Trending Creators in 2025

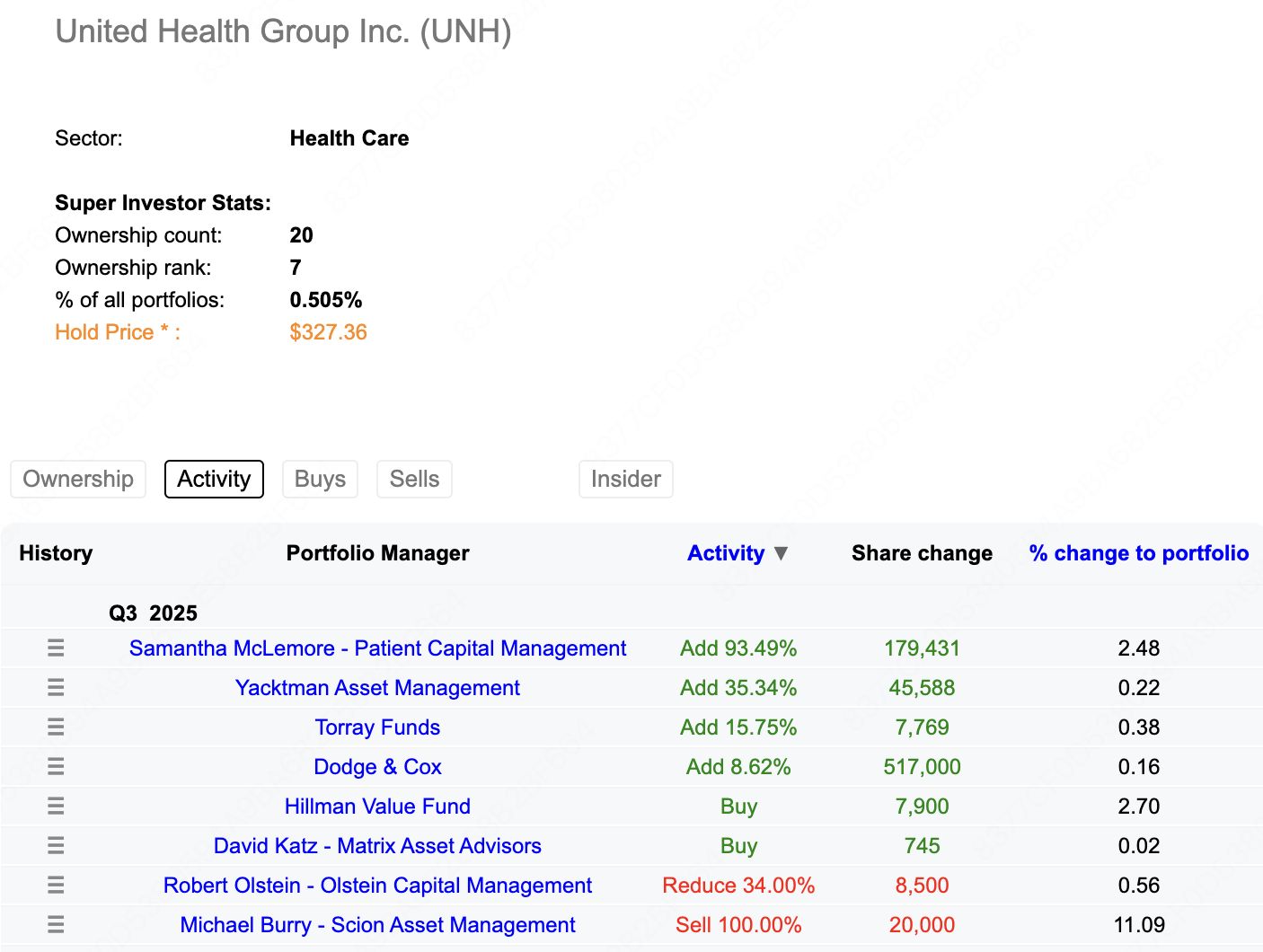

Trending Creators in 2025$Unitedhealth(UNH.US) The latest Q3 13F filing disclosed that Yacktman Asset Management increased its holdings of UNH by approximately 45,588 shares in Q3 2025, a 35.34% increase.

Yacktman Asset Management: The investment style is value-oriented, emphasizing high-quality companies, low valuation, and shareholder-friendly management. The top three holdings are CNQ (~9.21%), MSFT (~7.34%), and SCHW (5.52%).

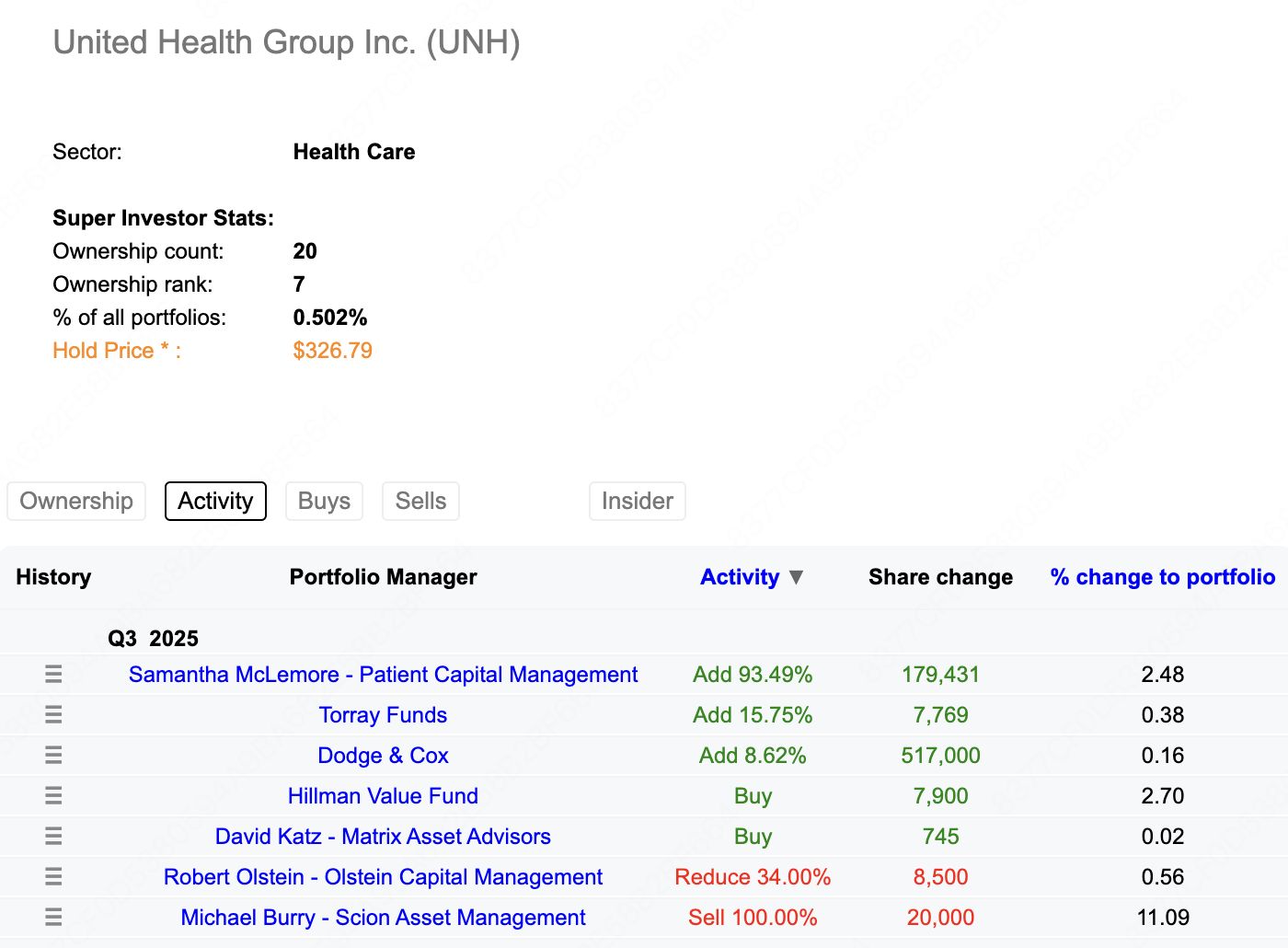

$Unitedhealth(UNH.US) The Q3 13F report disclosed that Michael Burry - Scion Asset Management liquidated UNH in Q3 2025, reducing holdings by 20,000 shares. At the same time, it also cleared 350,000 UNH call options in Q2.

It is a short-term warning for UNH retail investors, but long-term value investors can see it as a buying opportunity.

The copyright of this article belongs to the original author/organization.

The views expressed herein are solely those of the author and do not reflect the stance of the platform. The content is intended for investment reference purposes only and shall not be considered as investment advice. Please contact us if you have any questions or suggestions regarding the content services provided by the platform.