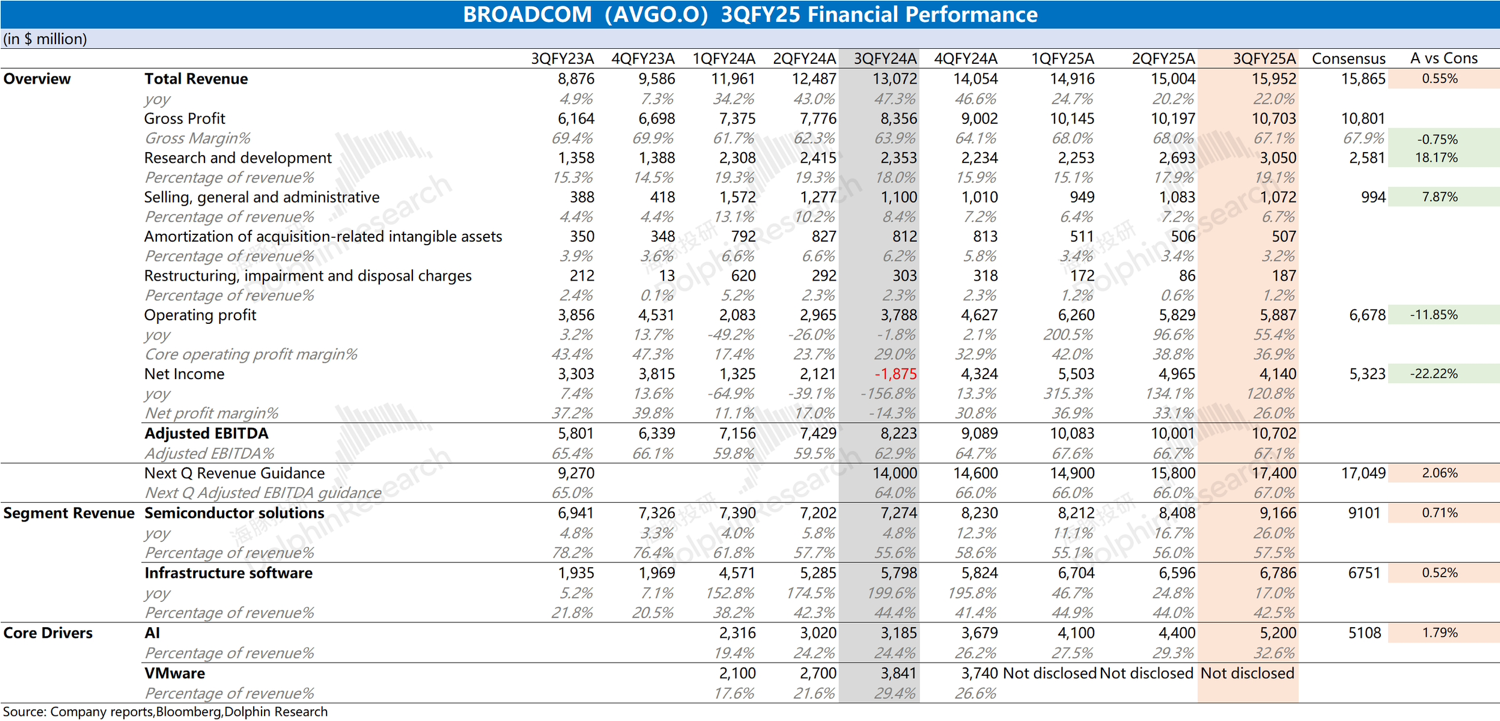

Broadcom AVGO Quick Interpretation: The company's performance this quarter basically met market expectations. Revenue growth was mainly driven by the growth of AI business; due to the relatively low gross margin of the custom ASIC business, the growth in related revenue has a structurally dilutive effect on the overall gross margin.

After the acquisition and integration of VMware, the company is committed to reducing expenses, while the increase in core operating expenses this quarter was mainly influenced by the increase in SBC-related expenses.

Excluding the impact of this factor, the company's core operating expenses this quarter are still declining, which directly affected the profit release performance this quarter.

For Broadcom AVGO, the market is most concerned about the AI business. This quarter, the company achieved AI revenue of $5.2 billion, an increase of $800 million quarter-on-quarter, reaching market expectations ($5.1 billion).

Currently, the company's AI revenue still mainly comes from products like Google and Meta, benefiting from the increase in customer capital expenditure.

Unlike Marvell (which provided guidance for no quarter-on-quarter growth), Broadcom provided guidance for next quarter's AI business revenue of $6.2 billion, an increase of $1 billion quarter-on-quarter, slightly better than buy-side expectations ($6 billion).

This not only dispels market doubts about ASIC but also demonstrates the company's capabilities in the custom ASIC field.

Overall, Broadcom AVGO's financial report this time is still quite good.

While meeting market expectations on the operational front, it has restored confidence in the ASIC market and once again demonstrated the company's competitiveness in the AI chip market.

Benefiting from the increased capital expenditure of downstream cloud service giants, the logic of the company's AI business growth remains intact.

If subsequent customer new product progress exceeds expectations, it is expected to bring more anticipation to the market. For more specific information, please follow Dolphin Research's subsequent commentary and Minutes of the conference call. $Broadcom(AVGO.US)

The copyright of this article belongs to the original author/organization.

The views expressed herein are solely those of the author and do not reflect the stance of the platform. The content is intended for investment reference purposes only and shall not be considered as investment advice. Please contact us if you have any questions or suggestions regarding the content services provided by the platform.