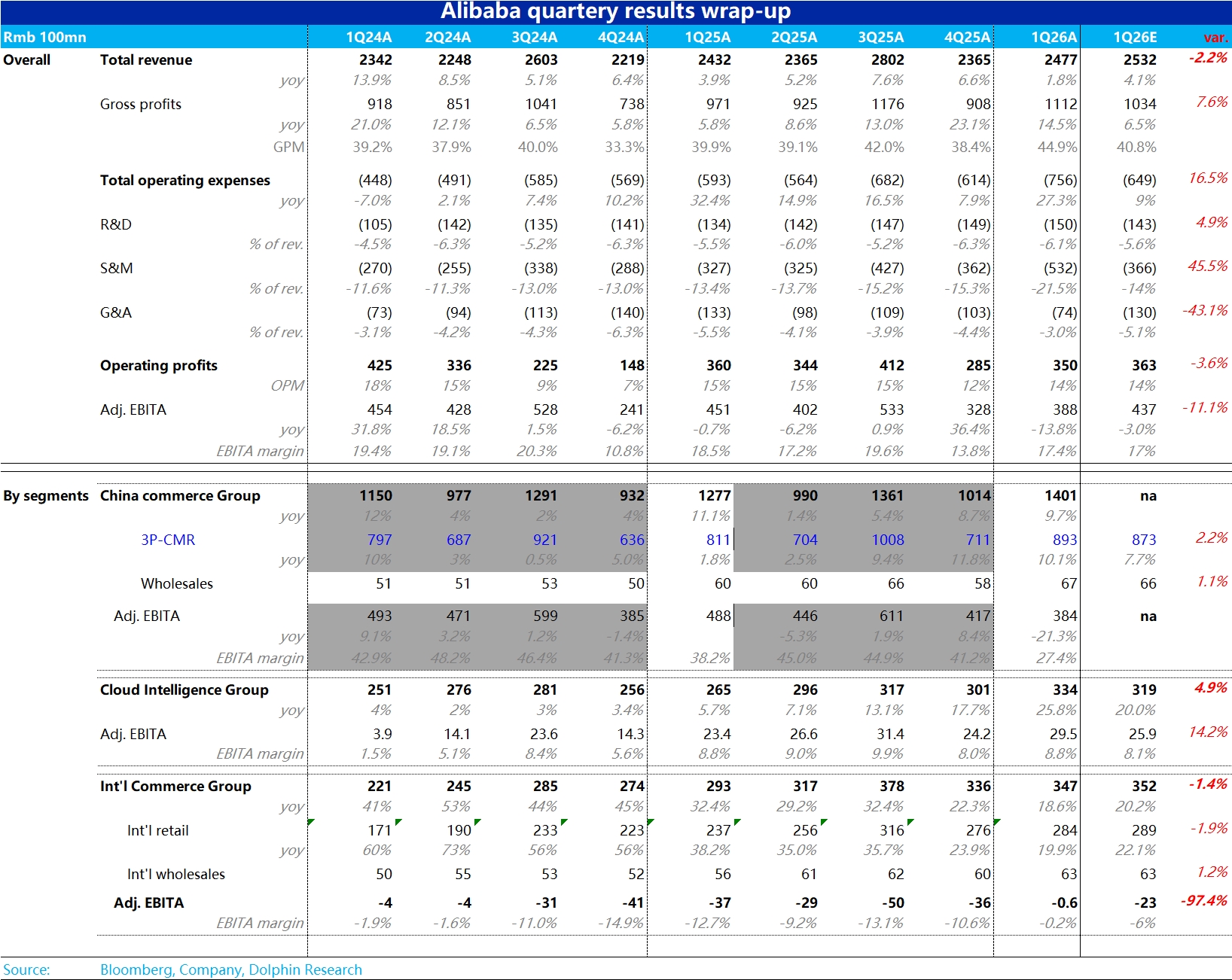

Alibaba 1QF26 Quick Interpretation: The last company in the 'Takeaway Index', Alibaba, has finally announced its earnings. Overall, this quarter, aside from the downside of losses caused by takeaways being higher than expected, other key indicators showed good performance. Cloud business growth exceeded expectations, overseas e-commerce reduced losses beyond expectations, and Taotian CMR maintained over 10% growth. Specifically:

1) In terms of large numbers, total revenue was 247.7 billion, up 1.8% year-on-year, slightly below Bloomberg's consensus expectation of 4%. However, revenue growth in the three core segments was not bad, mainly due to the impact of divesting Intime and Sun Art Retail.

On the profit indicator adj. EBITA, this quarter was 38.8 billion, down 14% year-on-year. Although Taobao Flash Sale exited from the end of April and began heavy investment in June, the actual losses caused by takeaways still exceeded expectations (though this is understandable when looking at JD.com and Meituan).

2) The core indicator CMR of the original Taotian Group still achieved a year-on-year growth of 10.1% this quarter, slightly slowing from the previous quarter but still slightly exceeding consensus expectations. The benefits of site-wide promotion and technical service fees continue to be released.

As for the current market's most concerned issue of takeaway losses, from two perspectives, the newly formed China E-commerce Group's total adj. EBITA this quarter was 38.4 billion, a year-on-year decrease of about 10.4 billion. Assuming no impact from the takeaway battle, the original profit would have grown 9% year-on-year, estimating takeaway losses at about 15 billion.

From the perspective of revenue expenses, this quarter was 53.2 billion, an increase of 20.5 billion year-on-year. Assuming no takeaway battle, it would have grown 20% year-on-year, estimating the net additional marketing investment caused by the takeaway battle at about 14 billion.

3) Alibaba Cloud performed well this time. Although the company communicated optimistically before the earnings, with the sell-side expecting Alibaba Cloud's growth rate to reach 25%, the actual 26% still slightly exceeded expectations, and the acceleration from the previous quarter was very noticeable.

This was the first full quarter benefiting from the domestic AI boom, showcasing Alibaba Cloud's bright prospects. Additionally, this quarter, Alibaba Cloud's profit margin rebounded from the low point of the previous quarter to 8.8%. As revenue growth accelerated, the drag on profits from increased investment also eased.

4) In the international e-commerce segment, this quarter maintained a growth rate of about 19% (slightly down quarter-on-quarter), and the loss significantly narrowed to less than 100 million, exceeding expectations. The management's promise of turning international e-commerce profitable in the new fiscal year has basically been realized. In the face of headwinds in the international environment, the company adopted refined operations, prioritizing profit over scale, with significant effects.

The copyright of this article belongs to the original author/organization.

The views expressed herein are solely those of the author and do not reflect the stance of the platform. The content is intended for investment reference purposes only and shall not be considered as investment advice. Please contact us if you have any questions or suggestions regarding the content services provided by the platform.