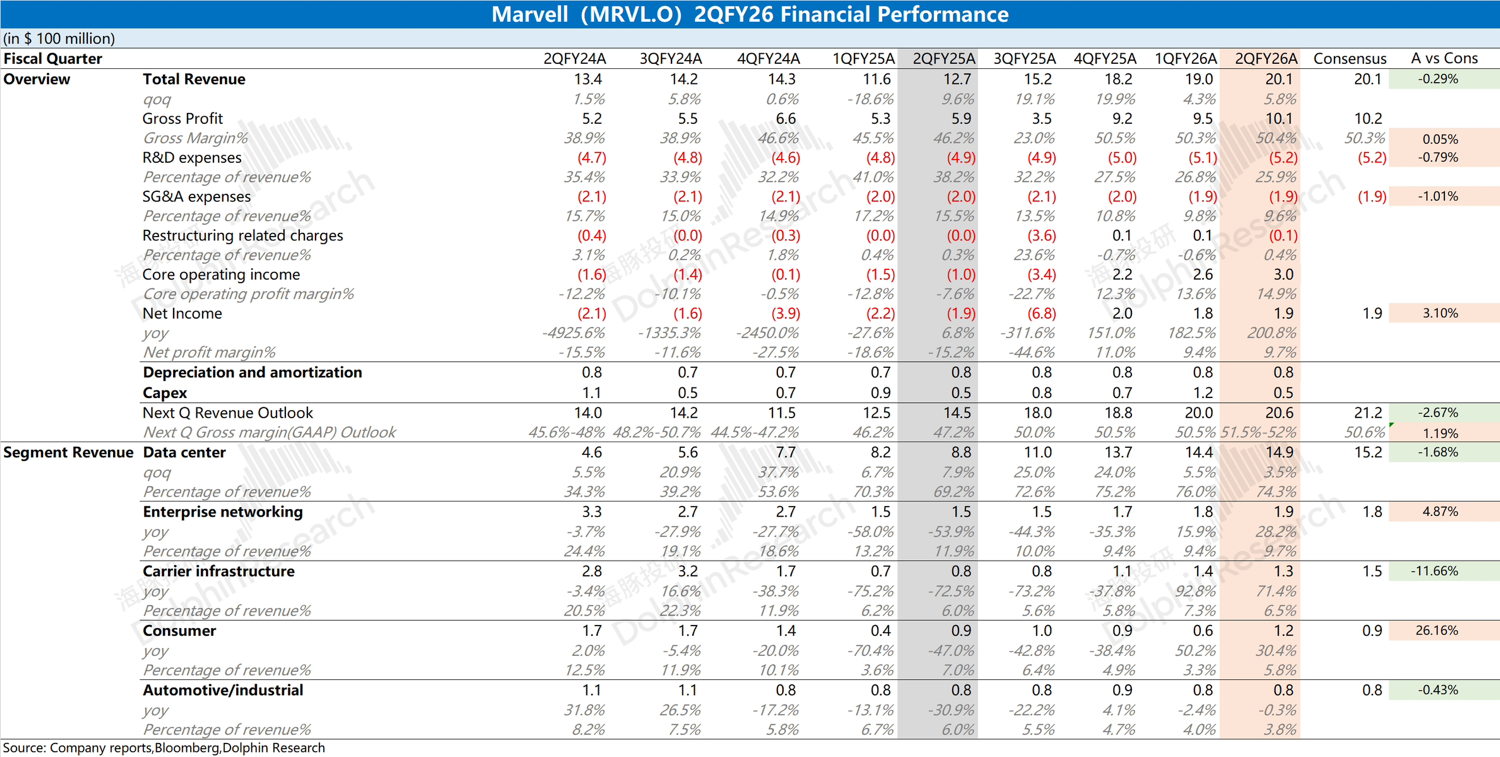

Marvell Quick Interpretation: Although the company's overall revenue and gross margin for this quarter were basically in line with expectations, the revenue guidance for the next quarter is relatively weak.

The most concerning aspect for the Marvell market is the performance of the data center business, especially the progress of custom ASICs.

However, after delivering a performance below expectations this quarter, the company has provided guidance for the next quarter that is flat quarter-over-quarter, with the custom ASIC business expected to face a quarter-over-quarter decline, which to some extent confirms market concerns.

Although several major cloud service providers have recently increased their capital expenditures, Marvell has not directly benefited at this stage.

Regarding the company's custom ASIC business, the current main revenue comes from Amazon's Trainium2 and Google's Axion CPU products, which will be mass-produced in 2024, while the product for the third customer, Microsoft, will not be mass-produced until 2026.

Without the drive of new products, the company's custom ASIC business is clearly under pressure at this stage, but a decline in the next quarter was unexpected.

The company is currently in a new product vacuum period and faces competition from AI chips. Although the company provided a promising outlook on AI Day, it still needs to deliver tangible performance results.

In the context of increased capital expenditures by major companies, the company's forecast of a decline will directly impact market confidence. For more specific information, please follow Dolphin Research's subsequent commentary and management communication content. $Marvell Tech(MRVL.US)

The copyright of this article belongs to the original author/organization.

The views expressed herein are solely those of the author and do not reflect the stance of the platform. The content is intended for investment reference purposes only and shall not be considered as investment advice. Please contact us if you have any questions or suggestions regarding the content services provided by the platform.