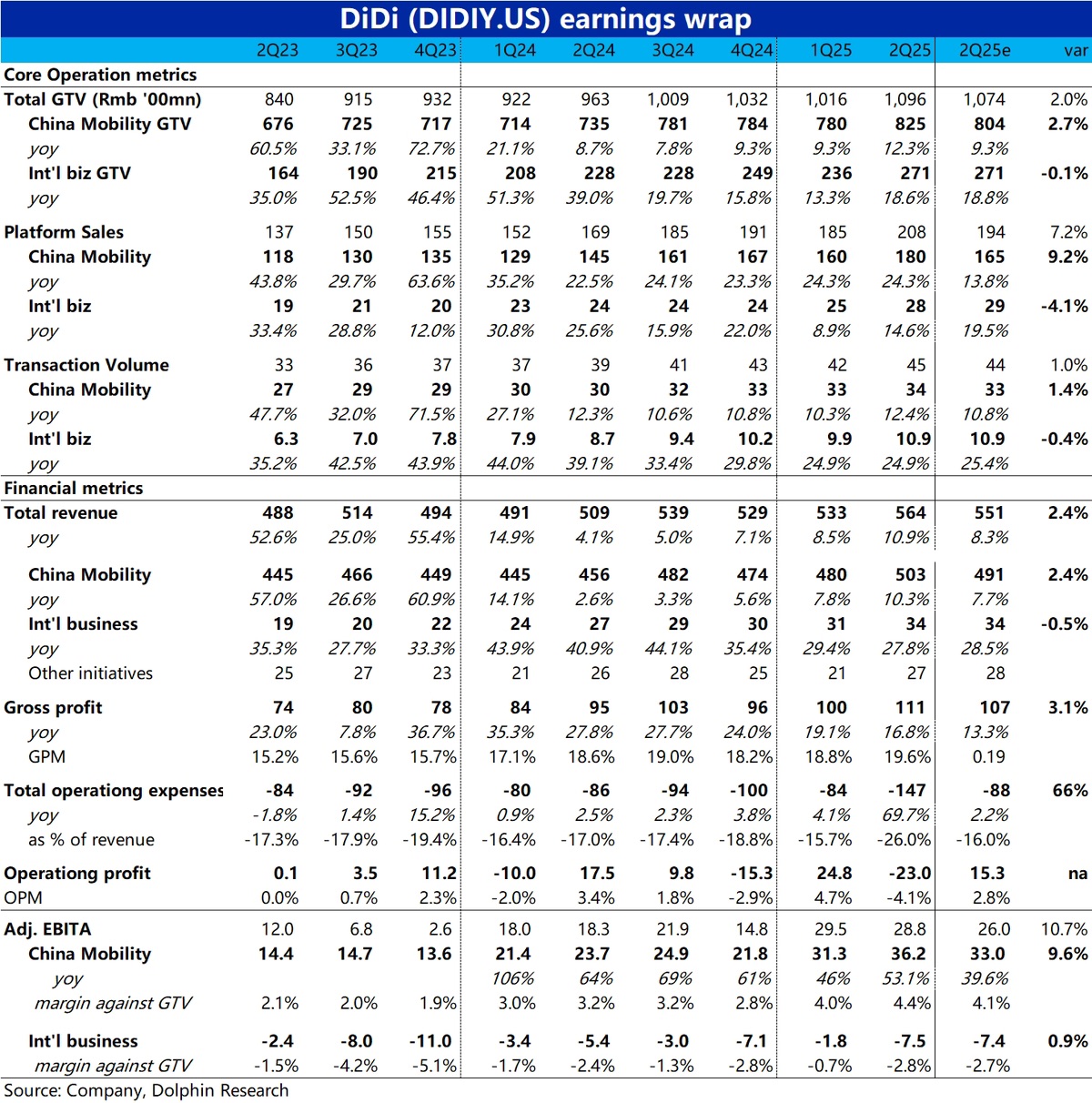

Didi 2Q25 Quick Interpretation: Overall, Didi delivered a decent performance this quarter. Driven by slightly better-than-expected domestic order volume and a continued rise in net monetization rate, total revenue slightly exceeded expectations, with profit performance being more impressive. Specifically:

1) Domestic order volume grew by 12.4%, slightly exceeding expectations and accelerating slightly quarter-on-quarter, driving GTV growth to be roughly in line with order volume.

However, platform sales surged by 24% year-on-year, significantly outpacing GTV growth, indicating that Didi's domestic net monetization continued to rise this quarter.

As a result, the proportion of domestic business adj. EBITDA to GTV increased by 0.4 percentage points quarter-on-quarter to 4.4%, with final profit margin at 36.2%, nearly 10% higher than market expectations.

2) International order volume growth remained flat quarter-on-quarter at 24.9%, still decent, but market expectations were higher (Didi restarted its food delivery business in Brazil, which the market might have anticipated).

It seems that international GTV underperformed order volume growth, but this was due to adverse exchange rate effects. At constant exchange rates, GTV growth was as high as 27.8%.

However, Didi's international business losses significantly expanded this quarter, reaching 750 million. But the market had anticipated this, so the expectation gap was not large.

The company explained that this was mainly due to increased subsidies in overseas business. The restart of the Brazilian food delivery business should also have an impact.

3) Additionally, it is worth noting that due to a one-time charge of approximately 5.3 billion related to previous shareholder litigation, GAAP profit turned negative this quarter. However, such impacts should be ignored, and attention should be paid to adjusted profits. $DiDi(DIDIY.US)

The copyright of this article belongs to the original author/organization.

The views expressed herein are solely those of the author and do not reflect the stance of the platform. The content is intended for investment reference purposes only and shall not be considered as investment advice. Please contact us if you have any questions or suggestions regarding the content services provided by the platform.