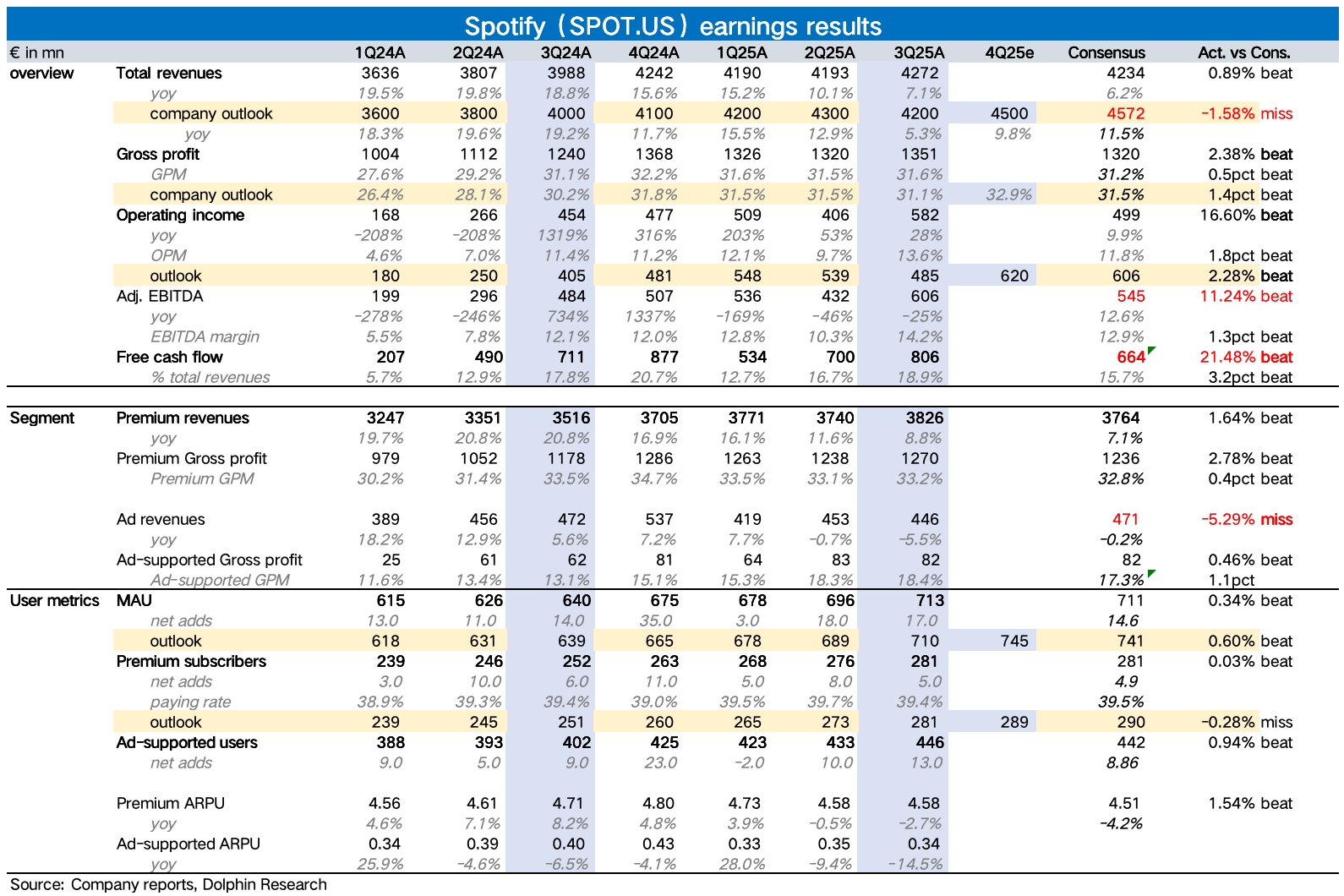

Spotify 3Q25 Quick Interpretation: The music streaming giant Spotify released its third-quarter results, which were mixed. However, the market's pre-market feedback was relatively positive, possibly because it alleviated major concerns about profit margins being under pressure before the earnings report.

1. Profits were impressive, despite the launch of many new features in the third quarter, the market had fully anticipated increased investments. In reality, both gross margin and operating margin improved beyond expectations. Operating expenses significantly contracted, with a notable decrease in social charges (generally following employee benefits fluctuations, including stock-based compensation, as Spotify's stock price fell by 10% compared to the end of the second quarter). The company also exercised strong control over marketing and personnel costs.

2. Q3 revenue grew by 7%, and by 12% excluding currency effects, continuing to slow down.

(1) Advertising remains the main drag, and with the new head of advertising yet to take office, it is expected to remain under pressure for some time.

(2) Subscription revenue grew by 9% year-on-year. In terms of volume and price, the subscription payment rate remained flat year-on-year, and the number of subscribers grew by 11% with the overall traffic trend. However, ARPPU continued to decline year-on-year due to exchange rates. Although there was a large-scale price increase in the third quarter, it was mainly implemented after mid-August, making it difficult to see a quick reflection within the quarter. Additionally, the second-largest market, North America, did not simultaneously increase prices, making it hard to offset the impact of the depreciation of the US dollar.

3. Revenue guidance fell short of expectations, with a focus on the subsequent price increase cycle. Management's Q4 revenue guidance of 4.5 billion euros fell short of market expectations. Besides advertising continuing to drag, subscription revenue is still mainly affected by ARPU (Dolphin Research estimates that ARPPU will decline by nearly 2% year-on-year in the fourth quarter), but the impact is slightly reduced.

However, Dolphin Research is quite optimistic that some product innovations launched in the third quarter (such as changing shuffle play to 1-hour free on-demand, lossless audio quality, Amazon Echo integration, and embedding ChatGPT) will gradually show results (accelerating MAU growth, increasing user stickiness, and converting to paid users). Combined with the price increase cycle, this will drive ARPU out of the bottom of the growth cycle. $Spotify(SPOT.US)

The copyright of this article belongs to the original author/organization.

The views expressed herein are solely those of the author and do not reflect the stance of the platform. The content is intended for investment reference purposes only and shall not be considered as investment advice. Please contact us if you have any questions or suggestions regarding the content services provided by the platform.