Likes Received

Likes Received Posts

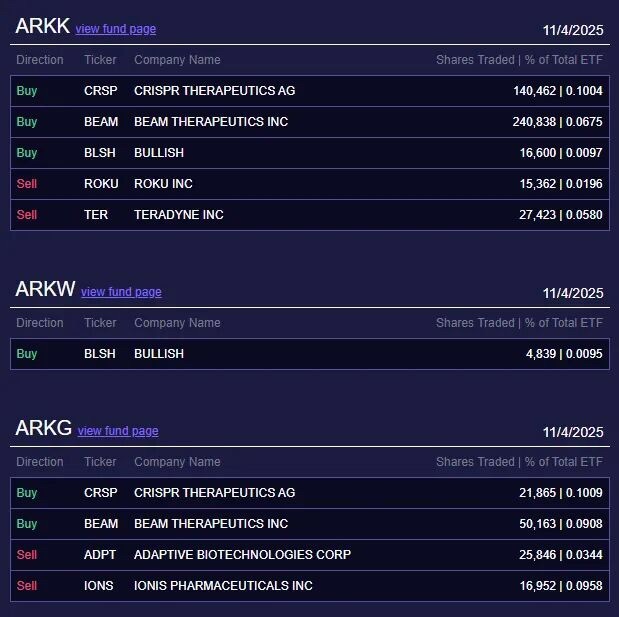

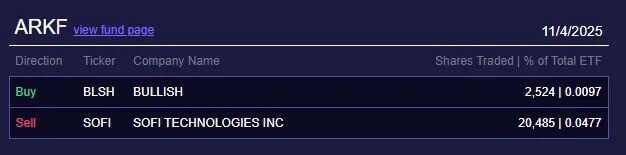

PostsCathie Wood bought $1.09 million BLSH and sold $4.9 million TER today, reducing her position in SOFI by $600,000

US stocks continued to fall, with the Nasdaq down -2.04% and the S&P -1.17%. The pre-market had already started to crash, and the opening continued to wash out. Around 11 o'clock, it still managed to hold up, and I took the opportunity to sell some Amazon at this critical moment.

During this period, I somewhat admire Cathie Wood's move to sell PLTR, reducing holdings at highs and executing a series of sales before the earnings report to avoid this big drop.

Despite the drop, Costco, Walmart, and Berkshire still rose. Stocks like Berkshire are usually quite useful during such market crashes. As defensive stocks, you can allocate some. The biggest issue now is Buffett's age—he could pass away at any time. When the market crashes, it'll be the time to pick up bargains.

Michael Burry, the real-life inspiration for the movie "The Big Short," recently filed documents showing he shorted Palantir and NVIDIA.

The notional value of his NVIDIA put options is about $187 million, and the notional value of his Palantir put options is about $912 million.

He believes the ROI on AI is too low. Many companies are spending so much on AI now, but they might not recoup that much money in the end. The back-and-forth order-signing game among major US companies won't last forever. Eventually, it'll burst like the dot-com bubble, and the leading AI stocks will collapse first.

Today, Cathie Wood bought $1.09 million of BLSH, $9.5 million of CRSP, and $6.8 million of BEAM.

She sold $4.9 million of TER, $1.6 million of ROKU, $1.2 million of IONS, and $430,000 of ADPT.

She also sold $600,000 of SOFI. Those who've been day-trading these days must be happy—it's not falling much, nor rising much, just hovering around 30.

The copyright of this article belongs to the original author/organization.

The views expressed herein are solely those of the author and do not reflect the stance of the platform. The content is intended for investment reference purposes only and shall not be considered as investment advice. Please contact us if you have any questions or suggestions regarding the content services provided by the platform.