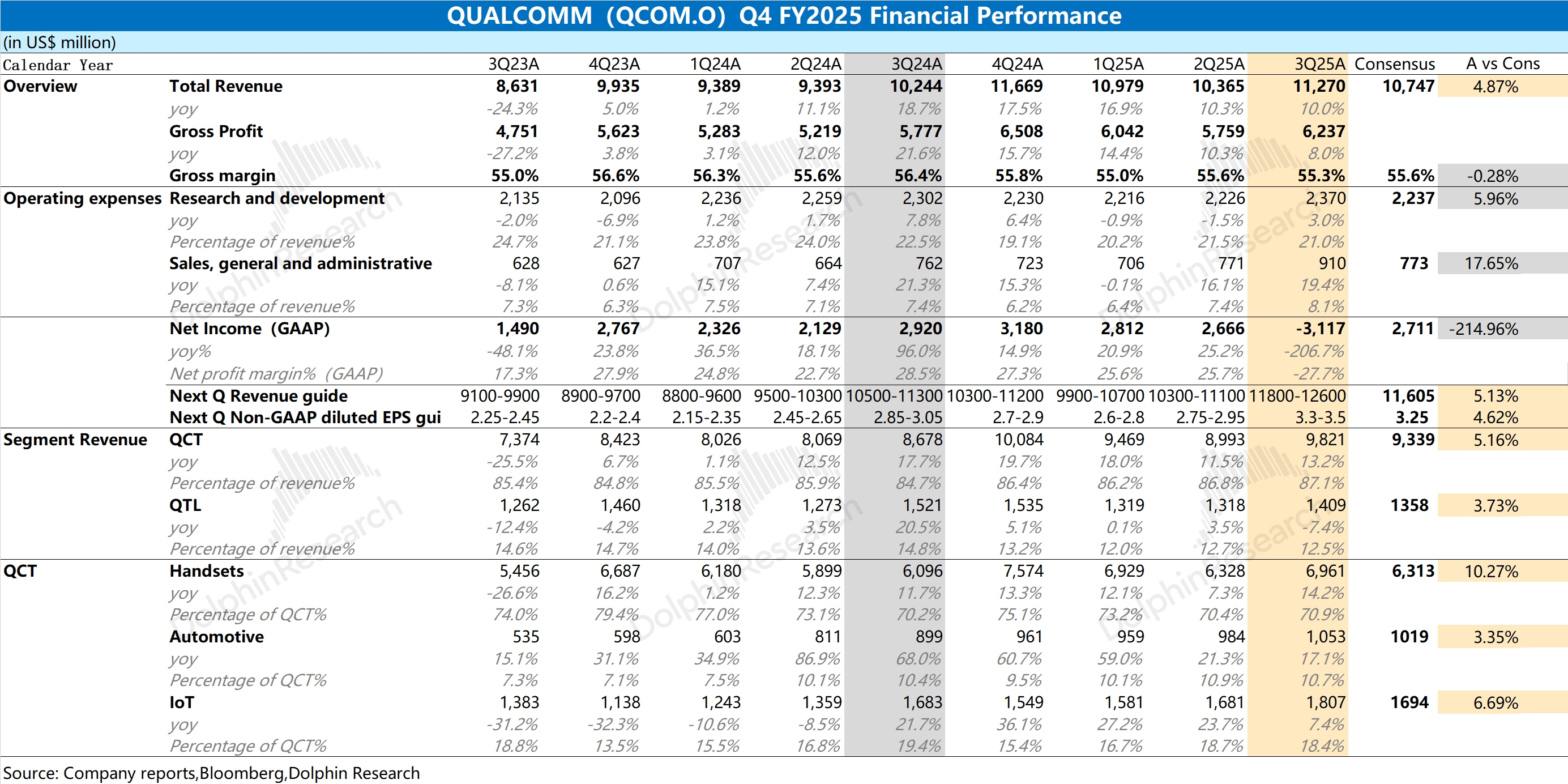

Qualcomm Quick Interpretation of Financial Report: The company's revenue for this quarter exceeded expectations, primarily driven by growth in the smartphone business; the decline in gross margin was due to the increased proportion of QCT hardware, which diluted the company's overall gross margin.

The decline in the company's profit for this quarter was mainly affected by the inclusion of a $5.7 billion deferred tax asset reserve. Excluding this impact, the company's net profit for this quarter is approximately $2.6 billion. The increase in R&D expenses and selling and administrative expenses also contributed to the decline in quarterly profit.

The company's current smartphone business remains the largest source of revenue, accounting for 60% of total revenue. The acceleration in smartphone business growth this quarter does not indicate an improvement in demand in the Android smartphone market (global smartphone market shipment growth in the third quarter was only in the low single digits), but is mainly due to the company once again releasing this year's flagship smartphone SoC—Snapdragon 8 Elite Gen5 ahead of schedule, nearly a month earlier than the previous generation Gen4, with downstream manufacturers' stocking demand also being brought forward.

For the company's guidance for the next quarter, the company expects revenue of $11.8-12.6 billion, better than market expectations ($11.6 billion). However, if viewed from the midpoint of the range ($12.2 billion) with a quarter-on-quarter increase of 8%, it is actually lower than the 13% quarter-on-quarter increase in the same period last year, which also confirms the demand preposition effect brought by the early release of new products.

Overall, the company's current performance still mainly revolves around the smartphone and IoT businesses, remaining quite stable. These traditional fields are already quite mature and stable, and will also be affected by factors such as the tightening of state subsidies policies. The market is more looking forward to the company's growth opportunities in the AI PC and data center fields. As the company's stock price had been maintained in the $150-170 range, it surged to $200 on the day of announcing its entry into the AI data center at the end of October.

Since there is no more incremental information, the company's stock price has fallen back again. Compared to the narrative in traditional fields, if the company can provide more progress on AI PC or data center orders and specific product planning, it will better stimulate market enthusiasm. For more detailed information, please follow Dolphin Research's subsequent commentary and Minutes content. $Qualcomm(QCOM.US)

The copyright of this article belongs to the original author/organization.

The views expressed herein are solely those of the author and do not reflect the stance of the platform. The content is intended for investment reference purposes only and shall not be considered as investment advice. Please contact us if you have any questions or suggestions regarding the content services provided by the platform.