Samsung SDI continues to lose money in Q3. Will solid-state batteries be its 'lifesaver'?

Produced by Zhineng Auto

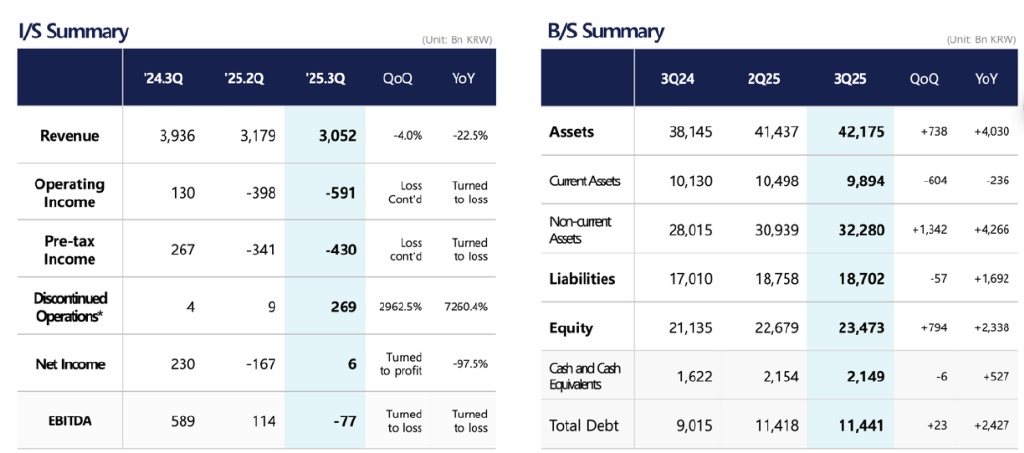

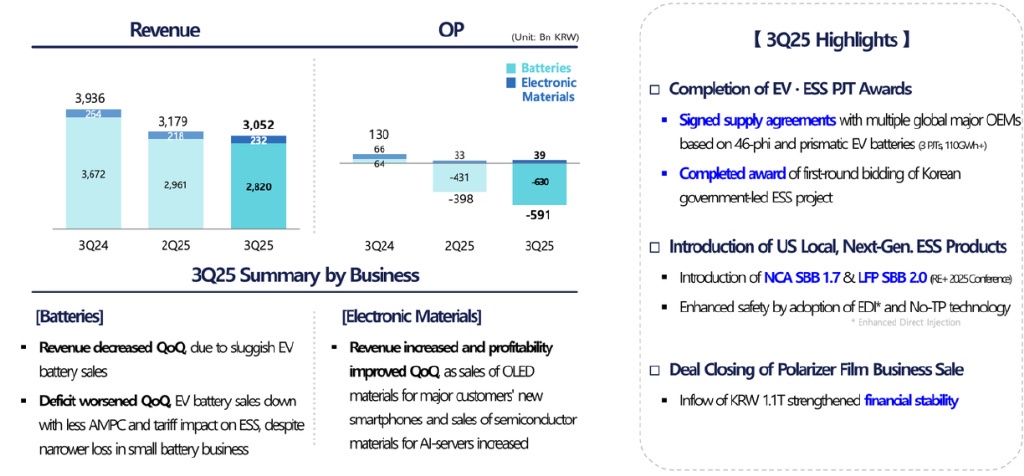

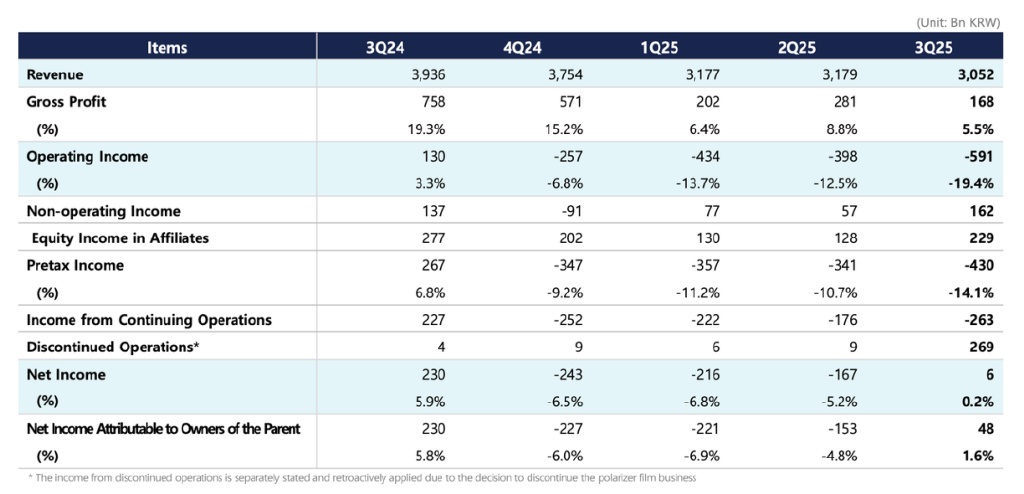

In Q3 2025, Samsung SDI faced dual pressures from weak EV demand and tariff impacts on energy storage systems (ESS), reporting operating revenue of KRW 3.05 trillion (RMB 15.296 billion), down 4.0% QoQ and 22.5% YoY.

The company recorded losses for two consecutive quarters, with operating losses widening to KRW 591 billion (RMB 2.924 billion), pushing the operating margin to -19.4%, a multi-year low.

To stabilize finances, Samsung SDI sold its polarizer business and bolstered cash reserves while deepening its battery focus—from high-nickel cylindrical cells to LFP prismatic layouts and solid-state collaborations—to reshape its growth trajectory.

Its tripartite partnership with BMW and Solid Power to validate solid-state battery commercialization warrants close observation.

Part 1

Samsung SDI’s Widening Losses

In Q3 2025, Samsung SDI’s operating revenue fell to KRW 3.05 trillion (RMB 15.296 billion), down 4.0% QoQ and 22.5% YoY, marking two straight quarters of losses. Operating losses expanded to KRW 591 billion (RMB 2.924 billion), with the operating margin hitting -19.4%, a record low in recent years.

The sale of its polarizer business generated KRW 1.1 trillion in cash inflow, briefly turning net profit positive, but core operations remain under significant strain.

Battery operations remain the core revenue driver, accounting for over 90% of sales. Q3 revenue dropped nearly 5% QoQ, primarily due to lower EV battery shipments.

Capacity ramp-up at its U.S. AMP plant faced constraints, while ESS projects were delayed by rising import tariffs, dragging overall profitability. Price competition in Europe and China also squeezed margins for high-nickel batteries. Seasonal demand for small batteries couldn’t offset the decline in automotive battery sales.

Electronic materials offered a rare bright spot.

AI server demand for high-performance memory chips boosted semiconductor material sales, while OLED materials contributed to growth during flagship smartphone refresh cycles, driving sequential profit improvement—a rare positive in overall performance.

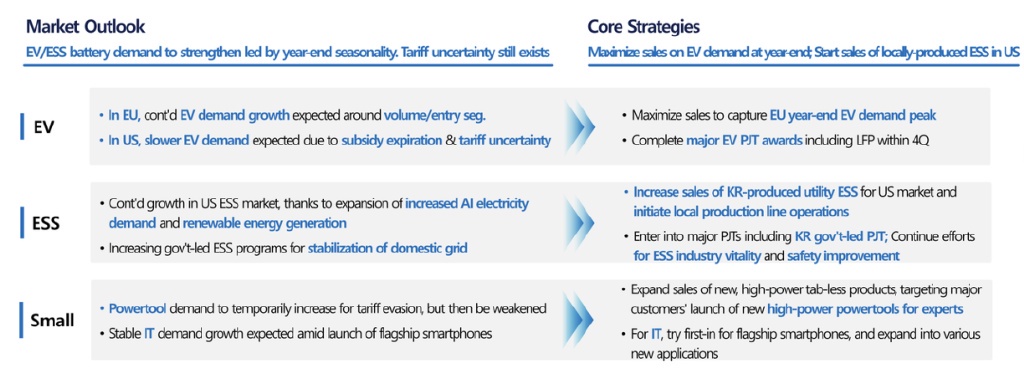

Behind the profit pressure lies the combined effect of cyclical volatility and structural shifts in the new energy market.

◎ Europe’s subsidy phase-out has shifted consumer interest to entry-level EVs;

◎ The U.S. Inflation Reduction Act’s localization requirements have forced Samsung SDI to bear higher supply chain restructuring costs.

Global structural adjustments have rapidly escalated short-term costs for Samsung SDI’s capacity expansion and tech transition.

In recent years, Samsung SDI relied on premium batteries (notably high-nickel NCA and mid-nickel cells) for gross margin advantages. But with LFP dominating cost competitiveness, it’s pivoting to a broader product mix—pressuring margins near-term.

Part 2

Strategic Overhaul:

From LFP Expansion to Solid-State Battery Push

Facing losses and structural challenges, Samsung SDI is executing systemic strategic adjustments.

Q4 2025 priorities are clear: stabilize cash flow and deepen technology investments.

◎ Samsung SDI is accelerating U.S. ESS production line retrofits.

Through the StarPlus Energy JV with Stellantis, it plans to convert some EV lines to ESS production, targeting ~30GWh U.S. ESS capacity by end-2026 to meet IRA localization rules and reduce reliance on Chinese supply chains.

It also launched IRA-compliant NCA SBB 1.7 and LFP SBB 2.0 ESS products, aiming to be the "first localized prismatic battery provider" among non-Chinese firms.

◎ In EV batteries, it’s diversifying—continuing high-nickel NCA cylindrical and 46-tab tech while expanding LFP prismatic and mid-nickel cell contracts by 2028 for the fast-growing mid/low-end market. HEV (hybrid) batteries are now part of its strategy to broaden customers and stabilize revenue.

The most symbolic move is in solid-state batteries. In October 2025, Samsung SDI announced a tripartite collaboration with BMW and Solid Power to co-develop all-solid-state battery (ASSB) validation.

Per the agreement, Samsung SDI will produce cells using Solid Power’s sulfide electrolyte, BMW will develop modules/packs, and integrate them into next-gen test vehicles.

◎ This marks Samsung SDI’s first step to commercialize lab-level ASSB R&D into automotive-grade validation, building on over a decade of battery supply trust with BMW in manufacturing and quality control.

After years of independent ASSB R&D targeting 2027 mass production, Solid Power’s platform accelerates the transition from materials to batch validation. ASSB promises dual gains in energy density (target: 900Wh/kg, +50% vs. high-nickel) and safety (no liquid electrolyte thermal runaway).

BMW plans to test ASSB in i7 prototypes for system integration. The trio forms a global ASSB value chain: Solid Power (materials), Samsung SDI (cell production), BMW (vehicle integration).

Strategically, this move isn’t just about catching up with Panasonic or Toyota—it redefines Samsung SDI’s market role.

With CATL and BYD dominating via LFP scale/cost, Korean firms have lost share. Samsung SDI’s ASSB bet is both a necessary "premium breakout" and a pivot for future profit models.

Summary

While Chinese battery firms boost utilization via ESS demand, Korean peers face pressure in both EV and ESS. Restructuring, capacity revamps, and tech bets aim to secure future growth.

With Europe focused on entry EVs, the U.S. on localized ESS, and China leading LFP, Samsung SDI seeks balance via line adjustments, LFP, ESS, and solid-state tech.

The copyright of this article belongs to the original author/organization.

The views expressed herein are solely those of the author and do not reflect the stance of the platform. The content is intended for investment reference purposes only and shall not be considered as investment advice. Please contact us if you have any questions or suggestions regarding the content services provided by the platform.