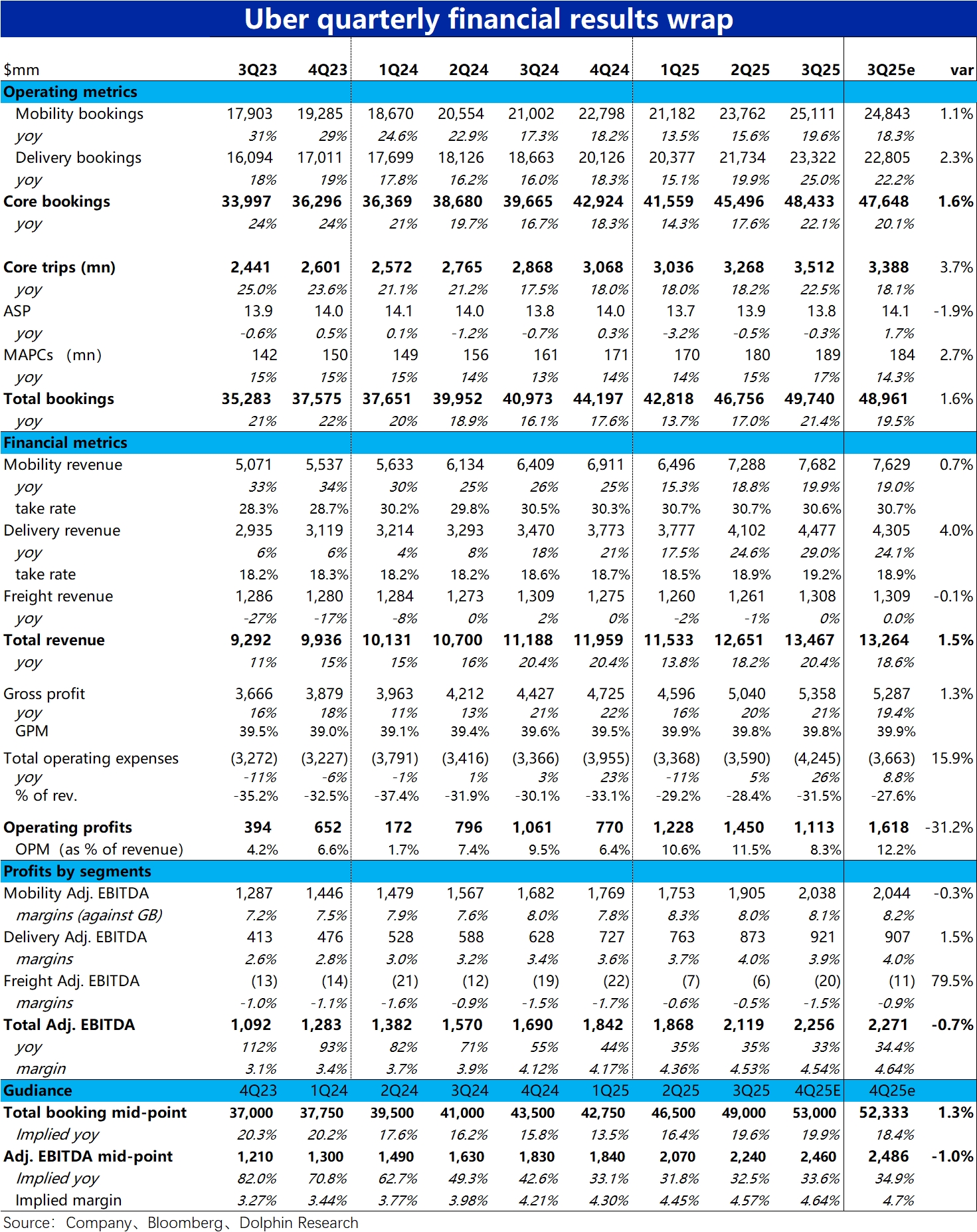

Uber 3Q25 Quick Interpretation: This quarter, Uber's overall performance shows strong growth, but the profit is not impressive, falling short of expectations. The core growth metric—order value growth rate accelerated significantly to nearly 20% quarter-on-quarter, which is quite strong.

However, expenses deviated from the previous growth rate of no more than 10%, sometimes even negative, and surged to 26% this quarter, resulting in this quarter's adj. EBITDA growth of 33.5% year-on-year, which is also decent, but slightly below expectations.

Regarding guidance for the next quarter, the expected median growth rate of total order value is nearly 20%, continuing to accelerate from this quarter and slightly exceeding expectations. However, the implied median year-on-year growth of adj. EBITDA is 33.6%, which is still good but also below the market's higher expectations.

Overall, the performance is quite decent, but under high stock prices and expectations, it also appears somewhat "limping." Specifically:

1) Firstly, the core order value (food delivery + ride-hailing) growth rate accelerated quarter-on-quarter, mainly due to the increase in active users (+17% yoy) and higher order frequency (+4.3% yoy). According to the company, the development of fresh grocery delivery business has made a significant contribution to customer acquisition and enhancing user stickiness.

Coupled with the decline in average order value, the company's increased supply of low-priced products (especially in the ride-hailing business) should also be another reason for the significant acceleration in order volume growth.

2) By segment, the performance of the delivery business is stronger than the ride-hailing business. Likely due to the impact of product structure decline, although the ride-hailing business order value growth rate increased by 4 percentage points quarter-on-quarter, revenue growth only increased by about 1 percentage point quarter-on-quarter, and the monetization rate decreased by 0.1 percentage points quarter-on-quarter.

In contrast, the delivery business revenue accelerated nearly 4 percentage points quarter-on-quarter, similar to order value, and revenue growth was higher than order value. This clearly reflects the good development trend of the delivery business under the benefits of fresh delivery and advertising monetization.

3) However, although business growth is strong and high-margin advertising revenue should continue to rise, the actual gross margin is only flat quarter-on-quarter. Meanwhile, expenses also accelerated with business growth, returning to an expansion trend (although there was nearly 500 million in one-time legal expenses this quarter).

Even excluding these one-time impacts under the adj. EBITDA metric, the profit margin of the e-commerce segment (as a percentage of order value) narrowed, and the delivery business profit margin declined by 0.1 percentage points quarter-on-quarter. The trend of profit margin expansion has stalled.

The copyright of this article belongs to the original author/organization.

The views expressed herein are solely those of the author and do not reflect the stance of the platform. The content is intended for investment reference purposes only and shall not be considered as investment advice. Please contact us if you have any questions or suggestions regarding the content services provided by the platform.