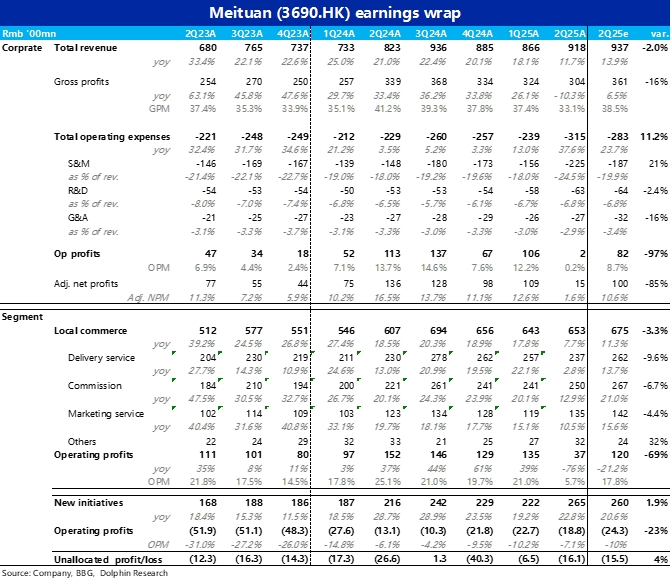

Meituan 2Q25 Quick Interpretation: The second in the "Takeaway Index"—Meituan's performance is almost identical to JD.com, with its previously over 10 billion yuan quarterly profit also "wiped out".

The actual operating profit for this quarter is only 200 million yuan, far below the market expectation of 8.2 billion yuan. Similar to JD.com, it also exhausted the profits from all other businesses.

1) Firstly, although earlier research indicated that Meituan's instant retail business profits were nearly zero in May and June, the market's actual profit expectations were not as high as Bloomberg's data suggests (still referencing the company's 1Q guidance data).

However, even so, considering that in the second quarter Meituan was still mainly competing with JD.com, and Taobao Flash Sale only started aggressive subsidies from late June.

In the second quarter, Meituan had already exhausted its profits (profits from takeaway and flash sales turned negative), which is certainly significantly below expectations.

This also implies that the profits in the most competitive third quarter will look much worse, and the overall profit is likely to turn negative.

2) Besides the unexpected negative turn in instant retail business profits, the growth rate of commission and advertising revenue in the local life segment also significantly slowed down quarter-on-quarter, both below market expectations, suggesting that Meituan's in-store business performance this quarter was also poor.

According to the company's previous guidance, it should be that the cost-effectiveness of takeaways increased significantly under subsidies, eroding consumers' willingness and scenarios to consume in-store.

3) What surprised Dolphin Research and the market is that the losses in new businesses did not increase but decreased this quarter.

Although there were previous reports of a large-scale halt in Meituan Select's operations, due to the front-end warehouses of Flash Sale and Xiaoxiang Supermarket, overseas Keeta, and Raccoon Canteen, the market expected new business losses to rise.

In reality, due to the core main business losses far exceeding expectations, Meituan has been "forced" to reduce its investment in new businesses, concentrating resources on the core main business.

Among the three major takeaway companies, the profits of two have fallen significantly below expectations, now it's up to Alibaba's performance on Friday. However, the second quarter is not yet the peak of competition, let's see how bad the third quarter will be. $MEITUAN(03690.HK) $MEITUAN-WR(83690.HK)

The copyright of this article belongs to the original author/organization.

The views expressed herein are solely those of the author and do not reflect the stance of the platform. The content is intended for investment reference purposes only and shall not be considered as investment advice. Please contact us if you have any questions or suggestions regarding the content services provided by the platform.