Hartford Insurance 4000-word In-depth Research Report

$HIG(000548.SZ)$Progressive(PGR.US) Research on Hartford (HIG) revealed that its long-term outperformance of the industry lies in two "uncommon" factors: a 92% underwriting profit margin and relentless focus on SMEs.

🎯 Core logic: The US P&C market is moderately concentrated (CR5 55%), with high barriers to entry in commercial insurance (mainly SMEs), requiring professional underwriting capabilities and service networks. The company has deep expertise in this field, building moats through underwriting discipline and specialized focus: Combined Ratio consistently around 92% (industry average 95%-100%), with precise risk pricing + strict claims management driving underwriting advantages; 60% of revenue comes from commercial insurance, deeply tied to SMEs' unique risk needs (workers' compensation, liability insurance), with strong customer stickiness. Dual profit engines: primarily underwriting profits, with investment income contributing 40% of profits.

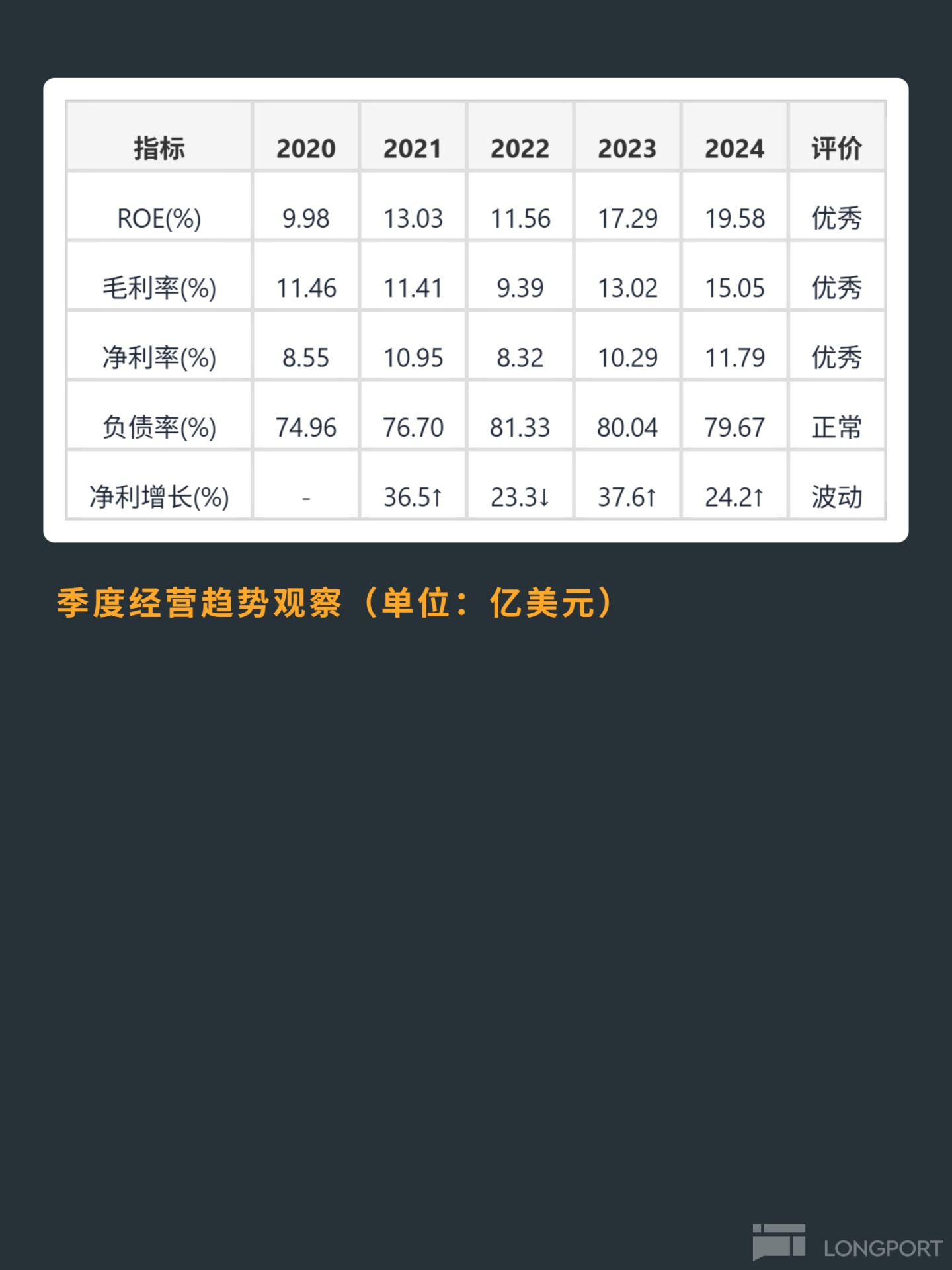

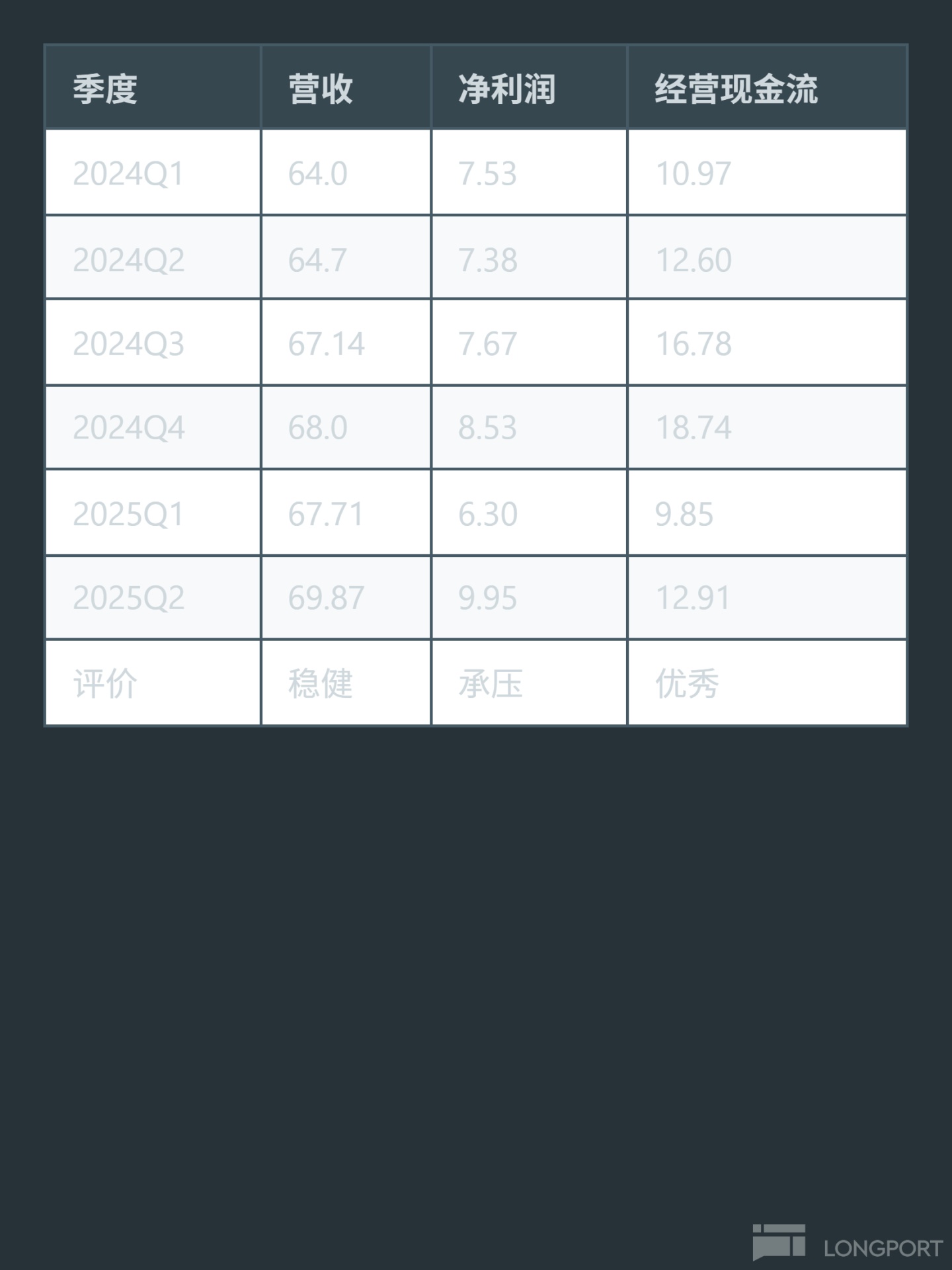

📈 Financial highlights: ROE reached 19.58% in 2024 (far exceeding industry 8%-12%), with 5-year revenue CAGR of 7% (2020: 20.3B → 2024: 26.4B). 2024 net margin 11.79%, free cash flow 5.76B (close to net profit 3.11B), current ratio 16.39x (float advantage), ESG rating AAA. But Q1 2025 revenue grew 6.1% while net profit fell 16.3%—need to monitor underwriting costs or investment-side volatility.

The copyright of this article belongs to the original author/organization.

The views expressed herein are solely those of the author and do not reflect the stance of the platform. The content is intended for investment reference purposes only and shall not be considered as investment advice. Please contact us if you have any questions or suggestions regarding the content services provided by the platform.