$NVIDIA(NVDA.US)

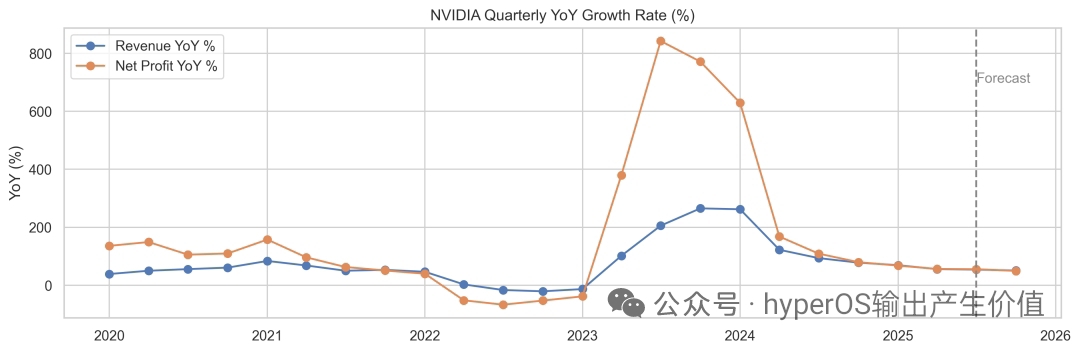

Using data to explain the decline:

1. Both revenue and net profit growth rates have declined rapidly, transitioning from a boom period to a normal growth rate.

2. The net profit growth rate has crossed below the revenue growth rate, indicating that excess profits are disappearing. This shows that the supply-demand imbalance has reversed, and the premium phase has ended. From being a darling of the market with arbitrary pricing, it is now moving toward price cuts to boost volume.

3. Competitors have emerged: Google's self-developed AI chips, Alibaba Cloud's self-developed AI chips, Huawei's self-developed AI chips, and OpenAI's collaboration with Broadcom to develop AI chips (already placing an order of $10 billion, which would have belonged to NVIDIA if not for the emergence of competitors).

In summary, the excess profits brought by NVIDIA's monopoly are about to disappear. Valuations based on monopoly-driven excess profits naturally become unreasonable, so a revaluation is necessary to form a new valuation equilibrium. In the short term, this new valuation equilibrium needs to exclude the monopoly premium, which is the risk. Only after the new valuation logic stabilizes, is accepted by capital, and reaches a new expected equilibrium can stability be expected, and development can proceed based on the new balanced valuation.

The copyright of this article belongs to the original author/organization.

The views expressed herein are solely those of the author and do not reflect the stance of the platform. The content is intended for investment reference purposes only and shall not be considered as investment advice. Please contact us if you have any questions or suggestions regarding the content services provided by the platform.