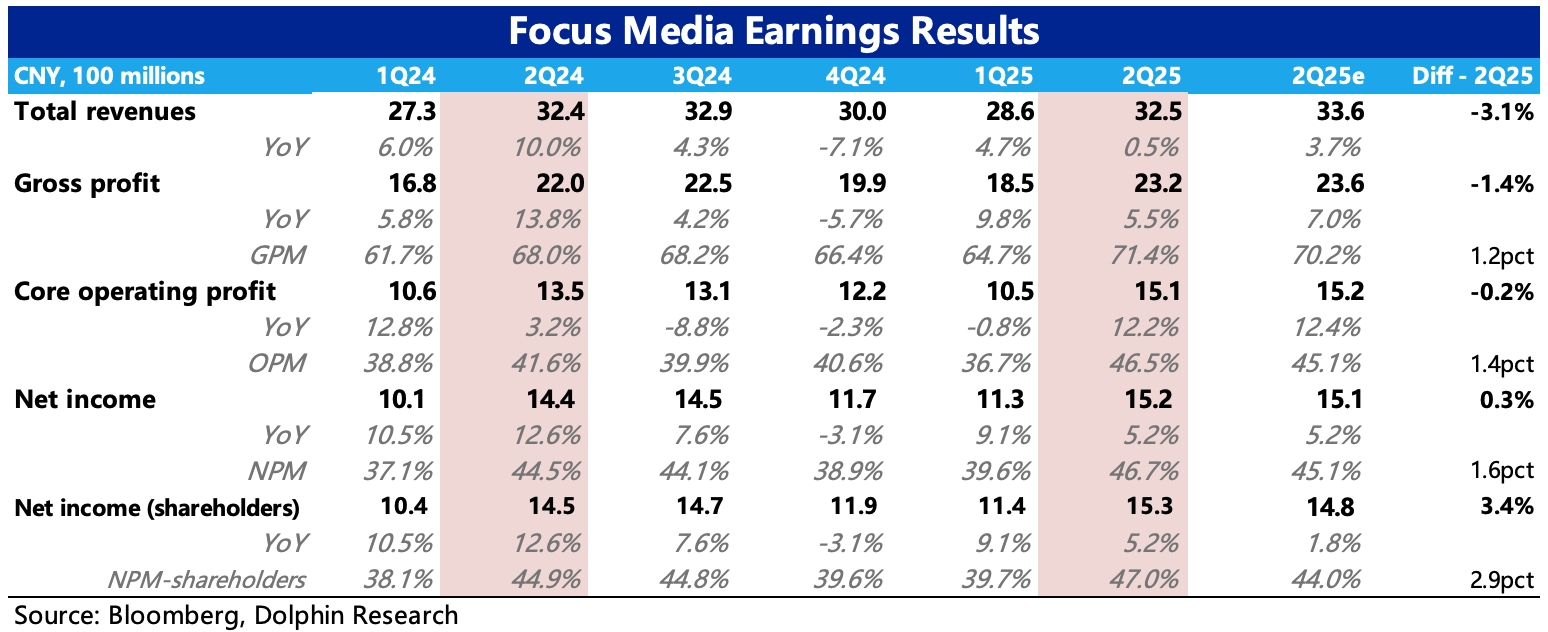

Focus Media 2Q25 Performance Review: Second-quarter revenue fell short of expectations, but with site optimization and operational efficiency improvements, the absolute profit target was met, implying that the profitability level is approaching historical peaks.

The performance is not perfect, but Dolphin Research believes the market is unlikely to impose significant penalties, as there is a new growth story on the revenue side—TapTap advertising and the acquisition of New Wave; meanwhile, the substantial improvement in profitability has already pre-validated the logic of Focus Media's expanded profit margin after acquiring New Wave.

1. Continuous Site Optimization: Compared to the first quarter, the second quarter continued to reduce elevator media poster sites while slightly increasing smart screens in first- and second-tier cities, but the total number of sites also began to show a downward trend. Smart screens can achieve more real-time, dynamic advertising effects compared to posters, and with the future acquisition of New Wave's 700,000 smart screens, duplicate sites also need to be quickly reorganized.

2. Revenue Growth Stagnant: Second-quarter revenue grew by 0.5%, a slowdown compared to the previous quarter, mainly due to environmental volatility, and the decline in the number of media terminal sites may have also somewhat affected revenue.

3. Cost Decline Against the Trend: The direct effect of site optimization is a 10% reduction in costs (mainly rent), with a quarter-on-quarter net decrease of 70 million yuan and a year-on-year decrease of 100 million yuan, raising the gross margin to 71.4%, almost at the level of the glorious period before the 2018 battle with New Wave.

Achieving stable or higher revenue with lower costs is essentially a manifestation of increased competitiveness—although the merger with New Wave has not yet been completed, advertisers are concerned about the impact of personnel adjustments during the acquisition on product effectiveness, as well as the partial migration of the original New Wave budget.

As a result, Focus Media benefits, with relatively increased bargaining power, such as reduced rate card discounts and increased publication rates.

4. Profit Margin Approaching Historical Peaks: Like costs, operating expenses are also strictly controlled, with the total expense ratio remaining stable, but personnel salaries decreased by 11%. The future merger with New Wave will inevitably involve a significant personnel adjustment. Ultimately, the operating profit margin of the core business reached 47%, an increase of 5 percentage points year-on-year, rapidly approaching the historical peak of 50%.

5. Customer Payment Cycle Decreased: Despite significant environmental pressure, the accounts receivable turnover days in the second quarter fell from 74 days in the first quarter to 69 days, indicating some improvement in customer payment conditions. $Focus Media(002027.SZ)

The copyright of this article belongs to the original author/organization.

The views expressed herein are solely those of the author and do not reflect the stance of the platform. The content is intended for investment reference purposes only and shall not be considered as investment advice. Please contact us if you have any questions or suggestions regarding the content services provided by the platform.