JPMorgan strongly supports gold, saying gold price may double in the next three years

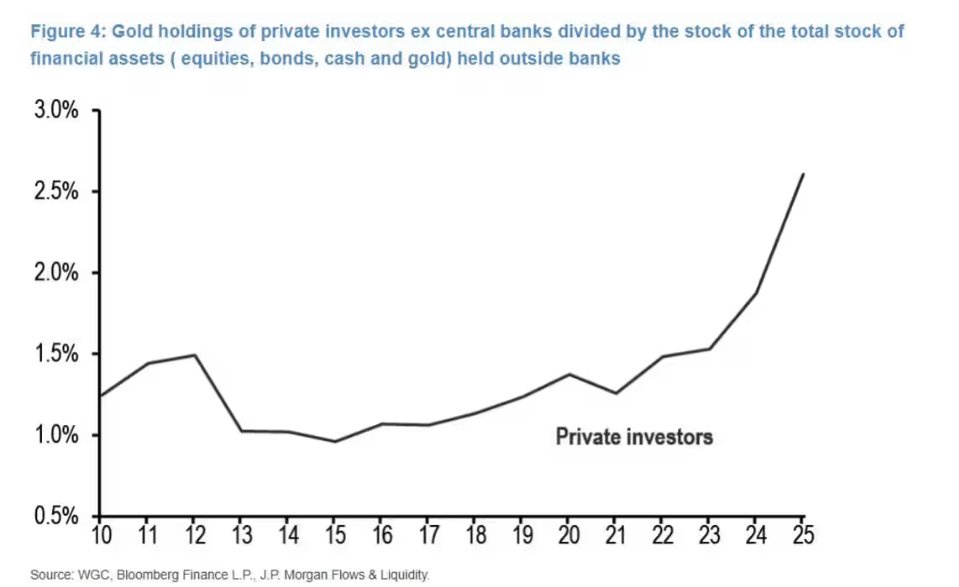

As investors increasingly use gold as a hedge against stocks, the price of gold may more than double in the next three years."Recent ETF inflows and client feedback show that many long-term capital allocators, including sovereign wealth funds, central banks, pension funds, private wealth managers and asset management companies, are planning to increase their gold holdings as a strategic diversification tool for their portfolios.""If this assessment is correct and retail investors were not the driving force behind Tuesday's gold pullback, their purchases of gold ETFs are likely not trend-driven but dominated by other factors."JPMorgan strategists estimate that the proportion of gold allocations by global non-bank investors has risen to 2.6% of total holdings. This figure is calculated by dividing the $6.6 trillion in private gold holdings not held by central banks by the total assets of stocks, bonds, cash and gold held outside the banking system. They said that if the theory of "investors using gold as a hedge against stock risk instead of bonds" holds, the current allocation ratio of 2.6% is likely still too low.The copyright of this article belongs to the original author/organization.

The views expressed herein are solely those of the author and do not reflect the stance of the platform. The content is intended for investment reference purposes only and shall not be considered as investment advice. Please contact us if you have any questions or suggestions regarding the content services provided by the platform.