Hyundai Mobis 2025 Transformation: Betting on Seven Key Areas to Dominate Future Markets

Produced by ZN Tech

Against the backdrop of the global automotive industry accelerating its electrification and intelligent transformation, the role of Hyundai Mobis is quietly changing.

In the past, it was the "behind-the-scenes factory" of Hyundai Motor Group, mainly supplying core components such as brakes, steering, and lighting. But as we enter 2025, Mobis is increasingly acting like a proactive player—it is no longer content with being a supporting role but aims to take a more prominent position in the future mobility industry chain.

This transformation can be seen in the technological directions it is betting on: from windshield holographic displays, electromechanical braking, and steer-by-wire systems to software-defined vehicles, electrification systems, and semiconductors and robotics. It covers almost all key aspects of intelligent mobility.

At the same time, Mobis is becoming more aggressive in global expansion and capital operations—establishing deeper ties with automakers in North America, Europe, and China through regional manufacturing centers and R&D hubs.

Behind this lies a clear logic: at the inflection point of the automotive industry's transformation, auto parts companies can only stand firm in future competition by mastering cutting-edge technologies, customer resources, and financial stability.

01

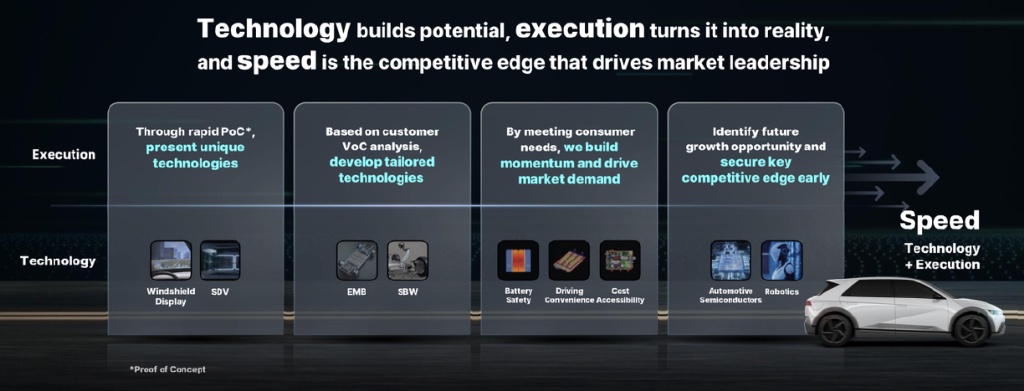

Product System Driven by Cutting-Edge Technologies

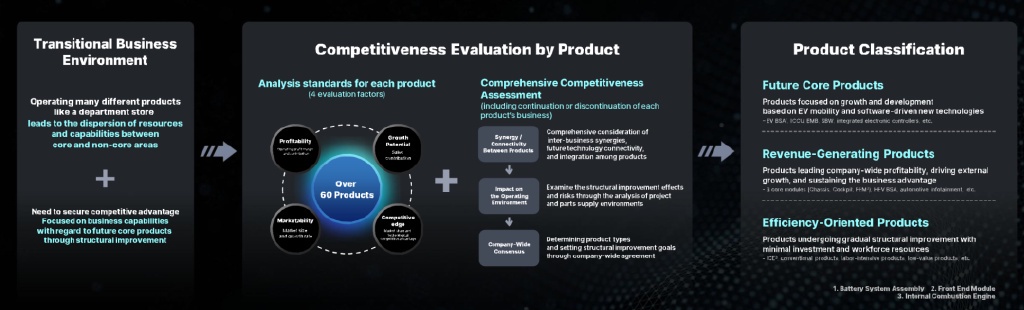

Hyundai Mobis has a clear strategic logic, with a vision to lead mobility transformation. It focuses on three major strategies: "mastering cutting-edge technologies, focusing on profitability, and accelerating global customer expansion," forming a closed loop of technology R&D, product implementation, and global layout.

In terms of cutting-edge technology deployment, Hyundai Mobis focuses on seven core areas: windshield displays, software-defined vehicles, electromechanical braking, steer-by-wire systems, electrification components, automotive semiconductors, and robotics, building competitiveness for future vehicles and smart mobility.

◎ Windshield Display (Windshield Display) reflects Mobis's foresight in interactive experiences.

Through partnerships with ZEISS and Envisics, leveraging holographic optical films and computer-generated holography, the goal is to achieve mass production by 2028-2029, providing OEM customers with high-end design flexibility and enhancing driving safety and intuitive information visualization for consumers.

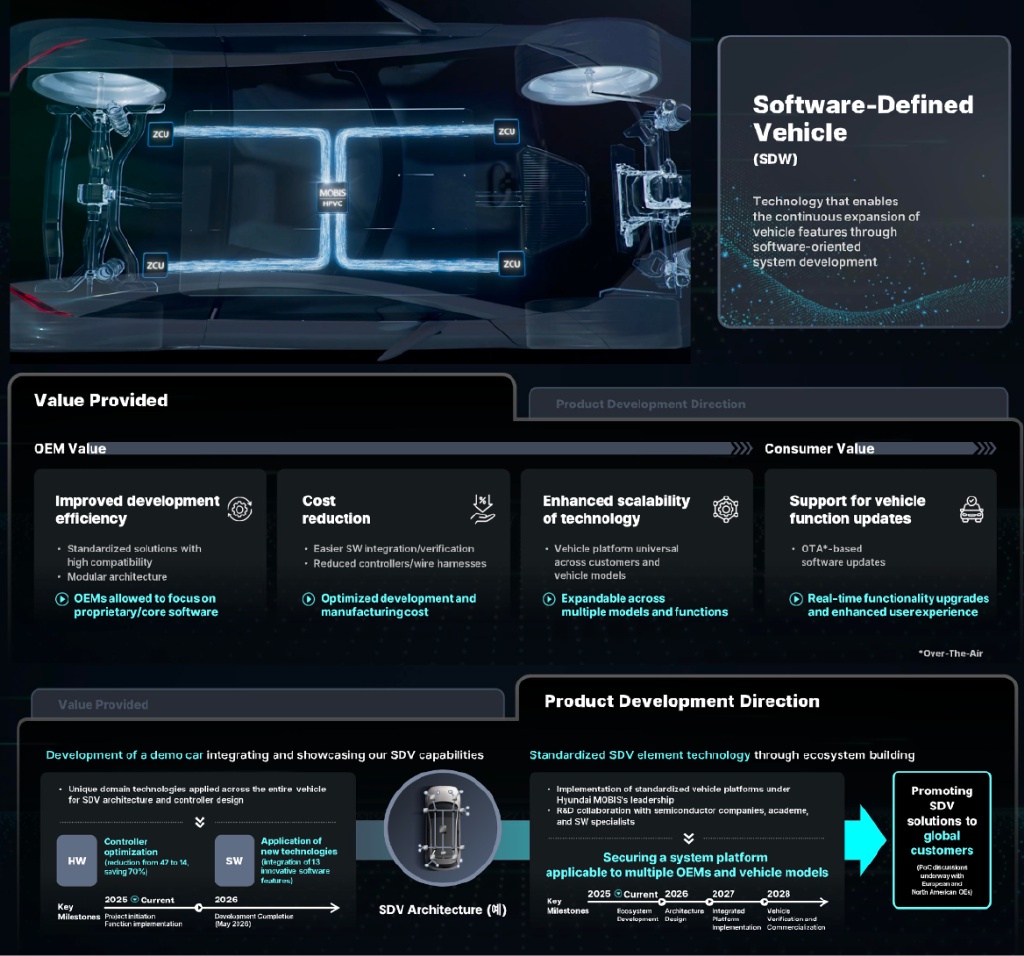

◎ Software-Defined Vehicle (SDV) adopts a modular architecture, standardized development, and a vehicle platform that is cross-customer and cross-model compatible, enabling OTA updates and continuous feature expansion. Mobis has planned a clear roadmap from project launch in 2025 to global customer promotion by 2028, collaborating with semiconductor companies and academia for R&D.

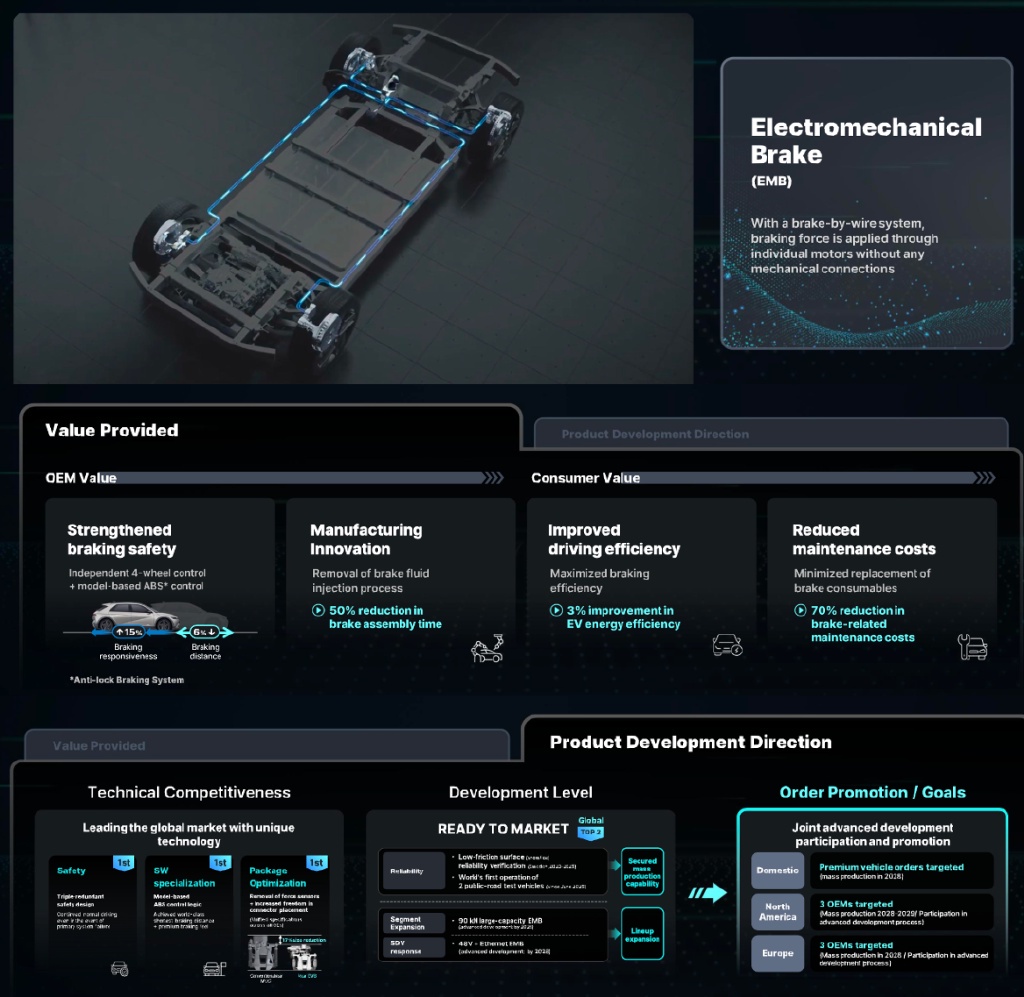

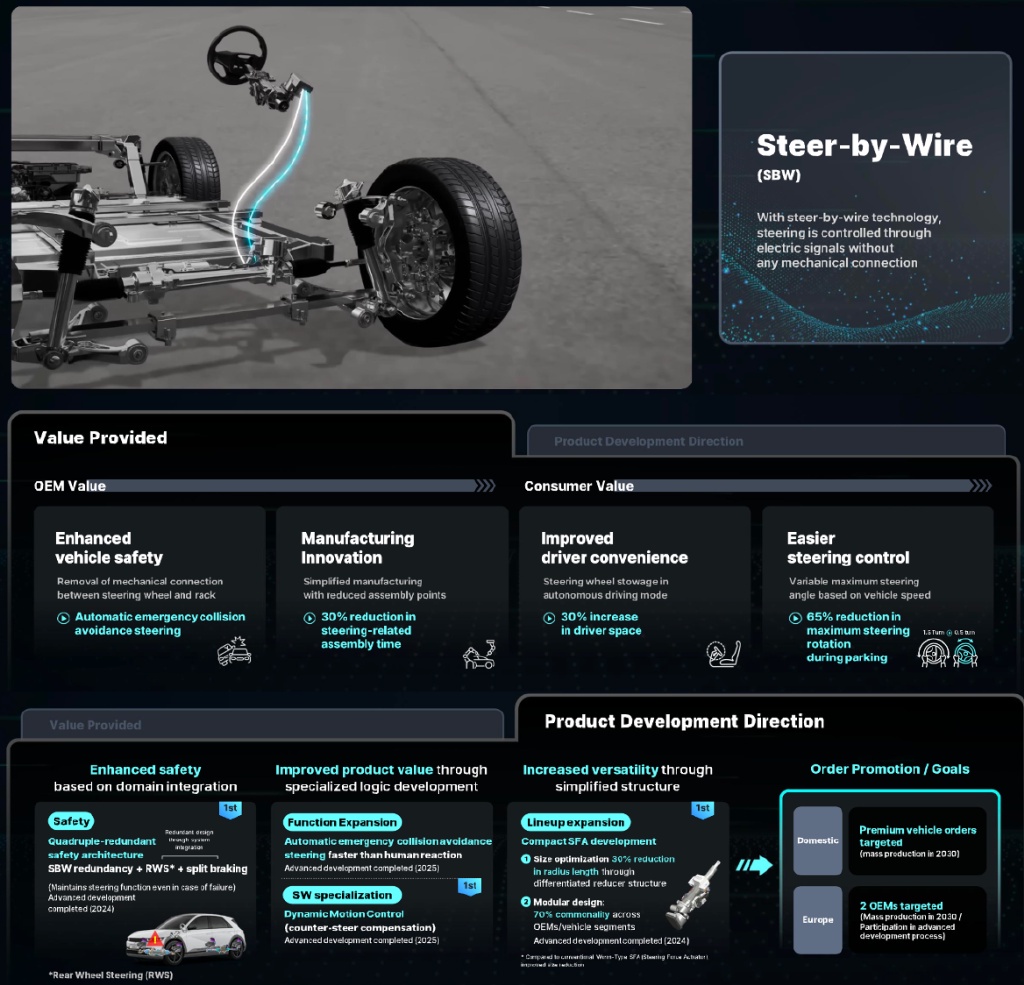

◎ In chassis and safety technologies, the Electromechanical Braking System (EMB) and Steer-by-Wire System (SBW) achieve precise control of braking and steering through wire technology, improving vehicle response speed and safety redundancy while optimizing manufacturing and assembly efficiency.

EMB applies braking force through independent motors, reducing braking distance and maintenance costs, with mass production expected by 2025 and orders from mainstream automakers in Europe and America.

SBW, through modular design and multiple redundancies, enhances autonomous driving safety and driving space, targeting mass production in domestic high-end models by 2030 and expansion into the European market.

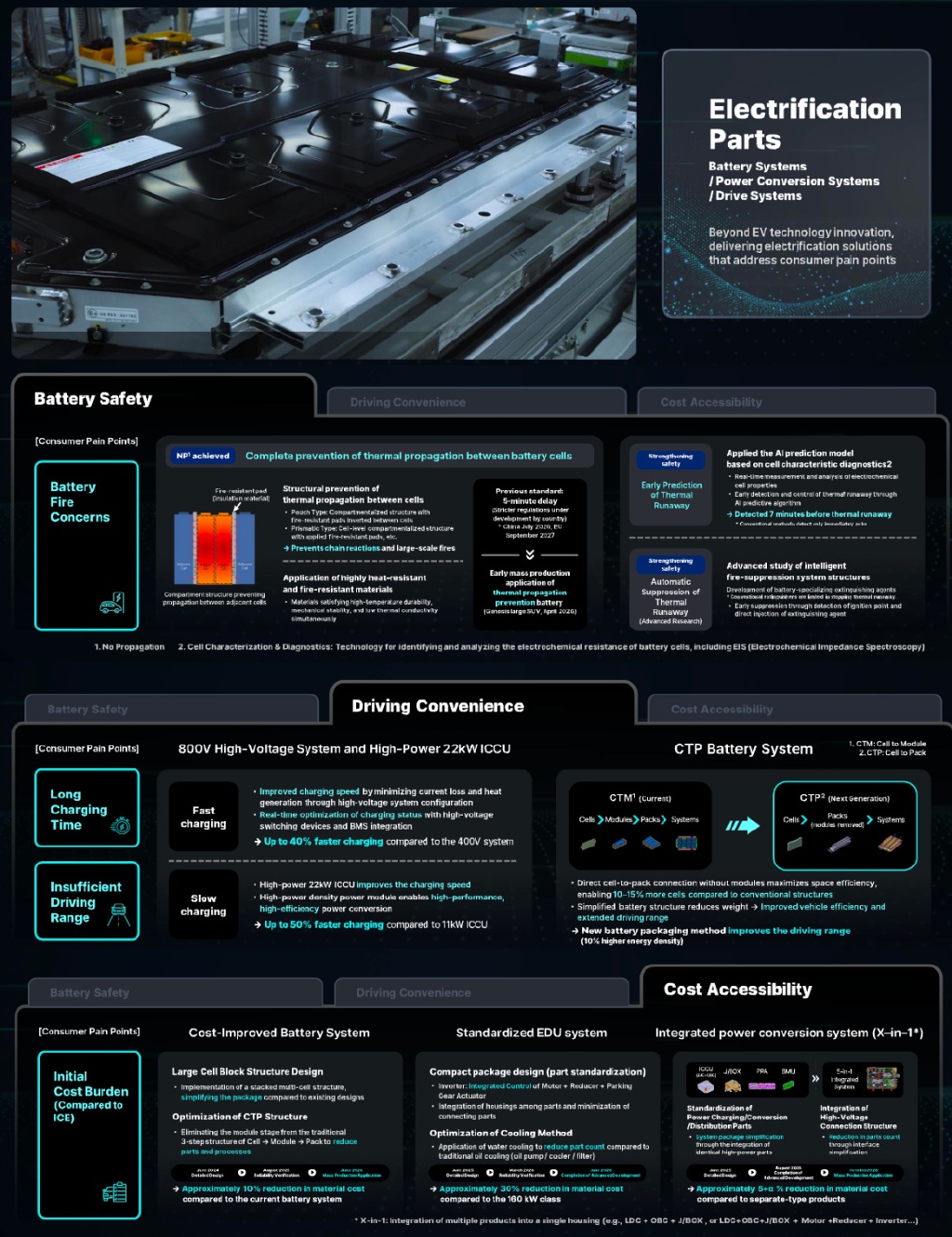

◎ In electrification components, Mobis promotes the development of CTP (Cell to Pack) and X-in-1 integrated power conversion systems through three technical routes: battery safety, charging convenience, and cost accessibility.

Through thermal diffusion prevention, 800V high-voltage systems, 22kW high-power ICCU, and high-energy-density battery solutions, it improves range and charging efficiency while reducing system costs.

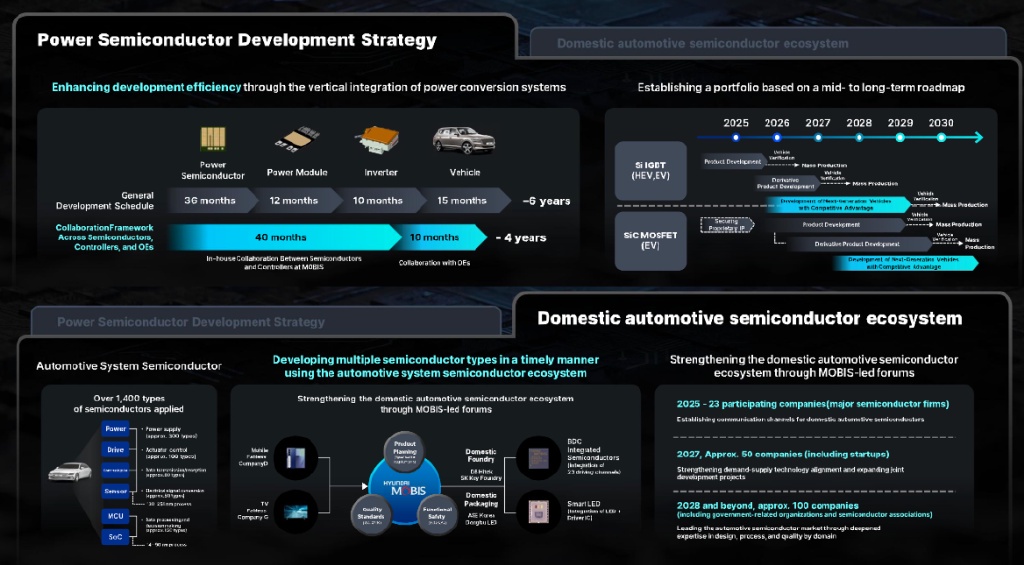

◎ Semiconductors are key to Mobis's autonomous control and core competitiveness.

System semiconductors develop network SoCs and BMICs to establish a local automotive semiconductor ecosystem; power semiconductors develop Si IGBT and SiC MOSFET to achieve vertical integration of inverters and power conversion systems.

Combined with robotics, Mobis accumulates experience in actuators, expanding from automotive component mass production to core robot components, creating a technology migration effect.

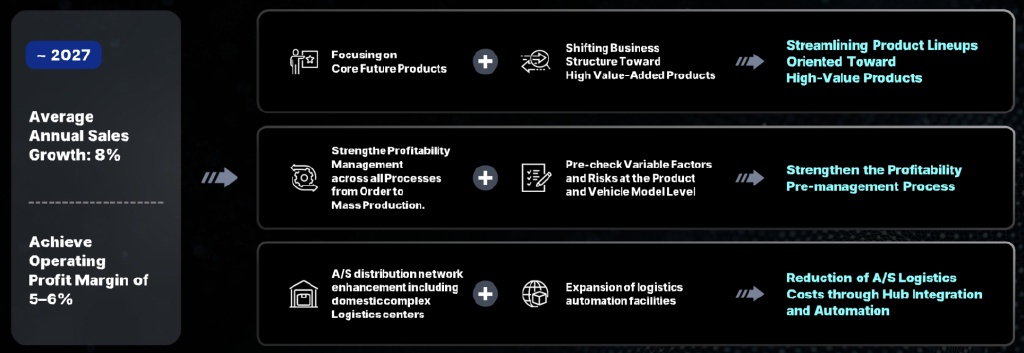

Profitability improvement relies on product line simplification and resource allocation.

Mobis concentrates R&D investment on core products, optimizes product development P&L management processes, and reduces costs through global logistics hubs and manufacturing hub layouts.

By 2027, the target is an average annual revenue growth rate of 8% and an operating margin of 5-6%, achieving simultaneous growth in quality and efficiency through increased core product revenue share and optimization of non-core products.

02

Global Customer Expansion and Financial Strategy

Global customer expansion is another core pillar of Hyundai Mobis's strategy.

Moving from reliance on the domestic market to emerging markets and global premium markets, Mobis enhances customer penetration through joint development models and regional localization strategies.

◎ In North America, it focuses on Ford, GM, and Rivian, supplying core components such as braking systems and display systems.

◎ In Europe, it covers Stellantis, Polestar, and VW, with complex modules and steer-by-wire systems as entry points.

◎ In India, leveraging Hyundai/KIA's foundation and local automakers' needs, it gradually builds order growth.

◎ In China, it enhances global competitiveness through technology feedback and HUD/AR/LiDAR products.

In financial strategy, Mobis maintains stable and flexible capital operations.

In 2024, revenue was 57.2 trillion KRW with an operating margin of 5.4%, facing challenges from EV demand volatility and geopolitical risks.

To achieve the 2027 target of 8% revenue CAGR and 5-6% operating margin, the company has a three-year cash utilization plan totaling 9 trillion KRW: ~6 trillion KRW for organic investments in manufacturing hub expansion and future growth engines, ~3 trillion KRW for M&A and partnerships, and 3-4 trillion KRW for shareholder returns through dividends and share buybacks.

Global hub layouts not only optimize manufacturing and logistics costs but also support rapid growth in electrification.

Regional manufacturing and R&D centers in North America, Europe, and India provide "local design-delivery" one-stop services, flexibly responding to EV market uncertainties. Through CTV technology, cylindrical/prismatic battery solutions, and powertrain differentiation, they meet diverse customer needs.

Meanwhile, through in-house R&D of semiconductors and software platforms, Mobis achieves hardware-software synergy, further strengthening strategic ties with customers.

Summary

Hyundai Mobis's story is about a traditional auto parts supplier breaking through, shifting from "supplying parts" to "providing solutions" through technology investment and global expansion. Through financial stability and shareholder return policies, it seeks balance between growth and stability.

Transformation comes at a cost. High R&D and manufacturing investments take time to materialize, and industry uncertainties—EV demand volatility, geopolitics, semiconductor cycles—may make the path bumpier.

The copyright of this article belongs to the original author/organization.

The views expressed herein are solely those of the author and do not reflect the stance of the platform. The content is intended for investment reference purposes only and shall not be considered as investment advice. Please contact us if you have any questions or suggestions regarding the content services provided by the platform.