Guidance stabilized, returns maximized, can the faith in New Oriental be restored?

$New Oriental EDU & Tech(EDU.US) On October 28th, Beijing time, New Oriental released its Q1 FY2026 earnings before the U.S. stock market opened, corresponding to the operating conditions during the peak summer season from June to August 2025 in the natural year.

A month before the earnings report, the company's outlook had already revealed three marginal positives: 1) Potential enhancement in shareholder returns; 2) The deterioration in the study abroad business is not as severe as the market expected, driving revenue growth to 5%, slightly exceeding the guidance (growth of 2-5%); 3) Competition faced by K9 in some cities has eased, with growth expected to rebound starting next quarter.

These three points directly led to a valuation recovery for New Oriental, with a 20% increase in just one month. However, the current question is, for the current market value of $9.6 billion, have the positives been fully priced in?

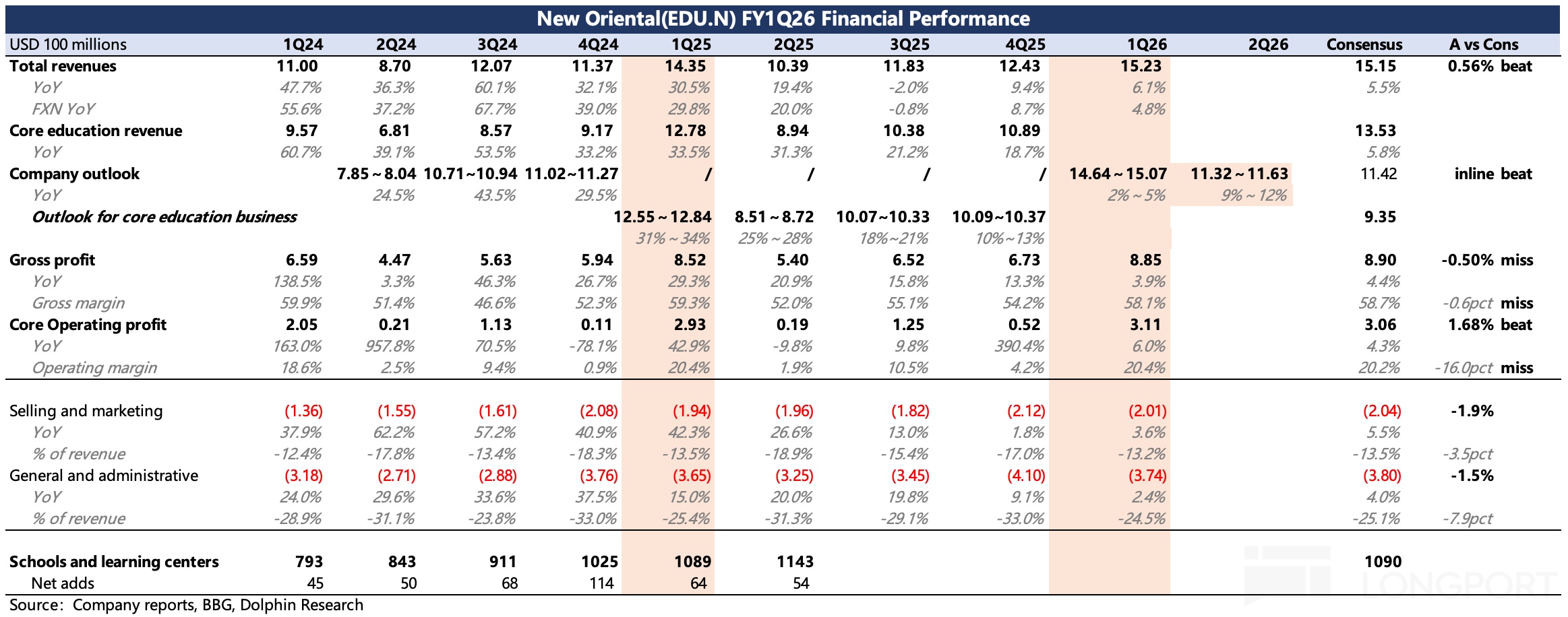

Let's first look at the performance, focusing on the education business:

1. Super positives already expected: Shareholder returns, study abroad

(1) Shareholder returns: The "dividend floor" valuation that Dolphin Research has been emphasizing has finally been exceeded! Originally, the new shareholder return plan was to use 50% of the previous year's net profit for dividends or buybacks. This quarter, the details were implemented, and the company announced a shareholder return plan of $1.9 billion in dividends + $3 billion in buybacks over the next year, totaling $4.9 billion, with a payout ratio reaching 130% of the 2025 attributable net profit, far exceeding the minimum baseline of 50% and higher than the optimistic 100% expectation from institutions.

If we trace back to the preview day, which was a market value of $8 billion, the return rate reached 6% (currently 5%), which is indeed a good investment return in a rate-cutting cycle.

(2) Study abroad business: Due to geopolitical risks, the study abroad business is a cautious consensus expectation in the market, originally expected to decline by 5-10%, but the actual dollar-denominated revenue still grew by 1-2% (1% in training, 2% in consulting), even excluding the tailwind of dollar depreciation, it is a performance of basic stability with a slight decline, which is much better than Dolphin Research's actual perception.

However, the hidden concerns about studying abroad have not dissipated. The resilience this quarter may be due to the substitution effect of non-U.S. study abroad demand, but this often exists in the short term. For users who have already made study abroad plans and preparations, they will choose alternative options in other regions (such as Australia).

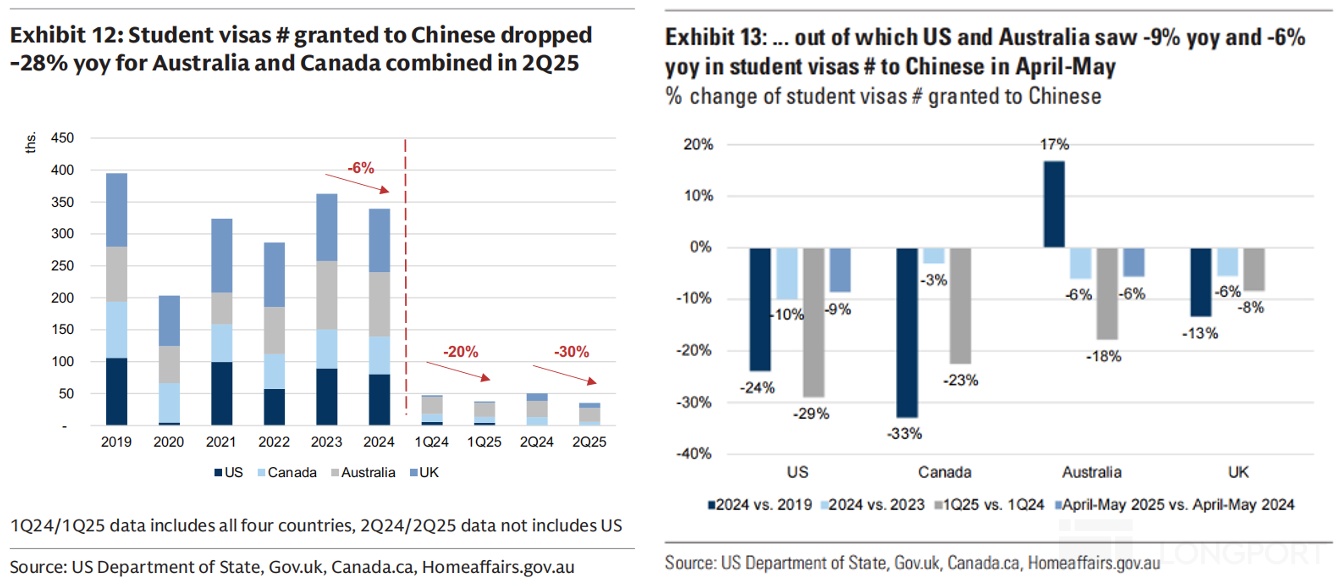

But the turbulent geopolitical relations will affect users with potential study abroad demand in the medium to long term. The current changes may not have substantially dispelled user concerns (student visa approval volumes remain low). Therefore, the outlook and how to respond, especially the statements in the conference call, need to be closely watched.

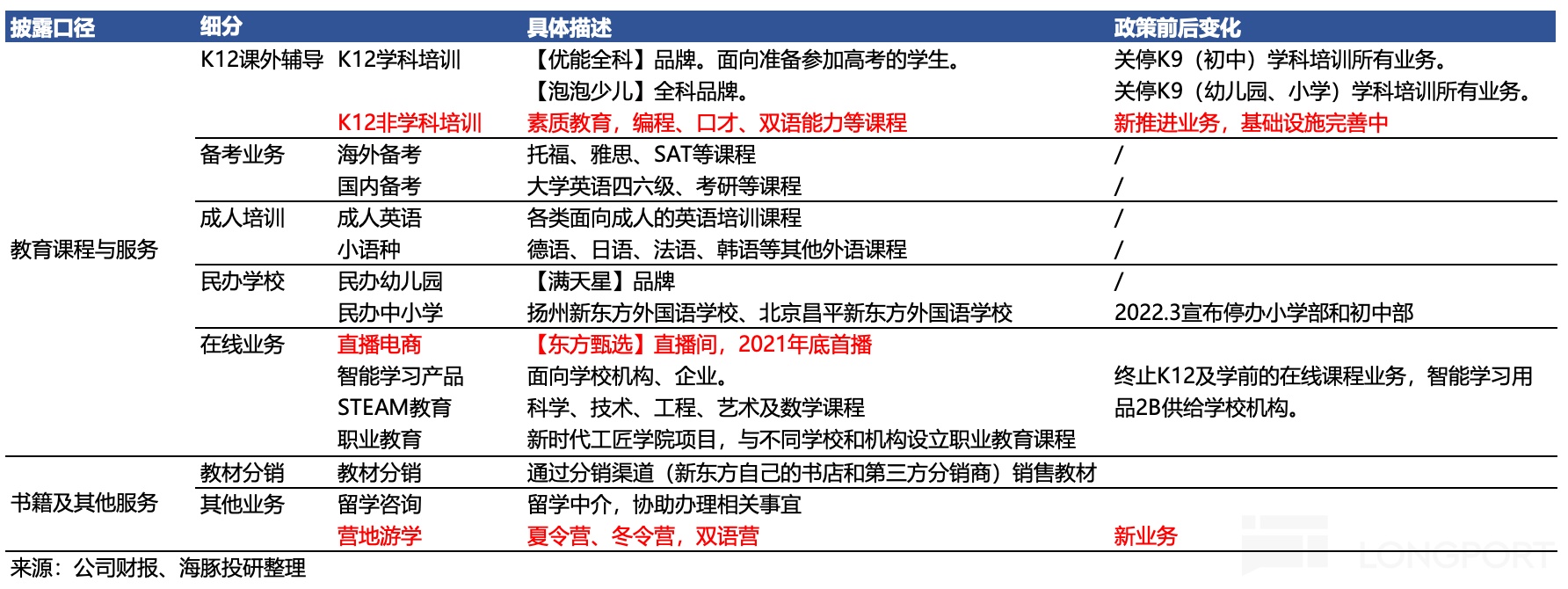

2. New business growth slows, may recover next quarter: This quarter, new business (non-subject, learning machines, others) revenue grew by only 15% year-on-year, while last quarter it was over 30%. According to institutional research, the reason for intensified competition from local institutions in some cities (small institutions often focus on summer and winter vacations) has a short-term impact.

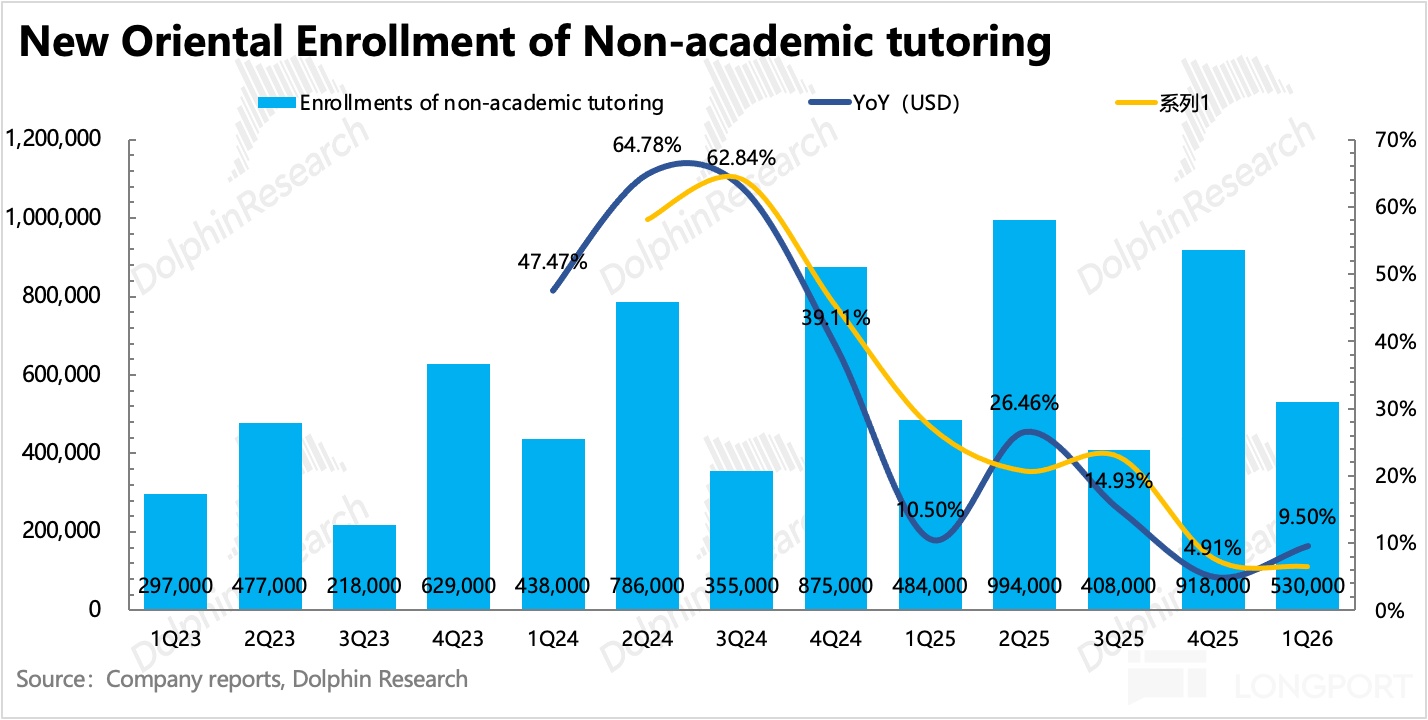

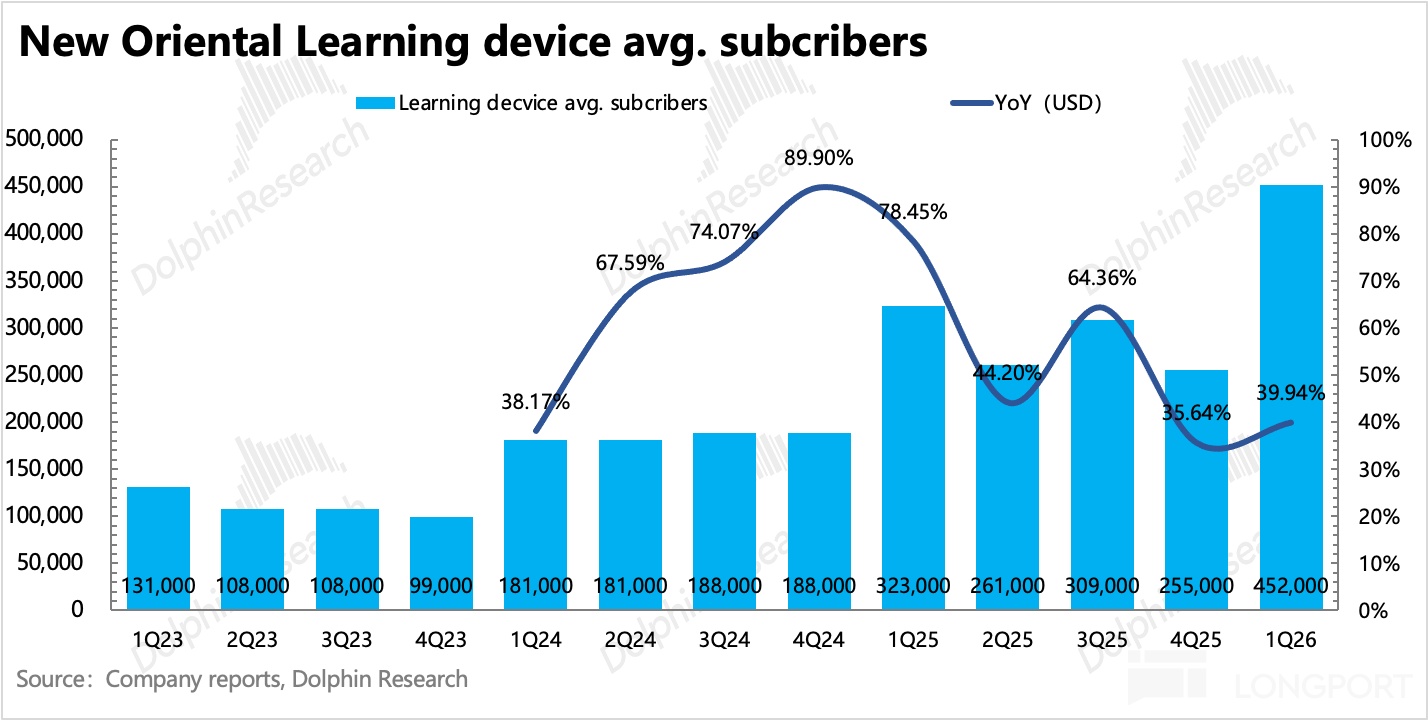

But from the trend of non-subject course enrollments (yoy+10%) and learning machine subscriptions (yoy+40%) (accelerating growth), the current performance should be temporary, and growth is expected to recover next quarter. Specific details and outlook can be followed in the conference call.

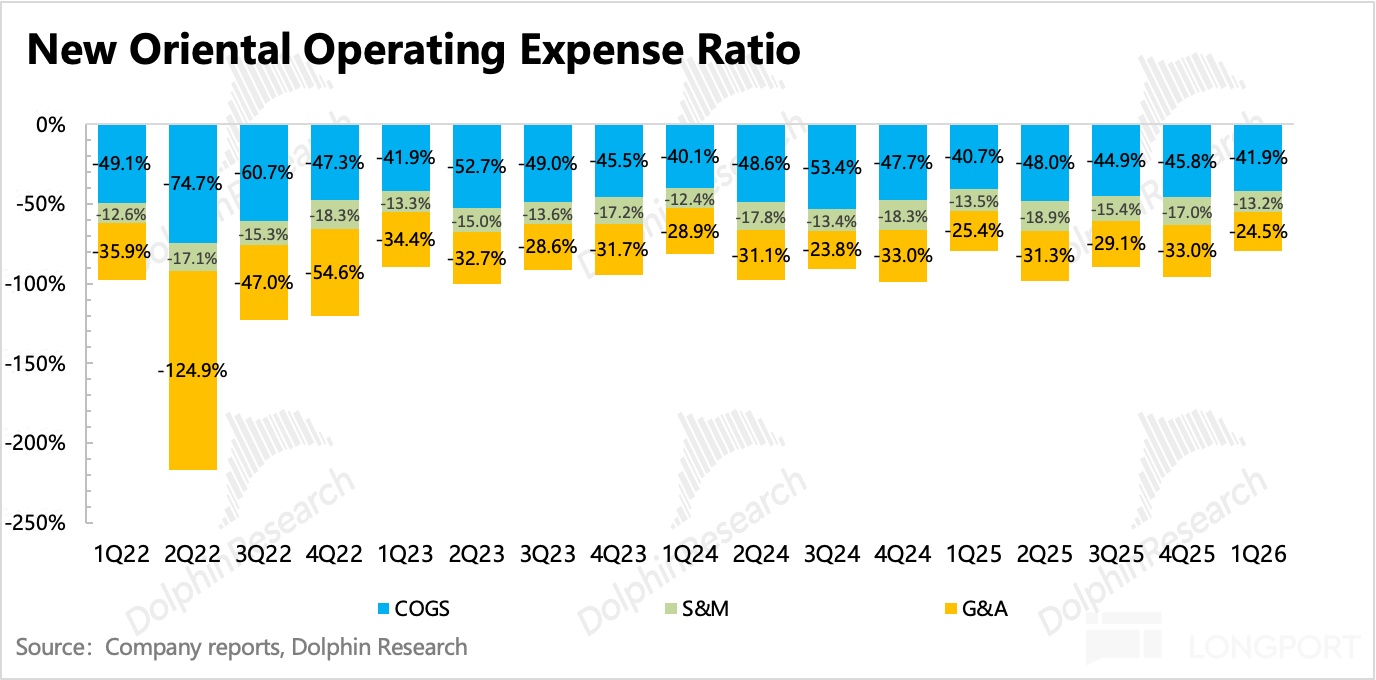

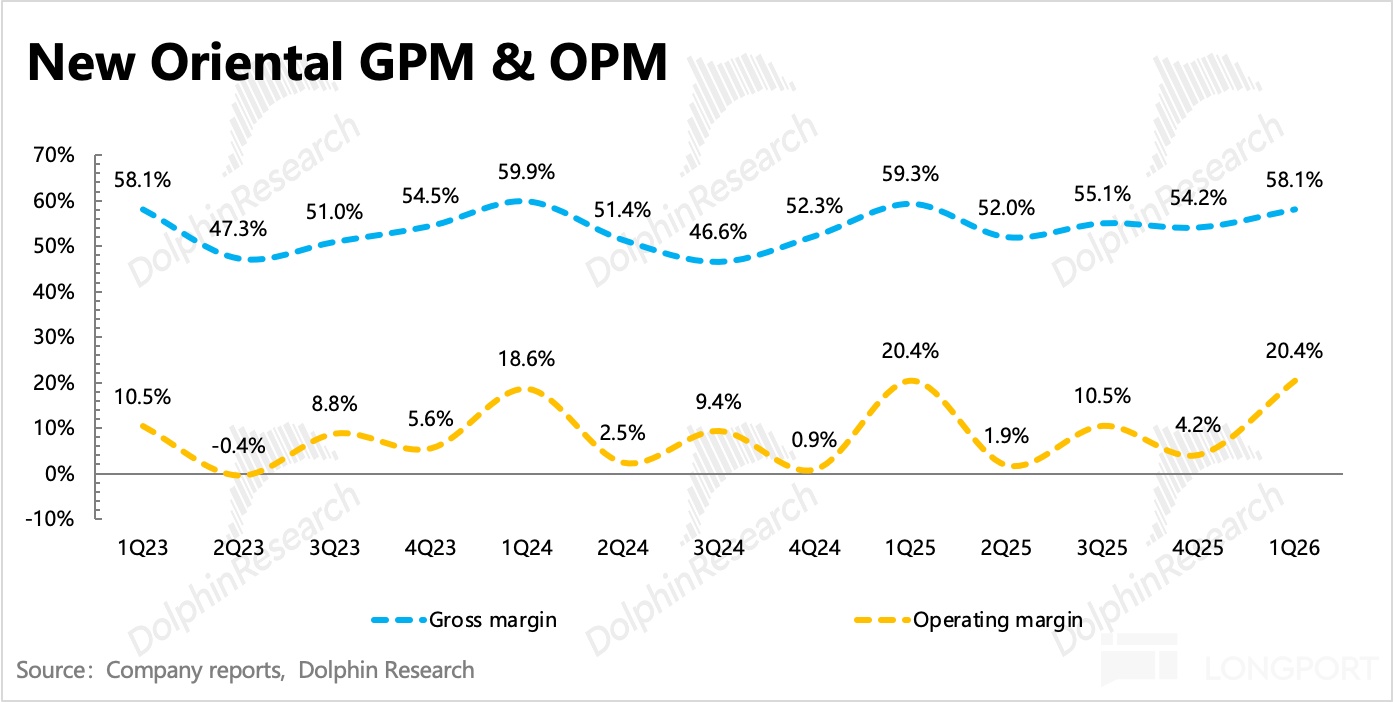

3. Continued strict control of costs and expenses: This quarter core operating profit was $311 million, with an operating profit margin of 20.4%, flat year-on-year. From a Non-GAAP perspective excluding stock-based compensation, the profit margin improved by 1 point year-on-year, and the company stated that it will continue to control costs in the future to ensure profitability.

4. Full-year guidance unchanged: The current FY2026 revenue guidance remains at a year-on-year growth of 5% to 10% (same as last quarter), which can only dispel concerns about uncontrolled deterioration in the study abroad business. But from the trend, in the second half of the year, with the recovery of new business growth, management has reserved more buffer space for the risks of the study abroad business.

5. Overview of important financial indicators:

Dolphin Research's View

The three marginal positives given in the earnings preview (shareholder returns, study abroad, plus a recovery in K9 business) are indeed exciting, especially after multiple guide downs, the company's faith completely collapsed, and the valuation once hit $6.5 billion, corresponding to 12x P/E for FY2026 (that year).

First, from the perspective of the group as a whole, rather than relative valuation SOTP, in the current market sentiment environment, it is already considered a relatively cautious preference, and when short-term business is under pressure, choosing to ignore the long-term intrinsic growth trend of core education (which should still maintain above the 15% level), only giving 12x P/E, this is basically a punitive valuation.

But Dolphin Research can also understand the market's panic, August was a period of high uncertainty in Sino-U.S. relations, visa study abroad business accounts for about 1/4 of New Oriental's revenue and profit, if geopolitical risks persist, coupled with the shrinkage of middle-class wealth, it is indeed difficult to judge when studying abroad can bottom out.

In this situation, Dolphin Research emphasized the logic of New Oriental's dividend floor in the last quarter's review. But indeed, Dolphin Research did not anticipate that this time the management would suddenly be so generous, directly using 130% of FY2025 profits for shareholder returns. Although the Preview had already disclosed in advance that the payout ratio would be significantly increased, this is higher than the optimistic expectation of a 100% payout ratio from institutions.

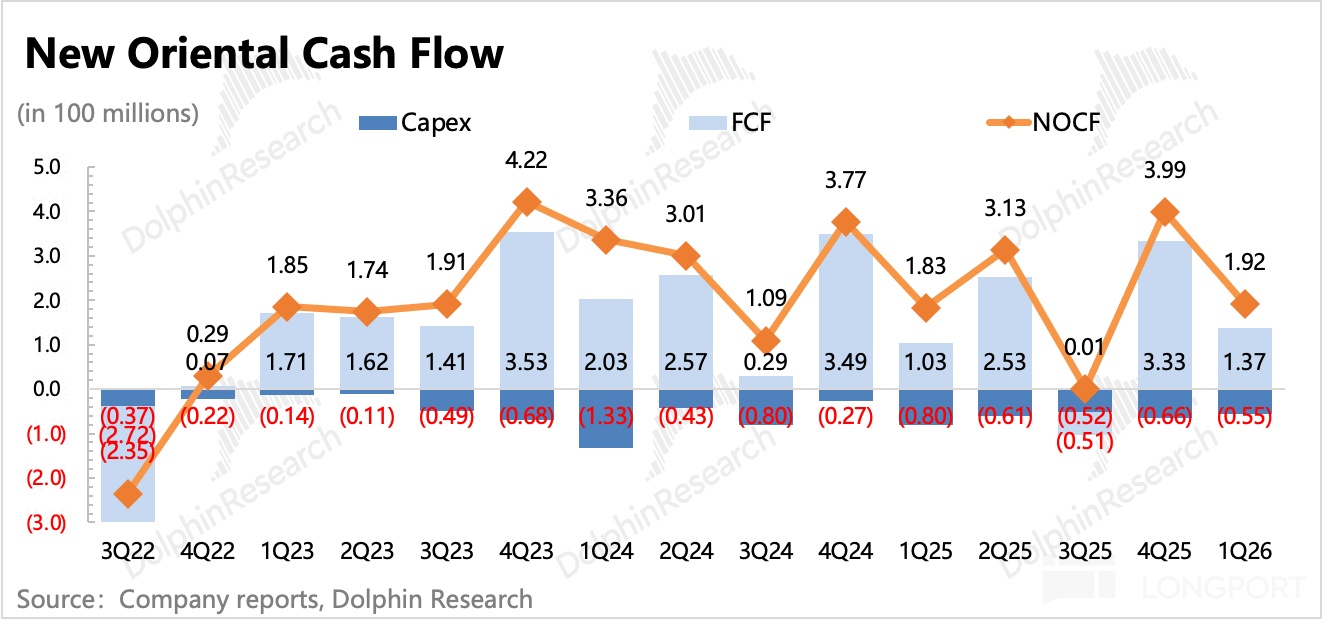

Although New Oriental is just a company with a market value of less than $10 billion, due to its business model being friendly to cash flow and years of accumulation, there is still a considerable amount of cash on the books. As of the end of August 2025, there was $2.9 billion (excluding prepaid tuition), and free cash flow has returned to positive after overcoming the pain of "double reduction". Therefore, as long as the management's "generous" attitude continues, this shareholder return can still be maintained.

So, still the previous expectation, fundamentally, study abroad and K9 business make a hedge, with total revenue expected to maintain at $5.3 billion. Meanwhile, under the general policy of strictly controlling expenditure items, the net profit margin is expected to increase by 1pct compared to last quarter's expectation (Non-GAAP OPM 13%, 20% tax rate), ultimately achieving a net profit of $550 million this year, with a 15x P/E corresponding to an $8.3 billion neutral valuation (a 6% increase compared to last quarter's valuation expectation).

And the $4.9 billion shareholder return over the next year is both an additional return on the neutral valuation (6% on the $8.3 billion valuation basis) and serves as a strong support during adjustments, calculated with a 7% net return yield (= required return rate of 10% - perpetual growth of 3%), corresponding to a $7 billion dividend floor.Overall, the conservative to neutral valuation range is $7 billion to $8.8 billion.

The current market value of $9.6 billion reflects the market's excessive expectations for a bottoming out and recovery in fundamentals (mainly the study abroad business), Dolphin Research believes that although the study abroad business is not that bad, it still has fluctuations, so it still tends to leave enough safety margin for itself.

Detailed Commentary Below

1. Study abroad concerns have not been substantially eliminated, new business expected to recover soon

Let's first look at the revenue situation affecting the main education business, especially the study abroad business, which is under significant short-term pressure, including study abroad test preparation and consulting.

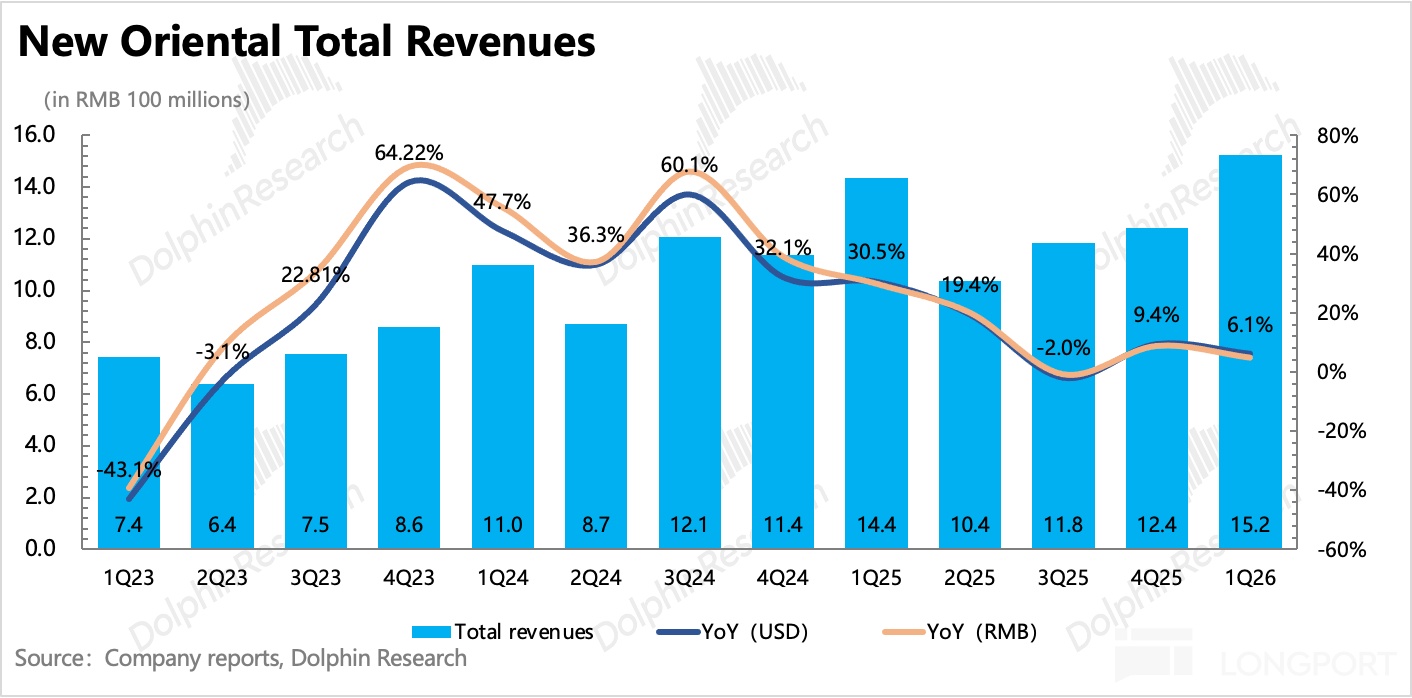

From June to August, New Oriental achieved total revenue of $1.523 billion, a year-on-year growth rate of 6%, higher than the upper end of the company's guidance range, slightly above the market expectations that had been raised after the Preview.

Next quarter's guidance is inline, and the full-year outlook for FY2026 remains at 5-10%, in line with market expectations.

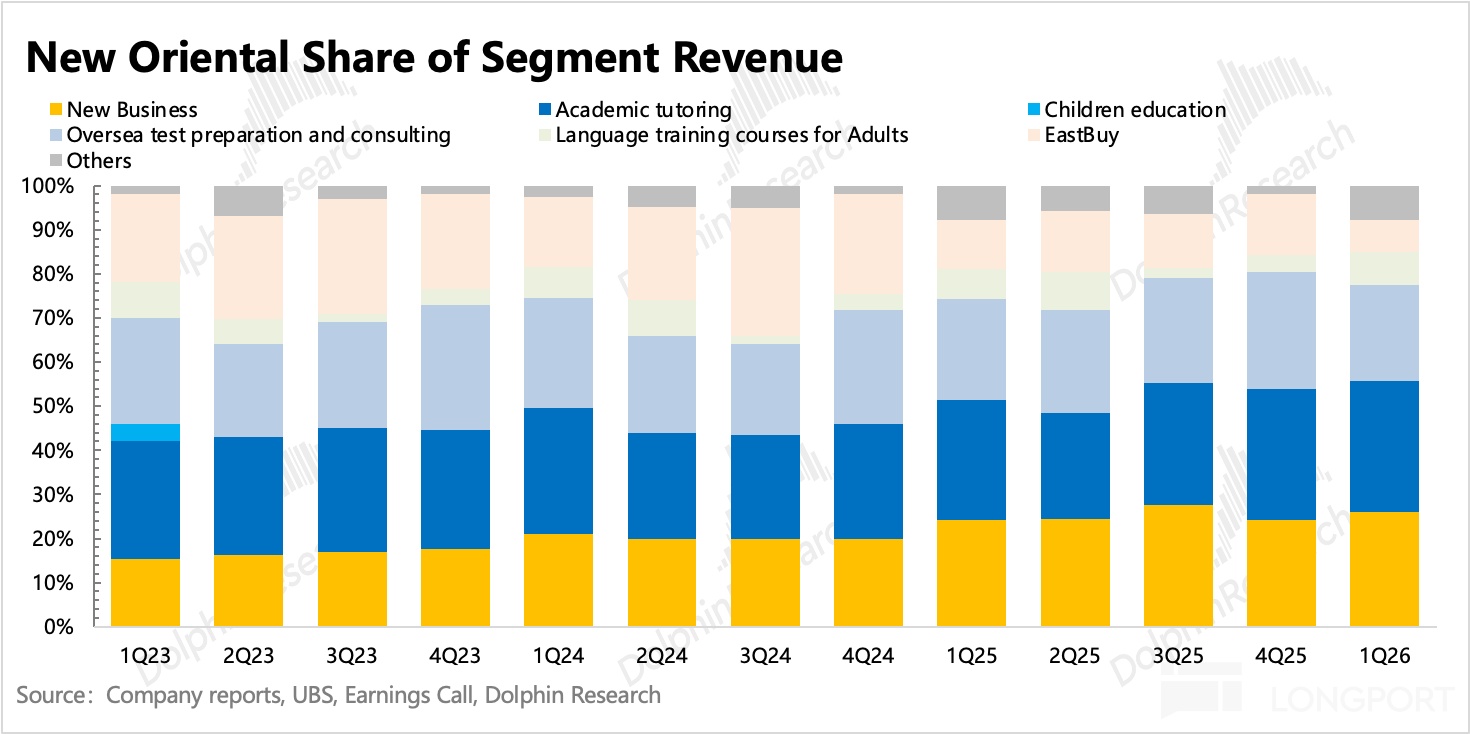

The specific performance of the segmented business is half announced in the conference call and half in small-scale institutional meetings. Dolphin Research currently provides estimated split values, and specific data will be clarified in the comment section later:

1) Study abroad training and consulting grew by 1% and 2% respectively in Q1, even excluding the tailwind from the depreciation of the dollar relative to the RMB, it is better than the original market expectation of a 5% decline. But in terms of trend, it still aligns with the actual "demand cooling" that can be felt. Last quarter's growth rates for training and consulting were 15% and 8% respectively.

For the study abroad business, Dolphin Research suggests remaining cautious. Although geopolitical tensions seem to have eased, and in the short term, the impact can be hedged by shifting study abroad demand to non-U.S. regions, uncertainty and repeated changes will continue to consume future user demand from a mid-term perspective. The chart below shows a significant decline in visa issuance volumes since the beginning of the year. Both Europe and the U.S. have seen substantial declines, while Australia has a noticeable substitution effect.

2) Adult English: Growth of 14%, vs 17% last quarter, growth has slowed, but it is better than the company's original expectations and is a relatively stable sub-business.

3) New business: Growth of only 15%, slightly below guidance (yoy+15%~16%) and expectations (yoy+16%). But from the non-subject course enrollments and learning machine subscription numbers, growth is expected to rebound next quarter.

According to institutional research, in the first quarter, some local institutions and small black classes in some cities intensified their class openings during the summer vacation, impacting New Oriental's competition. This situation is expected to ease in the next quarter's off-season, as small institutions mainly operate during summer and winter vacations due to operational cost considerations.

4) High school subjects: Expected growth of 15%, with a high base naturally slowing down.

Dolphin Research estimates the proportion of each business as shown in the figure:

2. Continue to strictly control group operating expenses

This quarter continues the strategy of cost reduction and efficiency improvement, striving to ensure profitability under revenue pressure. This quarter mainly reflects in the control of operating expenses, with a gross margin down 1 point year-on-year, operating expense ratio optimized by 1 point, and ultimately the operating profit margin flat with last year. But excluding the impact of SBC, the Non-GAAP operating profit margin improved by 1pct.

<End here>

Dolphin Research's "New Oriental" Historical Articles:

Earnings Reports

July 30, 2025 "New Oriental (Minutes): Cautious Study Abroad Expectations, Subject Training Slowdown is Seasonal Fluctuation"

July 30, 2025 "The "Thunderous" New Oriental, the Path to Rebirth is Not Easy"

January 22, 2025 "New Oriental: Strong Non-Subject Growth but Continued Slowdown, Study Abroad Pressure Will Drag Down Profitability (2Q25FY Conference Call)"

January 21, 2025 "Another Thunderstorm! Can New Oriental Still Be "Chicken" by Parents?"

October 23, 2024 "New Oriental: Pressure in Off-Season, Believe We Will Rebound in the Second Half (1Q25FY Conference Call Minutes)"

October 23, 2024 "The Turbulent New Oriental: Without Dong Yuhui, Has Education Collapsed?"

August 1, 2024 "New Oriental: Not Looking at Oriental Selection, Optimistic About Profit Margin Improvement Trend (4Q24FY Conference Call)"

July 31, 2024 "New Oriental: At the Peak of Live Streaming, Education is Booming"

April 24, 2024 "New Oriental: Improved Resource Utilization, Expansion Target Raised (3Q24FY Conference Call)"

April 24, 2024 "New Oriental: Live Streaming Drags Down Profits, Another Moment for Education to Support the Bottom Line"

January 25, 2024 Conference Call "New Oriental: Education Demand is Full, But We Don't Want to Expand Too Fast, Profit Margin First (2Q24FY Conference Call)"

January 25, 2024 Earnings Report Review "New Oriental: Enjoying the "Blossoming and Fruiting Period""

October 27, 2023 Conference Call "New Oriental: Actively Expanding, Demand Stronger Than Previously Expected (1Q24FY Performance Meeting Minutes)"

October 27, 2023 Earnings Report Review "Education is the True Face of New Oriental"

July 28, 2023 Conference Call "New Oriental: Education Demand is Very Strong (4Q23FY Conference Call Minutes)"

July 26, 2023 Earnings Report Review "New Oriental: The Reversal Logic of New and Old Businesses is Gradually Being Fulfilled"

April 20, 2023 Conference Call "New Oriental: The Repair is Not Over, Growth is Still Ahead (3Q23FY Conference Call Minutes)"

April 19, 2023 Earnings Report Review "New Oriental: How Many More Surprises Are Needed to Restore Market Faith?"

January 18, 2023 Conference Call "New Oriental: While Increasing Investment, More Concerned About Group Profit Margin (FY2Q23 Conference Call Minutes)"

January 17, 2023 Earnings Report Review "New Oriental: After Live Streaming Profits, Old Business Returns to Investment"

In-Depth

April 4, 2023 "Cash Builds a Thick Bottom, Dong Yuhui Can't Control New Oriental"

January 13, 2023 "Dong Yuhui Joins the Spring Festival Gala, Can New Oriental's Future Still Rely on Education?"

Hot Comments

July 26, 2024 "Dong Yuhui's Departure Brings Down New Oriental, Who is the Real Victim?"

Risk Disclosure and Statement of This Article:Dolphin Research Disclaimer and General Disclosure

The copyright of this article belongs to the original author/organization.

The views expressed herein are solely those of the author and do not reflect the stance of the platform. The content is intended for investment reference purposes only and shall not be considered as investment advice. Please contact us if you have any questions or suggestions regarding the content services provided by the platform.