Abbott 4000-word in-depth research report

$Abbott Laboratories(ABT.US)$Medtronic(MDT.US) $Johnson & Johnson(JNJ.US) Research on Abbott (ABT.US) concludes that its anti-cyclical healthcare demand, multi-business synergy, and strong R&D have built a solid moat in the healthcare sector.

🎯 Core logic: Rooted in healthcare, it operates in diagnostics (61%, "razor-razorblade" model with instruments + high-margin consumables), medical devices (26%, e.g., cardiac devices relying on R&D iteration and physician training), nutrition (10%, global leader in infant nutrition), and pharmaceuticals. Its business model leverages innovation ($2.7B annual R&D) and cross-business synergies (tech & channel sharing) to address health needs, with vertical integration in R&D (core tech in-house), manufacturing (>70% key components), and distribution (global hospital/retail coverage), controlling the value chain.

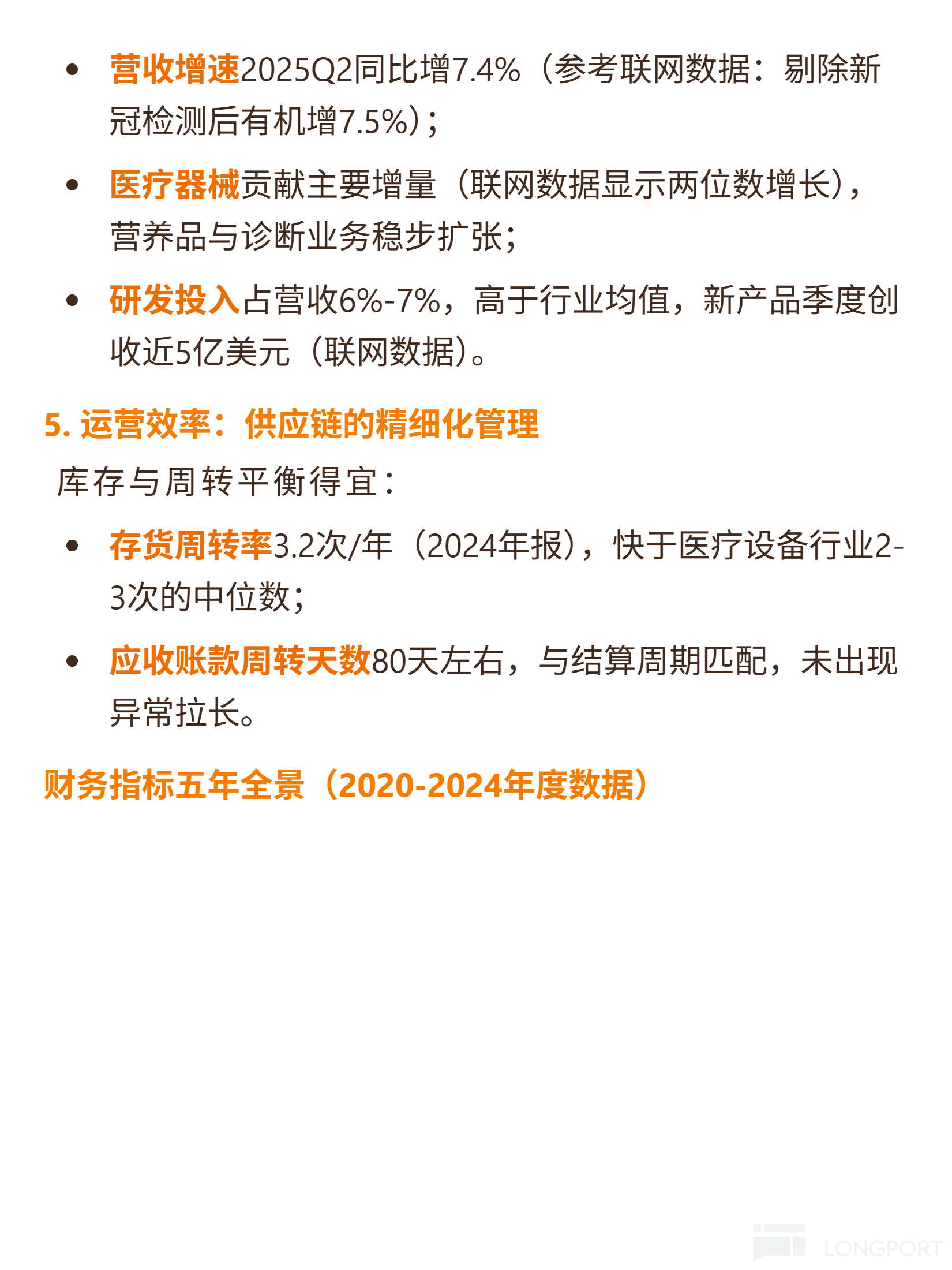

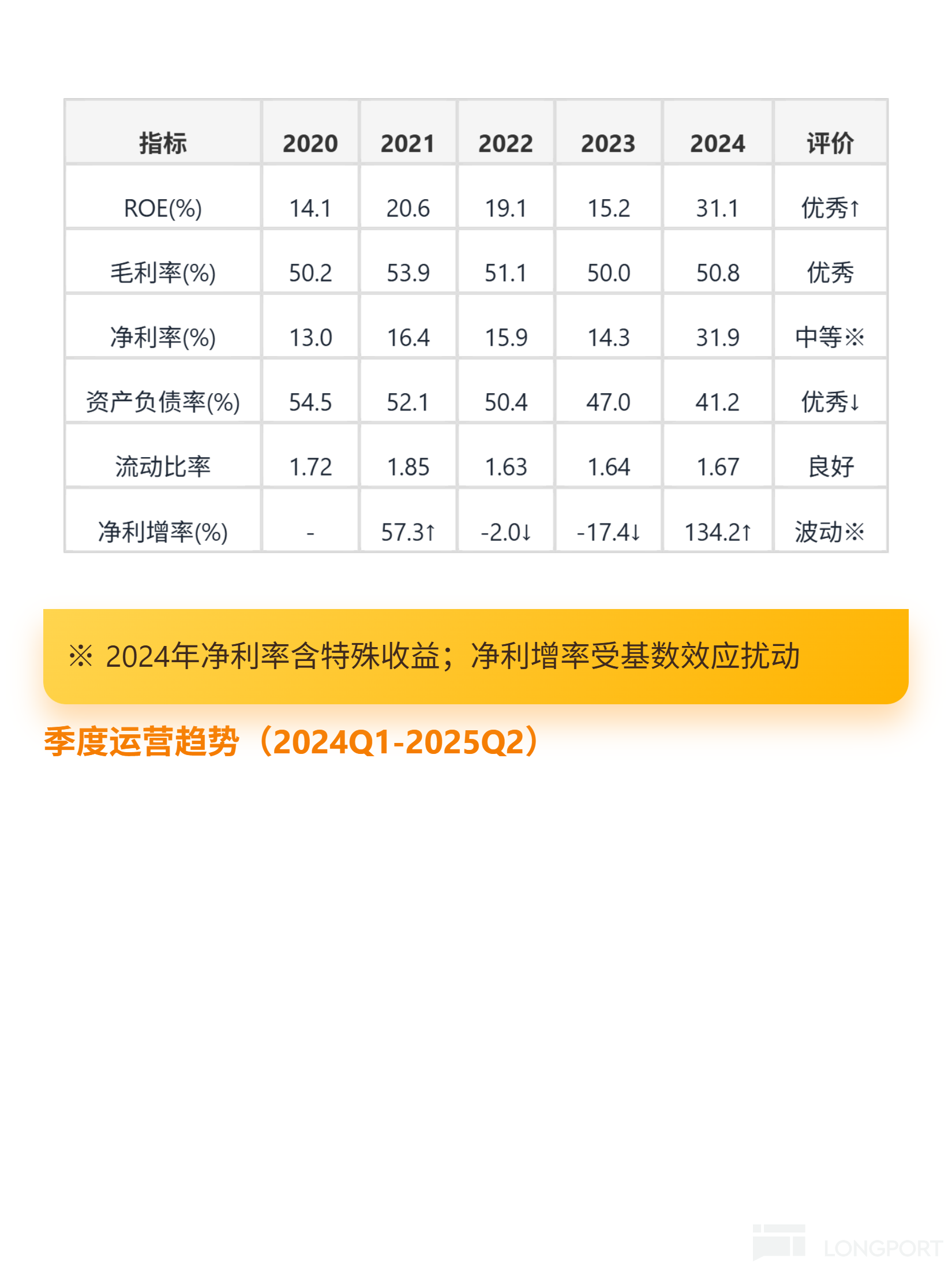

📈 Financial highlights: Stable 50%-56% gross margin (2025Q2: 56.4%, above peers); 20.1% 5-yr avg ROE (2024: 31.1%, >15% ex-items); debt ratio down from 54.5% (2020) to 39.5% (2025Q2, below avg); 5-yr positive operating cash flow (2024: $8.56B, covering net profit); 2025Q2 revenue +7.4% YoY (organic +7.5%), double-digit device growth; R&D at 6%-7% of revenue (above peers), new products generating ~$500M quarterly.

The copyright of this article belongs to the original author/organization.

The views expressed herein are solely those of the author and do not reflect the stance of the platform. The content is intended for investment reference purposes only and shall not be considered as investment advice. Please contact us if you have any questions or suggestions regarding the content services provided by the platform.