Alcon Inc 4000 字深度研报

$Alcon(ALC.US)$Johnson & Johnson(JNJ.US) $Bausch Health(BHC.US) Recently studied Alcon, the global leader in ophthalmology, whose core value lies in the dual-wheel-driven moat and the stability of the essential track.

🎯 Core logic: The ophthalmic care industry combines the attributes of essential consumption and healthcare, with stable demand growth (aging + myopia at a younger age), high concentration (CR3 60%-65%), technological barriers (R&D cycle over 10 years), and strong regulation forming a moat. Alcon is a global leader in both surgical instruments (leading market share in phacoemulsification equipment) and vision care (contact lenses and solutions), with core barriers in the closed-loop ecosystem of surgical equipment and consumables (high learning costs for doctors, low willingness to switch), as well as a global distribution network and brand trust.

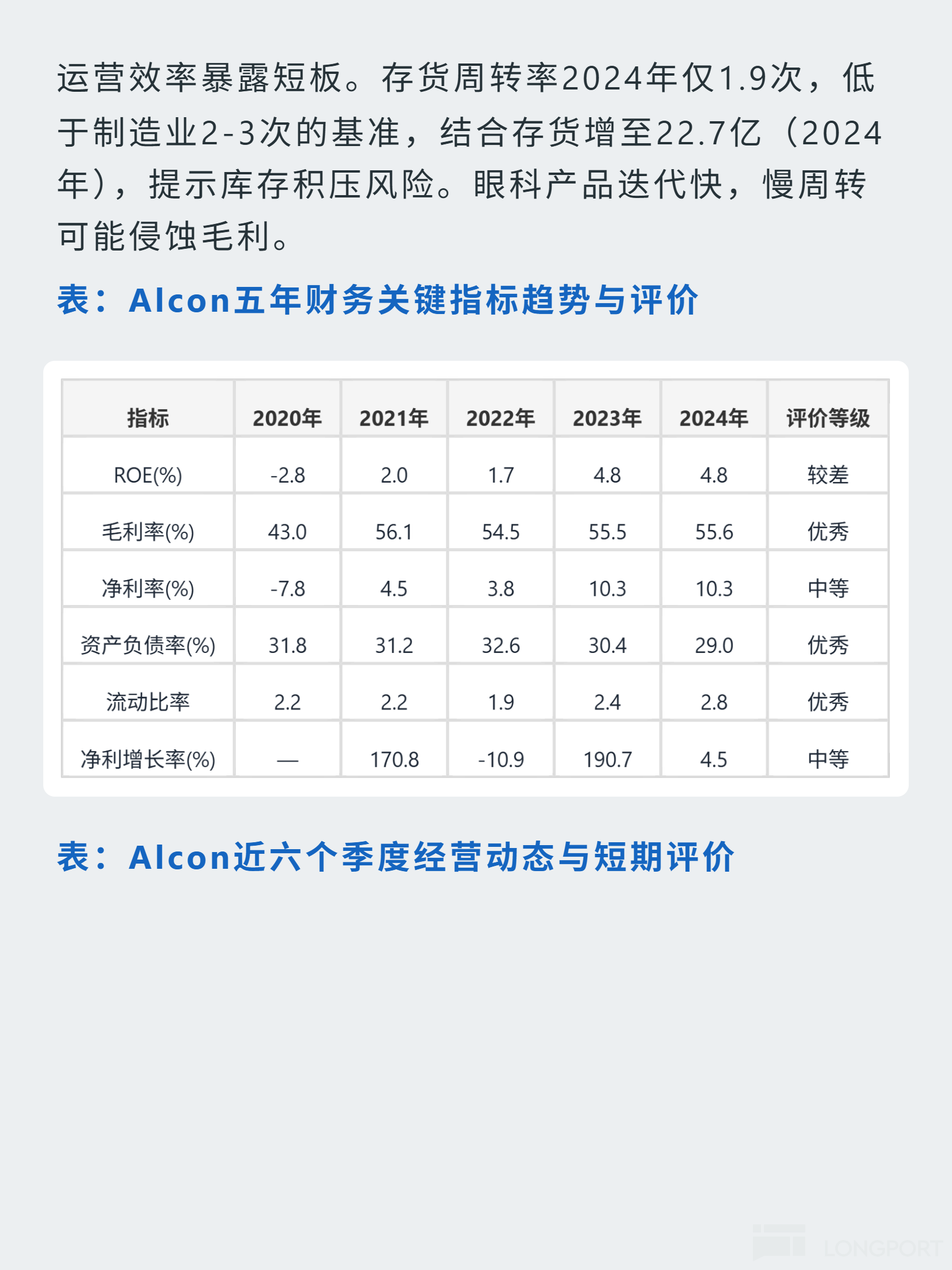

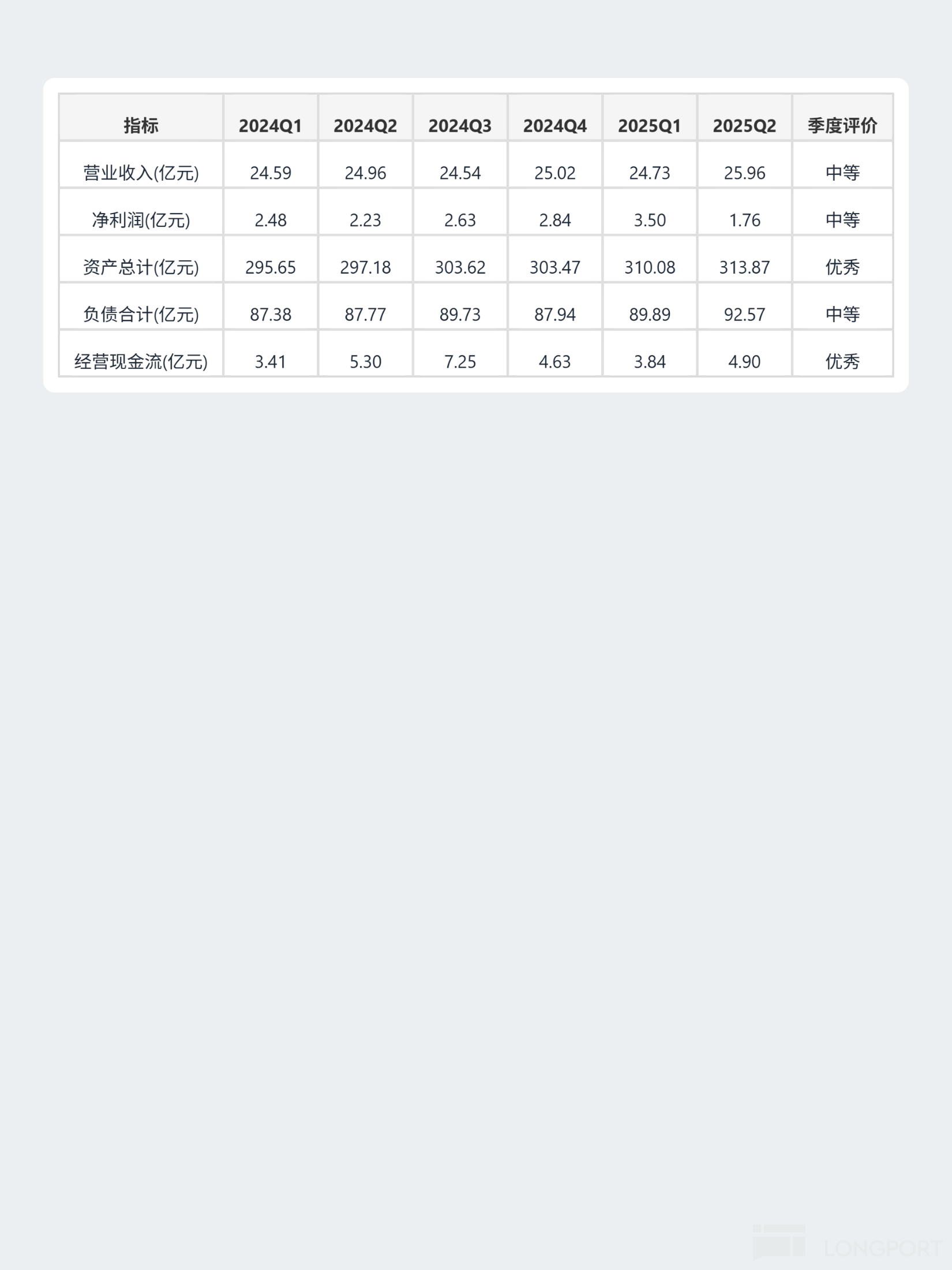

📈 Financial highlights: In 2024, the gross margin was 55.6% (stable around 55% for five years), net margin 10.3%; debt-to-asset ratio 29%, current ratio 2.8, low leverage ensuring safety; free cash flow increased from $260 million in 2020 to $1.41 billion in 2024, cash-to-net profit ratio 2.0 (high profit quality); ROE 4.8% is relatively low, inventory turnover 1.9 times (inventory efficiency needs attention). Q2 2025 revenue was $2.596 billion, operating cash flow remained stable for six consecutive quarters, and asset scale continued to grow.

The copyright of this article belongs to the original author/organization.

The views expressed herein are solely those of the author and do not reflect the stance of the platform. The content is intended for investment reference purposes only and shall not be considered as investment advice. Please contact us if you have any questions or suggestions regarding the content services provided by the platform.