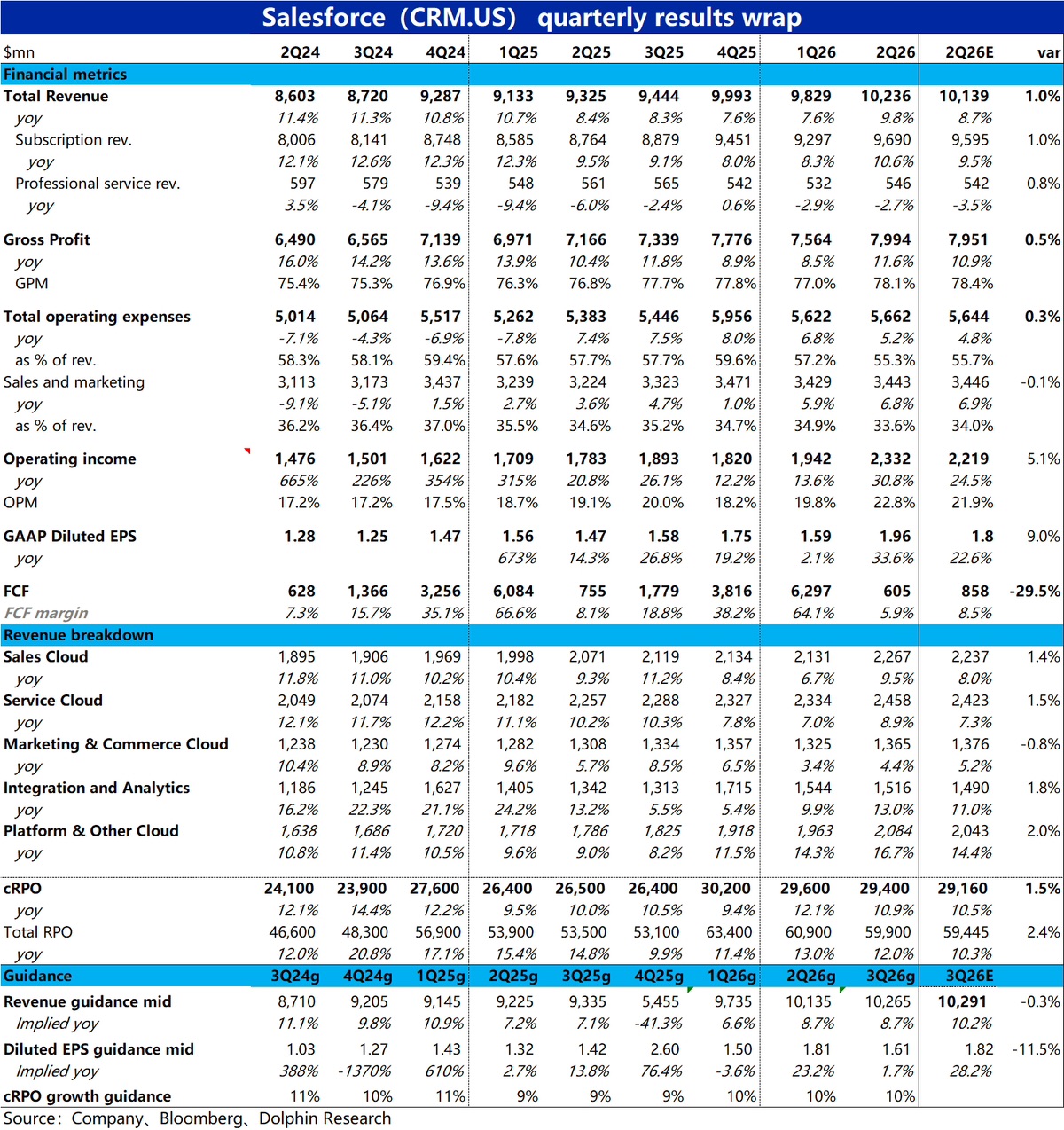

salesforce 2QF26 Quick Interpretation: This quarter, the performance of the SaaS leader Salesforce remained stable, albeit somewhat flat.

Growth was steady and slightly better than expected, with expenses growing by nearly 5%. Under the release of operating leverage, this quarter's operating profit was about 5% higher than expected.

The main drawback is the weak guidance for the next quarter. The midpoint of the guided revenue growth is below expectations, and the guided EPS is significantly 11.5% lower than expected, suggesting a significant expansion in expenses for the next quarter.

Specifically:

1) Total revenue for the quarter grew by 9.8%, showing some improvement compared to the 7.6% of the previous quarter. However, at constant currency, the growth rate for both quarters was around 9%, with the improvement mainly due to favorable exchange rates.

The growth rate of various sub-business lines also accelerated slightly quarter-on-quarter, with no particularly outstanding areas.

2) The short-term unfulfilled contract balance for the quarter increased by nearly 11% year-on-year, with a deceleration slightly higher than 1 percentage point compared to the previous quarter. The deceleration at constant currency was consistent.

Even though the company announced a price increase in August, leading to some users renewing early, the new contracts do not appear to be strong.

3) The annualized revenue contributed by AI and Data Cloud this quarter was approximately $1.2 billion, a limited increase from the $1 billion disclosed last quarter, currently accounting for only about 3% of total revenue. The impact of AI on the company's revenue remains very limited.

4) Recently, software stocks have generally underperformed (due to concerns about AI replacing software), and Salesforce's main issue is that after its traditional business has matured, the story of AI agents has yet to be validated. This quarter's performance still does not address this issue, so the stock price remains in a weak trend. $Salesforce(CRM.US)

The copyright of this article belongs to the original author/organization.

The views expressed herein are solely those of the author and do not reflect the stance of the platform. The content is intended for investment reference purposes only and shall not be considered as investment advice. Please contact us if you have any questions or suggestions regarding the content services provided by the platform.