August 2025 Auto Sales Review: New Forces Set New Records, Traditional Brands Accelerate Again

Produced by Zhineng Auto

September 1st was bustling, as most automakers began disclosing their August 2025 delivery data.

Traditional automakers like BYD, Geely, and Great Wall continued to show steady growth, while among the new players, Xiaomi, Nio, Li Auto, XPeng, and Leapmotor had mixed fortunes, with the "Nio-XPeng-Leapmotor" trio setting new historical records.

New collaboration models represented by HarmonyOS Intelligent Driving are accelerating their penetration, with brands like Geely Galaxy, Deepal, and Avita performing notably well.

Part 1

Sales Performance of Traditional Automakers and New Players

In August's report card:

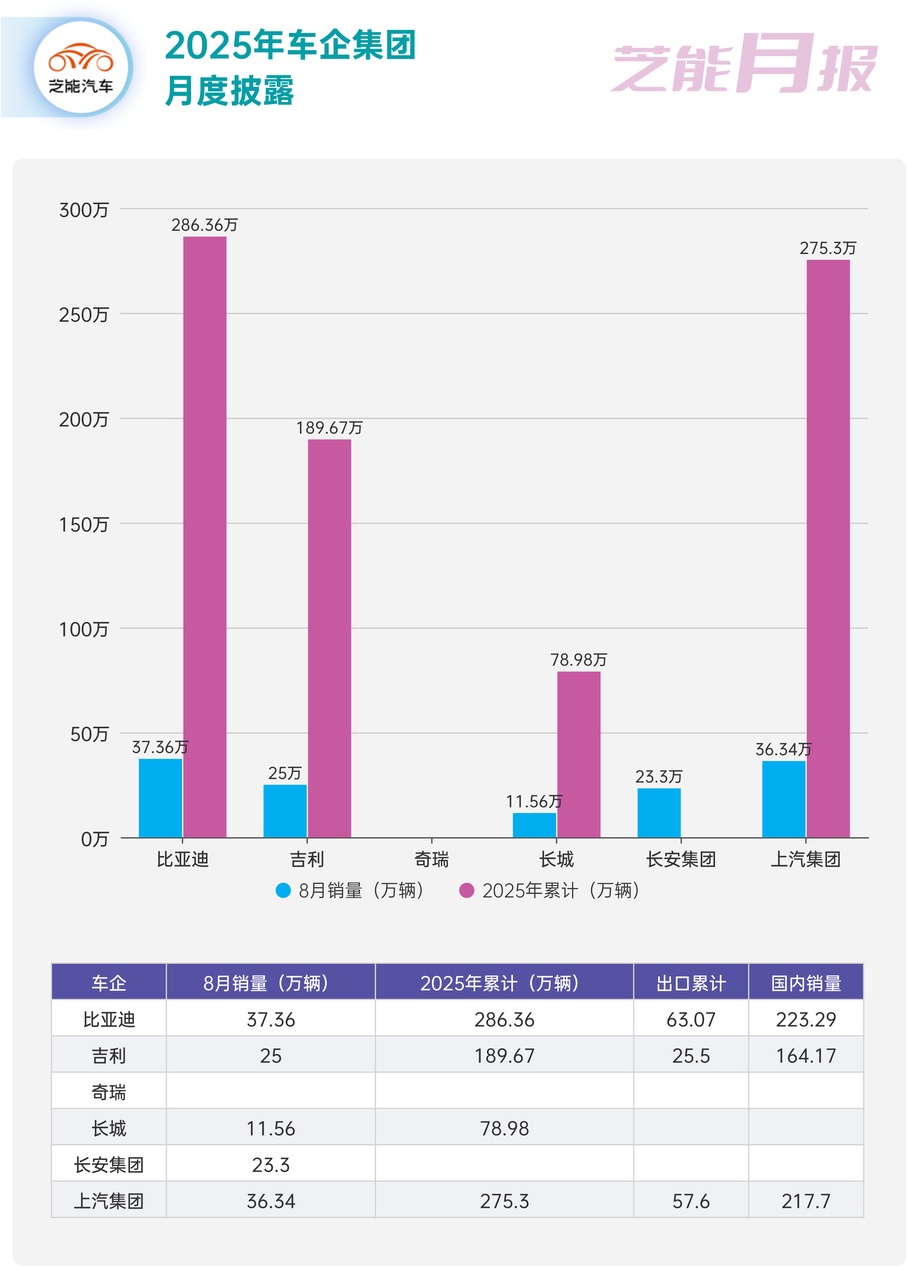

● BYD's new energy vehicle sales reached 373,600 units in a single month, maintaining stability year-on-year. Cumulative sales from January to August totaled 2.864 million units, up 23% year-on-year, with overseas exports exceeding 80,000 units.

● Geely also showed strong upward momentum, with August sales reaching 250,000 units, up 38% year-on-year. New energy vehicle sales exceeded 147,000 units, setting another record. The simultaneous high growth of pure electric and plug-in hybrid models has positioned Geely at the forefront of the transformation among domestic brands.

◎ ZEEKR and Lynk & Co. under Geely Technology delivered a total of 44,843 vehicles in August, up 10.6% year-on-year.

◎ Geely Galaxy set a new record with August sales of 110,666 units, up 173% year-on-year.

● Great Wall achieved sales of 115,600 units in August, up 22% year-on-year, with new energy vehicles contributing 37,500 units.

◎ Haval brand: August sales of 68,912 units, up 22.69% year-on-year.

◎ WEY brand: August sales of 8,028 units, up 167.51% year-on-year, with cumulative growth of 105.08% from January to August.

◎ Tank brand: August sales of 20,022 units, up 22.46% year-on-year.

◎ Ora brand: August sales of 5,223 units, up 1.40% year-on-year, but cumulative sales from January to August fell 43.78% year-on-year.

◎ Great Wall Pickup: August sales of 13,322 units, down 2.89% year-on-year.

For reference, SAIC Group's overall sales reached 363,400 units, with new energy vehicles contributing 129,800 units, up nearly 50% year-on-year. Changan Automobile sold 233,000 units in August, including 88,000 new energy vehicles, up 80% year-on-year, and 56,000 overseas units, up 23% year-on-year.

Among the new players, August performance was particularly outstanding.

● Leapmotor took the lead with 57,000 deliveries, up over 88% year-on-year, becoming the dark horse among new players.

● XPeng delivered 37,700 units, up 169% year-on-year, setting a single-month record.

● Nio delivered 31,300 units, up 55% year-on-year, with the Ledao brand contributing over 16,000 units.

● Li Auto delivered 28,500 units in August, with slight fluctuations month-on-month, as its pure electric product lineup gradually rolls out.

● Xiaomi Auto surpassed the 30,000-unit mark for the second consecutive month.

Overall, traditional automakers continue to grow steadily thanks to their vast systems and product line advantages, while the high growth rates of new players reflect strong market demand for intelligent and differentiated products. The competition between the two is gradually forming a complementary dynamic, accelerating the evolution of the industry landscape.

Part 2

HarmonyOS Intelligent Driving and the Reacceleration of Traditional Automakers

The collaborative ecosystem represented by HarmonyOS Intelligent Driving also delivered impressive results in August.

◎ HarmonyOS Intelligent Driving delivered 44,600 units across its lineup, surpassing 900,000 cumulative units, becoming a new benchmark in the wave of intelligent driving. This model, leveraging operating systems and ecosystem advantages, allows automotive products to transcend single brands and form new competitiveness through cross-border collaboration.

◎ Deepal Auto delivered 28,200 units in August, up 40% year-on-year.

◎ Avita delivered 10,500 units, surging 185% year-on-year.

◎ Voyah Auto delivered 13,505 units in August, up 119% year-on-year.

◎ Eπ Technology sold 29,118 units in August, up 62.39% year-on-year and 4.89% month-on-month, marking two consecutive months of growth.

Automakers leveraging Huawei's technology have not only boosted sales but also differentiated their brand image, which is increasingly critical in the competitive new energy market.

Traditional joint ventures and domestic brands also maintained steady growth.

◎ FAW Toyota sold over 70,000 units in August, with cumulative sales exceeding 510,000 units, up 11% year-on-year.

◎ BAIC Group's vehicle sales exceeded 135,000 units in August, up 3.3% year-on-year.

Beijing Off-Road sold 13,219 units in August, up 43% year-on-year, marking five consecutive months of sales exceeding 10,000 units and setting a new record for August. The BJ40 series sold 7,093 units, up 203% year-on-year, while the BJ30 series sold 5,009 units, up 55% year-on-year.

◎ Dongfeng Nissan N7 delivered 10,148 units in August, up 57% month-on-month.

◎ GAC Aion sold 27,044 units in August.

◎ Jishi 01 delivered 1,358 units in August.

Summary

August was a relatively joyful for everyone, with strong sales figures across the board.

The copyright of this article belongs to the original author/organization.

The views expressed herein are solely those of the author and do not reflect the stance of the platform. The content is intended for investment reference purposes only and shall not be considered as investment advice. Please contact us if you have any questions or suggestions regarding the content services provided by the platform.