Camco 4000-word in-depth research report

$Cameco(CCJ.US)$BHP(BHP.US) $Rio Tinto(RIO.US) dug out a Cameco research report, with the core logic being the revaluation of low-cost uranium mining leaders under a strong cycle.

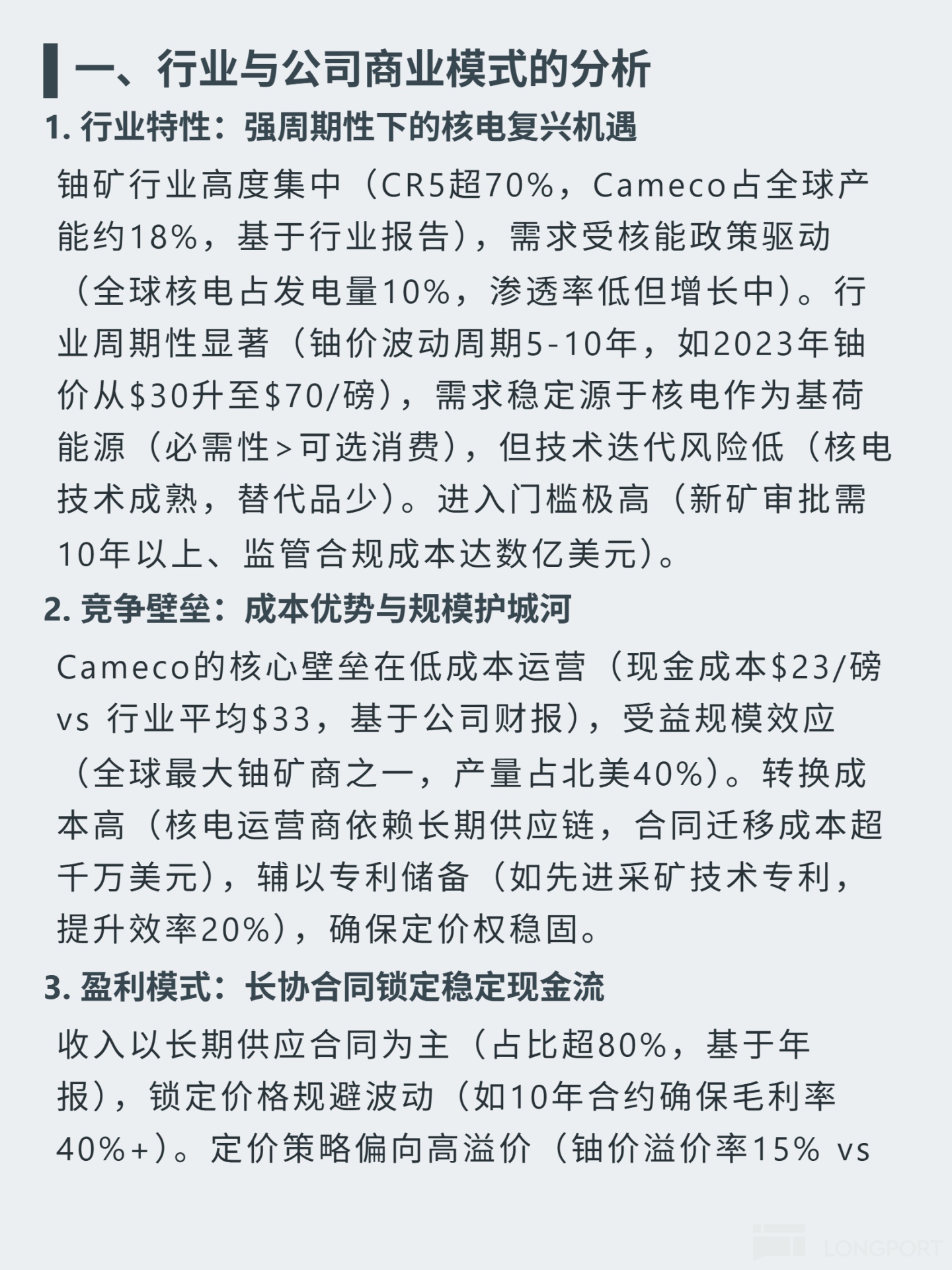

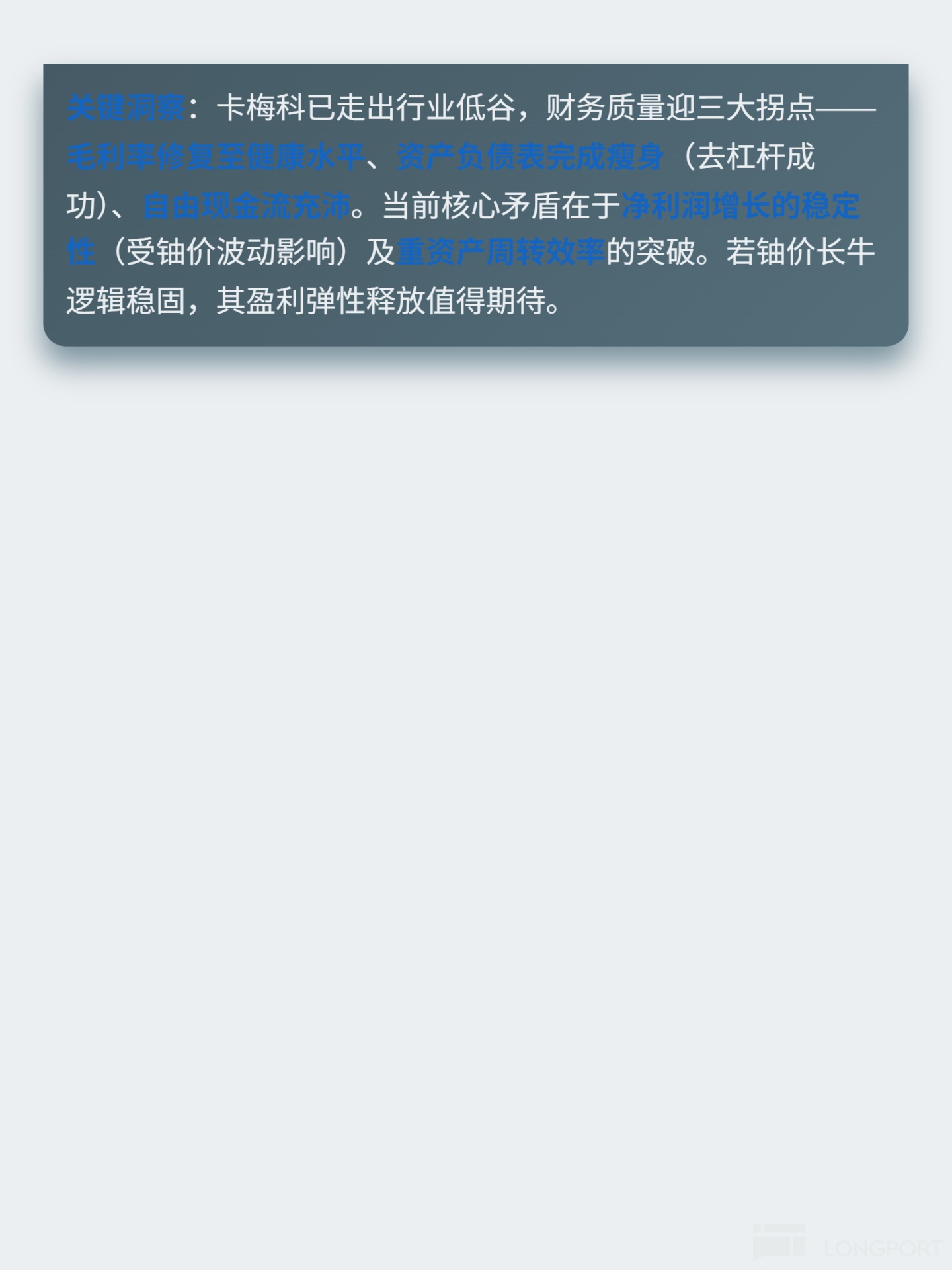

🎯 Core logic: The uranium mining industry is highly concentrated (CR5 over 70%), with significant cyclicality (5-10 year cycles, uranium price rose from $30 to $70/lb in 2023), and extremely high entry barriers (new mine approvals take 10+ years, compliance costs hundreds of millions). Cameco's advantage lies in low-cost operations (cash cost $23/lb vs industry average $33), scale effects accounting for 40% of North American production, 80% revenue from long-term contracts locking in 40%+ gross margins. Growth drivers come from global nuclear power expansion (IEA forecasts 30% uranium demand growth by 2030, China/India adding over 50GW capacity), plus 20% production expansion at Cigar Lake project.

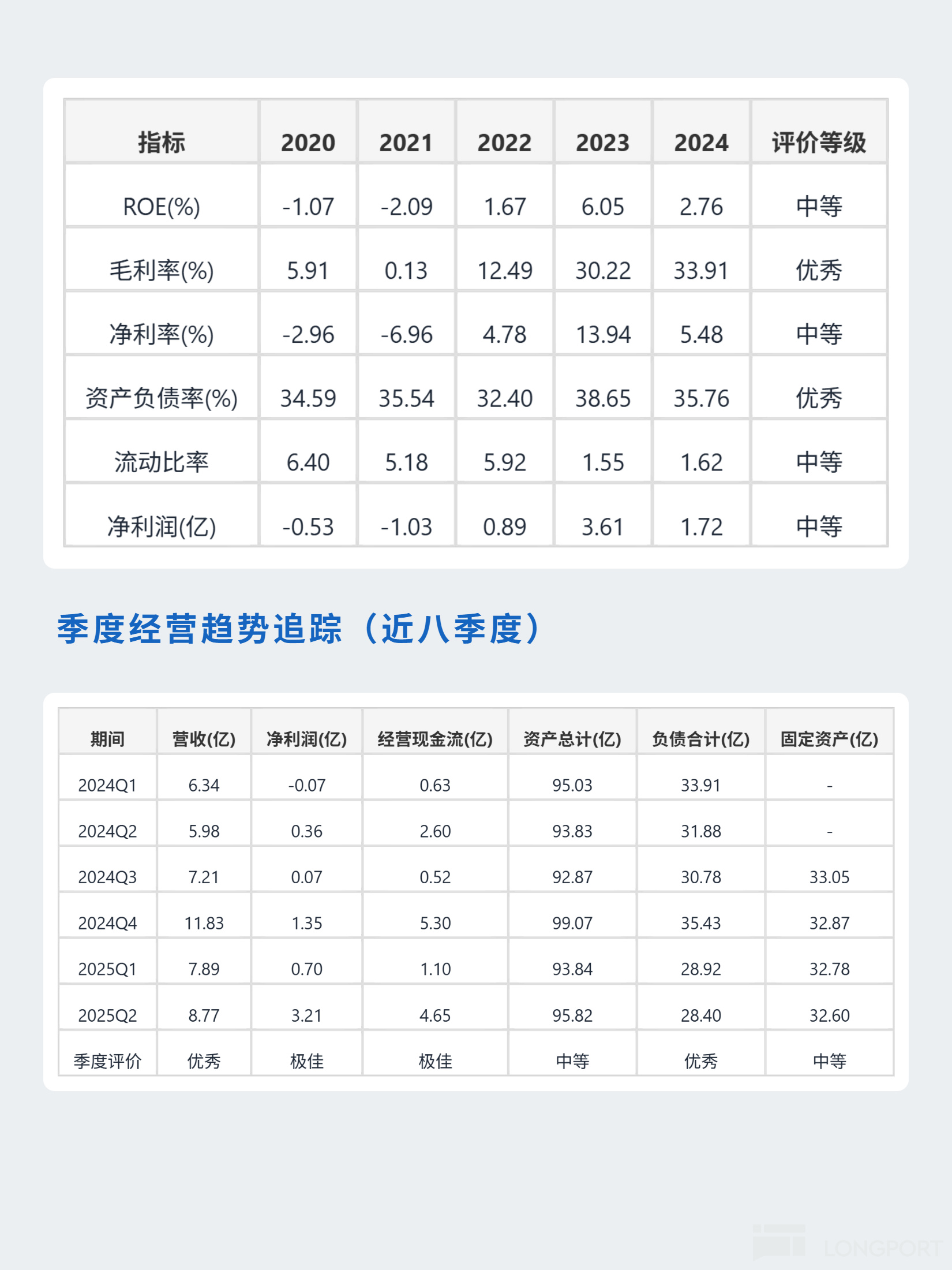

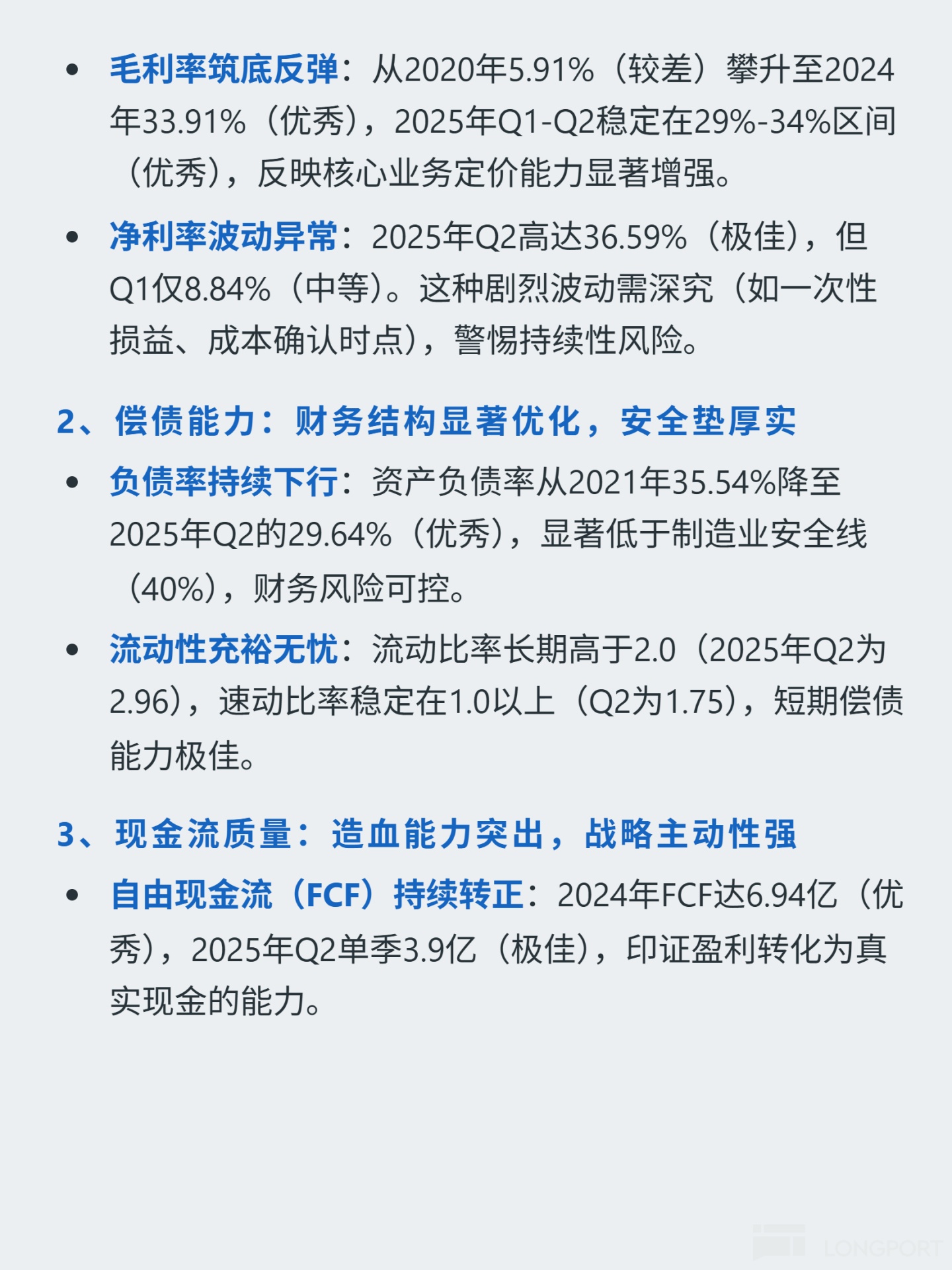

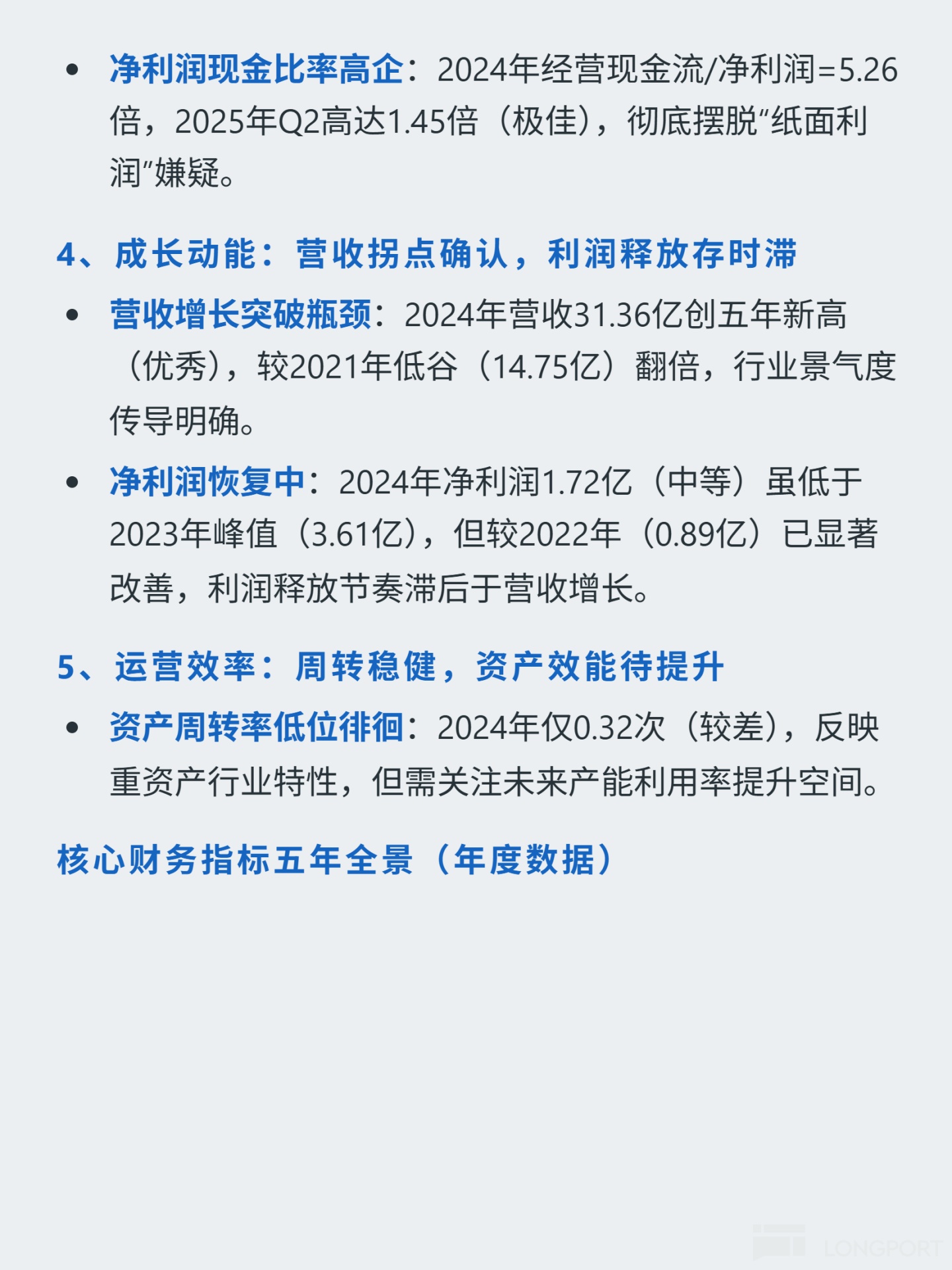

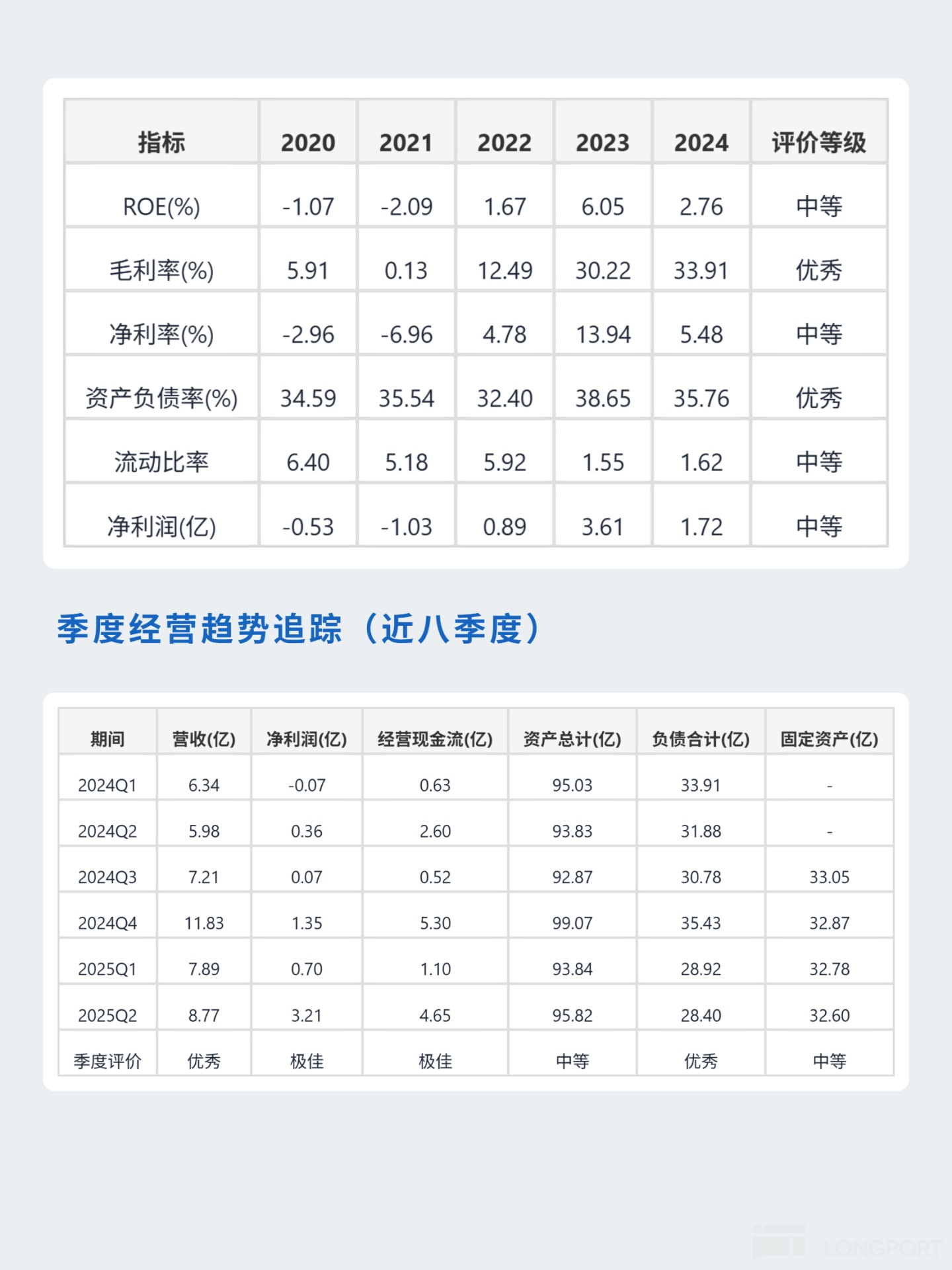

📈 Financial highlights: Gross margin rose from 5.91% in 2020 to 33.91% in 2024, ROE recovered from -2.09% in 2021 to 6.05% in 2023. 2024 free cash flow reached $694M, operating cash flow/net profit ratio at 5.26x showing strong earnings conversion. Debt-to-asset ratio dropped from 35.54% to 29.64%, current ratio at 2.96 indicates optimized financial structure. 2024 revenue hit $3.136B, doubling from 2021 trough, with profit growth lagging revenue - awaiting uranium bull market to realize full potential.

The copyright of this article belongs to the original author/organization.

The views expressed herein are solely those of the author and do not reflect the stance of the platform. The content is intended for investment reference purposes only and shall not be considered as investment advice. Please contact us if you have any questions or suggestions regarding the content services provided by the platform.