Unity 3Q25 Quick Interpretation: The Q3 performance overall slightly exceeded BBG consensus expectations. The market was particularly focused on advertising revenue, which grew by 11% quarter-on-quarter in Q3, and the guidance for Q4 indicates a mid-single-digit quarter-on-quarter growth (around 5%). Although the quarter-on-quarter growth trend did not surpass the previously expected Q4/Q3 growth rate (+7.6% qoq), considering the cautious guidance style of the new management over the past year (actual growth rates generally exceed guidance by 4-5 percentage points), it is still reasonable to expect a near 10% quarter-on-quarter growth similar to Q3.

Although the growth rate is not fast enough, especially compared to Applovin, it can slightly alleviate the nearly month-long sentiment suppression caused by poor channel research data in September and October. Specifically:

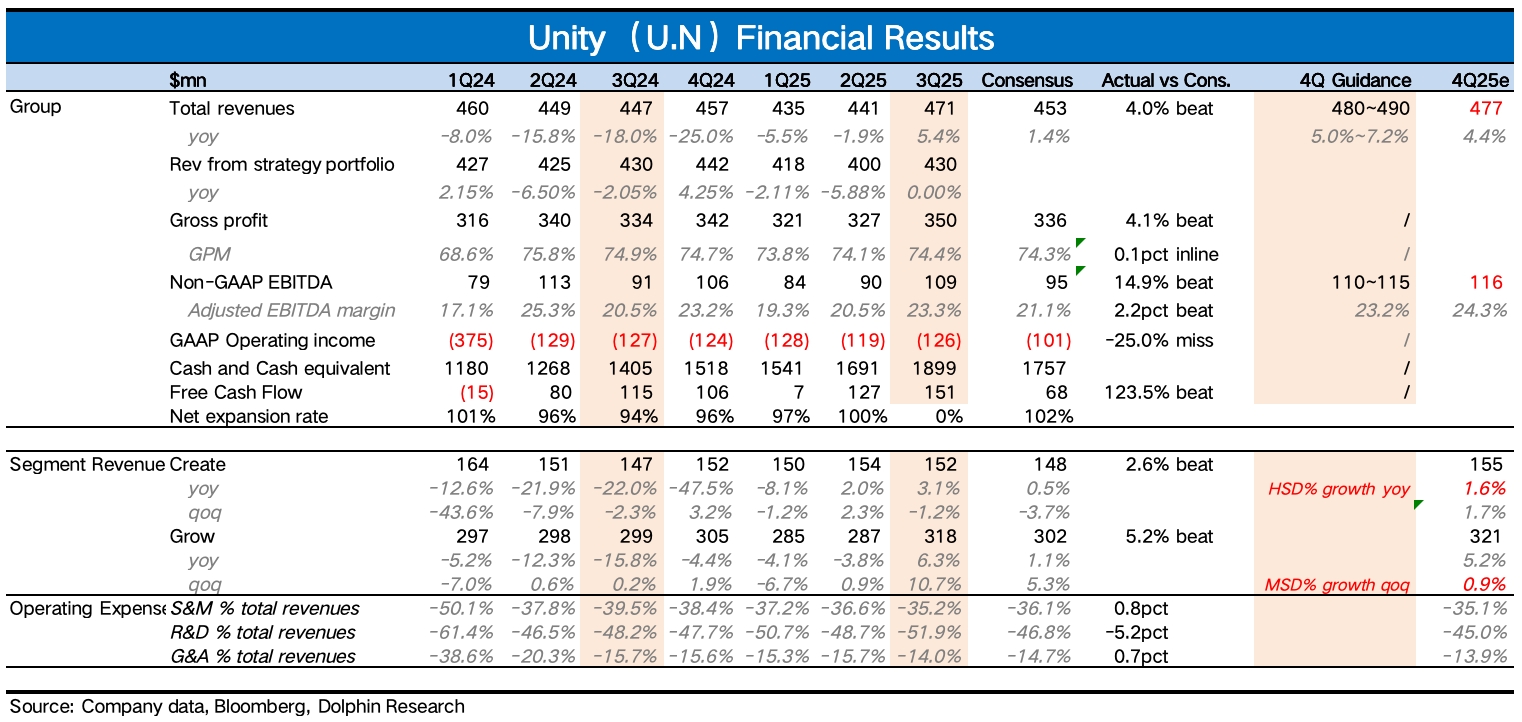

1. Total revenue of $471 million, a year-on-year growth rate of 5.4%. The company guides Q4 revenue of $480-490 million, a year-on-year growth of 5-7%, slightly exceeding market expectations.

(1) Create engine business grew by 3%, quarter-on-quarter -1%, but the guidance for Q4 indicates a high single-digit year-on-year growth, implying a quarter-on-quarter growth rate of 7-8%, finally showing signs of significant improvement (driven by the higher-priced Unity 6).

(2) Grow advertising business grew by 6%, significantly exceeding expectations, and the guidance is also positive, with a quarter-on-quarter growth rate of around 5%. The growth was mainly driven by the launch of the Vector model, while other revenue in the Grow business declined year-on-year, so the actual performance of Grow should be even better. Although the quarter-on-quarter growth rate for Q4 guidance has slowed down, it is slightly more positive than the concerns raised by previous research.

2. Profitability improvement, cash flow at a record high: Although the company is currently in a critical transition period, it is not necessary to be too demanding on profits. However, if the company can exceed the loss reduction and profitability targets, it would certainly be better.

In Q3, Unity achieved this, with a Non-GAAP EBITDA margin increasing by 3 percentage points quarter-on-quarter. Benefiting from the improvement in the main business, free cash flow reached $150 million, the highest free cash flow in the company's history. $Unity Software(U.US)

The copyright of this article belongs to the original author/organization.

The views expressed herein are solely those of the author and do not reflect the stance of the platform. The content is intended for investment reference purposes only and shall not be considered as investment advice. Please contact us if you have any questions or suggestions regarding the content services provided by the platform.