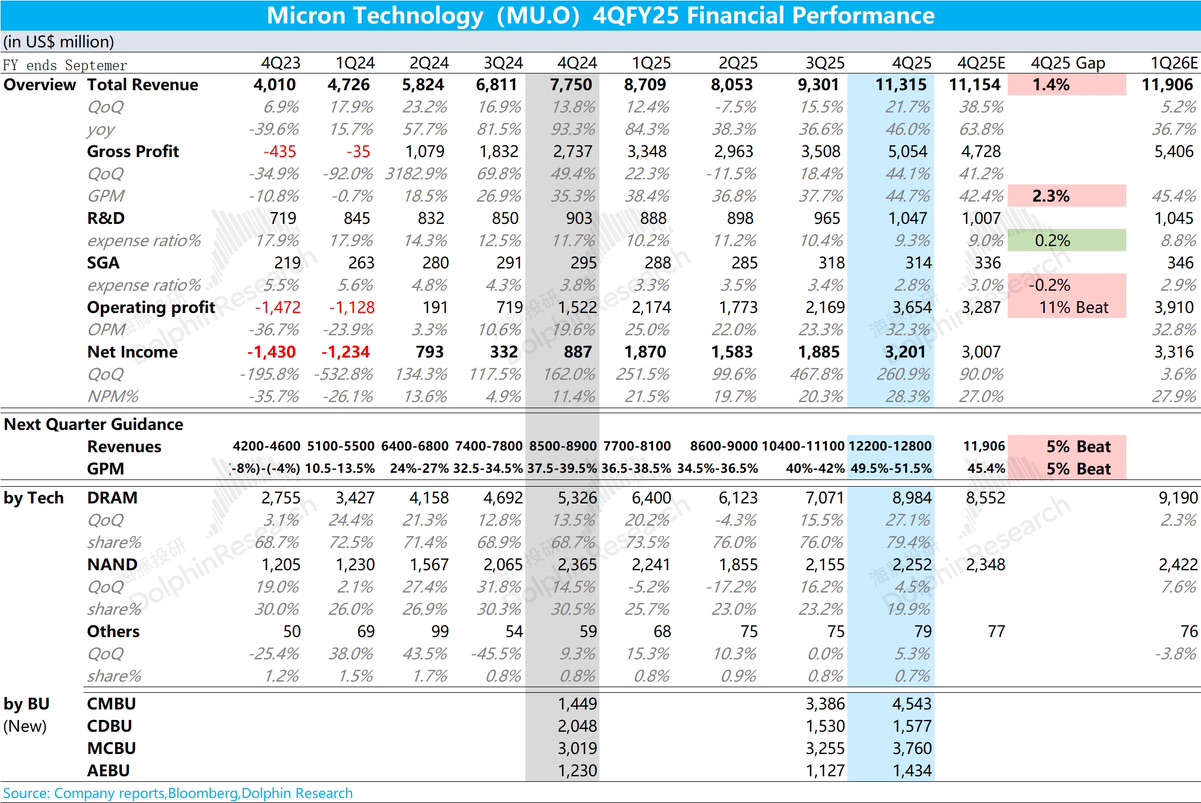

Micron 4Q FY25 Quick Interpretation: The company's revenue and gross margin for this quarter met market expectations, primarily driven by growth in the DRAM business.

The company's operating expenses remained relatively stable, with profit release mainly driven by revenue growth and gross margin improvement.

The company's specific business is divided into three parts:

① HBM business revenue for this quarter was nearly $2 billion, an increase of approximately $500 million quarter-on-quarter, mainly benefiting from the increased mass production of NVIDIA's GB series;

② Traditional DRAM business revenue for this quarter reached $6.9 billion, showing significant year-on-year and quarter-on-quarter growth, driven by both volume and price increases;

③ NAND business revenue for this quarter was $2.25 billion, although shipment volume declined quarter-on-quarter, prices have started to rebound.

Based on the company's guidance, Micron expects next quarter's revenue to be $12.5 billion (±$300 million), a quarter-on-quarter increase of $1.2 billion; gross margin is expected to reach 50.5% (±1%).

Both guidance figures are significantly better than market expectations, indicating that the company's storage products will continue to improve. As storage product prices rise, capacity utilization and gross margin will see significant improvements.

Driven by the substantial increase in capital expenditure by major cloud service providers, the supply and demand market for storage products has undergone significant changes, especially extending from the HBM field to traditional DRAM and NAND fields. As long as downstream AI Capex maintains high growth, Micron will continue to benefit from the current upward cycle in the storage industry.

For more detailed information, please follow Dolphin Research's subsequent specific commentary and management communication minutes. $Micron Tech(MU.US)

The copyright of this article belongs to the original author/organization.

The views expressed herein are solely those of the author and do not reflect the stance of the platform. The content is intended for investment reference purposes only and shall not be considered as investment advice. Please contact us if you have any questions or suggestions regarding the content services provided by the platform.