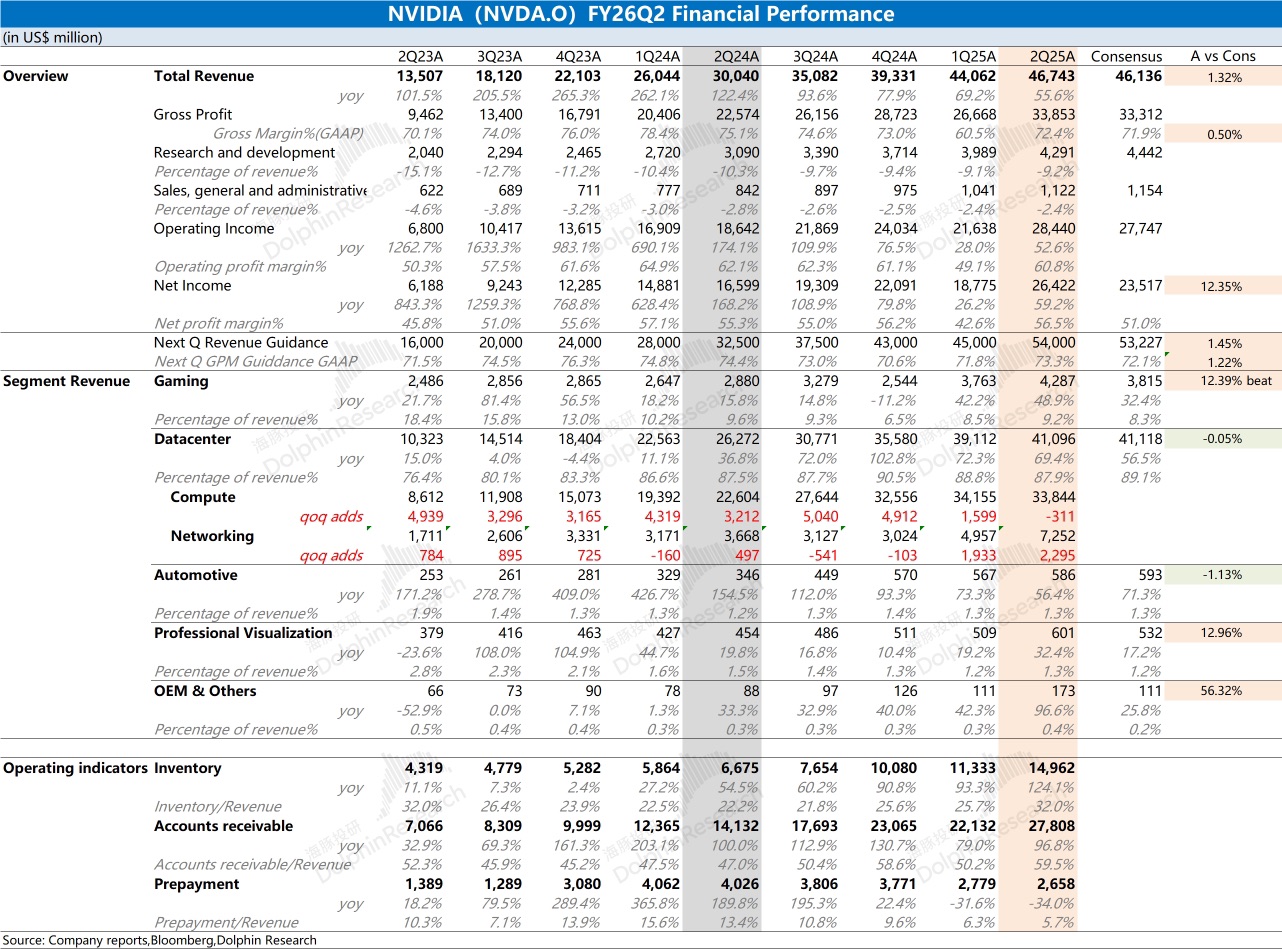

NVIDIA 2Q25 Quick Interpretation: Overall in line with expectations, the market hopes to see an outperformance.

1. Revenue Situation: Growth was mainly driven by products such as the GB series.

In this quarter, the company sold approximately $650 million worth of H20 products to regions outside China, with no revenue contribution from H20 products in China.

Since H20 products contributed approximately $4.6 billion in revenue in the first quarter, it can be inferred that products like the GB series contributed an incremental $6 billion this quarter.

2. Gross Margin Situation: The gross margin for this quarter was 72.4%, showing a significant recovery.

Last quarter, the company's gross margin fell to around 60% due to the impairment of H20 inventory.

Even after excluding this impact, the company's gross margin last quarter was about 71%, and there is still an improvement this quarter, mainly due to the increased mass production of the GB series.

3. Next Quarter Guidance: The company expects next quarter's revenue to be $54 billion (still excluding the portion of H20 sales to China), a sequential increase of $7.2 billion; next quarter's gross margin is expected to be 73.3%, a sequential increase of 0.9 percentage points.

Driven by the GB series product cycle, the company's performance is expected to continue improving next quarter.

4. Market Focus: For NVIDIA, the market's main focus is on the capital expenditure of major cloud service providers, Rubin's progress, and the business situation in the Chinese market.

As major companies have increased their capital expenditure for the second half of the year, it reflects the market's recognition of the GB series on one hand, and on the other hand, it shows that the current market demand for AI servers remains strong, which supports NVIDIA's performance growth.

Since August, the market has gradually raised its expectations for the company's next quarter and the second half of the year, and the buy-side market has already raised the company's next quarter revenue expectations to around $54-55 billion. However, the company's current guidance only reaches the lower end of expectations.

Overall, NVIDIA's financial report this time has shown a significant recovery, and the impact of the H20 incident on the company has weakened, which is also clearly reflected in the stock price.

Now, after surpassing $180, the market is more focused on the company's GB series, Rubin's progress, sovereign AI, and robotics for any outperformance.

For more specific information, please follow Dolphin Research's subsequent commentary and management communication minutes. $NVIDIA(NVDA.US)

The copyright of this article belongs to the original author/organization.

The views expressed herein are solely those of the author and do not reflect the stance of the platform. The content is intended for investment reference purposes only and shall not be considered as investment advice. Please contact us if you have any questions or suggestions regarding the content services provided by the platform.