Nio 2025 Q2: Breaking Through at the Turning Point

Produced by Zhineng Technology

After two years of fierce competition and operational pressure, Nio is attempting to rebuild market confidence through the launch of new models, improved cost efficiency, and the release of long-term technological accumulation.

At the Q2 earnings call, Li Bin stated that the competitiveness of automotive products depends on three capabilities: technology roadmap, product planning, and product definition. Based on Nio's latest sales performance and future product plans, it can be seen that this leading new-energy vehicle manufacturer is approaching a structural inflection point, though challenges and uncertainties remain.

01

Long-term Accumulation of Technology and Planning

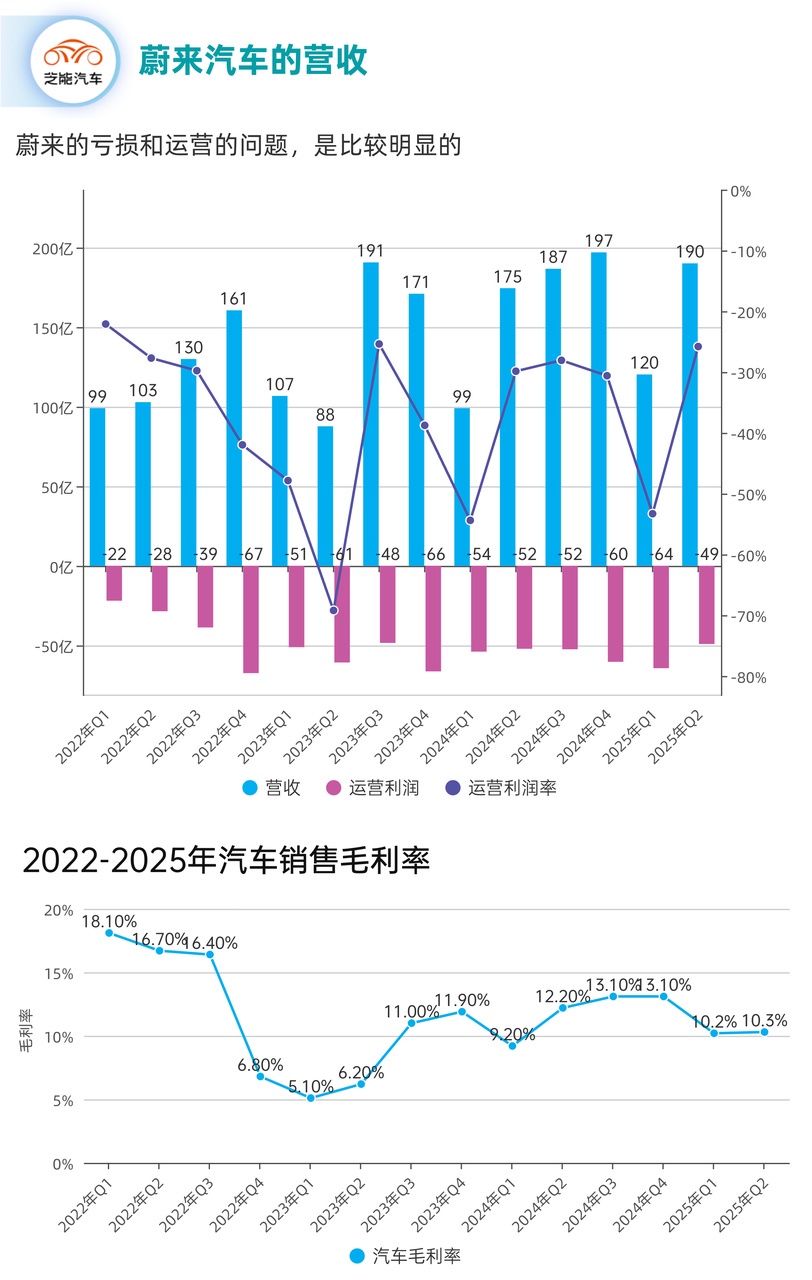

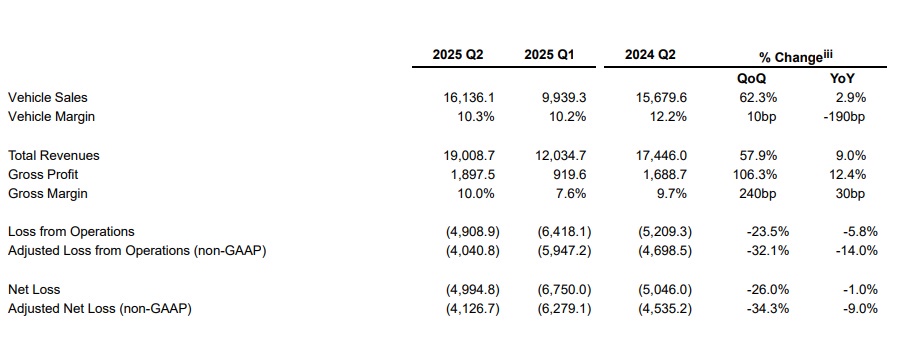

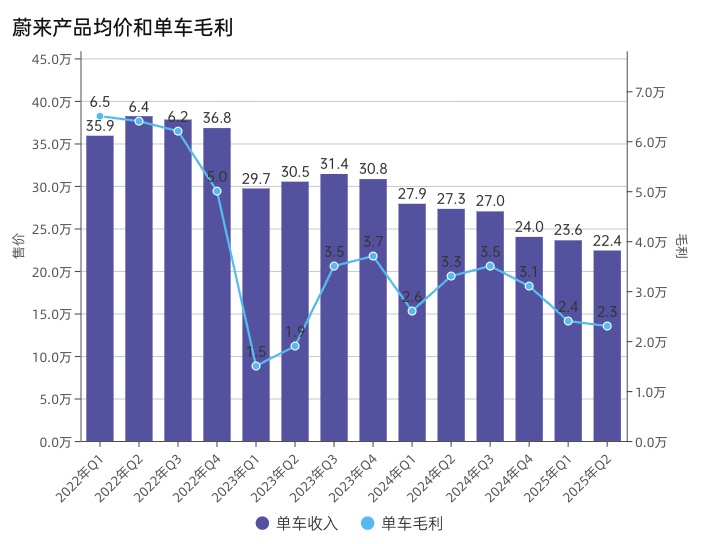

In Q2 2025, Nio delivered 72,056 vehicles, a year-on-year increase of 25.6% and a quarter-on-quarter increase of 71.2%, driving revenue to RMB 19.01 billion, up 9% year-on-year and 57.9% quarter-on-quarter.

Driven by the significant rebound in sales, the comprehensive gross margin in Q2 rose to 10%, with vehicle gross margin showing clear improvement. Other sales gross margin also turned positive for the first time, reaching 8.2%, a record high.

Overall cash flow and cash reserves increased quarter-on-quarter, indicating a recovery in financial stability.

For Q3, the company expects to deliver 87,000 to 91,000 vehicles, a year-on-year increase of 40.7%-47.1%, with revenue guidance reaching RMB 21.81 billion to RMB 22.88 billion, both record highs.

Li Bin reiterated during the call that "the correct technology roadmap is fundamental to product competitiveness." Since its inception, Nio has consistently adhered to the pure electric route, a choice that appears particularly resolute amid the industry's widespread pursuit of extended-range and hybrid solutions.

Over the past decade, Nio has invested over RMB 60 billion in R&D in areas such as autonomous driving chips, operating systems, and smart chassis. From 2022 to the present, its quarterly R&D expenditure has remained at RMB 2 billion to RMB 3 billion, with no cuts even during the most challenging financial pressures. This "counter-cyclical" persistence has allowed Nio to gradually build its own technological barriers.

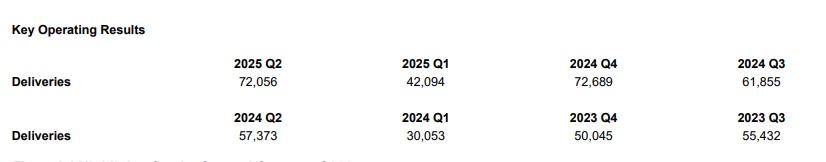

CFO Qu Yu stated that the cost reduction effects of the L90 and ES8 are attributed to in-house development of key components and the benefits of long-term procurement and economies of scale. The goal is to achieve a vehicle gross margin of 20% in Q4, reflecting the translation of technological value into profitability.

In terms of product planning, Nio is adopting a multi-brand strategy to cover different user segments. The Nio brand continues to target the high-end market, the Ledao brand is positioned for the mid-range mass market, and the Firefly brand caters to small cars and younger consumers.

This approach avoids internal competition while allowing each brand to focus on specific gross margin targets: Nio aims for over 20%, Ledao maintains 15%, and Firefly targets around 10%. Through this differentiated brand matrix, Nio seeks to establish a stable profit model amid intense price competition.

After 2026, the company plans to launch multiple new models annually to ensure continuous product updates.

02

Rebalancing Product Definition and Market Pace

If technology roadmap and product planning determine Nio's long-term direction, product definition is the "final touch" that determines whether it can stand firm in the competition.

Li Bin admitted at the earnings call that Nio had taken detours in product definition.

Some models deviated from market expectations in terms of feature configurations, pricing logic, and user experience, leading to sales pressure and impacting overall profitability. Although this process brought pain, it also provided Nio with valuable lessons.

The Ledao L90 is a concentrated embodiment of Nio's product definition efforts.

As a large five-seat pure electric SUV, it achieves a balance in space, performance, and price while maintaining Nio's technological advantages in autonomous driving and energy efficiency.

Its first-month sales exceeded 10,000 units, the fastest record in Nio's history, demonstrating that its product definition is now more aligned with user needs. The phenomenon of the L90 driving L60 sales also confirms the pull effect of a single hit product on the overall brand.

The new ES8 shoulders the strategic task of the high-end market.

As a large seven-seat SUV, it has undergone comprehensive upgrades in battery capacity, chassis structure, and smart cockpit. Market response has been positive, with orders exceeding the company's conservative expectations. The supply chain has been forced to accelerate capacity expansion, reflecting that large three-row pure electric SUVs are becoming a new consumer hotspot.

Li Bin even stated bluntly: "The golden age of extended-range large three-row SUVs is passing, and the era of pure electric large three-row SUVs is coming." This judgment captures market trends and highlights Nio's confidence in its technology roadmap.

Financial data also validates the effectiveness of this adjustment.

◎ Q2 2025 revenue reached RMB 19.01 billion, up 9% year-on-year and 57.9% quarter-on-quarter;

◎ Comprehensive gross margin rose to 10%, with net losses narrowing by 26% quarter-on-quarter;

◎ Cash reserves grew to RMB 27.2 billion.

If the gross margin reaches 16% to 17% in Q4 as expected, the company may achieve quarterly profitability. This is not only a financial milestone but also a critical moment for Nio to restore trust in the capital market.

Improved organizational efficiency has also played a supporting role.

Nio's implementation of CBU (Core Business Unit) reforms has made product line operations more flexible and efficient, with each unit independently responsible for profitability. This lean management method, similar to Toyota's, reduces hierarchical friction and improves market responsiveness.

Combined with R&D efficiency measures, Nio has achieved higher output ROI with limited resources. The sales and financial improvements in Q2 preliminarily demonstrate the positive effects of this transformation.

Summary

Looking back at Nio's development trajectory, technological accumulation, product planning, and product definition together form the core framework of its competitiveness.

In recent years, Nio has continued to invest in technology and planning but encountered deviations in product definition, leading to operational difficulties. Now, the market performance of the L90 and new ES8 proves that Nio is addressing this weakness and rebuilding user-centric product logic. Whether it can achieve profitability in Q4 remains to be seen.

The copyright of this article belongs to the original author/organization.

The views expressed herein are solely those of the author and do not reflect the stance of the platform. The content is intended for investment reference purposes only and shall not be considered as investment advice. Please contact us if you have any questions or suggestions regarding the content services provided by the platform.