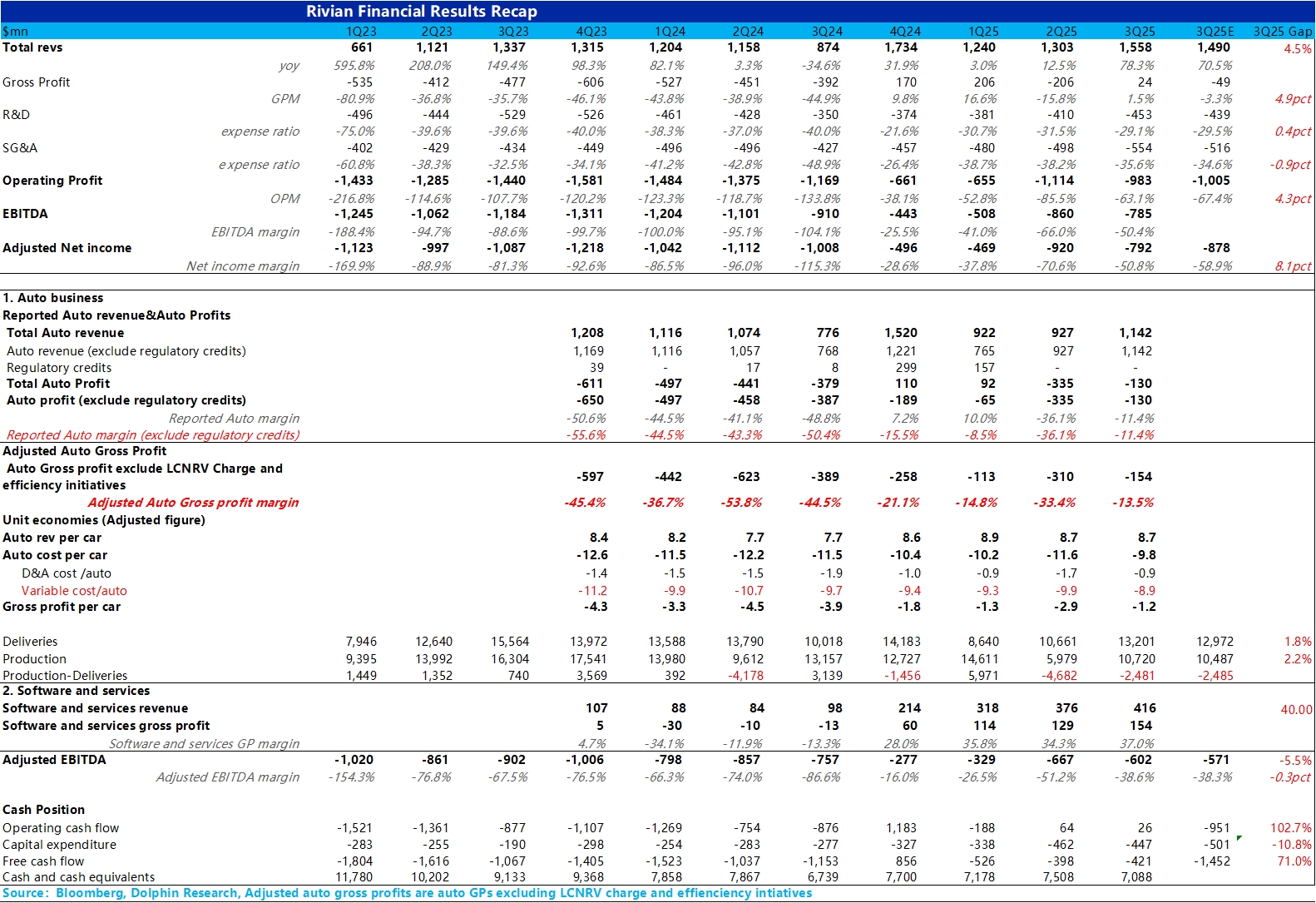

Rivian Quick Interpretation of Financial Report: Overall, Rivian delivered a decent third-quarter performance, with both revenue and net profit exceeding market expectations. Specifically:

This quarter's total revenue was $1.56 billion, higher than the market expectation of $1.49 billion. The reasons for exceeding expectations are:

① The selling price per vehicle this quarter remained flat compared to the previous quarter, without further decline. This was mainly due to Rivian benefiting from the rush effect before the phase-out of the U.S. IRA subsidies in the third quarter, which temporarily stimulated demand without any price reduction on models;

② Software and service revenue continued to perform well, reaching $416 million this quarter, an increase of $40 million compared to the previous quarter. This was primarily due to the joint venture with Volkswagen contributing the majority of service revenue.

What exceeded expectations even more was the gross margin this quarter, which turned positive again at 1.5%, improving by 16.4 percentage points from the previous quarter's low of -15.8%. The market had expected Rivian's gross margin this quarter to remain negative (-3.3%).

Despite Rivian still being impacted by the decline in pure gross margin from carbon credit revenue (with almost no carbon credit recognition in the second half) and tariffs this quarter, the market did not have a very optimistic gross margin expectation even with Rivian's good vehicle sales performance.

However, from the actual vehicle gross margin perspective, this quarter's vehicle gross margin was -13.5%, significantly improving from the previous quarter (-33.4%), mainly due to the reduction in per-unit amortized costs and some progress in Rivian's cost control.

Looking at the guidance for the full year 2025, Rivian's annual sales guidance has been narrowed from 40,000-46,000 units to 41,500-43,500 units, mainly due to the negative impact of the IRA subsidy phase-out in the fourth quarter. The market is concerned that Rivian might further lower the adjusted EBITDA expectations, but Rivian has maintained the Adjusted EBITDA guidance of -$2.0 to -$2.25 billion, which is also better than market expectations. $Rivian Automotive(RIVN.US)

The copyright of this article belongs to the original author/organization.

The views expressed herein are solely those of the author and do not reflect the stance of the platform. The content is intended for investment reference purposes only and shall not be considered as investment advice. Please contact us if you have any questions or suggestions regarding the content services provided by the platform.