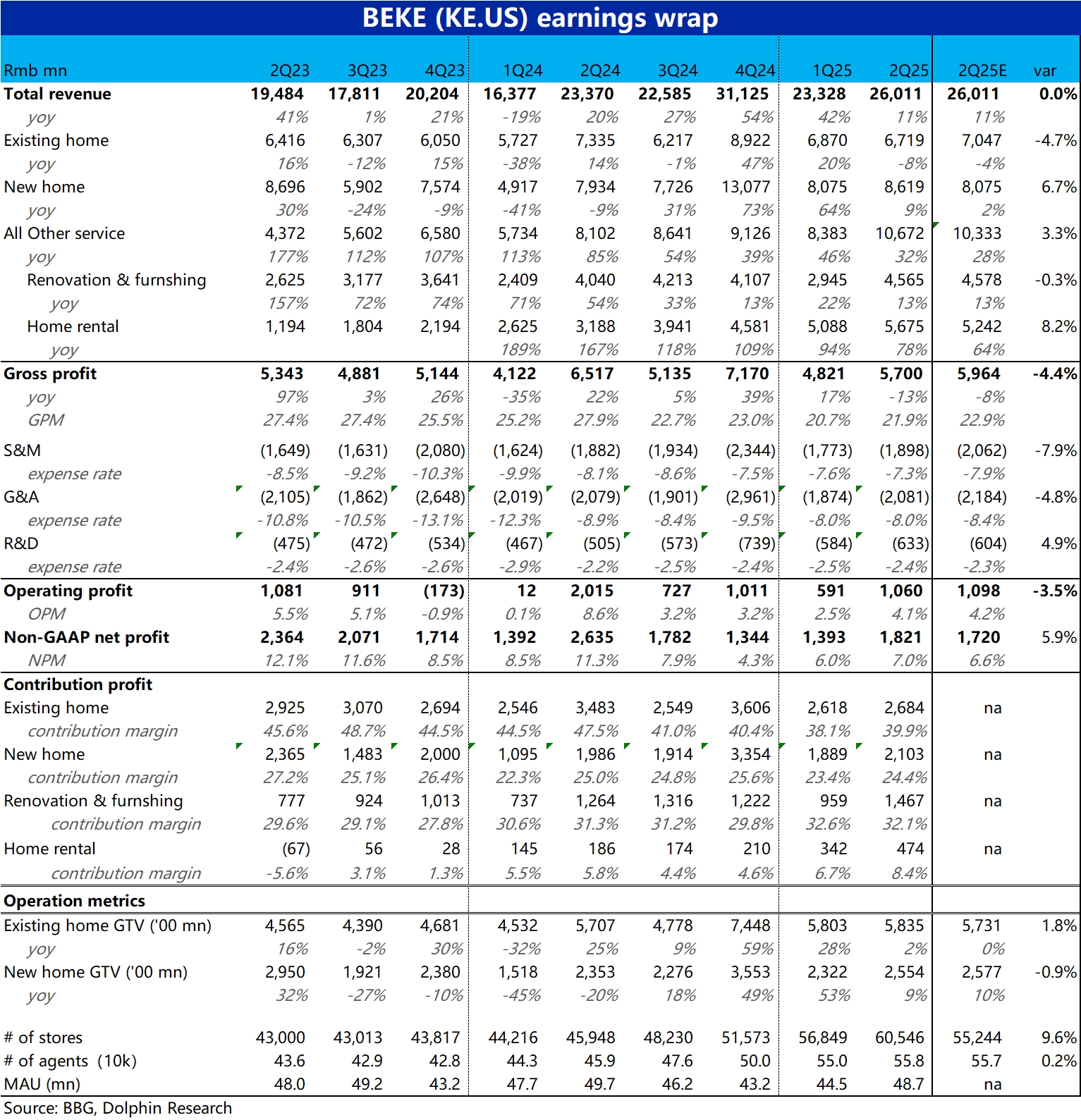

Beike 2Q25 Quick Interpretation: Overall, Beike's performance this quarter was relatively mediocre. Total revenue was generally in line with market expectations, but profits were slightly lower, lacking any standout features. Specifically:

1) In terms of large numbers, affected by the cooling of the domestic real estate market in the second quarter, the total revenue growth rate slowed to 11%, consistent with expectations. New home and innovative businesses were relatively strong, but the existing home business was weaker.

In terms of profit, both gross profit and operating profit were slightly below expectations. The adjusted net profit exceeded expectations mainly due to investment income and lower taxes.

2) By segment, due to the weakening of the second-hand housing market in major cities, the GTV of existing homes this quarter only increased by 2% year-on-year, and revenue even decreased by 8%, showing poor performance.

However, the new home business benefited from the company's market share increase, with transaction volume and revenue both growing by 9% year-on-year against the trend. The innovative business, led by strong growth in the rental business (up 78% year-on-year), also slightly exceeded expectations in actual revenue.

3) On the gross profit side, due to the increased proportion of low-margin rental business in the structure, and the commission ratio of transaction intermediary business rising year-on-year, the overall gross profit margin of the company significantly narrowed by 6 percentage points year-on-year, dragging down gross profit by 13%.

However, from a quarter-on-quarter perspective, the gross profit margin of rental and transaction intermediary businesses slightly improved compared to the previous quarter. It can only be said that the market's expected improvement was somewhat overestimated.

4) In terms of expenses, due to the continued increase in the number of stores, market expectations were for a significant increase in expense spending. However, the actual total operating expenses only increased by 3% year-on-year, partially offsetting the impact of the gross profit margin decline. Therefore, although the final profit was slightly below expectations, the actual 4.1% OPM showed a significant improvement from the previous quarter's low of 2.5%.$KE(BEKE.US) $BEKE-W(02423.HK)

The copyright of this article belongs to the original author/organization.

The views expressed herein are solely those of the author and do not reflect the stance of the platform. The content is intended for investment reference purposes only and shall not be considered as investment advice. Please contact us if you have any questions or suggestions regarding the content services provided by the platform.