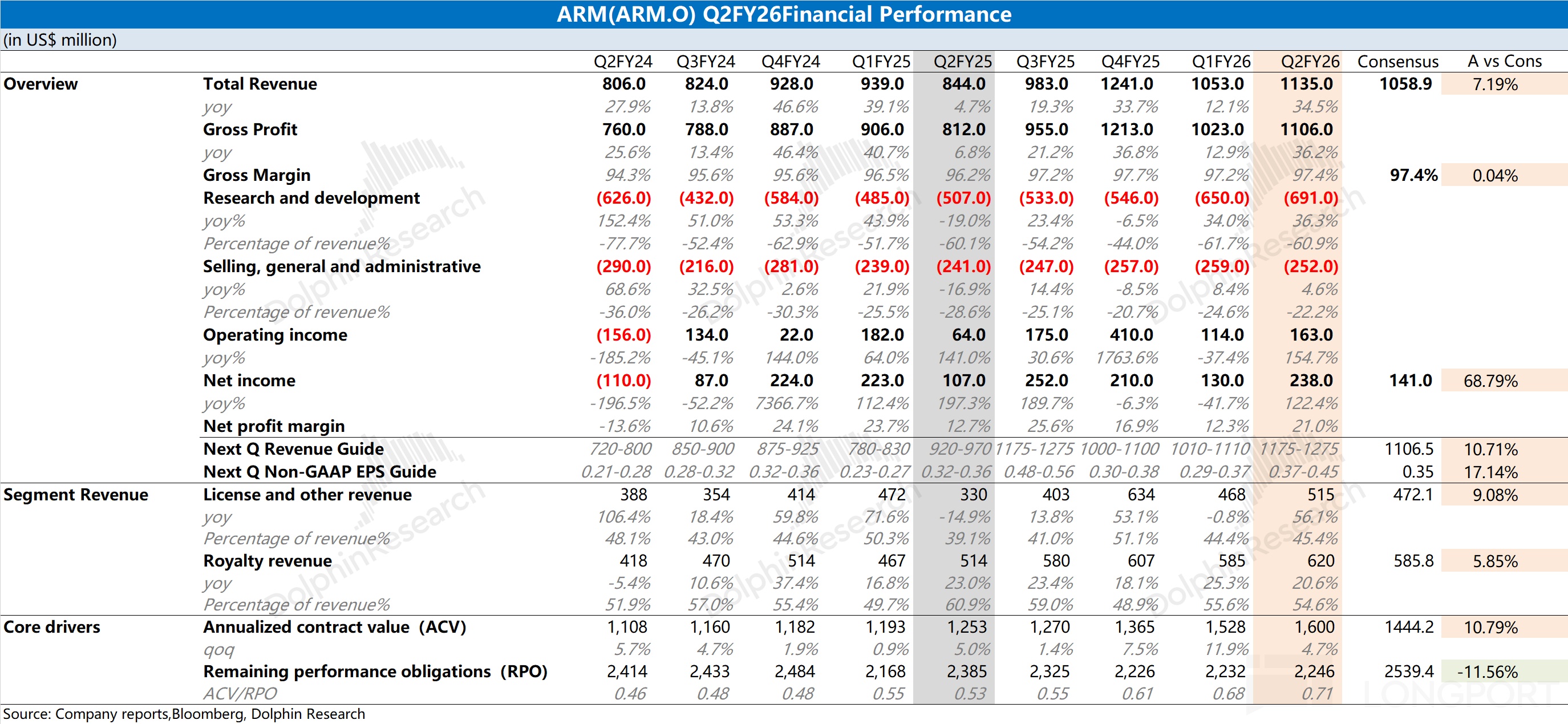

I. $Arm(ARM.US) Review of Core Financial Data

Overall Performance: Second-quarter revenue reached $1.14 billion, up 34% year-over-year, surpassing the $1 billion mark for three consecutive quarters.

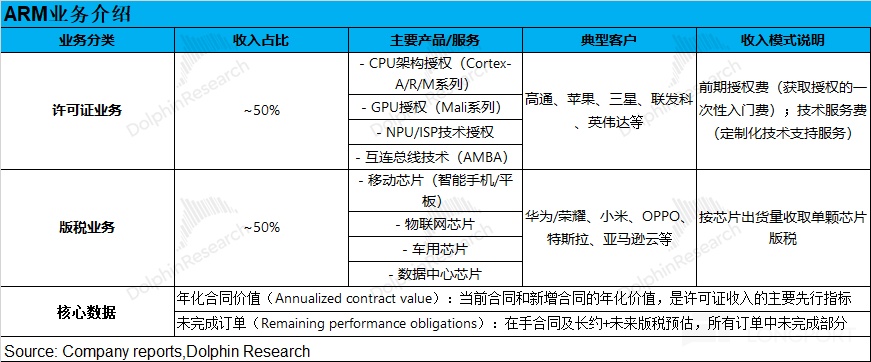

Segment Revenue: Royalty income (patent fees) hit a record $620 million, up 21% year-over-year, driven by growth in all major markets including data centers, smartphones, automotive, and IoT, with Neoverse (data center product line) royalties doubling year-over-year.

License revenue reached $515 million, up 56% year-over-year.

Profitability Metrics: Non-GAAP EPS exceeded the upper end of expectations, reaching $0.39.

Operating Profit: Non-GAAP operating profit reached $467 million, up 43% year-over-year; non-GAAP operating margin was 41.1%, showing year-over-year improvement.

II. Core Statements and Business Outlook from ARM Executives

2.1 Core Information from Executive Statements

Overall Strategy and Drivers:

AI is driving ubiquity: The demand for AI computing (from edge devices to data centers) is reshaping the tech landscape, positioning ARM as the only platform capable of achieving "ubiquitous AI computing." Power supply constraints in data centers are accelerating the deployment of ARM architecture.

Financial Health and Investment: Strong revenue growth enables the company to accelerate R&D investment while driving EPS growth. Strong demand for ARM technology supports the company's confidence in its long-term growth trajectory.

Performance and Outlook of Business Segments:

Smartphones:

Performance: Royalty income growth far exceeded market levels, thanks to multiple OEMs accelerating the launch of chips based on Armv9 and CSS architecture, and increased single-chip royalty rates.

Outlook and Products: The newly launched Lumix CSS mobile computing platform aims to deliver rich on-device AI experiences such as real-time translation. Flagship devices from partners like OPPO and vivo are expected to enter mass production in the second half of this year. All four of the world's top Android phone manufacturers have launched devices equipped with CSS.

(Note: CSS Computing Subsystem is a pre-assembled IP module that includes not only Arm CPU cores but also other IP parts, allowing companies to skip the integration phase and bring products to market faster)

Data Centers:

Performance: One of the fastest-growing areas, with over 10 billion Arm-based CPUs deployed, covering mainstream products like NVIDIA Grace, AWS Graviton, Google Axion, and Microsoft Cobalt.

Outlook: Google's Axion chip based on Arm architecture achieved up to 65% cost-performance improvement while reducing power consumption by 60%, and is migrating most of its internal workloads to the Arm platform. Customers are co-deploying Arm processors with AI accelerators to build large-scale clusters.

Automotive and IoT:

Performance: Royalty income from automotive and IoT businesses maintained year-over-year growth. Flagship electric vehicles based on the Arm platform feature advanced parking assistance, voice control, and safety functions.

Outlook: Tesla's next-generation AI 5 chip based on ARM architecture will boost AI performance by up to 40 times, heralding a new industry wave.

License Business (including CSS):

Performance: The growth momentum of the license business is driven by strong demand for next-generation architectures and deepening cooperation with core customers. This quarter, three new CSS licensing agreements were signed (involving smartphones, tablets, and data centers), bringing the total number of CSS licenses to 19. Cooperation with Samsung has improved the AI performance of its Exynos chipsets by up to 40%.

Metrics and Outlook: Annual contract value (ACV) grew 28% year-over-year, showing strong growth. CSS is rapidly becoming the starting point for customers to develop next-generation chips and is helping Arm achieve a tiered transaction model. The company continues to explore the possibility of expanding into computing subsystems, small chips, or complex SoCs.

Third Quarter Performance Guidance: Total revenue is expected to be $1.225 billion (±$50 million), representing a year-over-year growth of approximately 25% at the midpoint.

Royalty income is expected to grow by more than 20% year-over-year. License income is expected to grow by 25%-30% year-over-year.

Non-GAAP EPS is expected to be $0.41 (±$0.04). Non-GAAP operating expenses are expected to be approximately $720 million.

2.2 Q&A

Q: How do you view Arm's strategic positioning in numerous new AI data center projects and the opportunities it brings?

A: Power has become a bottleneck for everyone. In this environment, everyone wants to run the most energy-efficient computing platform. Arm's energy efficiency is about 50% higher than competing solutions, as evidenced by actual performance, which is why we see NVIDIA, Amazon, Google, Microsoft, and Tesla using our best technology. Unprecedented computing demand, all newly announced computing power is based on Arm, which presents us with tremendous growth opportunities and is one of the reasons our Neoverse business has more than doubled year-over-year.

Q: What is the reason for acquiring DreamBig Semiconductor and how does it fit into the expansion plan?

A: DreamBig has key IP in Ethernet and Arm DMA controllers, which helps expand networking and broaden product offerings to end customers.

Q: Significant increase in related party revenue and the nature and design activity changes of the collaboration with SoftBank's Stargate project

A: Arm is deeply collaborating with SoftBank and its partners on the Stargate project, providing technology for data center construction (computing, networking, power distribution, and assembly), bringing significant business opportunities.

Q: Growth in operating expenses and the investment return timeline for new technology strategies

A: The related solutions require substantial R&D investment, but currently, revenue growth exceeds the growth in operating expenses, which we have managed prudently. The demand for Arm-based computing is at an unprecedented opportunity, and we are evaluating all possibilities to ensure we seize the opportunity. The specific product timeline will be announced after achieving the three milestones of successful chip tape-out, sample return, and obtaining non-cancellable customer orders, as this will be a new business we have never ventured into.

Q: Specific amount of SoftBank-related revenue, future expectations, and whether it will affect the existing licensing business

A: Second-quarter SoftBank-related revenue increased from $126 million in the previous quarter to $178 million, an increase of $52 million, which can serve as a future reference benchmark. This revenue includes IP licensing and design services, with lower margins for design services. This revenue stream may continue for about a year, after which it may shift to new models such as chip sales royalties. If future physical chip business is developed, it may indeed partially replace current licensing and service revenue, but subsequent product iterations can also form an overlay of licensing fees and royalties. This collaboration is part of the broader "Stargate" project, including OpenAI, and should be seen as a continuous revenue stream.

Q: What is the revenue opportunity outlook for the Stargate project over the next 1/3/5 years? Why has the Lumex CSS product generated royalty income after its release in September?

A: Since its announcement in January this year, the demand for computing has continued to grow and has exceeded initial expectations. The main constraint on realizing this potential is currently infrastructure such as power. We are accelerating investment to seize this opportunity. Regarding CSS, this is because partners had previously adopted the first-generation CSS solution, and the close cooperation between the teams allowed the second-generation solution to be quickly adopted and generate royalties within months of technical delivery, demonstrating the significant acceleration of time-to-market by the CSS solution.

Q: Has the share of cloud and networking business in Arm's royalty income increased significantly?

A: Last fiscal year, this share was about 10%. Currently, the growth rate of the infrastructure business is twice the average level of other categories, and it is expected to continue growing, with a 15% to 20% share being a reasonable expectation, and the growth rate is faster than expected a year ago. Arm technology is rapidly penetrating all aspects of the network stack, including DPU, switches, etc. (such as Bluefield technology, Tomahawk, and Arista switches), with its energy efficiency advantage being an important growth driver.

Q: What is the impact of future chip demand and AI inference edge computing on Arm?

A: Current data center computing is mainly used for training, but will shift to inference in the future. We see strong demand for CPUs and Lumex (equipped with scalable matrix extensions) on the edge side, which can efficiently run AI workloads. Arm has a unique advantage in edge computing: on one hand, battery-powered devices are Arm's traditional stronghold; on the other hand, we are promoting cloud-edge collaboration, such as cooperation with Meta to ensure models can be efficiently ported in both cloud and edge. More AI computing means more edge computing demand, which is a significant opportunity for Arm.

Q: What are the main drivers of sales growth in China, licensing or royalties? What is the outlook for licensing revenue in the second half of the year?

A: This quarter, China's performance was strong, with demand reaching historical highs. Growth mainly came from license revenue (including a large licensing deal), and royalties also maintained steady growth. Currently, the licensing backlog is sufficient, but more specific guidance for the fourth quarter will be provided next quarter. Large licensing deals (license business) typically have a cycle of 6-9 months, with the final landing time mainly depending on the customer's demand point. Based on current capital expenditure and the ongoing strong AI cycle, we remain confident in the outlook.

Risk Disclosure and Statement of this Article:Dolphin Research Disclaimer and General Disclosure